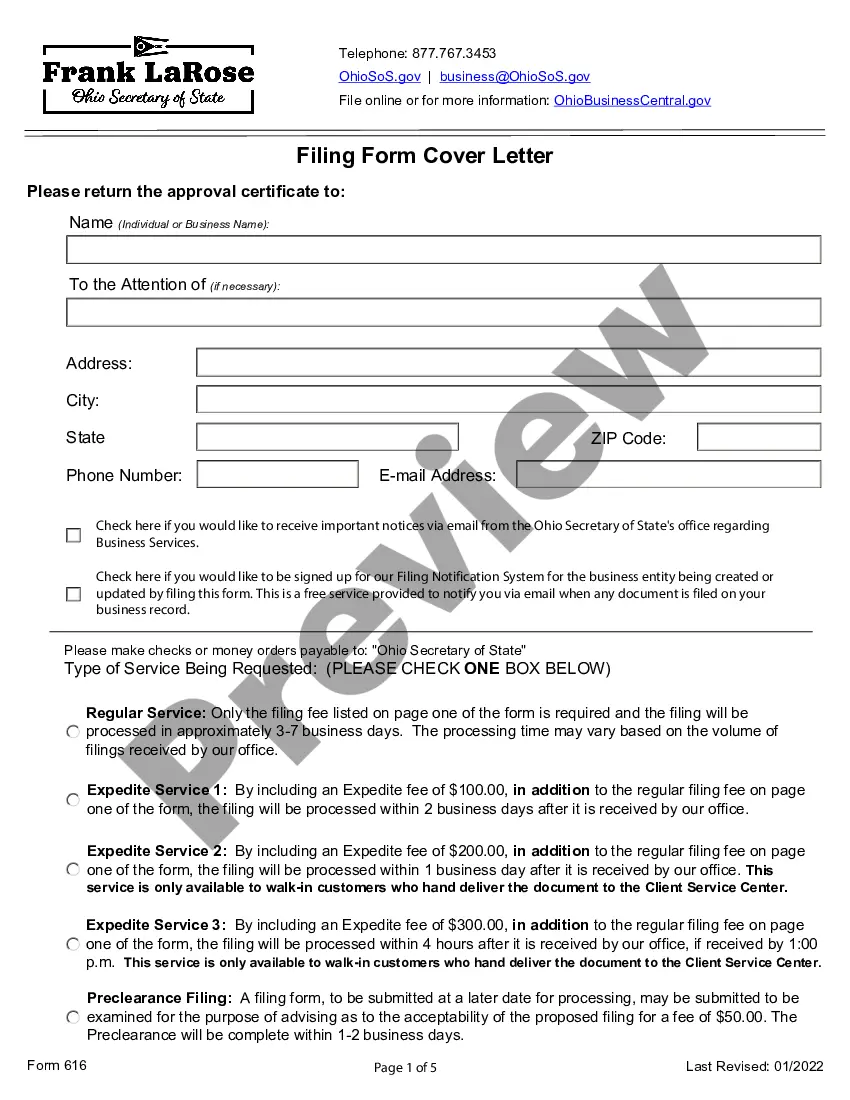

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new limited liability company. The form contains basic information concerning the LLC, normally including the LLC's name, names of the organizers, members and/or managers, purpose and duration of the LLC, the registered address, registered agent, and related information.

Ohio Organization - Registration - Domestic Limited Liability Company LLC

Description

How to fill out Ohio Organization - Registration - Domestic Limited Liability Company LLC?

In terms of submitting Organization - Registration - Domestic Limited Liability Company LLC for Ohio, you probably imagine an extensive process that involves finding a suitable sample among a huge selection of similar ones then needing to pay out a lawyer to fill it out for you. In general, that’s a slow-moving and expensive choice. Use US Legal Forms and select the state-specific template in just clicks.

If you have a subscription, just log in and then click Download to get the Organization - Registration - Domestic Limited Liability Company LLC for Ohio template.

In the event you don’t have an account yet but want one, follow the point-by-point manual below:

- Be sure the file you’re downloading applies in your state (or the state it’s required in).

- Do so by reading through the form’s description and by clicking on the Preview option (if available) to view the form’s content.

- Click Buy Now.

- Pick the appropriate plan for your budget.

- Join an account and select how you would like to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx format.

- Get the record on your device or in your My Forms folder.

Professional attorneys work on creating our templates so that after downloading, you don't have to bother about editing content outside of your personal details or your business’s information. Join US Legal Forms and receive your Organization - Registration - Domestic Limited Liability Company LLC for Ohio example now.

Form popularity

FAQ

Ohio does not require an operating agreement in order to form an LLC, but executing one is highly advisable.The operating agreement does not need to be filed with the state.

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.

To start an LLC in Ohio you will need to file the Articles of Organization with the Ohio Secretary of State, which costs $99. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your Ohio limited liability company.

Professional LLCs The main difference between a LLC and a PLLC is that only professionals recognized in a state through licensing, such as architects, medical practitioners and lawyers, can form PLLCs. The articles of organization are similar to those for a standard LLC, but extra steps are necessary to file.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

A professional limited liability company (PLLC) is a business entity designed for licensed professionals, such as lawyers, doctors, architects, engineers, accountants, and chiropractors.In these states, licensed professionals who want the benefits of an LLC must form a PLLC instead.

The Ohio Secretary of State charges a $99 fee to file the Articles of Organization. It will cost $39 to file a name reservation application, if you wish to reserve your LLC name prior to filing the Articles of Organization.

The owners of a PLLC are called members, and they have an operating agreement that governs how they work together and divide profits and losses. Many professionals start a PLLC because they want to separate their individual liability from their liability as a member of the business or practice.

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.