New York Volunteer Firefighters Claim For Benefits

Description

How to fill out New York Volunteer Firefighters Claim For Benefits?

In terms of submitting New York Volunteer Firefighter's Claim for Benefits - Workers' Compensation, you probably imagine a long process that requires choosing a appropriate sample among a huge selection of very similar ones and after that being forced to pay out an attorney to fill it out to suit your needs. In general, that’s a slow-moving and expensive choice. Use US Legal Forms and select the state-specific form in just clicks.

For those who have a subscription, just log in and click on Download button to have the New York Volunteer Firefighter's Claim for Benefits - Workers' Compensation form.

If you don’t have an account yet but need one, keep to the point-by-point manual listed below:

- Make sure the document you’re downloading is valid in your state (or the state it’s needed in).

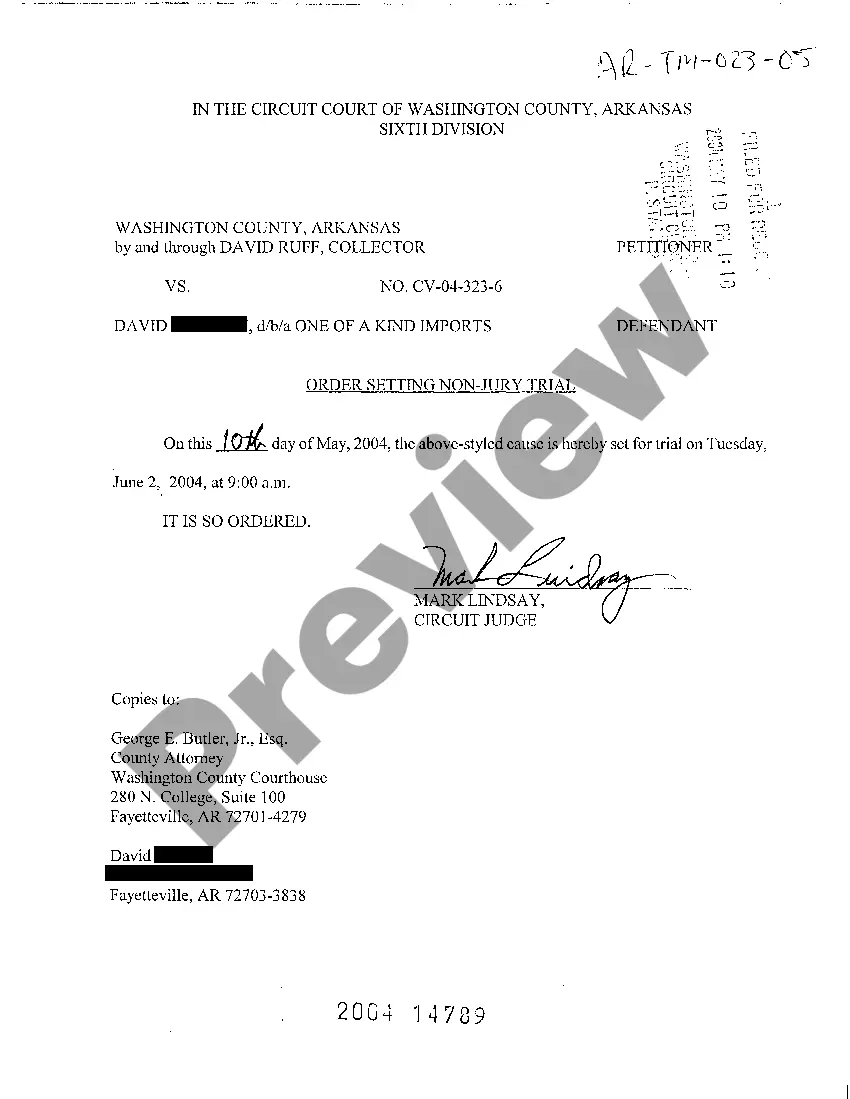

- Do it by looking at the form’s description and through visiting the Preview option (if readily available) to view the form’s information.

- Simply click Buy Now.

- Find the suitable plan for your financial budget.

- Join an account and choose how you would like to pay out: by PayPal or by credit card.

- Save the file in .pdf or .docx file format.

- Find the file on your device or in your My Forms folder.

Skilled attorneys work on creating our templates to ensure that after saving, you don't have to worry about enhancing content material outside of your individual info or your business’s information. Be a part of US Legal Forms and get your New York Volunteer Firefighter's Claim for Benefits - Workers' Compensation example now.

Form popularity

FAQ

Workers' compensation is a no-fault system that provides wage replacement benefits and lifetime medical care for work-related injuries and illnesses. All for-profit employers and most not-for-profit employers must carry workers' compensation insurance to cover all their employees.

Businesses in New York State must have workers' compensation coverage for all employees. The rule includes part-time employees and family members employed by the company. Employers must have a workers' compensation insurance policy.

Voluntary Compensation Endorsement enables an employer to extend the benefits provided by the workers compensation act to employees who may not be entitled to benefits under the terms of the act, such as executive officers, partners, sole proprietors, farm workers, domestic employees, or employees traveling overseas.

There are thousands of firefighters currently battling the fires across NSW.While volunteer fire fighters are not covered by the 1987 Act they have special protections under the Worker's Compensation (Bush Fire, Emergency and Rescue Services) Act 1987 (Bush Fire Act).

If your state does not permit workers comp insurance to cover volunteer workers, then talk to your insurance broker about adding a volunteer-accident medical insurance policy designed specifically to pay the medical bills (or deductibles and co-pays if otherwise covered under another plan) if injured in their capacity

New York law classifies day labor, leased or borrowed employees, part-time employees, unpaid volunteers (which includes family members), and most subcontractors as employees for the purposes of workers' compensation.The contractor is not under the employer's control or direction while performing a job.

Is volunteer work tax deductible? In short, there are certainly tax benefits to take advantage of as a volunteer.Although no tax deduction is allowed for the value of the services performed for this type of organization, some deductions are permitted for out-of-pocket costs incurred while volunteering.

S3267 (ACTIVE) - Summary Permits public employees who are volunteer firefighters or ambulance workers to leave work to respond to fire and ambulance calls without prejudice or loss of time.

As a result, tax benefits and up to $600 per year of other incentives that volunteer emergency responders receive as a reward for their service are exempt from federal income tax and reporting requirements.