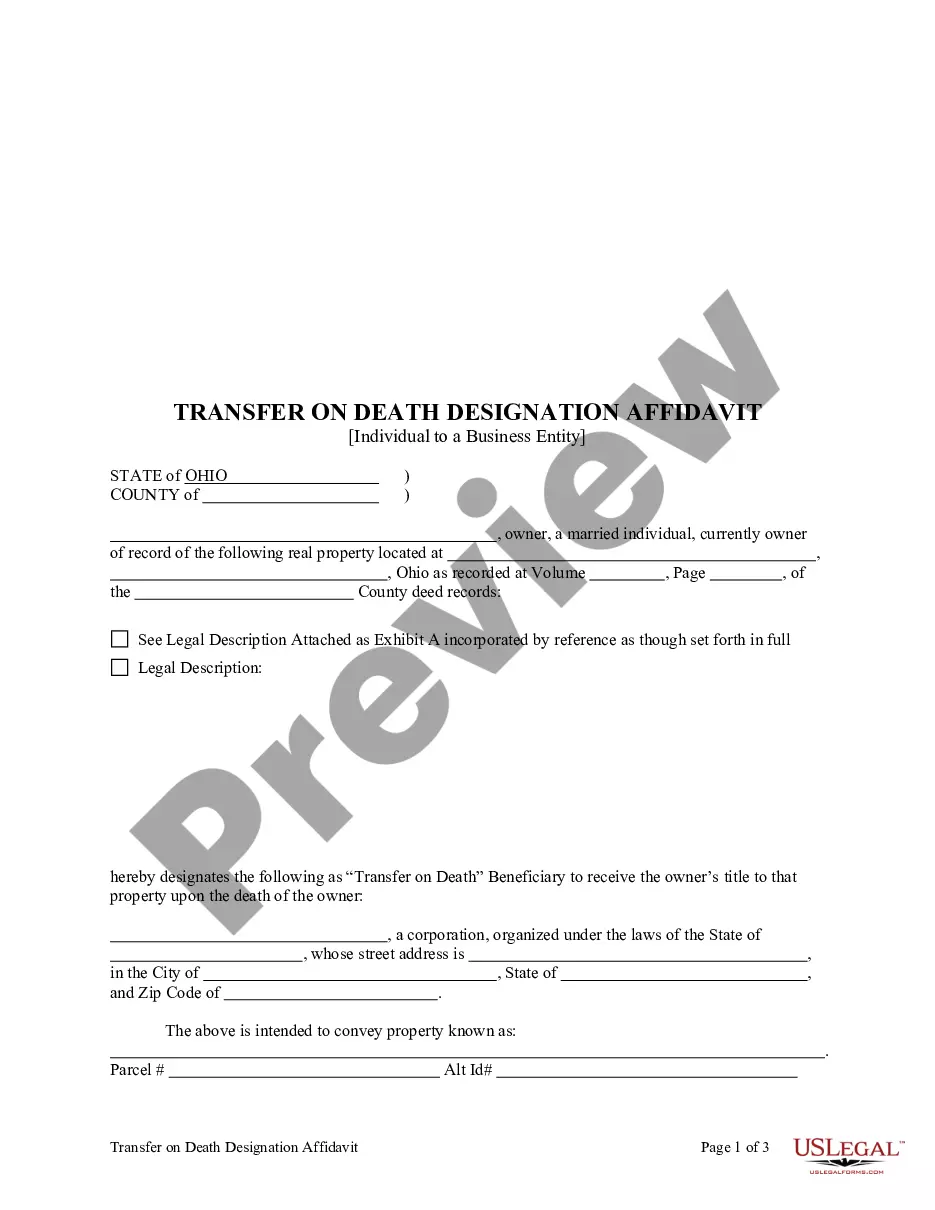

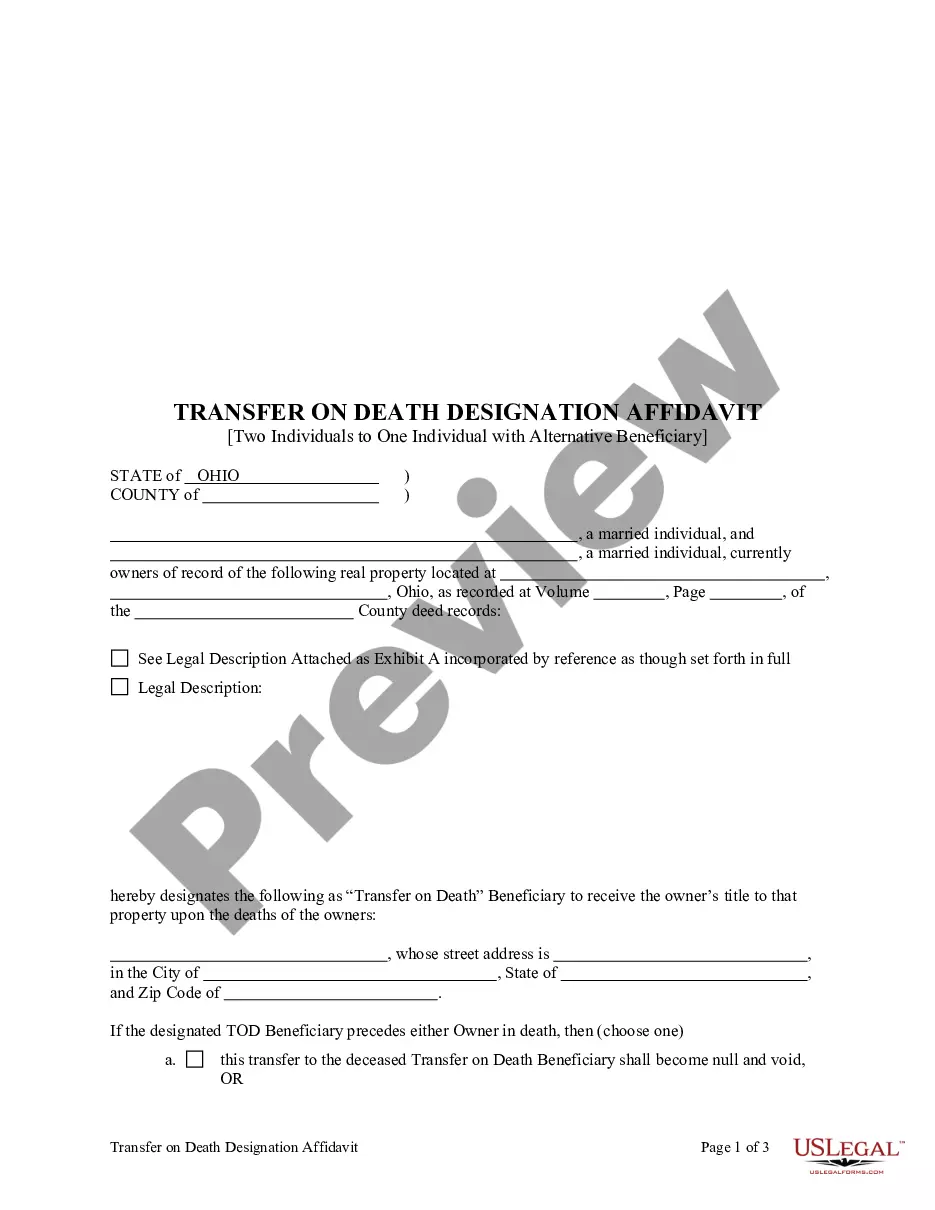

Ohio Transfer on Death Designation Affidavit - TOD from Individual to a Business Entity

