New York Estate Planning Questionnaire and Worksheets

Description

Key Concepts & Definitions

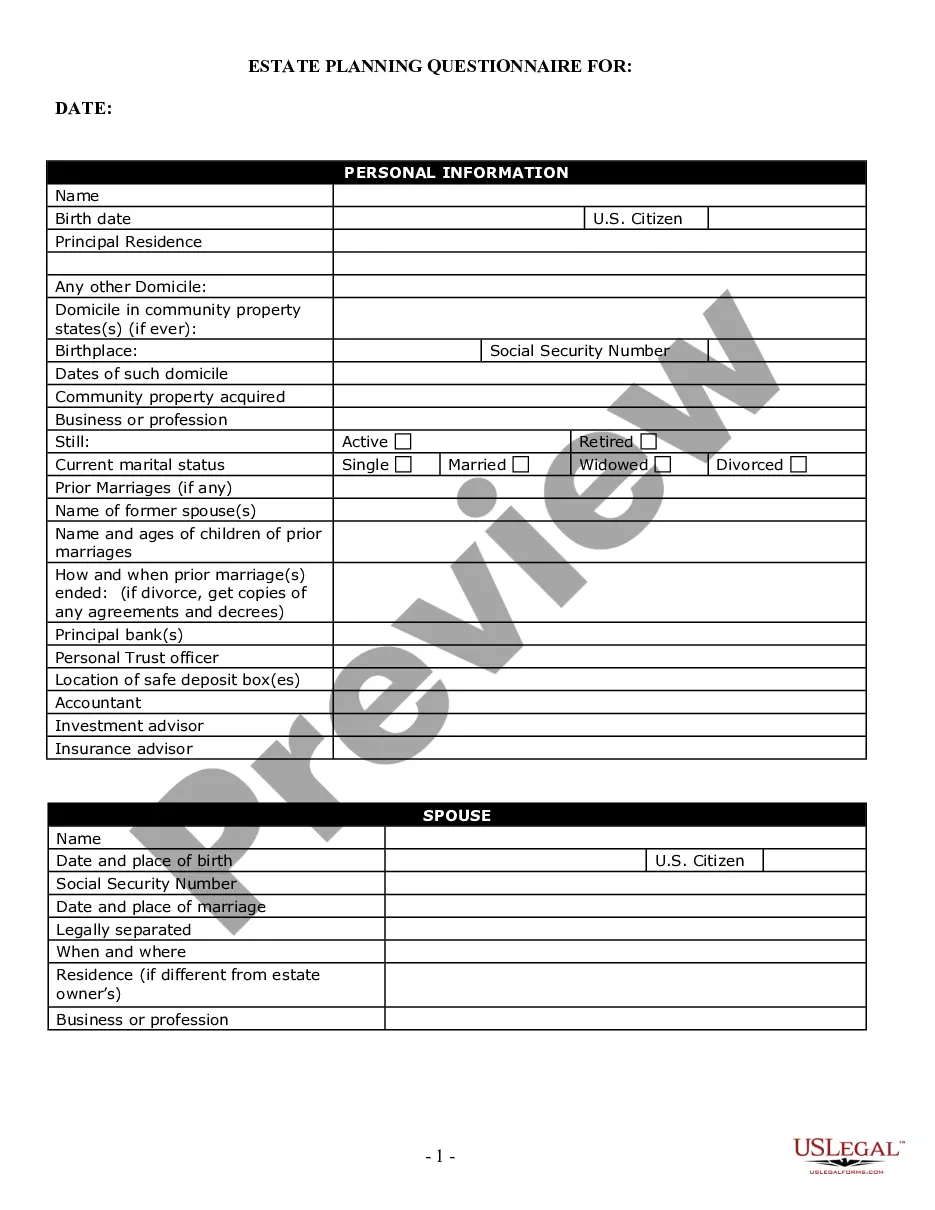

Estate Planning: The process of arranging and managing an individual's asset base in the event of their incapacitation or death. The planning includes the bequest of assets to heirs and may involve minimizing gift, estate, generation skipping transfer, and tax. Estate Planning Questionnaire and Worksheets are tools used to gather personal information and financial details that help in creating a detailed estate plan.

