A Contract for Deed is used as owner financing for the purchase of real property. The Seller retains title to the property until an agreed amount is paid. After the agreed amount is paid, the Seller conveys the property to Buyer.

- US Legal Forms

-

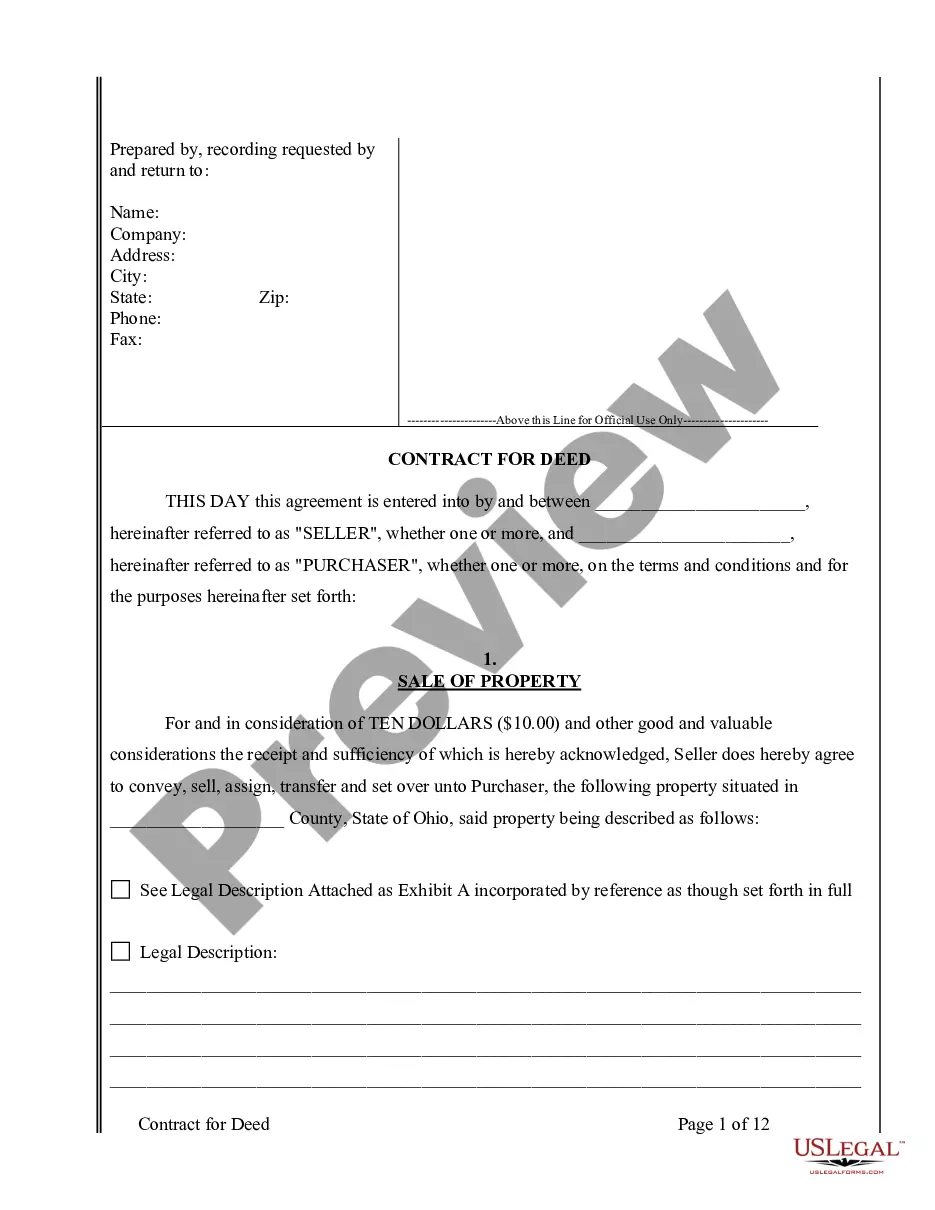

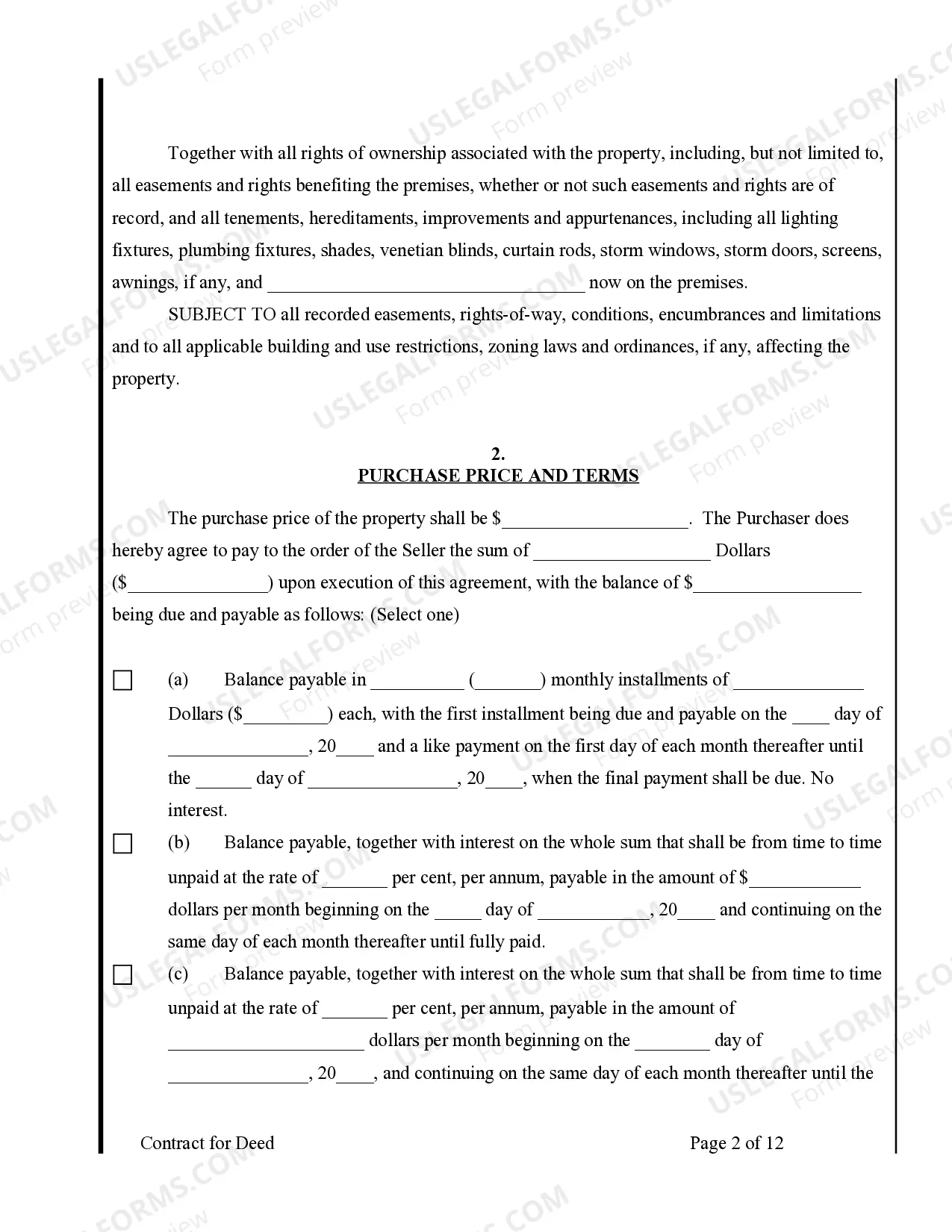

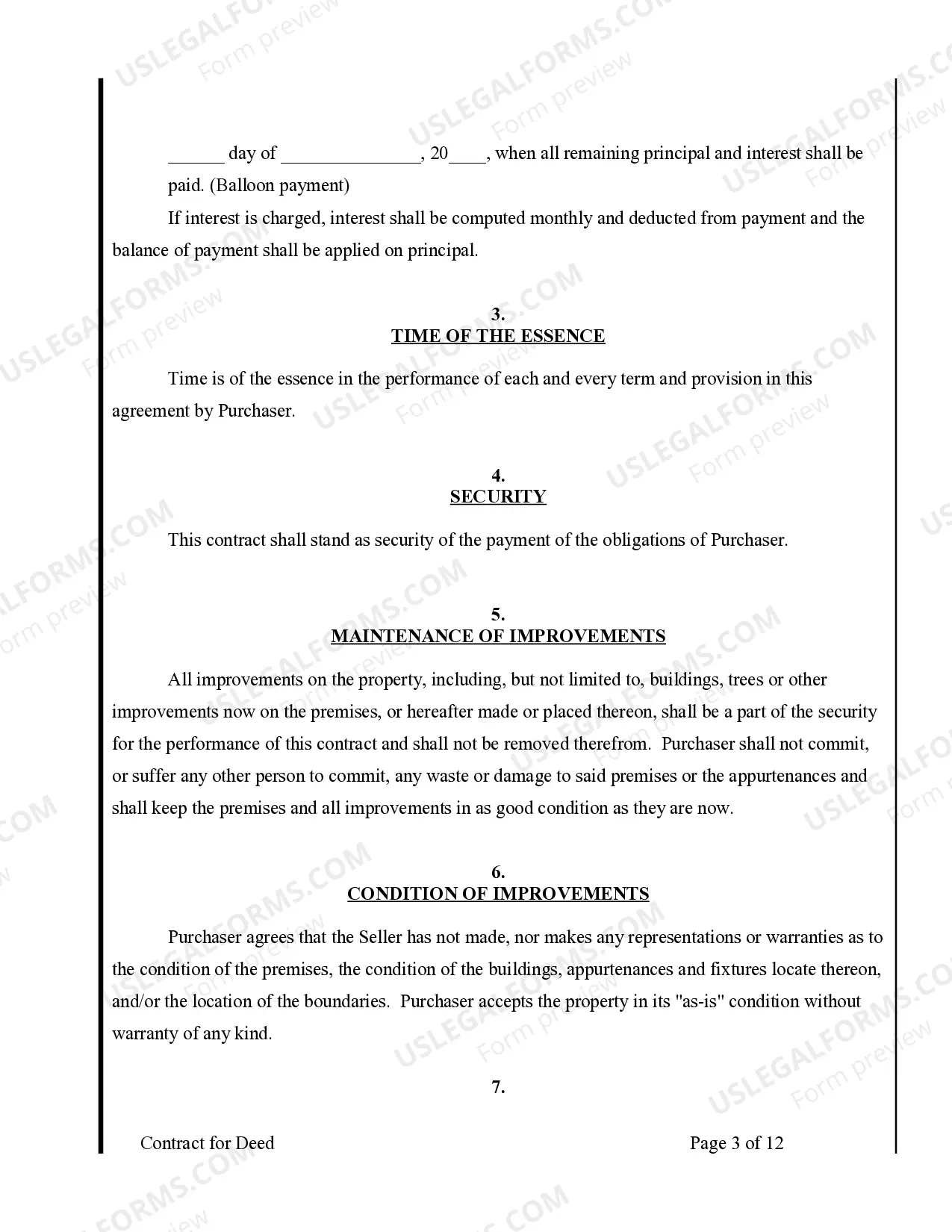

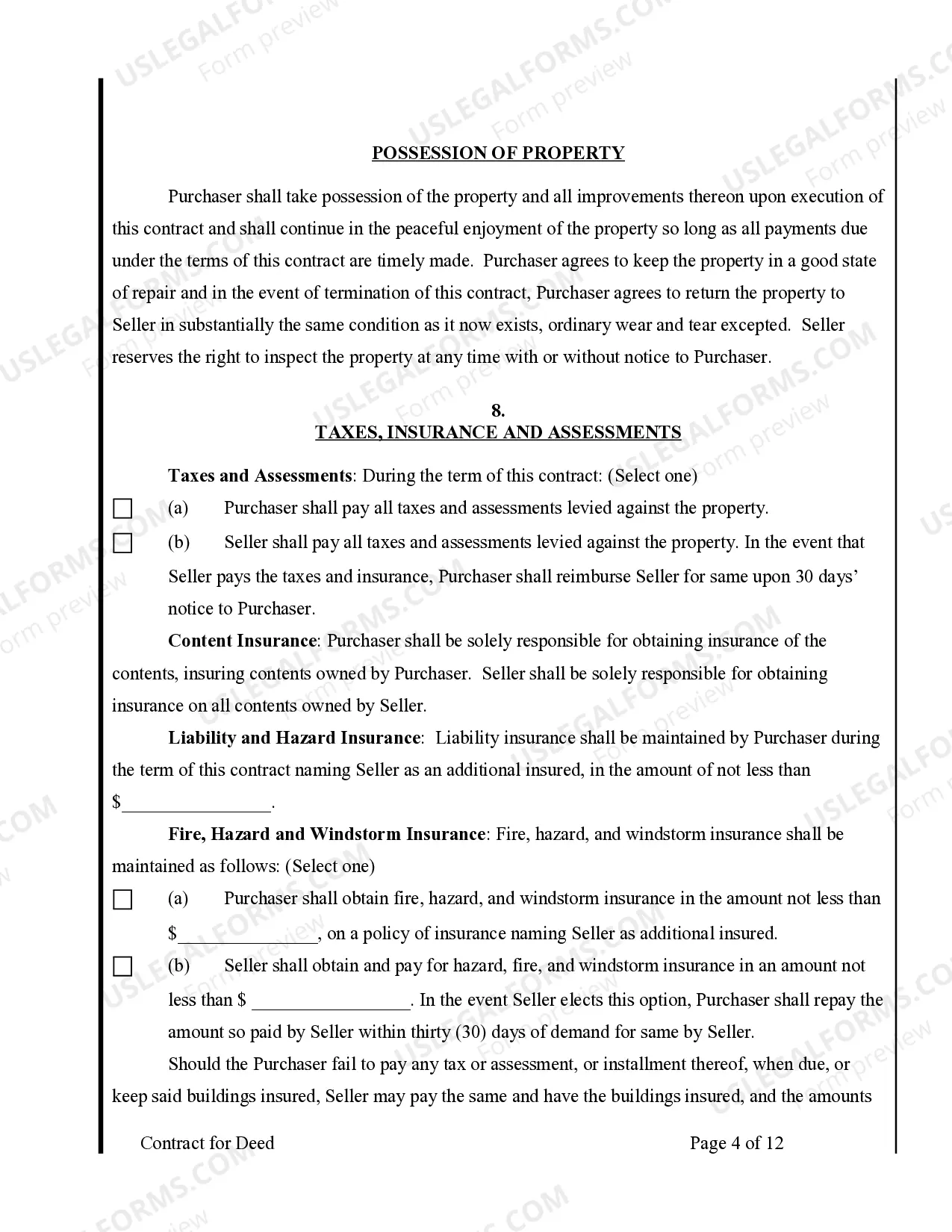

Ohio Agreement or Contract for Deed for Sale and Purchase of Real...