What this document covers

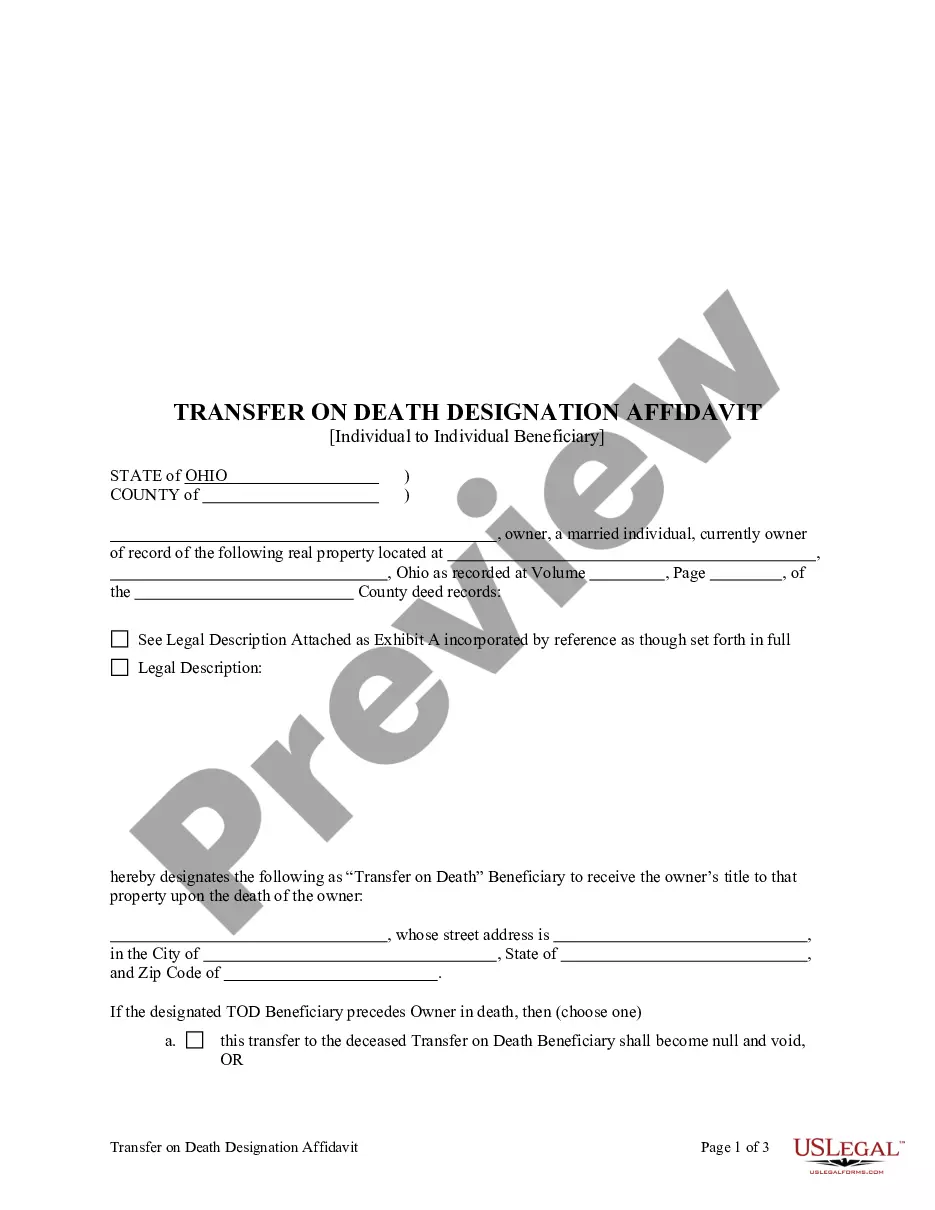

The Transfer on Death Designation Affidavit from Individual to a Business Entity is a legal document used to designate a business entity as the beneficiary of a property after the owner's death. This affidavit allows property owners to ensure a seamless transition of their real estate without the need for probate, differentiating it from other forms of property transfer, such as wills. It also allows for the inclusion of alternate beneficiaries if the primary beneficiary predeceases the owner.

Key parts of this document

- Identification of the owner/affiant and the designated business entity.

- Detailed description of the property being transferred.

- Provision for an alternate beneficiary to account for unforeseen circumstances.