Step-by-Step Guide

- Gather Personal Information: Use the questionnaire to collect basic information such as name, date of birth, family members, and contact details of all parties involved.

- Document Assets and Liabilities: List all assets including properties, investments, and personal valuables, as well as liabilities like loans and debts.

- Identify Beneficiaries: Specify who will inherit the assets. This can include family, friends, and charities.

- Select Executors and Trustees: Choose responsible persons or institutions to manage the estate and trust.

- Define Healthcare Directives: Determine preferences for medical care and appoint a healthcare proxy to make decisions if incapacitated.

- Review with Professionals: Consult with an estate planning attorney to ensure all elements are legally binding and tax-efficient.

Risk Analysis

- Legal Risks: Inaccurate or incomplete questionnaires can lead to legal disputes among heirs.

- Financial Risks: Poor estate planning can lead to significant tax liabilities reducing the value of the estate passed on.

- Emotional Risks: Miscommunication or lack of clarity in estate documents can strain family relationships.

Common Mistakes & How to Avoid Them

- Not Regularly Updating the Plan: Estate plans should be revisited and possibly revised after major life events like marriage, divorce, or the birth of a child.

- Omitting Digital Assets: Include digital assets like social media accounts, online banking accounts, and cryptocurrency assets in your estate plan.

- Choosing the Wrong Executor: Ensure the executor of the will is responsible, trustworthy, and willing to take on the task.

Key Takeaways

- Using detailed estate planning questionnaires and worksheets can streamline the process of estate planning.

- Regular updates and inclusion of all asset types are vital for effective estate planning.

- Professional advice is crucial to avoid common legal and financial pitfalls.

How to fill out New York Estate Planning Questionnaire And Worksheets?

When it comes to filling out New York Estate Planning Questionnaire and Worksheets, you probably imagine a long procedure that involves getting a perfect form among numerous similar ones and after that having to pay out an attorney to fill it out to suit your needs. Generally, that’s a slow-moving and expensive option. Use US Legal Forms and pick out the state-specific template in a matter of clicks.

If you have a subscription, just log in and click Download to get the New York Estate Planning Questionnaire and Worksheets form.

In the event you don’t have an account yet but want one, keep to the step-by-step guide below:

- Make sure the file you’re downloading is valid in your state (or the state it’s required in).

- Do this by reading through the form’s description and also by clicking the Preview option (if readily available) to find out the form’s content.

- Click on Buy Now button.

- Find the appropriate plan for your financial budget.

- Sign up for an account and choose how you would like to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx format.

- Get the file on your device or in your My Forms folder.

Professional legal professionals draw up our samples to ensure after downloading, you don't need to worry about enhancing content material outside of your individual info or your business’s details. Be a part of US Legal Forms and get your New York Estate Planning Questionnaire and Worksheets sample now.

Form popularity

FAQ

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

Fill out your attorney's intake questionnaire. Gather your financial documents. Bring copies of your current estate plan documents. Divorce agreements, premarital agreements, and other relevant contracts. Choose your executors and health care agents.

Most people can, in fact, create most important estate planning documents on their own, as long as they have reliable, clear instructions.The same is true for some other estate planning steps, such as creating a living will (advance directive), or naming beneficiaries for insurance policies and retirement accounts.

Creating an estate plan is a lot like getting into better shape. Step 1: Sign a will. Step 2: Name beneficiaries. Step 3: Dodge estate taxes. Step 4: Leave a letter. Step 5: Draw up a durable power of attorney. Step 6: Create an advance health care directive.