Land Contract Ohio

Description Deed Real Estate

Executory Agreement Agreement Pdf Or Docx Sec Gov Lawinsider Com Related Forms

Buyer's Request for Accounting from Seller under Contract for Deed

Contract for Deed Seller's Annual Accounting Statement

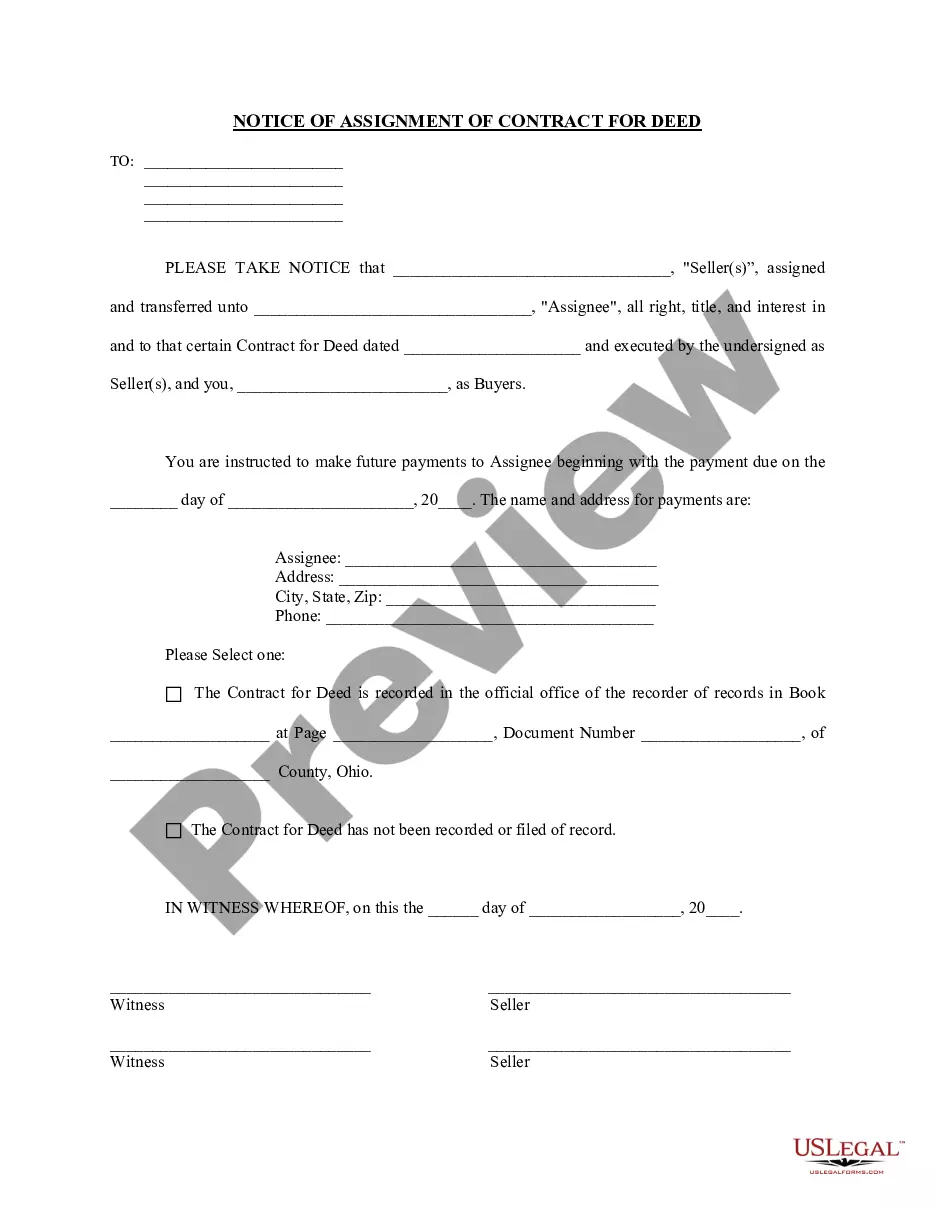

Assignment of Contract for Deed by Seller

Notice of Assignment of Contract for Deed

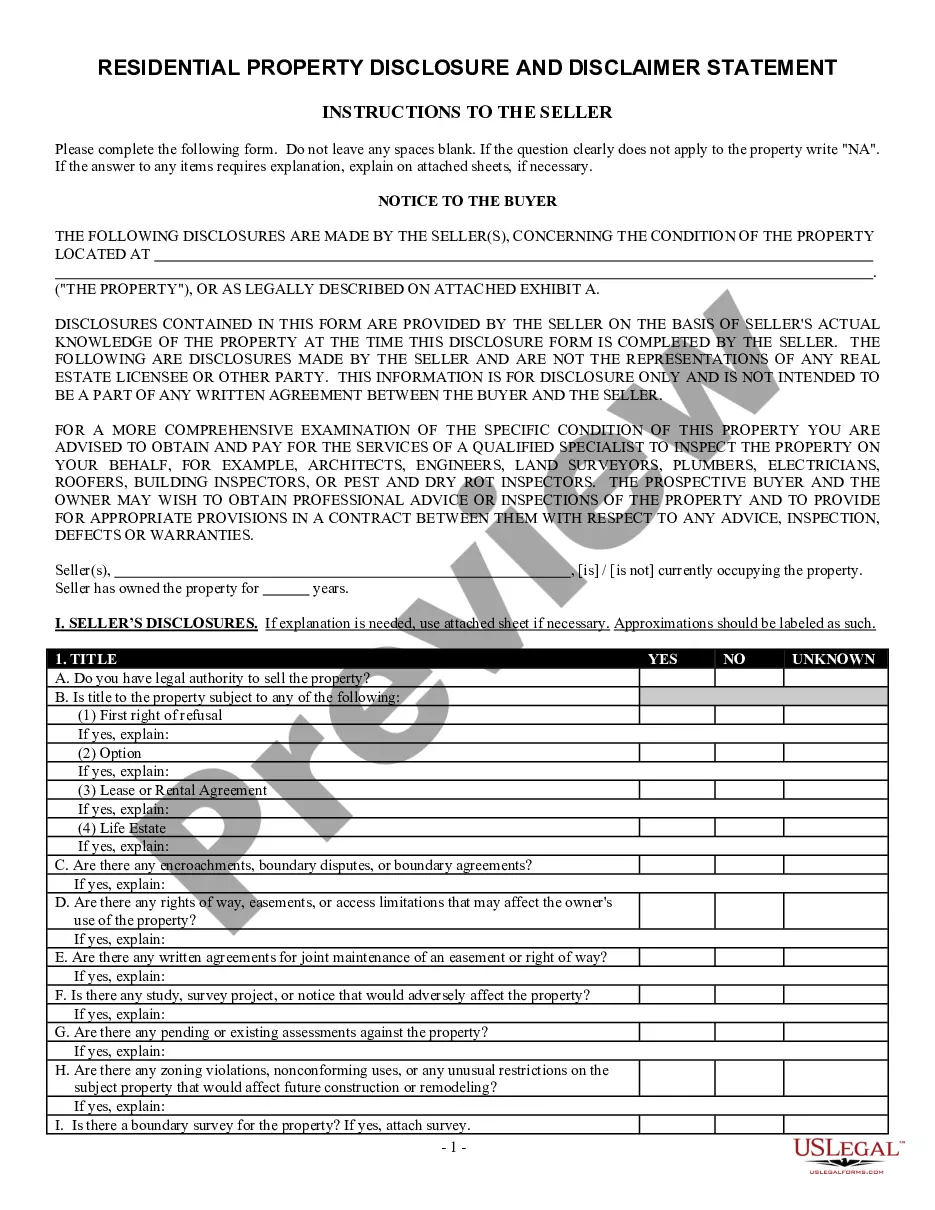

Residential Real Estate Sales Disclosure Statement

Lead Based Paint Disclosure for Sales Transaction

Related legal definitions

Viewed forms

Residential Real Estate Sales Disclosure Statement

Notice of Assignment of Contract for Deed

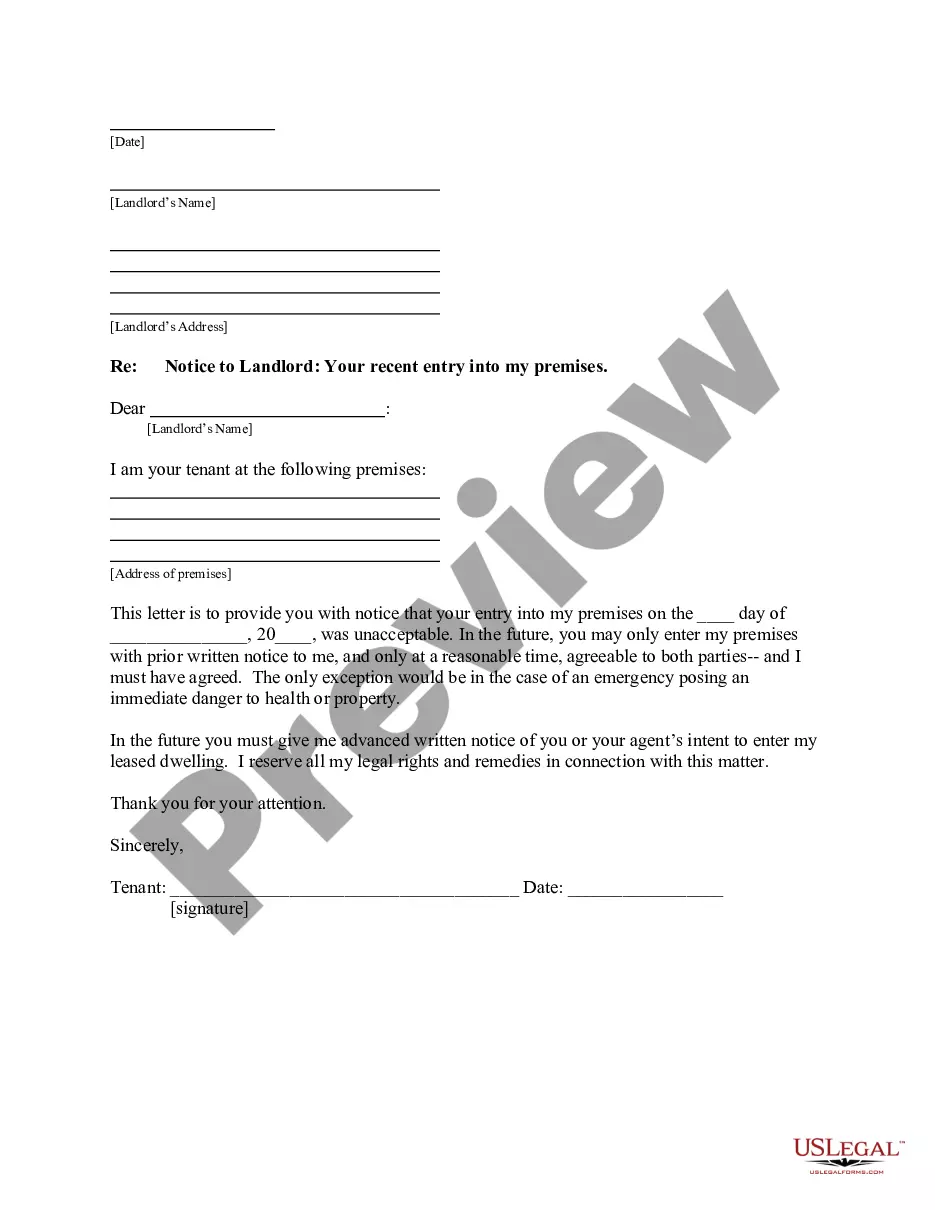

Letter from Tenant to Landlord about Illegal entry by landlord

How to fill out Ohio Agreement Or Contract For Deed For Sale And Purchase Of Real Estate A/k/a Land Or Executory Contract?

When it comes to submitting Ohio Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract, you probably think about an extensive procedure that involves getting a ideal form among countless similar ones and then needing to pay out legal counsel to fill it out for you. Generally, that’s a slow-moving and expensive choice. Use US Legal Forms and choose the state-specific document within just clicks.

For those who have a subscription, just log in and then click Download to have the Ohio Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract sample.

In the event you don’t have an account yet but need one, stick to the point-by-point guideline listed below:

- Make sure the document you’re getting is valid in your state (or the state it’s required in).

- Do it by reading the form’s description and by visiting the Preview function (if available) to find out the form’s content.

- Click on Buy Now button.

- Pick the suitable plan for your budget.

- Subscribe to an account and select how you want to pay out: by PayPal or by credit card.

- Save the file in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Skilled attorneys draw up our samples to ensure after downloading, you don't need to bother about modifying content material outside of your personal details or your business’s info. Be a part of US Legal Forms and get your Ohio Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract example now.

Oh Deed Form Rating

Ohio Deed Form popularity

Ohio Land Contract Other Form Names

FAQ

Who Prepares The Real Estate Purchase Agreement? Typically, the buyer's agent writes up the purchase agreement. However, unless they are legally licensed to practice law, real estate agents generally can't create their own legal contracts.

A real estate deal can take a turn for the worst if the contract is not carefully written to include all the legal stipulations for both the buyer and seller.You can write your own real estate purchase agreement without paying any money as long as you include certain specifics about your home.

The bottom line is: Real estate contracts must always be in writing in order to be enforceable. While laws may vary from state to state, most states have a Statute of Frauds that applies. And in general, oral contracts are hard to prove and enforce, so it pays to have agreements in writing.

In real estate, a purchase agreement is a binding contract between a buyer and seller that outlines the details of a home sale transaction. The buyer will propose the conditions of the contract, including their offer price, which the seller will then either agree to, reject or negotiate.

