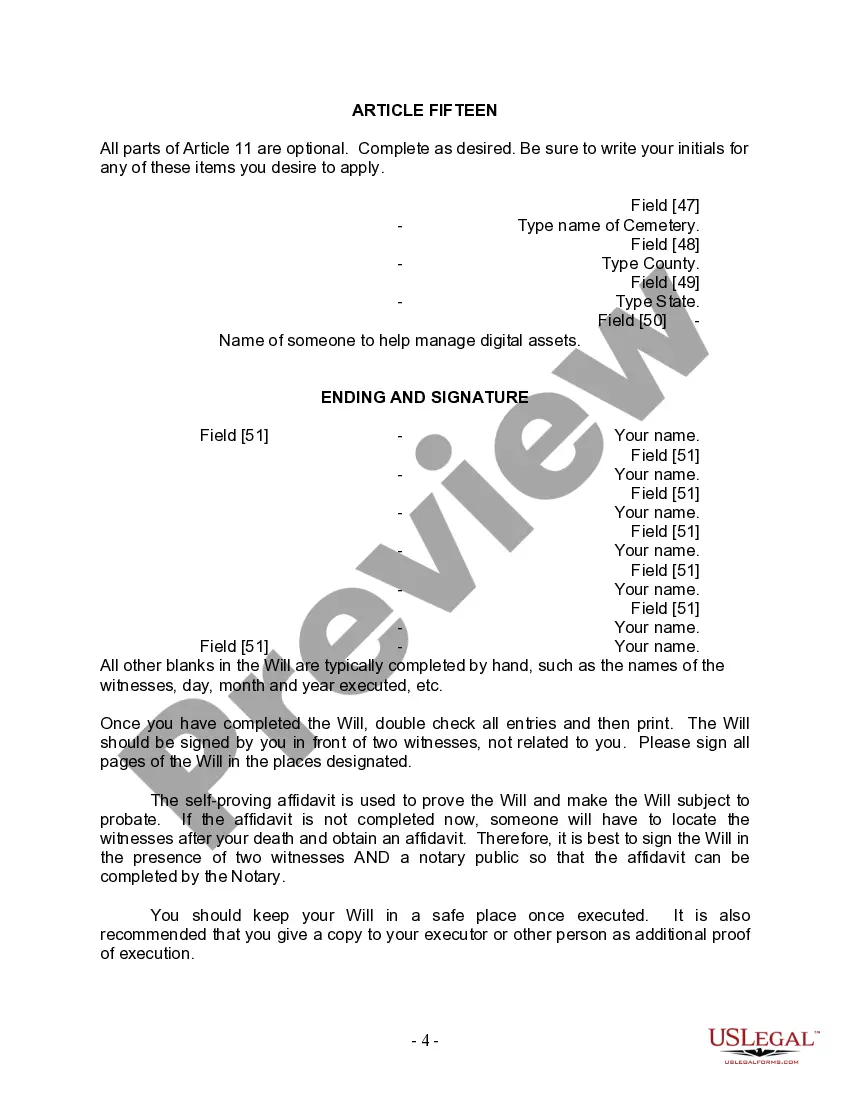

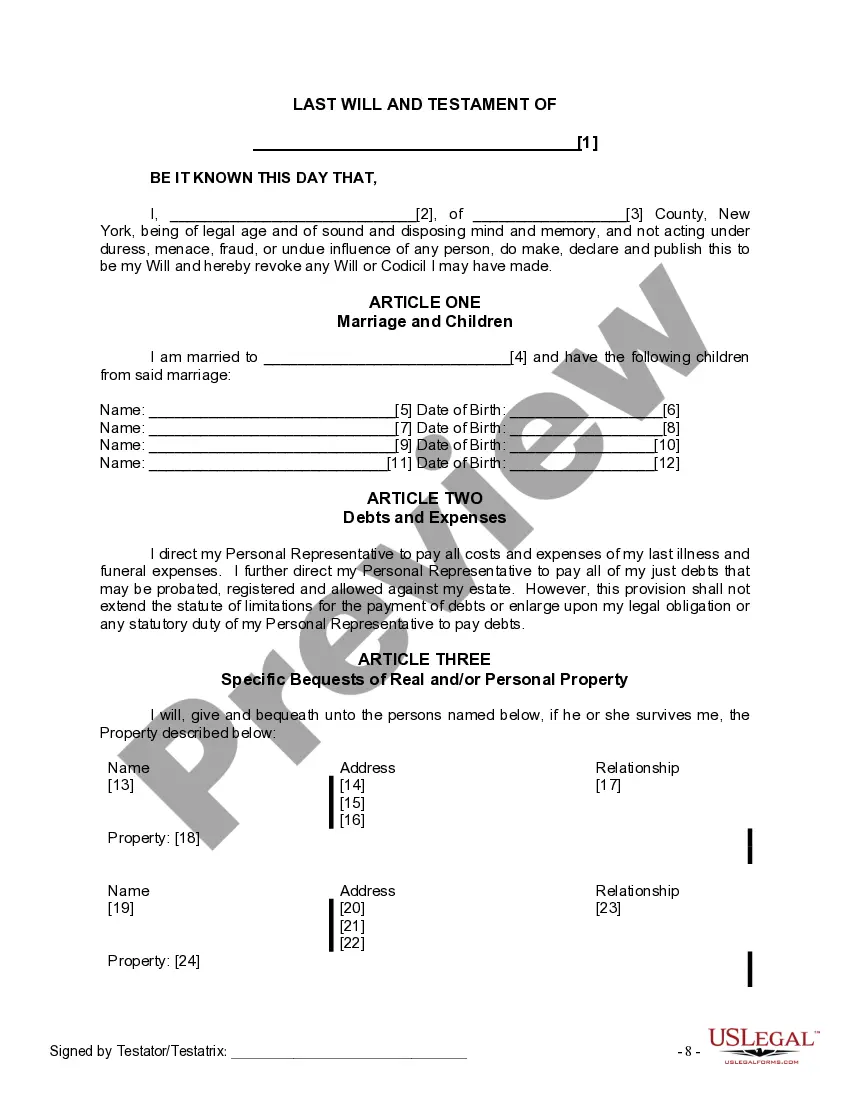

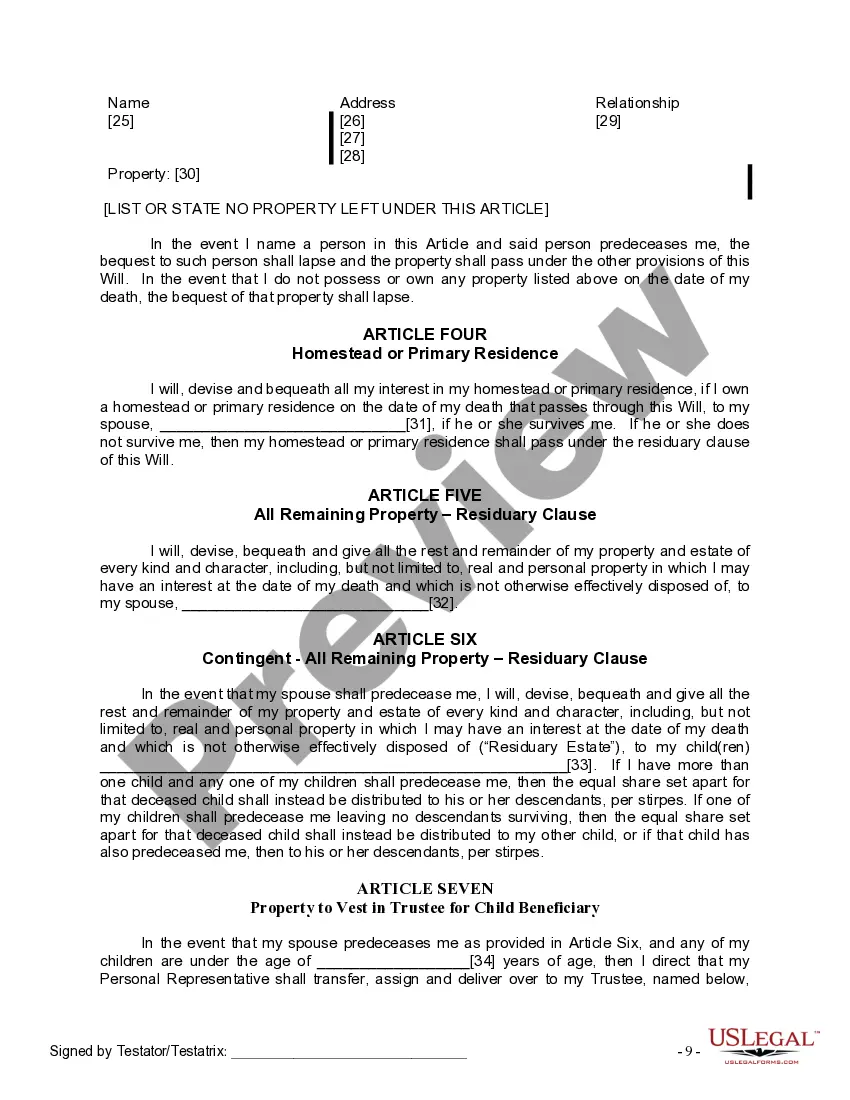

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

New York Last Will and Testament for Married person with Minor Children

Description Legal Last Will Testament

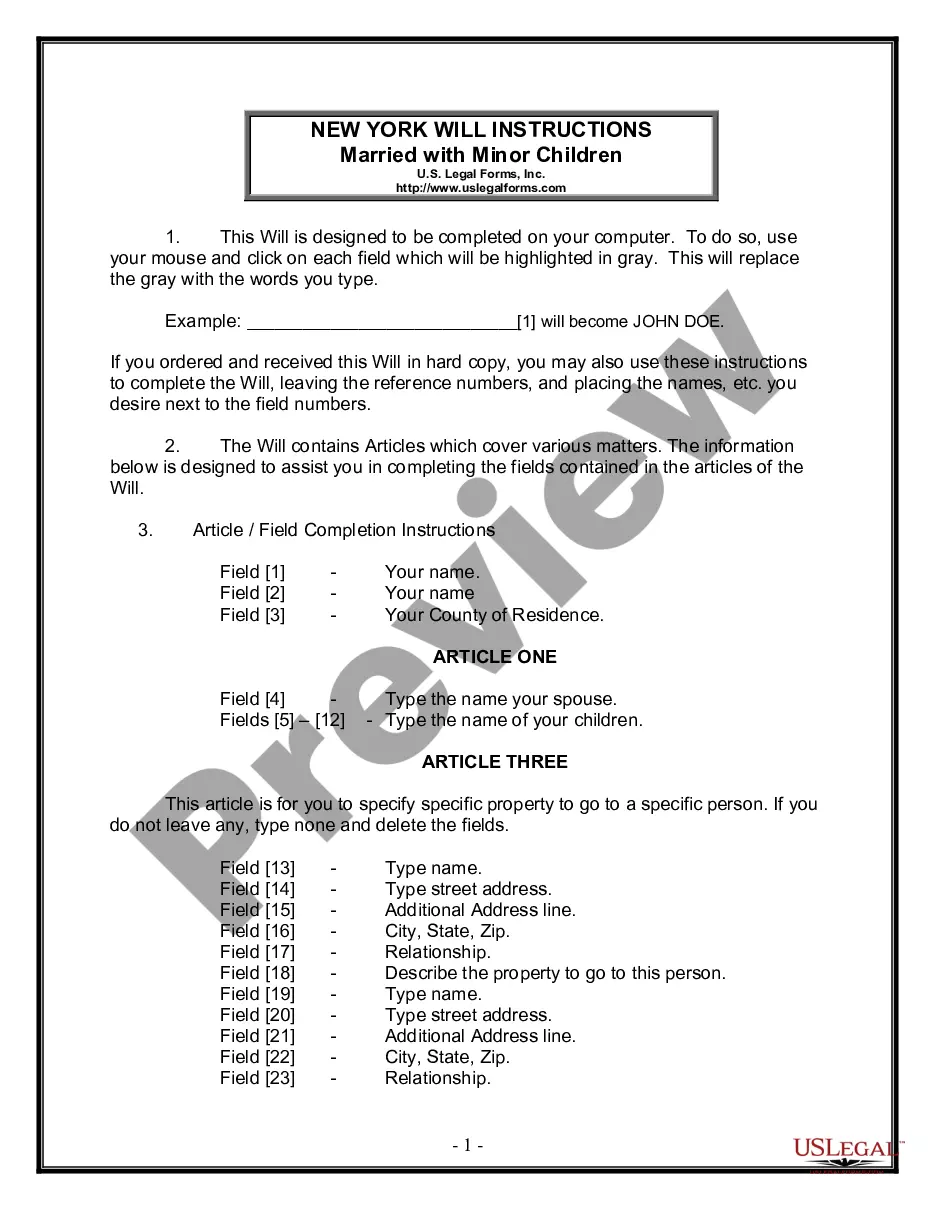

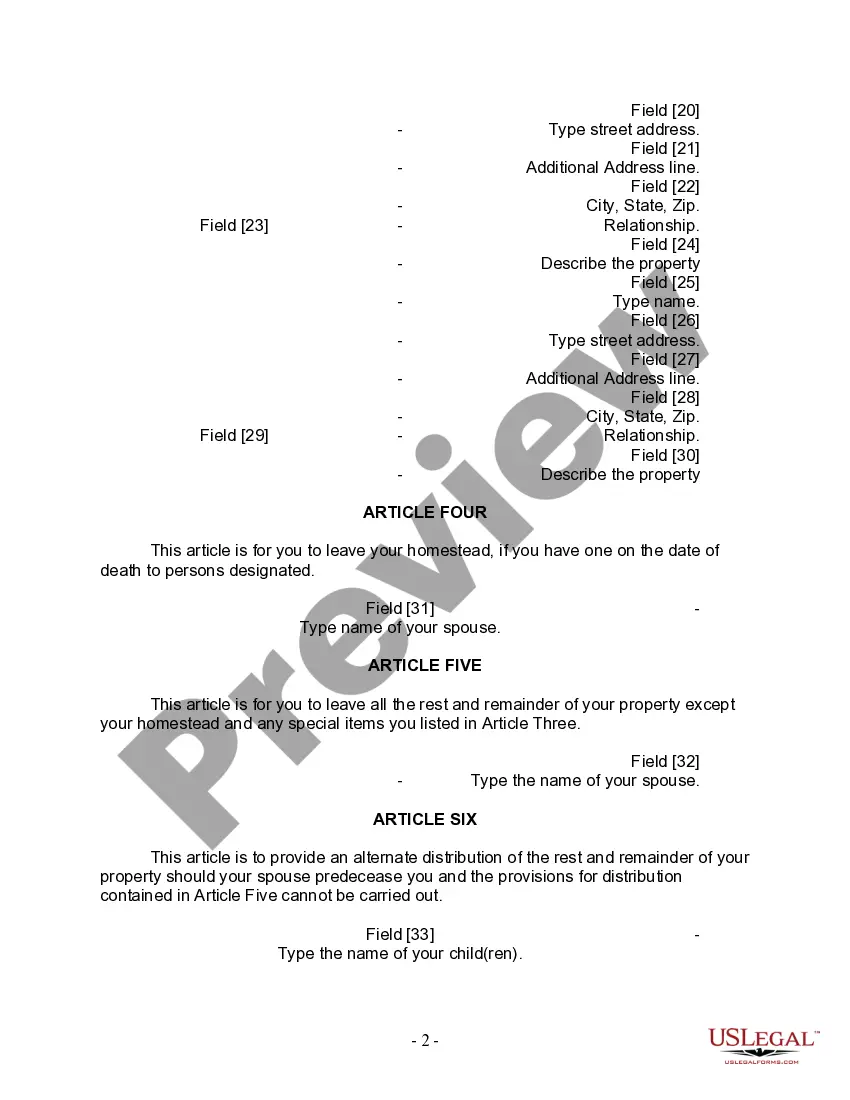

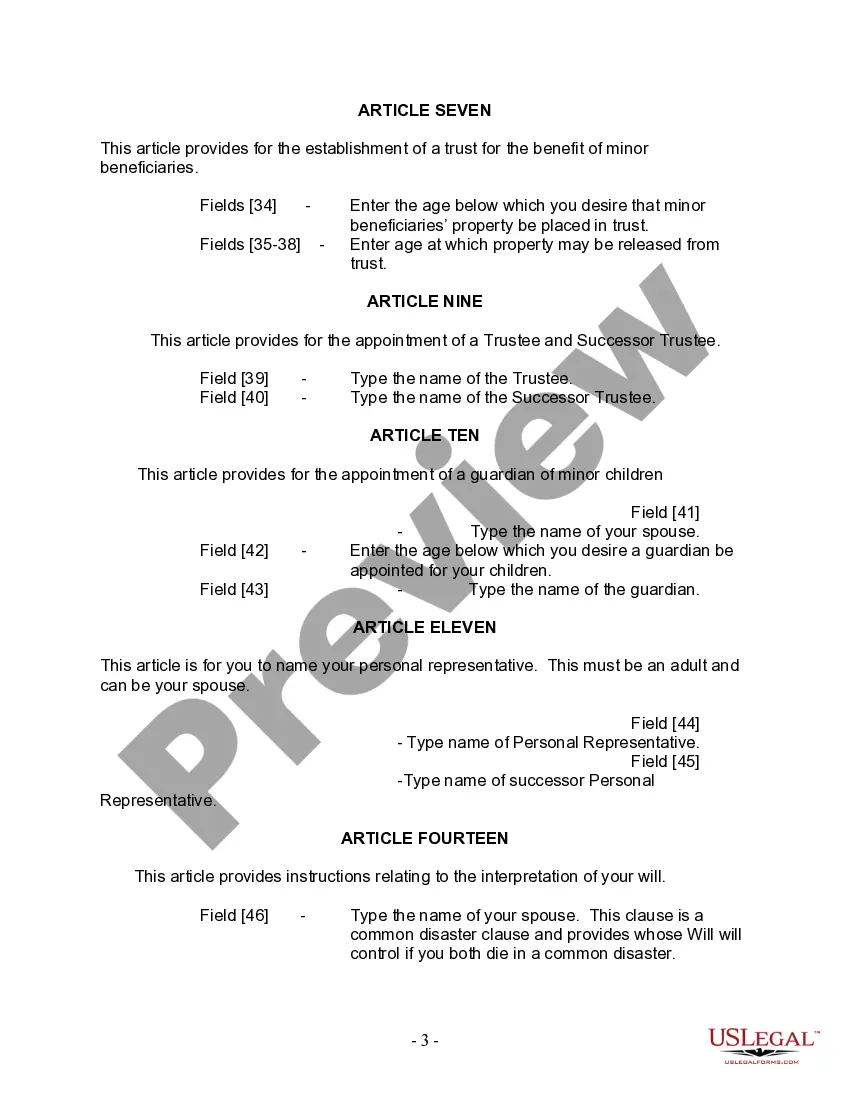

How to fill out Last Will Form Print?

When it comes to filling out New York Legal Last Will and Testament Form for Married person with Minor Children, you most likely visualize an extensive procedure that consists of getting a perfect sample among countless similar ones and then being forced to pay legal counsel to fill it out for you. Generally, that’s a slow-moving and expensive option. Use US Legal Forms and choose the state-specific form within clicks.

