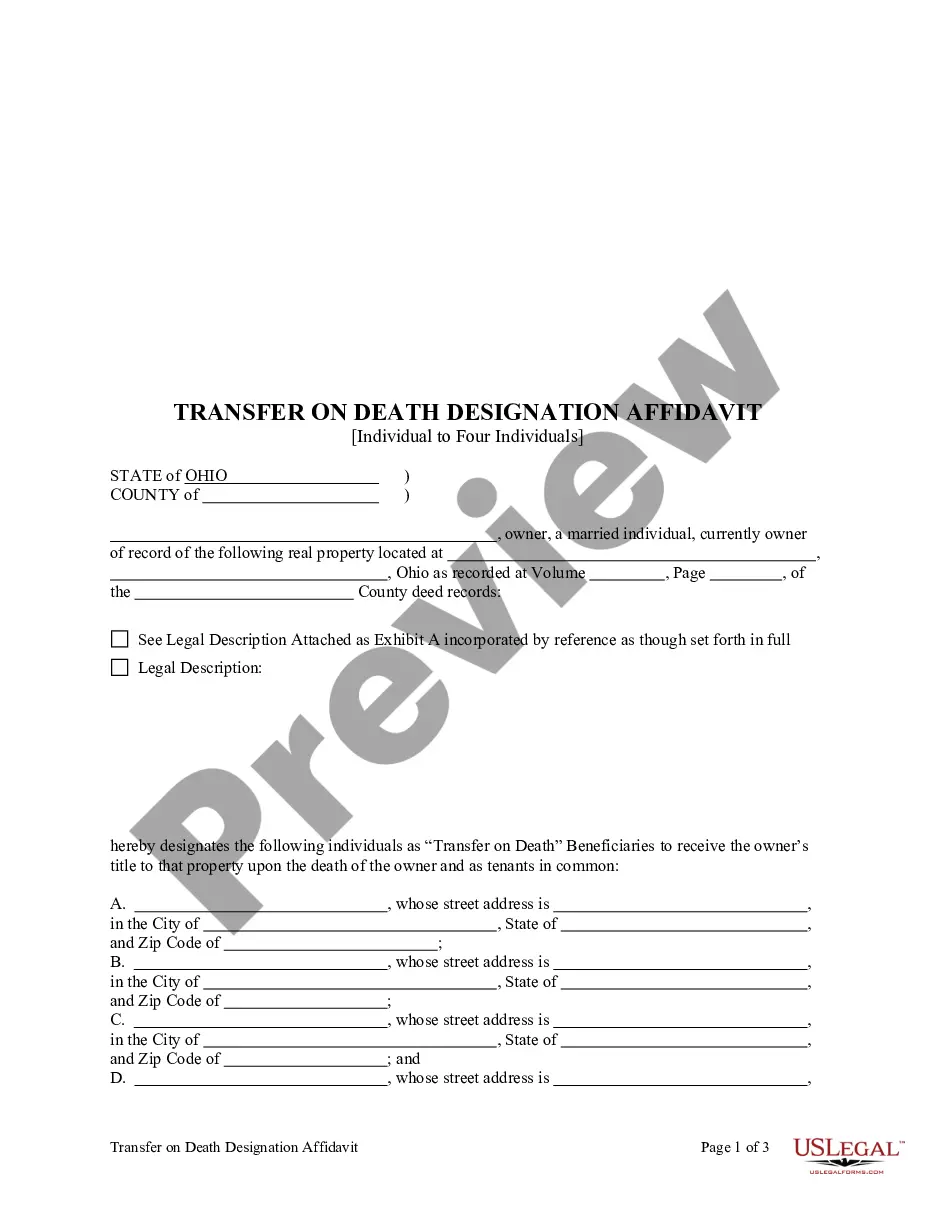

This form is a Transfer on Death Affidavit where the affiant is an individual and the beneficiaries are four individuals. This transfer is revocable by affiant until death and effective only upon the death of the affiant. The grantees take the property as tenants in common or jointly with a survivorship interest. This deed complies with all state statutory laws.

Ohio Transfer on Death Designation Affidavit - TOD - from Individual to Four Individuals

Description

How to fill out Ohio Transfer On Death Designation Affidavit - TOD - From Individual To Four Individuals?

When it comes to completing Ohio Transfer on Death Designation Affidavit - TOD - from Individual to Four Individuals, you almost certainly think about a long procedure that involves getting a perfect sample among a huge selection of similar ones after which having to pay a lawyer to fill it out to suit your needs. Generally speaking, that’s a sluggish and expensive choice. Use US Legal Forms and choose the state-specific template within just clicks.

For those who have a subscription, just log in and then click Download to have the Ohio Transfer on Death Designation Affidavit - TOD - from Individual to Four Individuals template.

In the event you don’t have an account yet but need one, stick to the step-by-step manual listed below:

- Make sure the file you’re downloading applies in your state (or the state it’s required in).

- Do it by looking at the form’s description and by clicking on the Preview function (if available) to find out the form’s content.

- Click Buy Now.

- Choose the proper plan for your financial budget.

- Sign up for an account and choose how you would like to pay out: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Get the file on the device or in your My Forms folder.

Skilled legal professionals work on creating our samples to ensure that after downloading, you don't need to bother about enhancing content material outside of your individual details or your business’s info. Be a part of US Legal Forms and receive your Ohio Transfer on Death Designation Affidavit - TOD - from Individual to Four Individuals document now.

Form popularity

FAQ

TOD account holders can name multiple beneficiaries and divide assets any way they like.However, the beneficiaries have no access or rights to a TOD account while its owner is alive. Those beneficiaries can also be changed at any time, so long as the TOD account holder is deemed mentally competent.

Ohio Eliminates Transfer on Death Deeds.Effective December 28, 2009, Ohio eliminated transfer on death deeds and replaced that deed with a TRANSFER ON DEATH DESIGNATION AFFIDAVIT.

Accounts or assets with named beneficiaries may be transferred without going through the probate process.If there is a TOD on the account, the assets will only go to the beneficiary if both joint owners pass away. In either case, the asset will not likely go through probate.

Using an Affidavit of Death to Claim Real Estate from a California Transfer on Death Deed. Transfer on death deeds allow individual landowners to transfer their real estate when they die, without a will or the need for probate distribution.

Yes. Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (TOD) Designation Affidavit.

On a nonretirement account, designating a beneficiary or beneficiaries establishes a transfer on death (TOD) registration for the account. For an individual account, a TOD registration generally allows ownership of the account to be transferred to the designated beneficiary upon your death.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

Fill in information about you and the TOD beneficiary. provide a description of the property. check over the completed deed. sign the deed in front of a notary public, and.

An account holder may choose to list both of their children as equal beneficiaries. However, an account holder can also choose to list individuals in unequal amounts. For example, you could designate a primary beneficiary to receive 50 percent of the funds and two secondary beneficiaries who receive 25 percent each.