New York Maintenance Guidelines Worksheet (UD-8(2))

Description

How to fill out New York Maintenance Guidelines Worksheet (UD-8(2))?

When it comes to submitting New York Maintenance Guidelines Worksheet, you probably think about a long procedure that consists of choosing a ideal form among hundreds of similar ones and then needing to pay out an attorney to fill it out for you. Generally, that’s a slow-moving and expensive option. Use US Legal Forms and select the state-specific template in a matter of clicks.

If you have a subscription, just log in and click Download to find the New York Maintenance Guidelines Worksheet form.

In the event you don’t have an account yet but need one, follow the step-by-step guideline listed below:

- Be sure the file you’re saving applies in your state (or the state it’s needed in).

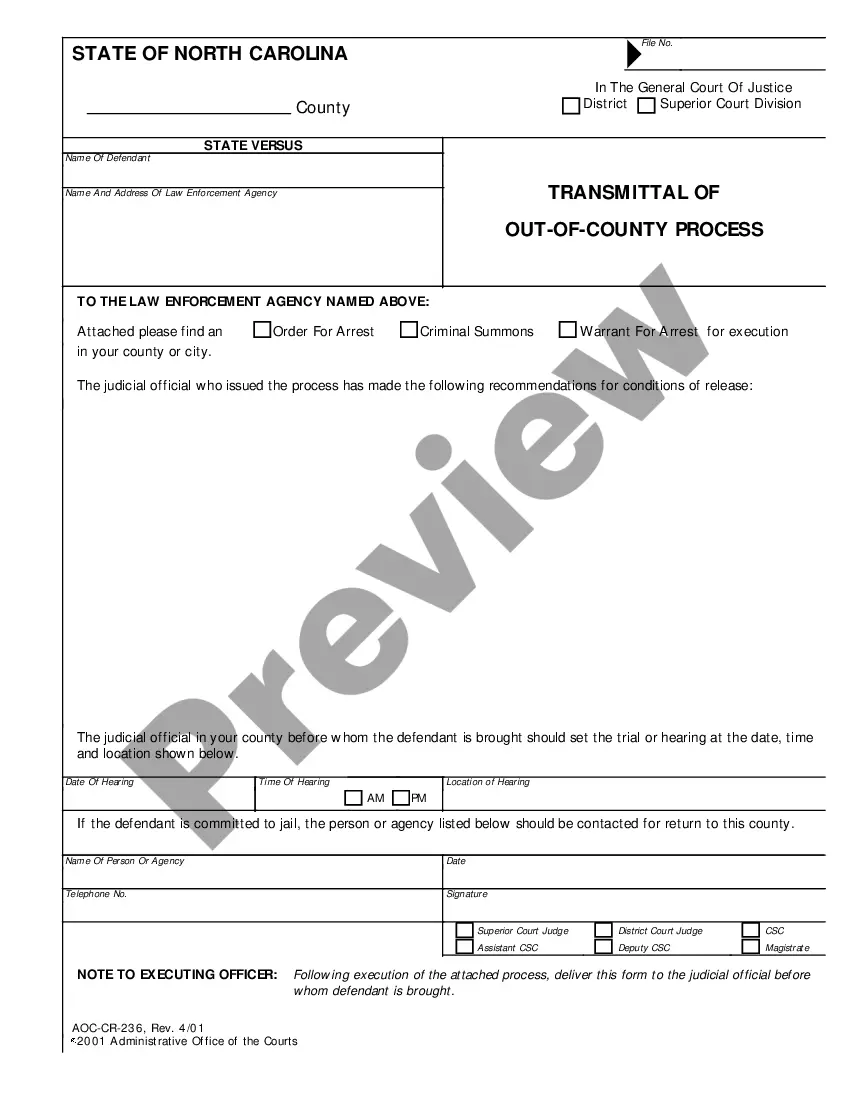

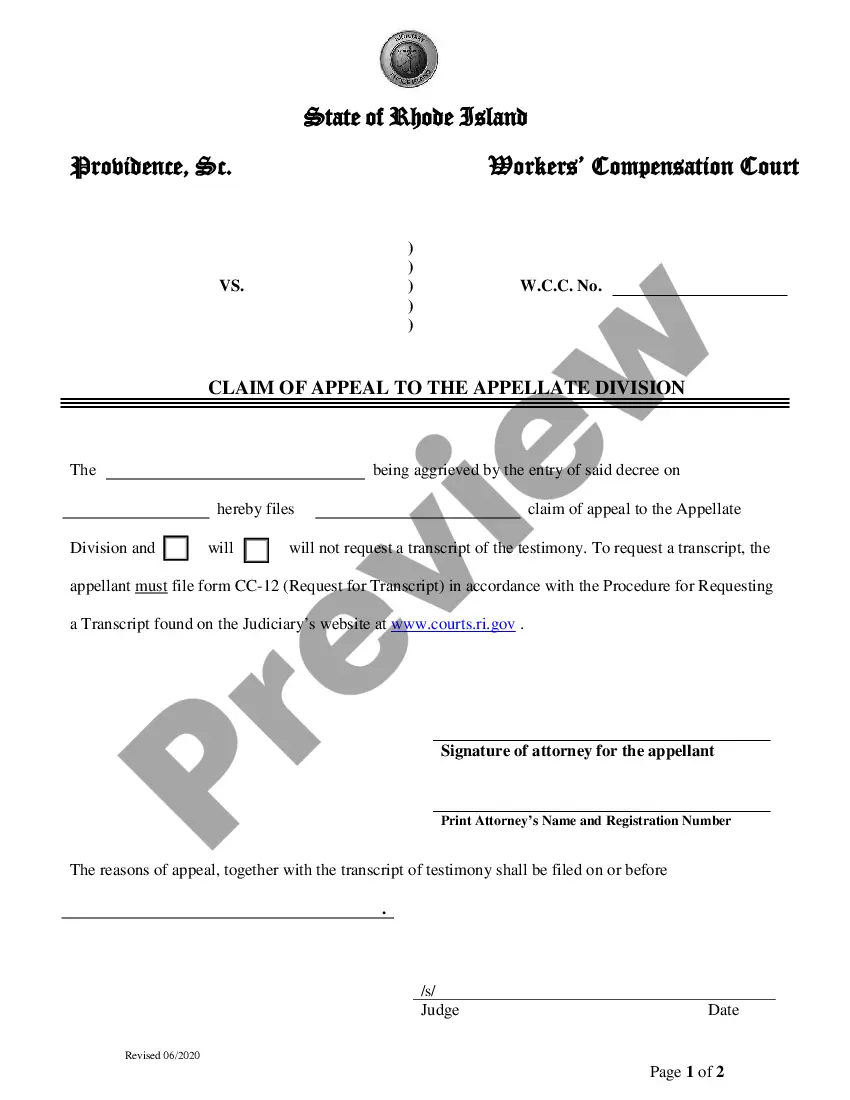

- Do this by reading through the form’s description and also by clicking on the Preview option (if available) to see the form’s information.

- Simply click Buy Now.

- Choose the suitable plan for your financial budget.

- Sign up for an account and select how you would like to pay: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Get the record on your device or in your My Forms folder.