A valid home purchase agreement must be in writing. The contract must contain an offer and an acceptance. The purpose of the agreement must be legal. There must be an exchange of things of value (usually, it's money for property)

A land contract, also known as a land installment contract, is an executory financing agreement between a seller and a buyer. The contract is essentially a seller-financed lending agreement for the purchase of a property, which requires the buyer to pay monthly installments until a balloon payment is due.

A land contract carries purchase obligations as the buyer had already committed into a financing agreement for the full purchase. On the other hand, a rent to own contract involves less obligations whereby the buyer has the option, but is not obligated to buy the property after the contract period.

1 Access The Desired Real Estate Template To Record A Purchase Agreement. 2 Introduce The Agreement, Seller, Buyer, And Concerned Property. 3 Define The Basic Terms Of The Real Estate Purchase. 4 Record Any Property The Buyer Must Sell To Complete This Purchase.

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Ohio

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Contract for Deed - General - Ohio

OHIO REVISED CODE

TITLE LIII REAL PROPERTY

CHAPTER 5301 CONVEYANCES; ENCUMBRANCES

5301.01. Acknowledgment of deed, mortgage, land contract, lease or memorandum of trust.

(A) A deed, mortgage, land contract as referred to in division (A) (21) of section 317.08 of the Revised Code, or lease of any interest in real property and a memorandum of trust as described in division (A) of section 5301.255 of the Revised Code shall be signed by the grantor, mortgagor, vendor, or lessor in the case of a deed, mortgage, land contract, or lease or shall be signed by the trustee in the case of a memorandum of trust. The signing shall be acknowledged by the grantor, mortgagor, vendor, or lessor, or by the trustee, before a judge or clerk of a court of record in this state, or a county auditor, county engineer, notary public, or mayor, who shall certify the acknowledgement and subscribe the official's name to the certificate of the acknowledgement.(B) (1) If a deed, mortgage, land contract as referred to in division (A) (21) of section 317.08 of the Revised Code, lease of any interest in real property, or a memorandum of trust as described in division (A) of section 5301.255 of the Revised Code was executed prior to February 1, 2002, and was not acknowledged in the presence of, or was not attested by, two witnesses as required by this section prior to that date, both of the following apply:

(a) The instrument is deemed properly executed and is presumed to be valid unless the signature of the grantor, mortgagor, vendor, or lessor in the case of a deed, mortgage, land contract, or lease or of the settlor and trustee in the case of a memorandum of trust was obtained by fraud.

(b) The recording of the instrument in the office of the county recorder of the county in which the subject property is situated is constructive notice of the instrument to all persons, including without limitation, a subsequent purchaser in good faith or any other subsequent holder of an interest in the property, regardless of whether the instrument was recorded prior to, on, or after February 1, 2002.

(2) Division (B)(1) of this section does not affect any accrued substantive rights or vested rights that came into existence prior to February 1, 2002.

Amended by 130th General Assembly File No. 41, HB 72, eff. 1/30/2014.

Effective Date: 07-20-2004; 2007 SB134 01-17-2008

[5301.01.1] 5301.011. Recorded instrument to contain reference.

