Ohio Transfer on Death Designation Affidavit - TOD from Individual to a Trust

About this form

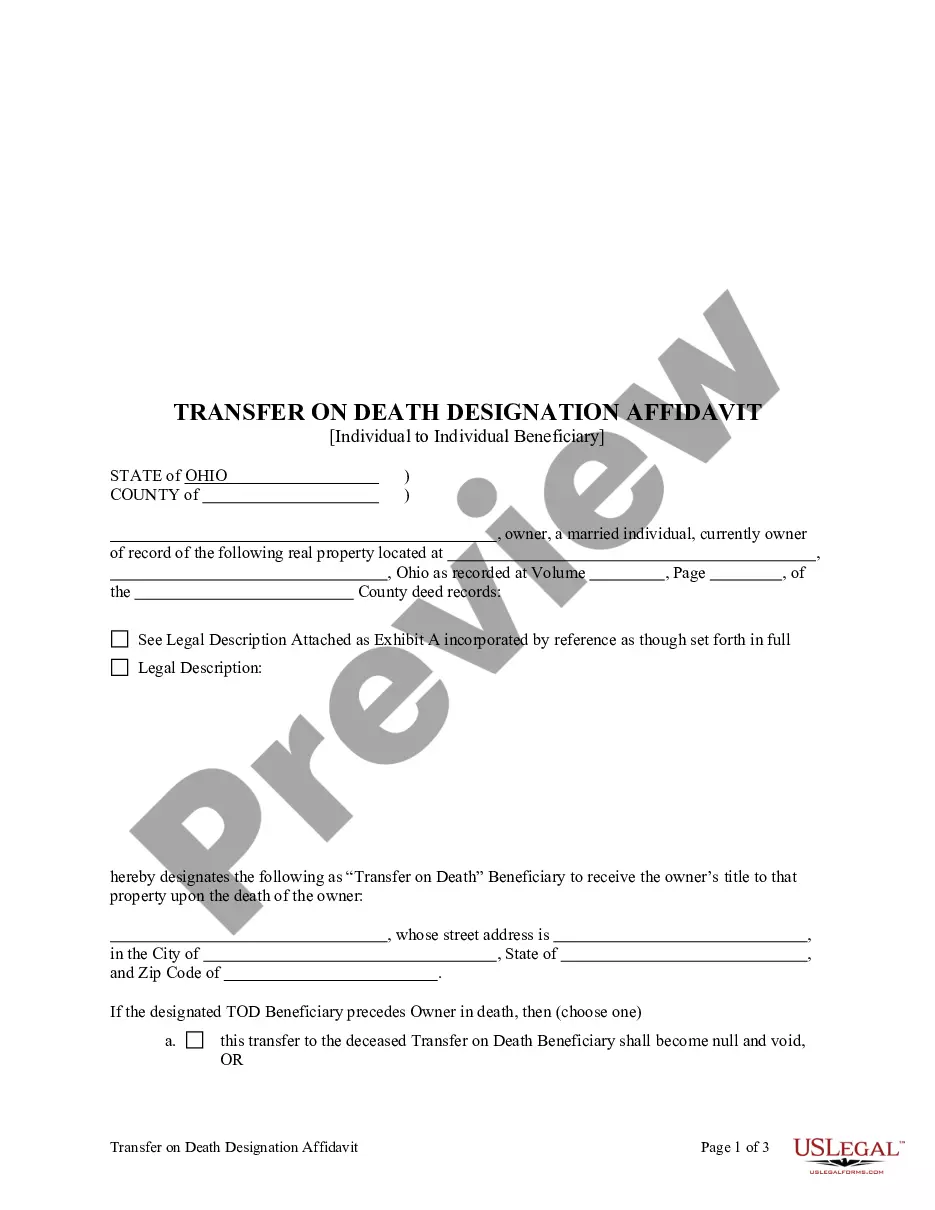

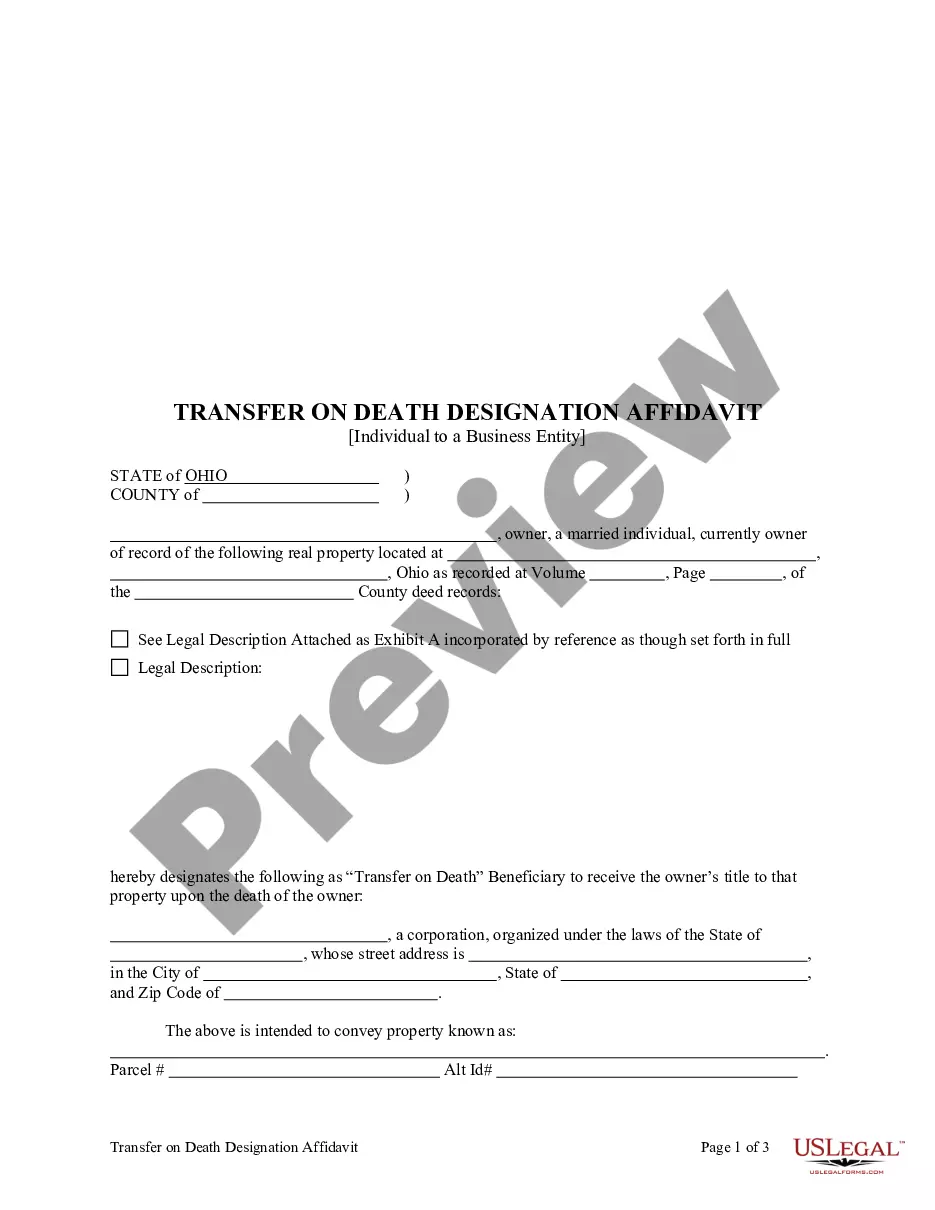

The Transfer on Death Designation Affidavit from Individual to Trust is a legal document that facilitates the transfer of property title upon the death of the property owner, known as the Affiant. It allows the owner to designate a trust as the beneficiary of the property, which simplifies estate planning and bypasses the probate process. This affidavit is distinct from other forms of property transfers because it specifically addresses the transfer of real estate to a trust upon the owner's death, providing clarity and ease for the beneficiaries involved.