Step 1: Create a checklist of important documents (and their locations) Step 2: List the names and contact information of key associates. Step 3: Catalog your digital asset inventory. Step 4: Ensure all documents are organized and accessible.

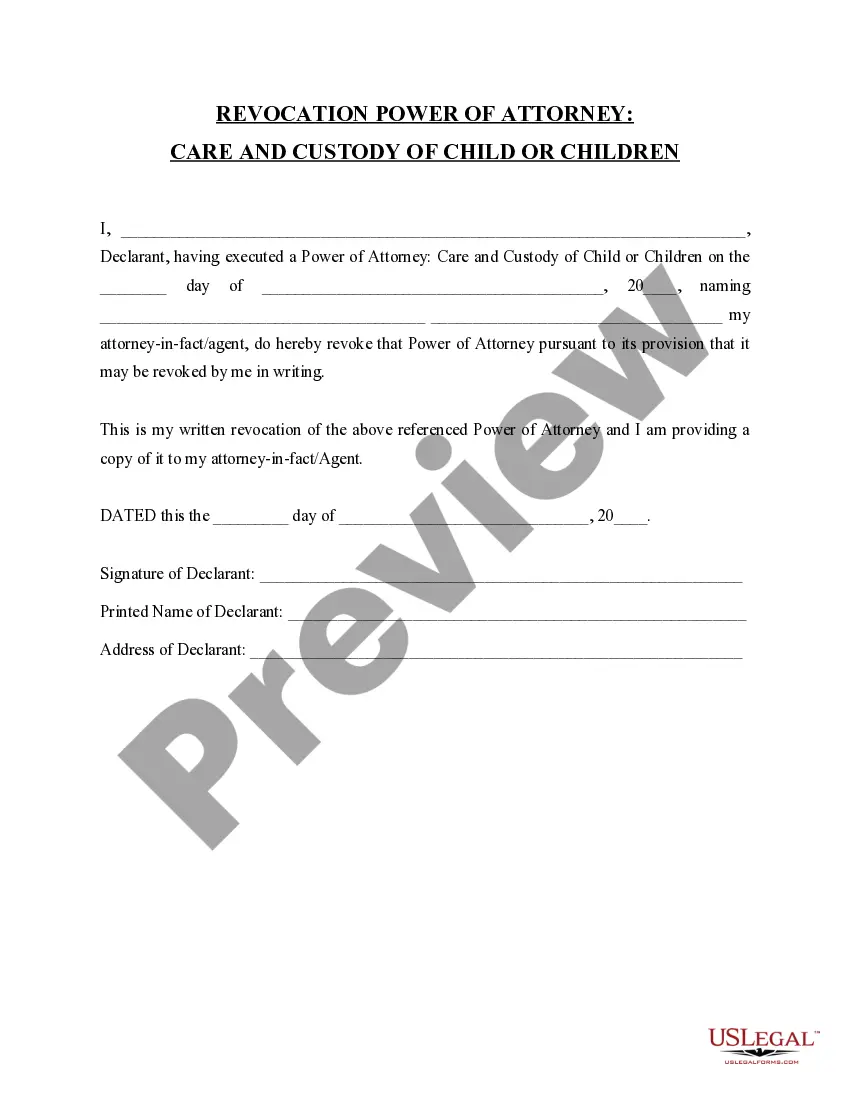

A Last Will and Testament. When it comes to estate planning, having a last will and testament is likely the first thing that will come to mind. A Document Granting Power of Attorney. An Advance Medical Directive. Revocable Living Trust.

More Than a Last Will. Itemize Your Inventory. Follow with Non-Physical Assets. Assemble a List of Debts. Make a Memberships List. Make Copies of Your Lists. Review Your Retirement Account. Update Your Insurance.

A Last Will and Testament. When it comes to estate planning, having a last will and testament is likely the first thing that will come to mind. A Document Granting Power of Attorney. An Advance Medical Directive. Revocable Living Trust.