A recorded grant, reservation, or agreement creating an easement or a recorded lease of any interest in real property shall contain a reference by volume and page to the record of the deed or other recorded instrument under which the grantor claims title, but the omission of such reference shall not affect the validity of the same.

Effective Date: 01-23-1963

[5301.01.2] 5301.012. Instrument to identify state agency for whose use and benefit an interest in real property is acquired.

(A) As used in this section, agency means every organized body, office, or agency established by the laws of the state for the exercise of any function of state government.(B) Any instrument by which the state or an agency of the state acquires an interest in real property, including any deed, transfer, grant, reservation, agreement creating an easement, or lease, shall identify the agency for whose use and benefit the interest in the real property is acquired.

(C) (1) If the instrument conveys less than a fee simple interest in real property and if the agency has authority to hold an interest in property in its own name, the instrument shall state that the interest in the real property is conveyed to .......... (the name of the agency). Otherwise, the instrument shall state that the interest in the real property is conveyed to the State of Ohio for the use and benefit of .......... (name of agency).

(2) If the instrument conveys a fee simple interest in real property and if the agency has authority to hold a fee simple interest in real property in its own name, the instrument shall state that the interest in the real property is conveyed to the .......... (name of agency) and its successors and assigns. Otherwise, the instrument that conveys a fee simple interest in the real property shall state to the State of Ohio and its successors and assigns for the use and benefit of .......... (name of agency).

(D) The purpose of specifying the name of the agency in the instrument is to identify the agency that has the use and benefit of the real property. The identification of the agency pursuant to this section does not confer on that agency any additional property rights in regard to the real property.

Effective Date: 10-26-1999

5301.02. Words necessary to create a fee simple estate.

The use of terms of inheritance or succession are not necessary to create a fee simple estate, and every grant, conveyance, or mortgage of lands, tenements, or hereditaments shall convey or mortgage the entire interest which the grantor could lawfully grant, convey, or mortgage, unless it clearly appears by the deed, mortgage, or instrument that the grantor intended to convey or mortgage a less estate.

Effective Date: 10-01-1953

5301.03. Grantee as trustee or agent.

Trustees, as trustee, or agent, or words of similar import, following the name of the grantee in any deed of conveyance or mortgage of land executed and recorded, without other language showing a trust or expressly limiting the grantee's or mortgagee's powers, or for whose benefit the same is made, or other recorded instrument showing such trust and its terms, do not give notice to or put upon inquiry any person dealing with said land that a trust or agency exists, or that there are beneficiaries of said conveyance or mortgage other than the grantee and those persons disclosed by the record, or that there are any limitations on the power of the grantee to convey or mortgage said land, or to assign or release any mortgage held by such grantee. As to all subsequent bona fide purchasers, mortgagees, lessees, and assignees for value, a conveyance, mortgage, assignment, or release of mortgage by such grantee, whether or not his name is followed by trustee, as trustee, agent, or words of similar import, conveys a title or lien free from the claims of any undisclosed beneficiaries, and free from any obligation on the part of any purchaser, mortgagee, lessee, or assignee to see to the application of any purchase money. This section does not apply to suits brought prior to July 16, 1927, in which any such deeds of conveyance, leases, or mortgages are called in question, or in which the rights of any beneficiaries in the lands described therein are involved. This section does not prevent the original grantor, trustor, undisclosed beneficiary, or any one claiming under them, from bringing suits other than suits affecting land which is the subject of such conveyance or mortgage.

Effective Date: 10-01-1953

5301.04. Deed, mortgage, or lease of a married person.

A deed, mortgage, or lease of any interest of a married person in real property shall be signed, acknowledged, and certified as provided in section 5301.01 of the Revised Code.

Effective Date: 02-01-2002

5301.06. Instruments executed according to law of place where made.

All deeds, mortgages, powers of attorney, and other instruments of writing for the conveyance or encumbrance of lands, tenements, or hereditaments situated within this state, executed and acknowledged, or proved, in any other state, territory, or country in conformity with the laws of such state, territory, or country, or in conformity with the laws of this state, are as valid as if executed within this state, in conformity with sections 1337.01 to 1337.03, inclusive, and 5301.01 to 5301.04, inclusive, of the Revised Code.

Effective Date: 10-01-1953

5301.07. Validating certain deeds; limitations.

When any instrument conveying real estate, or any interest therein, is of record for more than twenty-one years in the office of the county recorder of the county within this state in which such real estate is situated, and the record shows that there is a defect in such instrument, such instrument and the record thereof shall be cured of such defect and be effective in all respects as if such instrument had been legally made, executed, and acknowledged, if such defect is due to any one or more of the following:

(A) Such instrument was not properly witnessed.(B) Such instrument contained no certificate of acknowledgment.

(C) The certificate of acknowledgment was defective in any respect.

Any person claiming adversely to such instrument, if not already barred by limitation or otherwise, may, at any time within twenty-one years after the time of recording such instrument, bring proceedings to contest the effect of such instrument.

This section does not affect any suit brought prior to November 9, 1959 in which the validity of the acknowledgment of any such instrument is drawn in question.

Effective Date: 01-10-1961

5301.13. Mode of conveyance by state.

All conveyances of real estate, or any interest therein, sold on behalf of the state, with the exception of those agreements made pursuant to divisions (A), (B), (C), (D), and (E) of section 123.53 of the Revised Code, shall be drafted by the auditor of state, executed in the name of the state, signed by the governor, countersigned by the secretary of state, and sealed with the great seal of the state. The auditor of state thereupon must record such conveyance in books to be kept by him for that purpose, deliver them to the persons entitled thereto, and keep a record of such delivery, showing to whom delivered and the date thereof.

Effective Date: 11-15-1981

5301.14. Copy of record of lost deed to be evidence.

When a title deed, recorded by the auditor of state as required by section 5301.13 of the Revised Code, or recorded in the office of the secretary of state, the record of which is required to be kept in the office of the auditor of state, has been lost or destroyed by accident, without having been recorded in the county recorder's office, on demand and tender of the fees therefor, the auditor of state shall furnish to any person a copy of such deed certified under the auditor of state's official seal, which copy shall be received everywhere in this state as prima-facie evidence of the existence of the deed, and in all respects shall have the effect of certified copies from the official records of the county where such lands are situated.

Amended by 130th General Assembly File No. 41, HB 72, 1, eff. 1/30/2014.

Effective Date: 10-01-1953

5301.16. Execution of conveyance by state when purchaser dies before deed made.

When the purchaser of land from the state dies before a deed is made, and the lands pass to another by descent or devise, and the title still remains in him, or when the person to whom the lands have so passed has conveyed them or his interest therein to another person, by deed of general warranty or quitclaim, upon the proof of such facts being made to him and the attorney general, the governor shall execute the deed directly to the person entitled to the lands, although such person derives his title through one or more successive conveyances from the person to whom the lands passed by descent or devise.

Effective Date: 10-01-1953

OHIO REVISED CODE

TITLE LIII REAL PROPERTY

CHAPTER 5302 STATUTORY FORMS OF LAND CONVEYANCE

CO-OWNERSHIP

5302.22. Transfer on death deed.

(A) As used in sections 5302.22, 5302.222, 5302.23, and 5302.24 of the Revised Code:(1) Affidavit of confirmation means an affidavit executed under division (A) of section 5302.222 of the Revised Code.

(2) Survivorship tenancy means an ownership of real property or any interest in real property by two or more persons that is created by executing a deed pursuant to section 5302.17 of the Revised Code.

(3) Survivorship tenant means one of the owners of real property or any interest in real property in a survivorship tenancy.

(4) Tenants by the entireties mean only those persons who are vested as tenants in an estate by the entireties with survivorship pursuant to any deed recorded between February 9, 1972, and April 3, 1985, under section 5302.17 of the Revised Code as it existed during that period of time. Nothing in sections 5302.22, 5302.222, 5302.23, and 5302.24 of the Revised Code authorizes the creation of a tenancy by the entireties or recognizes a tenancy by the entireties created outside that period of time.

(5) Transfer on death designation affidavit means an affidavit executed under this section.

(6) Transfer on death beneficiary or beneficiaries means the beneficiary or beneficiaries designated in a transfer on death designation affidavit.

(B) Any individual who, under the Revised Code or the common law of this state, owns real property or any interest in real property as a sole owner , as a tenant in common, or as a survivorship tenant, or together with the individual's spouse owns an indivisible interest in real property as tenants by the entireties, may designate the entire interest, or any specified part that is less than the entire interest, in that real property as transferable on death to a designated beneficiary or beneficiaries by executing , together with the individual's spouse, if any, a transfer on death designation affidavit as provided in this section .

If the affidavit is executed by an individual together with the individual's spouse, if any, the dower rights of the spouse are subordinate to the vesting of title to the interest in the real property in the transfer on death beneficiary or beneficiaries designated under this section. The affidavit shall be recorded in the office of the county recorder in the county in which the real property is located, and, when so recorded, the affidavit or a certified copy of the affidavit shall be evidence of the transfer on death beneficiary or beneficiaries so designated in the affidavit insofar as the affidavit affects title to the real property.

(C) (1) If an individual who owns real property or an interest in real property as a sole owner or as a tenant in common executes a transfer on death designation affidavit, upon the death of that individual, title to the real property or interest in the real property specified in the affidavit vests in the transfer on death beneficiary or beneficiaries designated in the affidavit.

(2) If an individual who owns real property or an interest in real property as a survivorship tenant executes a transfer on death designation affidavit, upon the death of that individual or of one but not all of the surviving survivorship tenants, title to the real property or interest in the real property specified in the affidavit vests in the surviving survivorship tenant or tenants. Upon the death of the last surviving survivorship tenant, title to the real property or interest in the real property vests in the transfer on death beneficiary or beneficiaries designated in the affidavit, subject to division (B)(7) of section 5302.23 of the Revised Code.

(3) If an individual who together with the individual's spouse owns an indivisible interest in real property as tenants by the entireties executes a transfer on death designation affidavit, upon the death of that individual, title to the real property or interest in the real property vests in the remaining tenant by the entireties. Upon the death of the remaining tenant by the entireties, title to the real property or interest in the real property vests in the transfer on death beneficiary or beneficiaries designated in the affidavit, subject to division (B)(7) of section 5302.23 of the Revised Code.

(D) A transfer on death designation affidavit shall be verified before any person authorized to administer oaths and shall include all of the following:

(1) A description of the real property the title to which is affected by the affidavit and a reference to an instrument of record containing that description;

(2) If less than the entire interest in the real property is to be transferred on death under the affidavit, a statement of the specific interest or part of the interest in the real property that is to be so transferred;

(3) A statement by the individual executing the affidavit that the individual is the person appearing on the record of the real property as the owner of the real property or interest in the real property at the time of the recording of the affidavit and the marital status of that owner. If the owner is married, the affidavit shall include a statement by the owner's spouse stating that the spouse's dower rights are subordinate to the vesting of title to the real property or interest in the real property in the transfer on death beneficiary or beneficiaries designated in the affidavit.