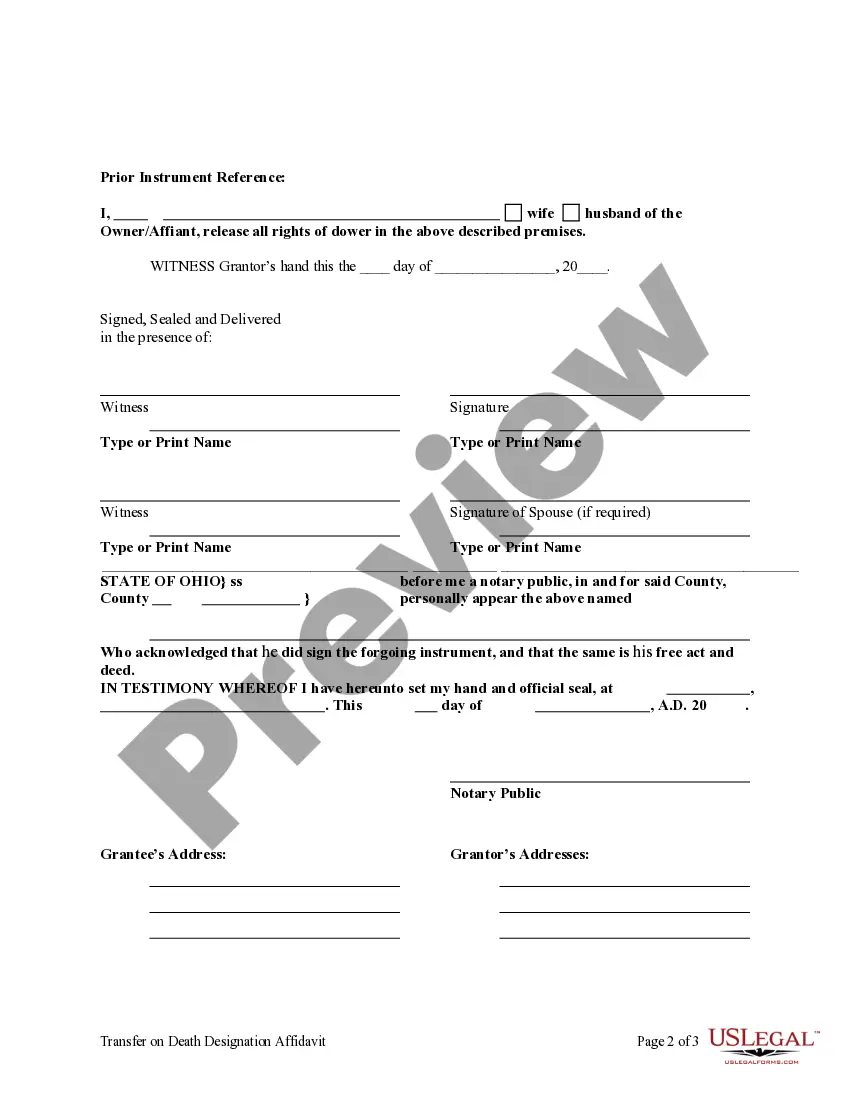

- Signature of the owner in front of a Notary Public.

- Revocation clause allowing changes to the beneficiary designation.

Situations where this form applies

This affidavit should be used when an individual wishes to transfer property directly to a business entity upon their death. It is particularly useful for business owners looking to ensure their assets are managed by their business entity rather than going through a potentially lengthy probate process. Additionally, this form is appropriate for individuals wishing to simplify the transfer of real estate to their chosen beneficiaries.

Who needs this form

- Property owners who want to designate a business entity as the beneficiary of their property.

- Individuals looking to streamline the transfer of real estate to avoid probate.

- Business owners interested in maintaining control over their real estate assets after death.

- Those wanting to provide for alternate beneficiaries in case of unforeseen circumstances.

How to prepare this document

- Identify the owner/affiant and the business entity receiving the property.

- Provide a detailed description of the real property being transferred.

- Specify the primary beneficiary and any alternate beneficiaries.

- Sign the document in front of a Notary Public to ensure legal validity.

- Record the completed affidavit with the appropriate county office to formalize the transfer.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to notarize the document, which can render it invalid.

- Not providing enough detail in the property description.

- Neglecting to name an alternate beneficiary.

- Inadequate verification of the business entity's legal standing.

Why complete this form online

- Convenient access to legally vetted templates anytime.

- Edit and customize the form to meet specific needs.

- Safe and secure processing without need for physical travel.

- Immediate downloads available upon completion.

Main things to remember

- The Transfer on Death Designation Affidavit facilitates the transfer of property upon the owner's death.

- It is important to include alternate beneficiaries to ensure the owner's intent is carried out.

- Notarization is required to validate the affidavit.

- This form helps avoid probate, expediting the process for beneficiaries.

Looking for another form?

Form popularity

FAQ

If the deeds to the property are unregistered, it is possible to place a death certificate with the deeds, but it's advisable to register the title with the Land Registry at this point. Once this has been done, the property will then be registered in the name of the surviving joint owner.

Fill in information about you and the TOD beneficiary. provide a description of the property. check over the completed deed. sign the deed in front of a notary public, and.

Using an Affidavit of Death to Claim Real Estate from a California Transfer on Death Deed. Transfer on death deeds allow individual landowners to transfer their real estate when they die, without a will or the need for probate distribution.

Ohio Eliminates Transfer on Death Deeds.Effective December 28, 2009, Ohio eliminated transfer on death deeds and replaced that deed with a TRANSFER ON DEATH DESIGNATION AFFIDAVIT.

The amount that's in a TOD account at the time of your death is not taxable under federal law to the person who receives the account, although it may be taxable to your estate. If your beneficiary or the account are in a state with an inheritance tax, he may have to pay that.

Survivorship Deeds contain special language that enables the property to transfer to the surviving owner(s) upon the deceased owner's death.A Transfer-On-Death Designation Affidavit allows the owner of Ohio real estate to designate one or more beneficiaries of the property.

Yes. Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (TOD) Designation Affidavit.