In case you have a subscription, just log in and click Download to find the New York Legal Last Will and Testament Form for Married person with Minor Children form.

In the event you don’t have an account yet but need one, stick to the step-by-step guideline listed below:

- Make sure the file you’re downloading is valid in your state (or the state it’s needed in).

- Do it by looking at the form’s description and also by visiting the Preview function (if available) to see the form’s content.

- Simply click Buy Now.

- Pick the suitable plan for your budget.

- Sign up for an account and choose how you would like to pay: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Get the record on the device or in your My Forms folder.

Professional lawyers work on drawing up our templates to ensure after saving, you don't need to bother about enhancing content material outside of your personal info or your business’s info. Sign up for US Legal Forms and get your New York Legal Last Will and Testament Form for Married person with Minor Children sample now.

Last Will Testament Form Form popularity

Last Will Testament Template Other Form Names

Legal Last Will Pdf FAQ

You must file Form IT-201, Resident Income Tax Return, if you were a New York State resident for the entire year.

The New York Department of Taxation and Finance removed the penalty so you may file a NY state tax return by mail (see page 35: https://www.tax.ny.gov/pdf/current_forms/it/it201i.pdf).You may Continue past the screen(s) regarding "Filing your New York return on paper is not recommended."

Form NYS-1, Return of Tax Withheld, must be filed and the total tax withheld paid after each payroll that caused the total accumulated withholding tax to equal or exceed $700. If you withhold less than $700 during a calendar quarter, remit the taxes withheld with your quarterly return, Form NYS-45.

Form NYS-1 is used to remit to New York State the personal income taxes that you have withheld from your employees' wages or from certain other payments (for example, pensions).

The state as a whole has a progressive income tax that ranges from 4.00% to 8.82%, depending on an employee's income level. There is also a supplemental withholding rate of 9.62% for bonuses and commissions.

The IT-201 is a New York State income tax return form. If you are filing state taxes for New York this year, then yes you will need this form and you want to make sure that you fill it out entirely. Turbo Tax would have a copy of your 2015 IT-201 only if you filed state taxes for the state of New York last year.

Generally, you must file a New York State income tax return if you're a New York State resident and are required to file a federal return. You may also have to file a New York State return if you're a nonresident of New York and you have income from New York State sources.

Form IT-201, Resident Income Tax Return.

NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return. All employers required to withhold tax from wages must file Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, each calendar quarter.