(4) A statement designating one or more persons, identified by name, as transfer on death beneficiary or beneficiaries.

(E) The county recorder of the county in which a transfer on death designation affidavit is offered for recording shall receive the affidavit and cause it to be recorded in the same manner as deeds are recorded. The county recorder shall collect a fee for recording the affidavit in the same amount as the fee for recording deeds. The county recorder shall index the affidavit in the name of the owner of record of the real property or interest in the real property who executed the affidavit.

(F) A transfer on death designation affidavit need not be supported by consideration and need not be delivered to the transfer on death beneficiary or beneficiaries designated in the affidavit to be effective. However, in order to be effective, that affidavit shall be recorded with the county recorder as described in this section prior to the death of the individual who executed the affidavit.

(G) Subject to division (C) of this section, upon the death of any individual who owns real property or an interest in real property that is subject to a transfer on death beneficiary designation made under a transfer on death designation affidavit as provided in this section, that real property or interest in real property of the deceased owner shall be transferred only to the transfer on death beneficiary or beneficiaries who are identified in the affidavit by name and who survive the deceased owner or that are in existence on the date of death of the deceased owner.

For purposes of this division, if a natural or legal person designated by name in the affidavit as a transfer on death beneficiary or as a contingent transfer on death beneficiary as provided in division (B)(2) of section 5302.23 of the Revised Code solely in that person's capacity as a trustee of a trust has died, has resigned, or otherwise has been replaced by a successor trustee of the trust on the date of death of the deceased owner, the successor trustee of the trust shall be considered the transfer on death beneficiary or contingent transfer on death beneficiary in existence on the date of death of the deceased owner in full compliance with this division, notwithstanding that the successor trustee is not named as a transfer on death beneficiary or contingent transfer on death beneficiary in the affidavit.

(H) Any person who knowingly makes any false statement in a transfer on death designation affidavit is guilty of falsification under division (A)(6) of section 2921.13 of the Revised Code.

Amended by 128th General Assembly File No.17, SB 124, 1, eff. 12/28/2009.

Effective Date: 02-01-2002

5302.23. Designation of transfer on death beneficiary.

(A) Any affidavit containing language that shows a clear intent to designate a transfer on death beneficiary shall be liberally construed to do so.(B) Real property or an interest in real property that is the subject of a transfer on death designation affidavit as provided in section 5302.22 of the Revised Code or as described in division (A) of this section has all of the following characteristics and ramifications:

(1) An interest of a deceased owner shall be transferred to the transfer on death beneficiaries who are identified in the affidavit by name and who survive the deceased owner or that are in existence on the date of the deceased owner's death. If there is a designation of more than one transfer on death beneficiary, the beneficiaries shall take title to the interest in equal shares as tenants in common, unless the deceased owner has specifically designated other than equal shares or has designated that the beneficiaries take title as survivorship tenants, subject to division (B)(3) of this section. If a transfer on death beneficiary does not survive the deceased owner or is not in existence on the date of the deceased owner's death, and the deceased owner has designated one or more persons as contingent transfer on death beneficiaries as provided in division (B)(2) of this section, the designated contingent transfer on death beneficiaries shall take the same interest that would have passed to the transfer on death beneficiary had that transfer on death beneficiary survived the deceased owner or been in existence on the date of the deceased owner's death. If none of the designated transfer on death beneficiaries survives the deceased owner or is in existence on the date of the deceased owner's death and no contingent transfer on death beneficiaries have been designated , have survived the deceased owner, or are in existence on the date of death of the deceased owner, the interest of the deceased owner shall be distributed as part of the probate estate of the deceased owner of the interest. If there are two or more transfer on death beneficiaries and the deceased owner has designated that title to the interest in the real property be taken by those beneficiaries as survivorship tenants, no designated contingent transfer on death beneficiaries shall take title to the interest unless none of the transfer on death beneficiaries survives the deceased owner on the date of death of the deceased owner.

(2) A transfer on death designation affidavit may contain a designation of one or more persons as contingent transfer on death beneficiaries, who shall take the interest of the deceased owner that would otherwise have passed to the transfer on death beneficiary if that named transfer on death beneficiary does not survive the deceased owner or is not in existence on the date of death of the deceased owner. Persons designated as contingent transfer on death beneficiaries shall be identified in the affidavit by name.

(3) Any transfer on death beneficiary or contingent transfer on death beneficiary may be a natural or legal person, including, but not limited to, a bank as trustee of a trust, except that if two or more transfer on death beneficiaries are designated as survivorship tenants, all of those beneficiaries shall be natural persons and if two or more contingent transfer on death beneficiaries are designated as survivorship tenants, all of those contingent beneficiaries shall be natural persons. A natural person who is designated a transfer on death beneficiary or contingent transfer on death beneficiary solely in that natural person's capacity as a trustee of a trust is not considered a natural person for purposes of designating the transfer on death beneficiaries or contingent transfer on death beneficiaries as survivorship tenants under division (B)(3) of this section.

(4) The designation of a transfer on death beneficiary has no effect on the present ownership of real property, and a person designated as a transfer on death beneficiary has no interest in the real property until the death of the owner of the interest.

(5) The designation in a transfer on death designation affidavit of any transfer on death beneficiary may be revoked or changed at any time, without the consent of that transfer on death beneficiary, by the owner of the interest, by the surviving survivorship tenants of the interest, or by the remaining tenant by the entireties of the interest, by executing and recording, prior to the death of the owner of the interest, of the surviving survivorship tenants of the interest, or of the remaining tenant by the entireties of the interest, as the case may be, a new transfer on death designation affidavit pursuant to section 5302.22 of the Revised Code stating the revocation or change in that designation. The new transfer on death designation affidavit shall automatically supersede and revoke all prior recorded transfer on death designation affidavits with respect to the real property or the interest in real property identified in the new affidavit, provided that the prior recorded affidavit was executed before the later recorded affidavit.

(6) A fee simple title or any fractional interest in a fee simple title may be subjected to a transfer on death beneficiary designation.

(7) (a) A transfer on death beneficiary takes only the interest that the deceased owner or owners of the interest held on the date of death, subject to all encumbrances, reservations, and exceptions.

(b) If the owners hold title to the interest in a survivorship tenancy, the death of all except the last survivorship tenant automatically terminates and nullifies any transfer on death beneficiary designations made solely by the deceased survivorship tenant or tenants without joinder by the last surviving survivorship tenant. The termination or nullification of any transfer on death beneficiary designations under division (B)(7)(b) of this section is effective as of the date of death of a deceased survivorship tenant. No affirmative act of revocation is required of the last surviving survivorship tenant for the termination or nullification of the transfer on death beneficiary designations to occur as described in division (B)(7)(b) of this section. If the last surviving survivorship tenant dies with no transfer on death beneficiary designation, the entire interest of that last surviving survivorship tenant shall be distributed as part of the tenant's probate estate.

(c) If the owners hold title to the interest in a tenancy by the entireties, the death of the first tenant by the entireties automatically terminates and nullifies any transfer on death beneficiary designations made solely by that deceased first tenant without joinder by the remaining tenant by the entireties. The termination or nullification of any transfer on death beneficiary designations under division (B)(7)(c) of this section is effective as of the date of death of the first tenant by the entireties. No affirmative act of revocation is required of the remaining tenant by the entireties for the termination or nullification of the transfer on death beneficiary designations to occur as described in division (B)(7)(c) of this section. If the remaining tenant by the entireties dies with no transfer on death beneficiary designation, the entire interest of that remaining tenant shall be distributed as part of the tenant's probate estate.

(8) No rights of any lienholder, including, but not limited to, any mortgagee, judgment creditor, or mechanic's lien holder, shall be affected by the designation of a transfer on death beneficiary pursuant to this section and section 5302.22 of the Revised Code. If any lienholder takes action to enforce the lien, by foreclosure or otherwise through a court proceeding, it is not necessary to join any transfer on death beneficiary as a party defendant in the action unless the transfer on death beneficiary has another interest in the real property .

(9) Any transfer on death of real property or of an interest in real property that results from a transfer on death designation affidavit designating a transfer on death beneficiary is not testamentary. That transfer on death shall supersede any attempted testate or intestate transfer of that real property or interest in real property.

(10) The execution and recording of a transfer on death designation affidavit shall be effective to terminate the designation of a transfer on death beneficiary in a transfer on death deed involving the same real property or interest in real property and recorded prior to the effective date of this section.

(11) The execution and recording of a transfer on death designation affidavit shall be effective to bar the vesting of any rights of dower in a subsequent spouse of the owner of the real property who executed that affidavit unless the affidavit is revoked or changed.

Amended by 128th General AssemblyFile No.17, SB 124, 1, eff. 12/28/2009.

Effective Date: 08-29-2000

OHIO REVISED CODE

TITLE LIII REAL PROPERTY

CHAPTER 5313 LAND INSTALLMENT CONTRACTS

5313.01. Definitions.

As used in Chapter 5313. of the Revised Code:

(A) Land installment contract means an executory agreement which by its terms is not required to be fully performed by one or more of the parties to the agreement within one year of the date of the agreement and under which the vendor agrees to convey title in real property located in this state to the vendee and the vendee agrees to pay the purchase price in installment payments, while the vendor retains title to the property as security for the vendee's obligation. Option contracts for the purchase of real property are not land installment contracts.(B) Property means real property located in this state improved by virtue of a dwelling having been erected on the real property.

(C) Vendor means any individual, partnership, corporation, association, trust, or any other group of individuals however organized making a sale of property by means of a land installment contract.

(D) Vendee means the person who acquires an interest in property pursuant to a land installment contract, or any legal successor in interest to that person.

(E) Legal description means a description of the property by metes and bounds or lot numbers of a recorded plat including a description of any portion of the property subject to an easement or reservation, if any.