Professional attorneys work on drawing up our templates to ensure after saving, you don't have to worry about editing and enhancing content outside of your individual information or your business’s info. Be a part of US Legal Forms and get your New York Maintenance Guidelines Worksheet example now.

Form popularity

FAQ

Subtract 25% of the payor's income from 20% of the payee's income. subtract 20% of the payee's income from 30% of the payor's income, or. multiple the total income of both spouses by 40% and subtract the support spouse's income from that number.

1100 ml/kg/24-hours = 4 ml/kg/hr for the 1st 10 kg.250 ml/kg/24-hours = 2 ml/kg/hr for the 2nd 10 kg.320 ml/kg/24-hours = 1 ml/kg/hr for the remainder.

Spousal maintenance is paid for the benefit of the recipient spouse and is determined with reference to the recipient's income, needs and earning capacity as well as the paying party's ability to pay.

The formula for Maintenance is calculated by taking 30% of the payor spouse's gross annual income minus 20% of the payee's gross annual income. The amount that is calculated as Maintenance cannot result in the payee spouse receiving more than 40% of the combined gross income of both spouses.

17% for one child. 25% for two children. 29% for three children. 31% for four children. Not less than 35% for five children or more.

Subtract 25% of the payor's income from 20% of the payee's income. subtract 20% of the payee's income from 30% of the payor's income, or. multiple the total income of both spouses by 40% and subtract the support spouse's income from that number.