New York Business Certificate For Partners

Description

How to fill out New York Business Certificate For Partners?

If you’re searching for a way to appropriately complete the New York Business Certificate For Partners without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every private and business situation. Every piece of paperwork you find on our online service is drafted in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Adhere to these straightforward guidelines on how to obtain the ready-to-use New York Business Certificate For Partners:

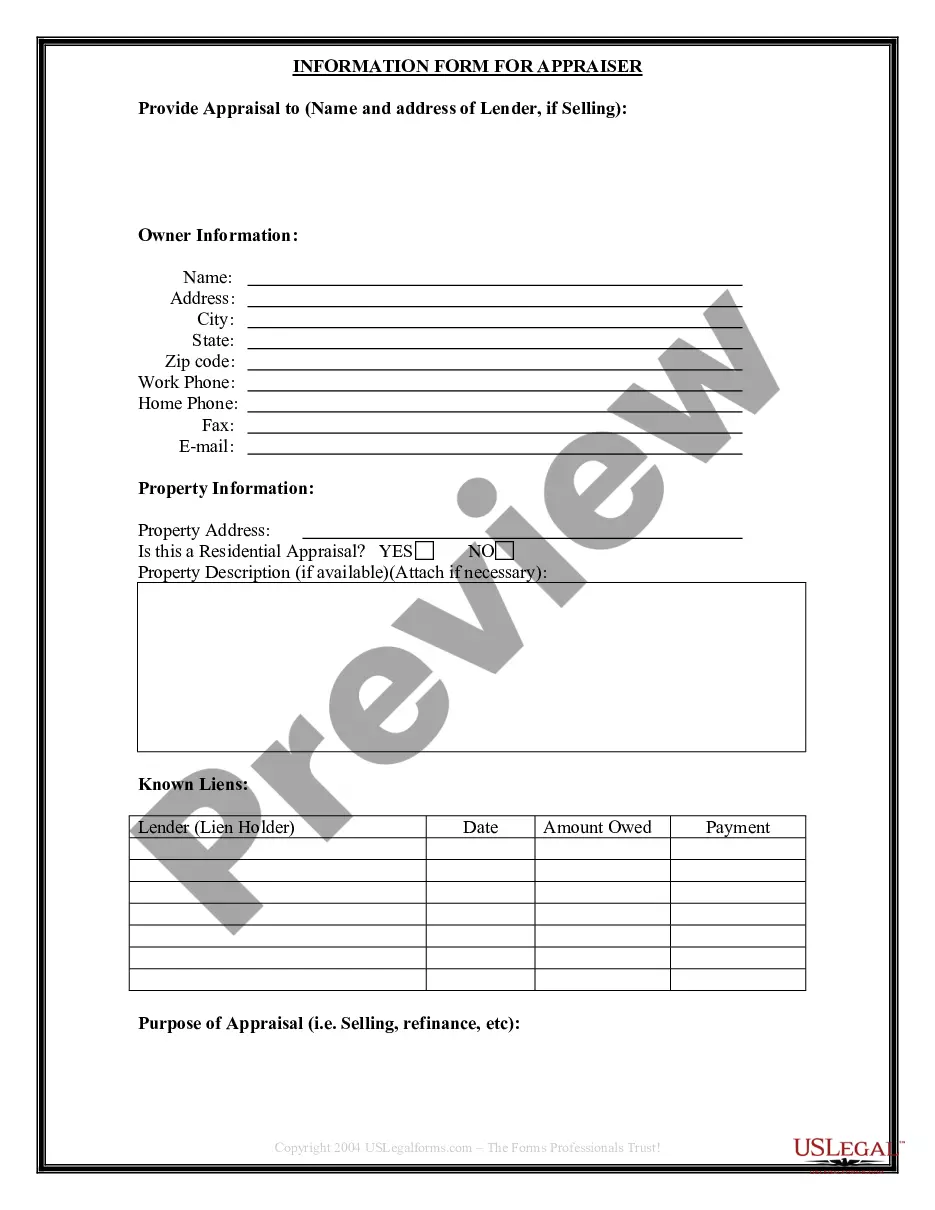

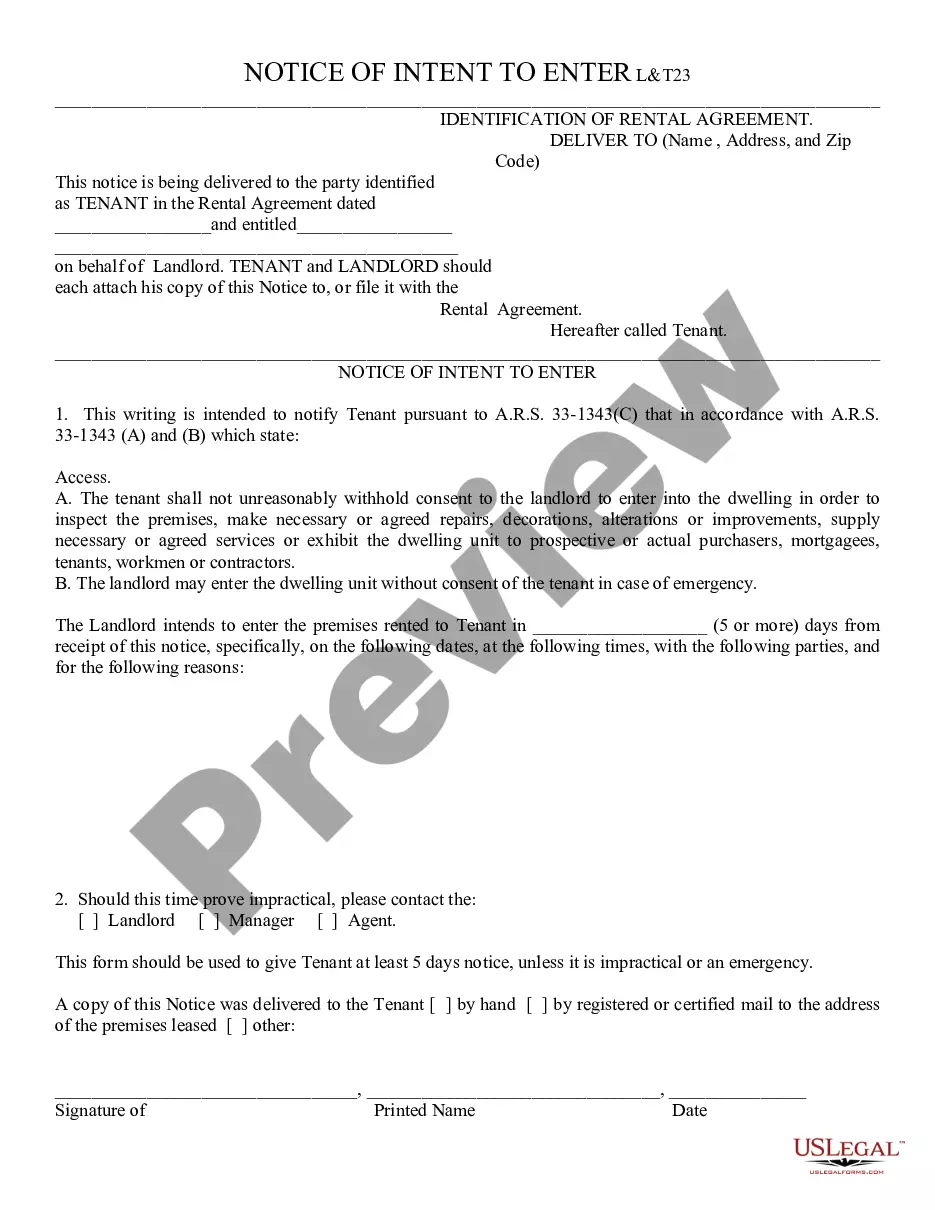

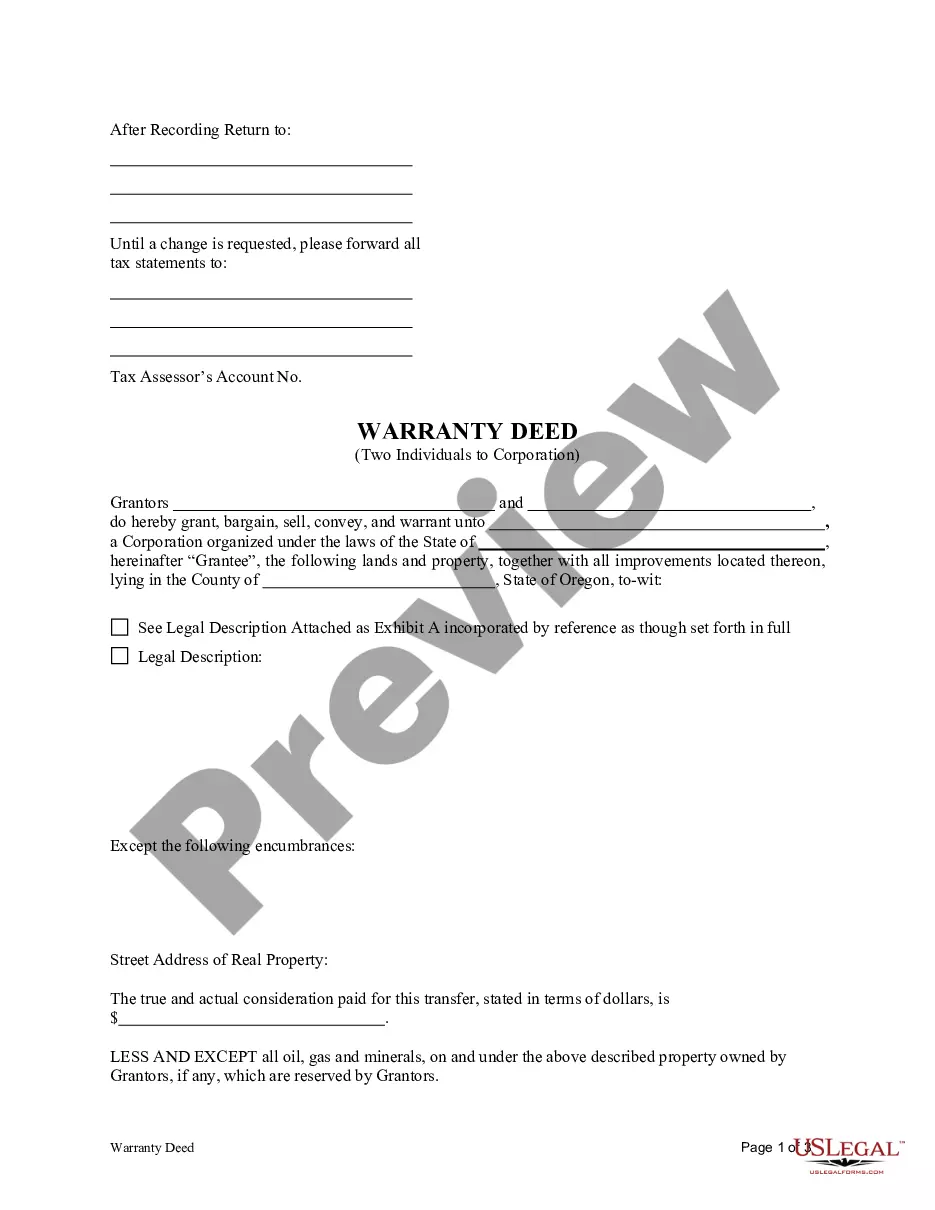

- Ensure the document you see on the page corresponds with your legal situation and state laws by examining its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and choose your state from the dropdown to find another template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your New York Business Certificate For Partners and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