Effective Date: 10-06-1980

5313.02. Required provisions of land installment contracts.

(A) Every land installment contract shall be executed in duplicate, and a copy of the contract shall be provided to the vendor and the vendee. The contract shall contain at least the following provisions:(1) The full names and then current mailing addresses of all the parties to the contract;

(2) The date when the contract was signed by each party;

(3) A legal description of the property conveyed;

(4) The contract price of the property conveyed;

(5) Any charges or fees for services that are includable in the contract separate from the contract price;

(6) The amount of the vendee's down payment;

(7) The principal balance owed, which is the sum of the items specified in divisions (A)(4) and (5) of this section less the item specified in division (A)(6) of this section;

(8) The amount and due date of each installment payment;

(9) The interest rate on the unpaid balance and the method of computing the rate;

(10) A statement of any encumbrances against the property conveyed;

(11) A statement requiring the vendor to deliver a general warranty deed on completion of the contract, or another deed that is available when the vendor is legally unable to deliver a general warranty deed;

(12) A provision that the vendor provide evidence of title in accordance with the prevailing custom in the area in which the property is located;

(13) A provision that, if the vendor defaults on any mortgage on the property, the vendee can pay on that mortgage and receive credit on the land installment contract;

(14) A provision that the vendor shall cause a copy of the contract to be recorded;

(15) A requirement that the vendee be responsible for the payment of taxes, assessments, and other charges against the property from the date of the contract, unless agreed to the contrary;

(16) A statement of any pending order of any public agency against the property.

(B) No vendor shall hold a mortgage on property sold by a land installment contract in an amount greater than the balance due under the contract, except a mortgage that covers real property in addition to the property that is the subject of the contract where the vendor has made written disclosure to the vendee of the amount of that mortgage and the release price, if any, attributable to the property in question.

No vendor shall place a mortgage on the property in an amount greater than the balance due on the contract without the consent of the vendee.

(C) Within twenty days after a land installment contract has been signed by both the vendor and the vendee, the vendor shall cause a copy of the contract to be recorded as provided in section 5301.25 of the Revised Code and a copy of the contract to be delivered to the county auditor.

(D) Every land installment contract shall conform to the formalities required by law for the execution of deeds and mortgages. The vendor of any land installment contract that contains a metes and bounds legal description shall have that description reviewed by the county engineer. The county engineer shall indicate his approval of the description on the contract.

Effective Date: 03-19-1993

5313.03. Statements required to be furnished to vendee.

Every vendor under a land installment contract shall, at least once a year, or on demand of the vendee, but no more than twice a year, furnish a statement to the vendee showing the following:

(A) The amount credited to principal and interest;(B) The balance due.

A land contract passbook issued by the vendor or a financial institution shall be sufficient compliance with this section.

HISTORY: 133 v S 156. Eff 11-25-69.

5313.04. Vendee to enforce chapter provisions.

Upon the failure of any vendor to comply with Chapter 5313. of the Revised Code, the vendee may enforce such provisions in a municipal court, county court, or court of common pleas. Upon the determination of the court that the vendor has failed to comply with these provisions, the court shall grant appropriate relief.

Effective Date: 11-25-1969

5313.05. Default of vendee

When the vendee of a land installment contract defaults in payment, forfeiture of the interest of the vendee under the contract may be enforced only after the expiration of thirty days from the date of the default. A vendee in default may, prior to the expiration of the thirty-day period, avoid the forfeiture of his interest under the contract by making all payments currently due under the contract and by paying any fees or charges for which he is liable under the contract. If such payments are made within the thirty-day period, forfeiture of the interest of the vendee shall not be enforced.

Effective Date: 11-25-1969

5313.06. Notice of forfeiture.

Following expiration of the period of time provided in section 5313.05 of the Revised Code, forfeiture of the interest of a vendee in default under a land installment contract shall be initiated by the vendor or by his successor in interest, by serving or causing to be served on the vendee or his successor in interest, if known to the vendor or his successor in interest, a written notice which:

(A) Reasonably identifies the contract and describes the property covered by it;(B) Specifies the terms and conditions of the contract which have not been complied with;

(C) Notifies the vendee that the contract will stand forfeited unless the vendee performs the terms and conditions of the contract within ten days of the completed service of notice and notifies the vendee to leave the premises.

Such notice shall be served by the vendor or his successor in interest by handing a written copy of the notice to the vendee or his successor in interest in person, or by leaving it at his usual place of abode or at the property which is the subject of the contract or by registered or certified mail by mailing to the last known address of the vendee or his successor in interest.

Effective Date: 04-01-1986

5313.07. Proceeding for foreclosure and judicial sale.

If the vendee of a land installment contract has paid in accordance with the terms of the contract for a period of five years or more from the date of the first payment or has paid toward the purchase price a total sum equal to or in excess of twenty per cent thereof, the vendor may recover possession of his property only by use of a proceeding for foreclosure and judicial sale of the foreclosed property as provided in section 2323.07 of the Revised Code. Such action may be commenced after expiration of the period of time prescribed by sections 5313.05 and 5313.06 of the Revised Code. In such an action, as between the vendor and vendee, the vendor shall be entitled to proceeds of the sale up to and including the unpaid balance due on the land installment contract.

Chapter 5313: of the Revised Code does not prevent the vendor or vendee of a land installment contract from commencing a quiet title action to establish the validity of his claim to the property conveyed under a land installment contract nor from bringing an action for unpaid installments.

Chapter 5313: of the Revised Code does not prevent the vendor and vendee from cancelling their interest in a land installment contract under section 5301.331 of the Revised Code.

Effective Date: 11-25-1969

5313.08. Action for forfeiture and restitution.

If the contract has been in effect for less than five years, in addition to any other remedies provided by law and after the expiration of the periods prescribed by sections 5313.05 and 5313.06 of the Revised Code, if the vendee is still in default of any payment the vendor may bring an action for forfeiture of the vendee's rights in the land installment contract and for restitution of his property under Chapter 1923. of the Revised Code. When bringing the action under Chapter 1923. of the Revised Code, the vendor complies with the notice requirement of division (A) of section 1923.04 of the Revised Code by serving notice pursuant to section 5313.06 of the Revised Code. The court may also grant any other claim arising out of the contract.

Effective Date: 10-06-1980

5313.09. Instrument of cancellation of land contract.

A judgment for the vendor shall operate to cancel the land installment contract as of a date to be specified by the court. The clerk of the county or municipal court in which such judgment is rendered shall transmit an authenticated copy of such dated judgment to the county recorder of the county in which the property is located.

The county recorder of such county shall record such authenticated judgment as an instrument of cancellation under section 5301.331 of the Revised Code.

Effective Date: 11-25-1969

5313.10 Terminating land installment contract is exclusive remedy

The election of the vendor to terminate the land installment contract by an action under section 5313.07 or 5313.08 of the Revised Code is an exclusive remedy which bars further action on the contract unless the vendee has paid an amount less than the fair rental value plus deterioration or destruction of the property occasioned by the vendee's use. In such case the vendor may recover the difference between the amount paid by the vendee on the contract and the fair rental value of the property plus an amount for the deterioration or destruction of the property occasioned by the vendee's use.

Effective Date: 11-25-1969

OHIO REVISED CODE

TITLE LVIII OHIO TRUST CODE

CHAPTER 5815 FIDUCIARY LAW

MISCELLANEOUS PROVISIONS

5815.36. Disclaimer of succession to property.

(A) As used in this section:(1) Disclaimant means any person, any guardian or personal representative of a person or estate of a person, or any attorney-in-fact or agent of a person having a general or specific authority to act granted in a written instrument, who is any of the following:

(a) With respect to testamentary instruments and intestate succession, an heir, next of kin, devisee, legatee, donee, person succeeding to a disclaimed interest, surviving joint tenant, surviving tenant by the entireties, surviving tenant of a tenancy with a right of survivorship, beneficiary under a testamentary instrument, or person designated to take pursuant to a power of appointment exercised by a testamentary instrument;

(b) With respect to nontestamentary instruments, a grantee, donee, person succeeding to a disclaimed interest, surviving joint tenant, surviving tenant by the entireties, surviving tenant of a tenancy with a right of survivorship, beneficiary under a nontestamentary instrument, or person designated to take pursuant to a power of appointment exercised by a nontestamentary instrument;

(c) With respect to fiduciary rights, privileges, powers, and immunities, a fiduciary under a testamentary or nontestamentary instrument. Division (A)(1)(c) of this section does not authorize a fiduciary who disclaims fiduciary rights, privileges, powers, and immunities to cause the rights of any beneficiary to be disclaimed unless the instrument creating the fiduciary relationship authorizes the fiduciary to make such a disclaimer.

(d) Any person entitled to take an interest in property upon the death of a person or upon the occurrence of any other event.

(2) Personal representative includes any fiduciary as defined in section 2109.01 of the Revised Code and any executor, trustee, guardian, or other person or entity having a fiduciary relationship with regard to any interest in property passing to the fiduciary, executor, trustee, guardian, or other person or entity by reason of a disclaimant's death.

(3) Property means all forms of property, real and personal, tangible and intangible.

(B) (1) A disclaimant, other than a fiduciary under an instrument who is not authorized by the instrument to disclaim the interest of a beneficiary, may disclaim, in whole or in part, the succession to any property by executing and by delivering, filing, or recording a written disclaimer instrument in the manner provided in this section.

(2) A disclaimant who is a fiduciary under an instrument may disclaim, in whole or in part, any right, power, privilege, or immunity, by executing and by delivering, filing, or recording a written disclaimer instrument in the manner provided in this section.

(3) The written instrument of disclaimer shall be signed and acknowledged by the disclaimant and shall contain all of the following:

(a) A reference to the donative instrument;

(b) A description of the property, part of property, or interest disclaimed, and of any fiduciary right, power, privilege, or immunity disclaimed;

(c) A declaration of the disclaimer and its extent.

(4) The guardian of the estate of a minor or an incompetent, or the personal representative of a deceased person, whether or not authorized by the instrument to disclaim, with the consent of the probate division of the court of common pleas may disclaim, in whole or in part, the succession to any property, or interest in property, that the ward, if an adult and competent, or the deceased, if living, might have disclaimed. The guardian or personal representative, or any interested person may file an application with the probate division of the court of common pleas that has jurisdiction of the estate, asking that the court order the guardian or personal representative to execute and deliver, file, or record the disclaimer on behalf of the ward, estate, or deceased person. The court shall order the guardian or personal representative to execute and deliver, file, or record the disclaimer if the court finds, upon hearing after notice to interested parties and such other persons as the court shall direct, that:

(a) It is in the best interests of those interested in the estate of the person and of those who will take the disclaimed interest;

(b) It would not materially, adversely affect the minor or incompetent, or the beneficiaries of the estate of the decedent, taking into consideration other available resources and the age, probable life expectancy, physical and mental condition, and present and reasonably anticipated future needs of the minor or incompetent or the beneficiaries of the estate of the decedent.

A written instrument of disclaimer ordered by the court under this division shall be executed and be delivered, filed, or recorded within the time and in the manner in which the person could have disclaimed if the person were living, an adult, and competent.

(C) A partial disclaimer of property that is subject to a burdensome interest created by the donative instrument is not effective unless the disclaimed property constitutes a gift that is separate and distinct from undisclaimed gifts.

