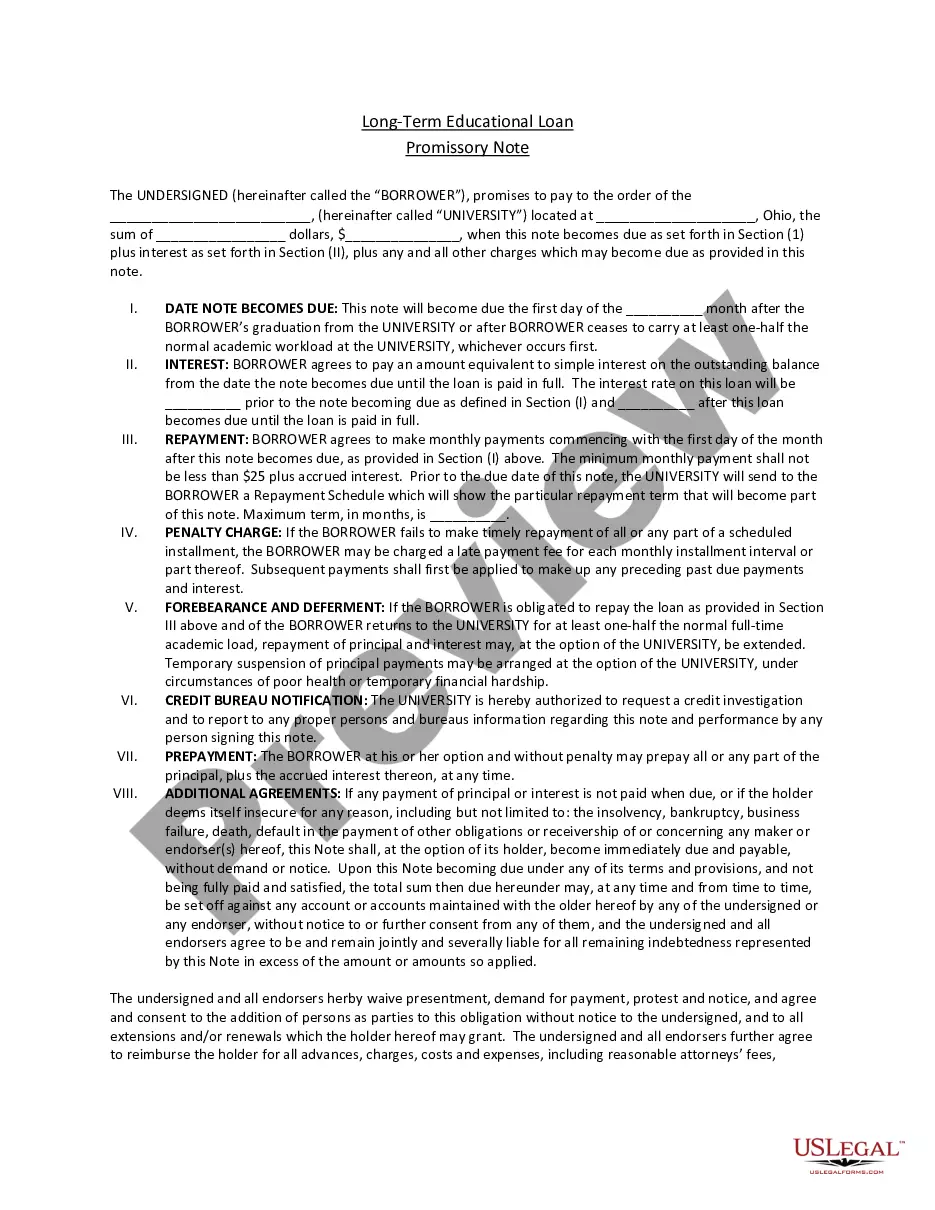

Ohio Long Term Educational Loan Promissory Note is a legally binding document between a borrower and a lender, such as a bank or financial institution. It is a document that outlines the terms of a loan, including the amount borrowed, repayment terms, interest rate, and any other conditions the borrower must meet. The Ohio Long Term Educational Loan Promissory Note allows for the repayment of the loan over a predetermined period of time, usually a few years. There are two types of Ohio Long Term Educational Loan Promissory Note — the Subsidized and Unsubsidized Promissory Note. The Subsidized Promissory Note is available to students who qualify for a need-based loan and are enrolled at least half-time in a degree program at an eligible college or university. The Unsubsidized Promissory Note is available to those who do not qualify for need-based aid or are enrolled less than half-time. Both types of Promissory Note require the borrower to make monthly payments on the loan, which are determined by the interest rate, term length, and repayment plan. The Ohio Long Term Educational Loan Promissory Note is an important document for borrowers to understand and acknowledges the responsibility of the borrower to repay the loan. It is a legally binding agreement and should be read carefully before signing.

Ohio Long Term Educational Loan Promissory Note

Description

How to fill out Ohio Long Term Educational Loan Promissory Note?

Dealing with official paperwork requires attention, precision, and using properly-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Ohio Long Term Educational Loan Promissory Note template from our service, you can be sure it complies with federal and state laws.

Working with our service is easy and fast. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to get your Ohio Long Term Educational Loan Promissory Note within minutes:

- Remember to carefully examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another official template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Ohio Long Term Educational Loan Promissory Note in the format you need. If it’s your first time with our service, click Buy now to continue.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the Ohio Long Term Educational Loan Promissory Note you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

Unlike the federal government, there isn't a website you can visit to request a copy of your private student loan promissory notes. You'll need to ask the creditor or loan servicer contacting you about the debt to provide you with a copy.

All borrowers need to complete an MPN before they can receive a federal student loan. Some circumstances may require you to sign an MPN more than once: If you're receiving a type of loan for which you haven't signed an MPN previously. If your school requires you to sign a new MPN each academic year.

Parents must complete a separate PLUS MPN for each dependent child. How long will it take? Most people complete each MPN in less than 30 minutes. The entire MPN process must be completed in a single session.

The Master Promissory Note (MPN) is a legal document in which you promise to repay your loan(s) and any accrued interest and fees to the U.S. Department of Education. It also explains the terms and conditions of your loan(s).

If you fail to meet the conditions of your MPN, you could end up defaulting on your loan.

??????An MPN is a legal document that contains the Borrower's Rights and Responsibilities and Terms and Conditions for repayment. Direct PLUS and Direct Subsidized / Unsubsidized loans have different MPNs. An MPN can also be good for up to 10 years if certain enrollment requirements are met.

All borrowers need to complete an MPN before they can receive a federal student loan. Some circumstances may require you to sign an MPN more than once: If you're receiving a type of loan for which you haven't signed an MPN previously. If your school requires you to sign a new MPN each academic year.

Your school's financial aid office will be notified of your Master Promissory Note (MPN) completion and will contact you if further action is needed. Before loans are disbursed, you will receive a disclosure statement from the U.S. Department of Education or your school.