The Certificate of Authority gives you the right to collect tax on your taxable sales and to issue and accept most New York State sales tax exemption certificates. Generally, the seller collects the tax from the purchaser and remits it to New York State.

New York requires all businesses operating under a business name to register as a legal entity to operate a business. Limited liability companies (LLCs) and corporations must register with the state.

Complete and file the Certificate of Registration with the Department of State. The completed Certificate of Registration, together with the filing fee of $200, should be forwarded to: New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

Generally speaking, a business registration certificate is what allows the state to identify and recognize your business as a separate legal entity. Upon the successful completion of the filing process, the state will confer the legal benefits of registration on your business.

Do general partnerships have to register in New York? You do not need to register a general partnership in New York. However, you will need to file a Certificate of Assumed Name for any additional business names.

Businesses that conduct business under a name that is not their legal name need a Certificate of Assumed Name. This certificate is also called the "doing business as (DBA) certificate." Businesses must file the certificate with the New York State Department of State (NYSDOS).

If you plan on conducting a for-profit business through a sole proprietorship or general partnership under any name other than your own, you are required by law to file a Business Certificate (also called a Certificate of Assumed Name).

The Business Certificate form is X-74 for a partnership and X-201 for a sole proprietorship, and they can be purchased at any commercial or legal stationery store, including the candy shop/newsstand in the lobby of the courthouse at 60 Centre Street.