(D) The disclaimant shall deliver, file, or record the disclaimer, or cause the same to be done, prior to accepting any benefits of the disclaimed interest and at any time after the latest of the following dates:

(1) The effective date of the donative instrument if both the taker and the taker's interest in the property are finally ascertained on that date;

(2) The date of the occurrence of the event upon which both the taker and the taker's interest in the property become finally ascertainable;

(3) The date on which the disclaimant attains eighteen years of age or is no longer an incompetent, without tendering or repaying any benefit received while the disclaimant was under eighteen years of age or an incompetent, and even if a guardian of a minor or incompetent had filed an application pursuant to division (B)(4) of this section and the probate division of the court of common pleas involved did not consent to the guardian executing a disclaimer.

(E) No disclaimer instrument is effective under this section if either of the following applies under the terms of the disclaimer instrument:

(1) The disclaimant has power to revoke the disclaimer.

(2) The disclaimant may transfer, or direct to be transferred, to self the entire legal and equitable ownership of the property subject to the disclaimer instrument.

(F) (1) Subject to division (F)(2) of this section, if the interest disclaimed is created by a nontestamentary instrument, including, but not limited to, a transfer on death designation affidavit pursuant to section 5302.22 of the Revised Code, the disclaimer instrument shall be delivered personally or by certified mail to the trustee or other person who has legal title to, or possession of, the property disclaimed. If the interest disclaimed is created by a transfer on death designation affidavit pursuant to section 5302.22 of the Revised Code, the disclaimer instrument shall be filed with the county recorder of the county in which the real property that is the subject of that affidavit is located.

(2) If the interest disclaimed is created by a testamentary instrument, by intestate succession, or by a certificate of title to a motor vehicle, watercraft, or outboard motor that evidences ownership of the motor vehicle, watercraft, or outboard motor that is transferable on death pursuant to section 2131.13 of the Revised Code, the disclaimer instrument shall be filed in the probate division of the court of common pleas in the county in which proceedings for the administration of the decedent's estate have been commenced, and an executed copy of the disclaimer instrument shall be delivered personally or by certified mail to the personal representative of the decedent's estate.

(3) If no proceedings for the administration of the decedent's estate have been commenced, the disclaimer instrument shall be filed in the probate division of the court of common pleas in the county in which proceedings for the administration of the decedent's estate might be commenced according to law. The disclaimer instrument shall be filed and indexed, and fees charged, in the same manner as provided by law for an application to be appointed as personal representative to administer the decedent's estate. The disclaimer is effective whether or not proceedings thereafter are commenced to administer the decedent's estate. If proceedings thereafter are commenced for the administration of the decedent's estate, they shall be filed under, or consolidated with, the case number assigned to the disclaimer instrument.

(4) If an interest in real estate is disclaimed, an executed copy of the disclaimer instrument also shall be recorded in the office of the recorder of the county in which the real estate is located. The disclaimer instrument shall include a description of the real estate with sufficient certainty to identify it, and shall contain a reference to the record of the instrument that created the interest disclaimed. If title to the real estate is registered under Chapters 5309. and 5310. of the Revised Code, the disclaimer interest shall be entered as a memorial on the last certificate of title. A spouse of a disclaimant has no dower or other interest in the real estate disclaimed.

(G) If a donative instrument expressly provides for the distribution of property, part of property, or interest in property if there is a disclaimer, the property, part of property, or interest disclaimed shall be distributed or disposed of, and accelerated or not accelerated, in accordance with the donative instrument. In the absence of express provisions to the contrary in the donative instrument, the property, part of property, or interest in property disclaimed, and any future interest that is to take effect in possession or enjoyment at or after the termination of the interest disclaimed, shall descend, be distributed, or otherwise be disposed of, and shall be accelerated, in the following manner:

(1) If intestate or testate succession is disclaimed, as if the disclaimant had predeceased the decedent;

(2) If the disclaimant is one designated to take pursuant to a power of appointment exercised by a testamentary instrument, as if the disclaimant had predeceased the donee of the power;

(3) If the donative instrument is a nontestamentary instrument, as if the disclaimant had died before the effective date of the nontestamentary instrument;

(4) If the disclaimer is of a fiduciary right, power, privilege, or immunity, as if the right, power, privilege, or immunity was never in the donative instrument.

(H) A disclaimer pursuant to this section is effective as of, and relates back for all purposes to, the date upon which the taker and the taker's interest have been finally ascertained.

(I) A disclaimant who has a present and future interest in property, and disclaims the disclaimant's present interest in whole or in part, is considered to have disclaimed the disclaimant's future interest to the same extent, unless a contrary intention appears in the disclaimer instrument or the donative instrument. A disclaimant is not precluded from receiving, as an alternative taker, a beneficial interest in the property disclaimed, unless a contrary intention appears in the disclaimer instrument or in the donative instrument.

(J) The disclaimant's right to disclaim under this section is barred if the disclaimant does any of the following:

(1) Assigns, conveys, encumbers, pledges, or transfers, or contracts to assign, convey, encumber, pledge, or transfer, the property or any interest in it;

(2) Waives in writing the disclaimant's right to disclaim and executes and delivers, files, or records the waiver in the manner provided in this section for a disclaimer instrument;

(3) Accepts the property or an interest in it;

(4) Permits or suffers a sale or other disposition of the property pursuant to judicial action against the disclaimant.

(K) Neither a fiduciary's application for appointment or assumption of duties as a fiduciary nor a beneficiary's application for appointment as a personal representative or fiduciary waives or bars the disclaimant's right to disclaim a right, power, privilege, or immunity as a personal representative or fiduciary or the beneficiary's right to disclaim property.

(L) The right to disclaim under this section exists irrespective of any limitation on the interest of the disclaimant in the nature of a spendthrift provision or similar restriction.

(M) A disclaimer instrument or written waiver of the right to disclaim that has been executed and delivered, filed, or recorded as required by this section is final and binding upon all persons.

(N) (1) The right to disclaim and the procedures for disclaimer established by this section are in addition to, and do not exclude or abridge, any other rights or procedures that exist or formerly existed under any other section of the Revised Code or at common law to assign, convey, release, refuse to accept, renounce, waive, or disclaim property.

(2) A disclaimer is not considered a transfer or conveyance by the disclaimant, and no creditor of a disclaimant may avoid a disclaimer.

(3) This section shall take precedence over any other section of the Revised Code that conflicts with this section.

(O) (1) No person is liable for distributing or disposing of property in a manner inconsistent with the terms of a valid disclaimer if the distribution or disposition is otherwise proper and the person has no actual knowledge of the disclaimer.

(2) No person is liable for distributing or disposing of property in reliance upon the terms of a disclaimer that is invalid because the right of disclaimer has been waived or barred if the distribution or disposition is otherwise proper and the person has no actual knowledge of the facts that constitute a waiver or bar to the right to disclaim.

(P) (1) A disclaimant may disclaim pursuant to this section any interest in property that is in existence on September 27, 1976, if either the interest in the property or the taker of the interest in the property is not finally ascertained on that date.

(2) No disclaimer executed pursuant to this section destroys or diminishes an interest in property that exists on September 27, 1976, in any person other than the disclaimant.

(Q) This section may be applied separately to different interests or powers created in the disclaimant by the same testamentary or nontestamentary instrument.

Amended by 129th General AssemblyFile No.201, HB 479, 1, eff. 3/27/2013.

Amended by 128th General AssemblyFile No.17, SB 124, 1, eff. 12/28/2009.

Effective Date: 01-01-2007; 2008 HB160 06-20-2008

OHIO CASE LAW

A vendee of a land installment contract stands as an equitable owner of property sold under the contract: Blue Ash Bldg. & Loan Co. v. Hahn, 20 Ohio App. 3d 21, 484 N.E.2d 186 (1984).

Where property has been sold pursuant to a land installment contract, the vendor, without the consent of the vendee, may not place a mortgage on the property in an amount greater than the balance due on the contract. A mortgage executed in violation of this prohibition is null and void: Toledo Trust Co. v. Cole, 27 Ohio App. 3d 340, 500 N.E.2d 920 (1986).

Contract for Deed - General - Ohio

OHIO REVISED CODE

TITLE LIII REAL PROPERTY

CHAPTER 5301 CONVEYANCES; ENCUMBRANCES

5301.01. Acknowledgment of deed, mortgage, land contract, lease or memorandum of trust.

(A) A deed, mortgage, land contract as referred to in division (A) (21) of section 317.08 of the Revised Code, or lease of any interest in real property and a memorandum of trust as described in division (A) of section 5301.255 of the Revised Code shall be signed by the grantor, mortgagor, vendor, or lessor in the case of a deed, mortgage, land contract, or lease or shall be signed by the trustee in the case of a memorandum of trust. The signing shall be acknowledged by the grantor, mortgagor, vendor, or lessor, or by the trustee, before a judge or clerk of a court of record in this state, or a county auditor, county engineer, notary public, or mayor, who shall certify the acknowledgement and subscribe the official's name to the certificate of the acknowledgement.(B) (1) If a deed, mortgage, land contract as referred to in division (A) (21) of section 317.08 of the Revised Code, lease of any interest in real property, or a memorandum of trust as described in division (A) of section 5301.255 of the Revised Code was executed prior to February 1, 2002, and was not acknowledged in the presence of, or was not attested by, two witnesses as required by this section prior to that date, both of the following apply:

(a) The instrument is deemed properly executed and is presumed to be valid unless the signature of the grantor, mortgagor, vendor, or lessor in the case of a deed, mortgage, land contract, or lease or of the settlor and trustee in the case of a memorandum of trust was obtained by fraud.

(b) The recording of the instrument in the office of the county recorder of the county in which the subject property is situated is constructive notice of the instrument to all persons, including without limitation, a subsequent purchaser in good faith or any other subsequent holder of an interest in the property, regardless of whether the instrument was recorded prior to, on, or after February 1, 2002.

(2) Division (B)(1) of this section does not affect any accrued substantive rights or vested rights that came into existence prior to February 1, 2002.

Amended by 130th General Assembly File No. 41, HB 72, eff. 1/30/2014.

Effective Date: 07-20-2004; 2007 SB134 01-17-2008

[5301.01.1] 5301.011. Recorded instrument to contain reference.

A recorded grant, reservation, or agreement creating an easement or a recorded lease of any interest in real property shall contain a reference by volume and page to the record of the deed or other recorded instrument under which the grantor claims title, but the omission of such reference shall not affect the validity of the same.

Effective Date: 01-23-1963

[5301.01.2] 5301.012. Instrument to identify state agency for whose use and benefit an interest in real property is acquired.