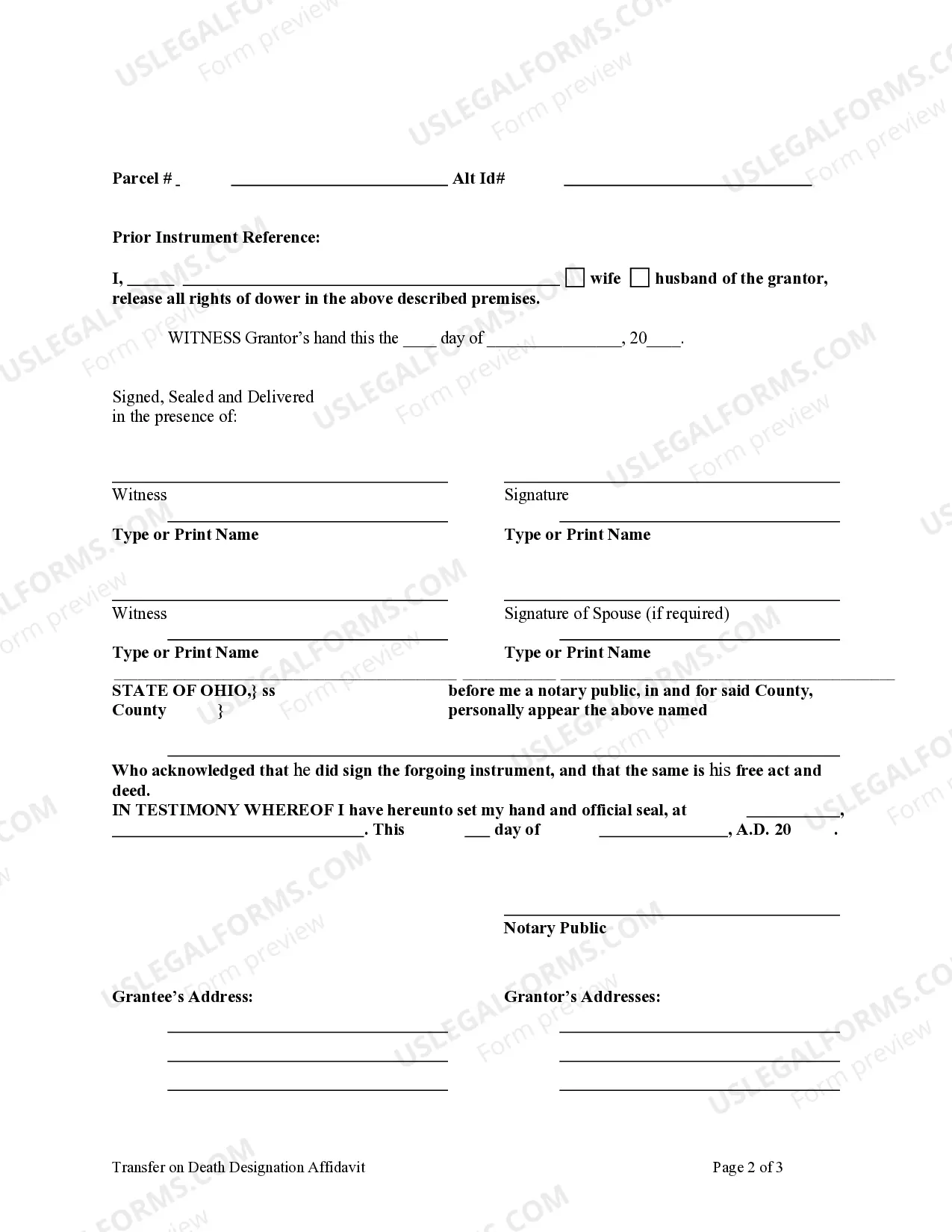

Main sections of this form

- Identification of the Affiant/Owner and the Trust as the beneficiary.

- Description of the property being transferred, including legal descriptions.

- A declaration stating the intent to transfer the title upon death.

- Signature line for the Affiant, with a requirement for notarization.

- Fields to revoke or change the beneficiary designation if needed.

Situations where this form applies

This form is commonly used when an individual wants to ensure that their real estate is transferred directly to a trust after their passing, avoiding probate delays and providing a clear guideline for the disposition of the property. It is particularly useful for estate planning, ensuring that the owner's wishes are followed without unnecessary complications for the beneficiaries.

Intended users of this form

- Individuals who own real estate and wish to transfer it to a trust upon their death.

- People engaged in estate planning who want to simplify property transfer for their heirs.

- Trustees managing a trust that may receive property as part of an estate plan.

Steps to complete this form

- Identify yourself as the Affiant/Owner and provide your contact information.

- Clearly describe the property intended for transfer, using legal descriptions and parcel numbers.

- Designate the trust as the beneficiary by providing the trust's name and relevant details.

- Sign the form in front of a Notary Public to validate the affidavit.

- If needed, fill out any sections to revoke or change previous beneficiary designations.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide complete legal descriptions of the property.

- Not having the document notarized, which is essential for its validity.

- Neglecting to review and update beneficiary designations when circumstances change.

Why complete this form online

- Conveniently download and customize the form from home.

- Access to attorney-drafted templates ensures legal reliability.

- Easy to store, edit, and manage your legal documents digitally.

Looking for another form?

Form popularity

FAQ

Keep in mind that if you have a revocable living trust and name it as the beneficiary of your TOD accounts, each time you change the beneficiaries of the trust you will also change the TOD beneficiaries without having to change the designation you have on file with the investment company.

Yes. Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (TOD) Designation Affidavit.

Using an Affidavit of Death to Claim Real Estate from a California Transfer on Death Deed. Transfer on death deeds allow individual landowners to transfer their real estate when they die, without a will or the need for probate distribution.

Fill in information about you and the TOD beneficiary. provide a description of the property. check over the completed deed. sign the deed in front of a notary public, and.

A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.

States that allow TOD deeds are Alaska, Arizona, Arkansas, California, Colorado, District of Columbia, Hawaii, Illinois, Indiana, Kansas, Maine, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, South Dakota, Texas, Utah, Virginia, Washington, West Virginia,

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.