(A) As used in this section, agency means every organized body, office, or agency established by the laws of the state for the exercise of any function of state government.(B) Any instrument by which the state or an agency of the state acquires an interest in real property, including any deed, transfer, grant, reservation, agreement creating an easement, or lease, shall identify the agency for whose use and benefit the interest in the real property is acquired.

(C) (1) If the instrument conveys less than a fee simple interest in real property and if the agency has authority to hold an interest in property in its own name, the instrument shall state that the interest in the real property is conveyed to .......... (the name of the agency). Otherwise, the instrument shall state that the interest in the real property is conveyed to the State of Ohio for the use and benefit of .......... (name of agency).

(2) If the instrument conveys a fee simple interest in real property and if the agency has authority to hold a fee simple interest in real property in its own name, the instrument shall state that the interest in the real property is conveyed to the .......... (name of agency) and its successors and assigns. Otherwise, the instrument that conveys a fee simple interest in the real property shall state to the State of Ohio and its successors and assigns for the use and benefit of .......... (name of agency).

(D) The purpose of specifying the name of the agency in the instrument is to identify the agency that has the use and benefit of the real property. The identification of the agency pursuant to this section does not confer on that agency any additional property rights in regard to the real property.

Effective Date: 10-26-1999

5301.02. Words necessary to create a fee simple estate.

The use of terms of inheritance or succession are not necessary to create a fee simple estate, and every grant, conveyance, or mortgage of lands, tenements, or hereditaments shall convey or mortgage the entire interest which the grantor could lawfully grant, convey, or mortgage, unless it clearly appears by the deed, mortgage, or instrument that the grantor intended to convey or mortgage a less estate.

Effective Date: 10-01-1953

5301.03. Grantee as trustee or agent.

Trustees, as trustee, or agent, or words of similar import, following the name of the grantee in any deed of conveyance or mortgage of land executed and recorded, without other language showing a trust or expressly limiting the grantee's or mortgagee's powers, or for whose benefit the same is made, or other recorded instrument showing such trust and its terms, do not give notice to or put upon inquiry any person dealing with said land that a trust or agency exists, or that there are beneficiaries of said conveyance or mortgage other than the grantee and those persons disclosed by the record, or that there are any limitations on the power of the grantee to convey or mortgage said land, or to assign or release any mortgage held by such grantee. As to all subsequent bona fide purchasers, mortgagees, lessees, and assignees for value, a conveyance, mortgage, assignment, or release of mortgage by such grantee, whether or not his name is followed by trustee, as trustee, agent, or words of similar import, conveys a title or lien free from the claims of any undisclosed beneficiaries, and free from any obligation on the part of any purchaser, mortgagee, lessee, or assignee to see to the application of any purchase money. This section does not apply to suits brought prior to July 16, 1927, in which any such deeds of conveyance, leases, or mortgages are called in question, or in which the rights of any beneficiaries in the lands described therein are involved. This section does not prevent the original grantor, trustor, undisclosed beneficiary, or any one claiming under them, from bringing suits other than suits affecting land which is the subject of such conveyance or mortgage.

Effective Date: 10-01-1953

5301.04. Deed, mortgage, or lease of a married person.

A deed, mortgage, or lease of any interest of a married person in real property shall be signed, acknowledged, and certified as provided in section 5301.01 of the Revised Code.

Effective Date: 02-01-2002

5301.06. Instruments executed according to law of place where made.

All deeds, mortgages, powers of attorney, and other instruments of writing for the conveyance or encumbrance of lands, tenements, or hereditaments situated within this state, executed and acknowledged, or proved, in any other state, territory, or country in conformity with the laws of such state, territory, or country, or in conformity with the laws of this state, are as valid as if executed within this state, in conformity with sections 1337.01 to 1337.03, inclusive, and 5301.01 to 5301.04, inclusive, of the Revised Code.

Effective Date: 10-01-1953

5301.07. Validating certain deeds; limitations.

When any instrument conveying real estate, or any interest therein, is of record for more than twenty-one years in the office of the county recorder of the county within this state in which such real estate is situated, and the record shows that there is a defect in such instrument, such instrument and the record thereof shall be cured of such defect and be effective in all respects as if such instrument had been legally made, executed, and acknowledged, if such defect is due to any one or more of the following:

(A) Such instrument was not properly witnessed.(B) Such instrument contained no certificate of acknowledgment.

(C) The certificate of acknowledgment was defective in any respect.

Any person claiming adversely to such instrument, if not already barred by limitation or otherwise, may, at any time within twenty-one years after the time of recording such instrument, bring proceedings to contest the effect of such instrument.

This section does not affect any suit brought prior to November 9, 1959 in which the validity of the acknowledgment of any such instrument is drawn in question.

Effective Date: 01-10-1961

5301.13. Mode of conveyance by state.

All conveyances of real estate, or any interest therein, sold on behalf of the state, with the exception of those agreements made pursuant to divisions (A), (B), (C), (D), and (E) of section 123.53 of the Revised Code, shall be drafted by the auditor of state, executed in the name of the state, signed by the governor, countersigned by the secretary of state, and sealed with the great seal of the state. The auditor of state thereupon must record such conveyance in books to be kept by him for that purpose, deliver them to the persons entitled thereto, and keep a record of such delivery, showing to whom delivered and the date thereof.

Effective Date: 11-15-1981

5301.14. Copy of record of lost deed to be evidence.

When a title deed, recorded by the auditor of state as required by section 5301.13 of the Revised Code, or recorded in the office of the secretary of state, the record of which is required to be kept in the office of the auditor of state, has been lost or destroyed by accident, without having been recorded in the county recorder's office, on demand and tender of the fees therefor, the auditor of state shall furnish to any person a copy of such deed certified under the auditor of state's official seal, which copy shall be received everywhere in this state as prima-facie evidence of the existence of the deed, and in all respects shall have the effect of certified copies from the official records of the county where such lands are situated.

Amended by 130th General Assembly File No. 41, HB 72, 1, eff. 1/30/2014.

Effective Date: 10-01-1953

5301.16. Execution of conveyance by state when purchaser dies before deed made.

When the purchaser of land from the state dies before a deed is made, and the lands pass to another by descent or devise, and the title still remains in him, or when the person to whom the lands have so passed has conveyed them or his interest therein to another person, by deed of general warranty or quitclaim, upon the proof of such facts being made to him and the attorney general, the governor shall execute the deed directly to the person entitled to the lands, although such person derives his title through one or more successive conveyances from the person to whom the lands passed by descent or devise.

Effective Date: 10-01-1953

OHIO REVISED CODE

TITLE LIII REAL PROPERTY

CHAPTER 5302 STATUTORY FORMS OF LAND CONVEYANCE

CO-OWNERSHIP

5302.22. Transfer on death deed.

(A) As used in sections 5302.22, 5302.222, 5302.23, and 5302.24 of the Revised Code:(1) Affidavit of confirmation means an affidavit executed under division (A) of section 5302.222 of the Revised Code.

(2) Survivorship tenancy means an ownership of real property or any interest in real property by two or more persons that is created by executing a deed pursuant to section 5302.17 of the Revised Code.

(3) Survivorship tenant means one of the owners of real property or any interest in real property in a survivorship tenancy.

(4) Tenants by the entireties mean only those persons who are vested as tenants in an estate by the entireties with survivorship pursuant to any deed recorded between February 9, 1972, and April 3, 1985, under section 5302.17 of the Revised Code as it existed during that period of time. Nothing in sections 5302.22, 5302.222, 5302.23, and 5302.24 of the Revised Code authorizes the creation of a tenancy by the entireties or recognizes a tenancy by the entireties created outside that period of time.

(5) Transfer on death designation affidavit means an affidavit executed under this section.

(6) Transfer on death beneficiary or beneficiaries means the beneficiary or beneficiaries designated in a transfer on death designation affidavit.

(B) Any individual who, under the Revised Code or the common law of this state, owns real property or any interest in real property as a sole owner , as a tenant in common, or as a survivorship tenant, or together with the individual's spouse owns an indivisible interest in real property as tenants by the entireties, may designate the entire interest, or any specified part that is less than the entire interest, in that real property as transferable on death to a designated beneficiary or beneficiaries by executing , together with the individual's spouse, if any, a transfer on death designation affidavit as provided in this section .

If the affidavit is executed by an individual together with the individual's spouse, if any, the dower rights of the spouse are subordinate to the vesting of title to the interest in the real property in the transfer on death beneficiary or beneficiaries designated under this section. The affidavit shall be recorded in the office of the county recorder in the county in which the real property is located, and, when so recorded, the affidavit or a certified copy of the affidavit shall be evidence of the transfer on death beneficiary or beneficiaries so designated in the affidavit insofar as the affidavit affects title to the real property.

(C) (1) If an individual who owns real property or an interest in real property as a sole owner or as a tenant in common executes a transfer on death designation affidavit, upon the death of that individual, title to the real property or interest in the real property specified in the affidavit vests in the transfer on death beneficiary or beneficiaries designated in the affidavit.

(2) If an individual who owns real property or an interest in real property as a survivorship tenant executes a transfer on death designation affidavit, upon the death of that individual or of one but not all of the surviving survivorship tenants, title to the real property or interest in the real property specified in the affidavit vests in the surviving survivorship tenant or tenants. Upon the death of the last surviving survivorship tenant, title to the real property or interest in the real property vests in the transfer on death beneficiary or beneficiaries designated in the affidavit, subject to division (B)(7) of section 5302.23 of the Revised Code.

(3) If an individual who together with the individual's spouse owns an indivisible interest in real property as tenants by the entireties executes a transfer on death designation affidavit, upon the death of that individual, title to the real property or interest in the real property vests in the remaining tenant by the entireties. Upon the death of the remaining tenant by the entireties, title to the real property or interest in the real property vests in the transfer on death beneficiary or beneficiaries designated in the affidavit, subject to division (B)(7) of section 5302.23 of the Revised Code.

(D) A transfer on death designation affidavit shall be verified before any person authorized to administer oaths and shall include all of the following:

(1) A description of the real property the title to which is affected by the affidavit and a reference to an instrument of record containing that description;

(2) If less than the entire interest in the real property is to be transferred on death under the affidavit, a statement of the specific interest or part of the interest in the real property that is to be so transferred;

(3) A statement by the individual executing the affidavit that the individual is the person appearing on the record of the real property as the owner of the real property or interest in the real property at the time of the recording of the affidavit and the marital status of that owner. If the owner is married, the affidavit shall include a statement by the owner's spouse stating that the spouse's dower rights are subordinate to the vesting of title to the real property or interest in the real property in the transfer on death beneficiary or beneficiaries designated in the affidavit.

(4) A statement designating one or more persons, identified by name, as transfer on death beneficiary or beneficiaries.