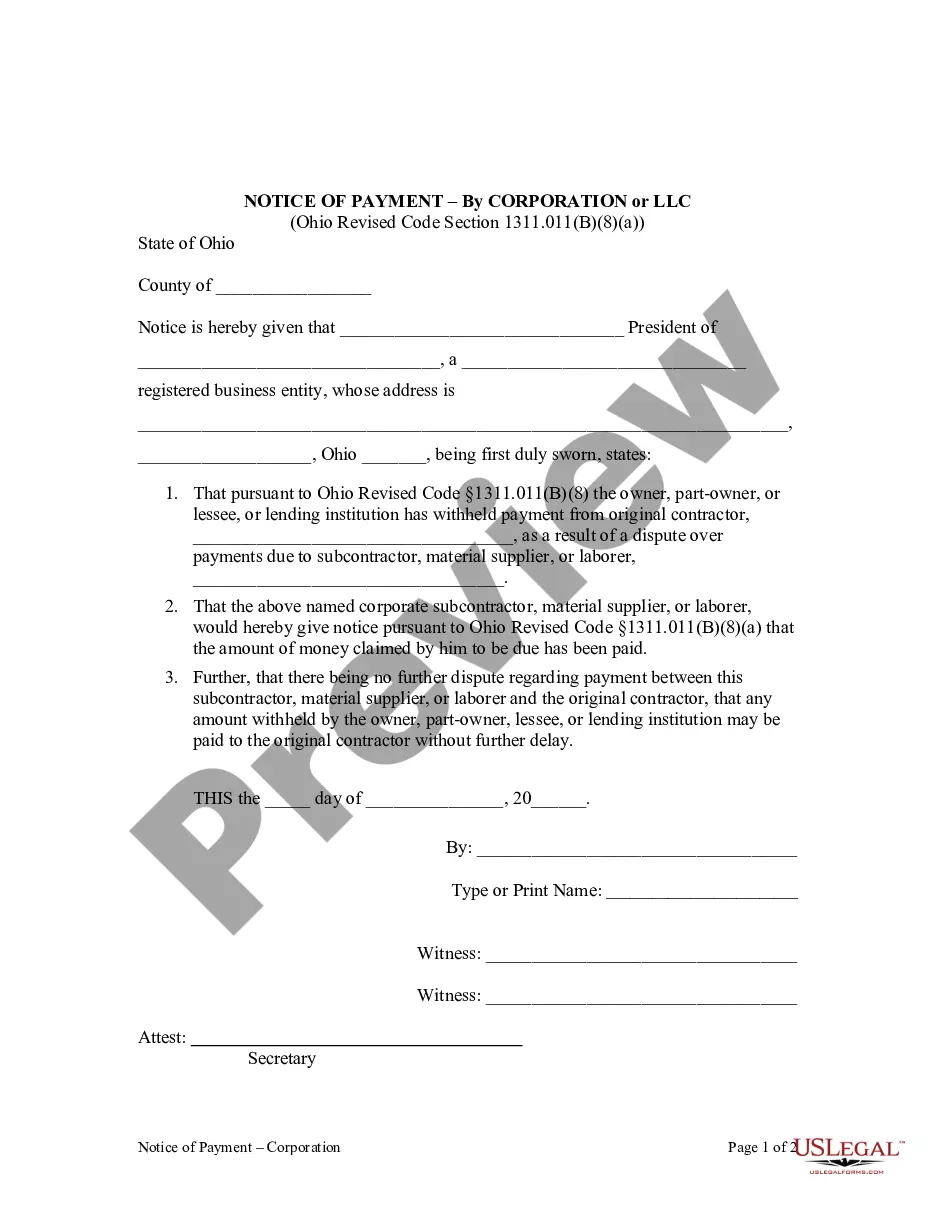

When a lending institution or an owner, part-owner, or lessee withholds payment from an original contractor due to a dispute over payment between the contractor and the subcontractor, materialman, or laborer, this form serves to notify the owner or lending institution that payment has been made to the subcontractor, materialman, or laborer, and that the owner and lender may now release funds to the original contractor.

Ohio Notice of Payment - Corporation

Description

How to fill out Ohio Notice Of Payment - Corporation?

When it comes to submitting Ohio Notice of Payment - Corporation or LLC, you probably think about a long process that consists of finding a ideal form among numerous very similar ones and then having to pay a lawyer to fill it out for you. On the whole, that’s a slow and expensive choice. Use US Legal Forms and pick out the state-specific template within just clicks.

In case you have a subscription, just log in and click Download to find the Ohio Notice of Payment - Corporation or LLC form.

In the event you don’t have an account yet but need one, follow the step-by-step manual listed below:

- Make sure the document you’re getting is valid in your state (or the state it’s required in).

- Do this by reading the form’s description and by clicking the Preview function (if available) to find out the form’s content.

- Click Buy Now.

- Find the appropriate plan for your financial budget.

- Subscribe to an account and select how you would like to pay out: by PayPal or by credit card.

- Download the document in .pdf or .docx file format.

- Get the file on your device or in your My Forms folder.

Professional lawyers work on creating our samples to ensure that after downloading, you don't need to bother about enhancing content material outside of your personal information or your business’s details. Be a part of US Legal Forms and get your Ohio Notice of Payment - Corporation or LLC document now.

Form popularity

FAQ

Ohio does not require an operating agreement in order to form an LLC, but executing one is highly advisable.The operating agreement does not need to be filed with the state.

Generally, most entrepreneurs choose to form a Corporation or a Limited Liability Company (LLC). The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders.It also provides limited liability protection.

In an LLC, individuals with an ownership share are called members. In a corporation, they are called shareholders. One of the advantages an LLC has over a corporation is that in many states, a creditor cannot collect a member's dividends, whereas in a corporation dividends can be collected from shareholders.

All states recognize businesses formed as corporations, limited liability companies (LLCs) or partnerships, or variations of these forms. Forming an LLC. An LLC is formed by one or more business people, as owners. The owners, called "members," file Articles of Organization with a state.

Forming an LLC or a corporation will allow you to take advantage of limited personal liability for business obligations. LLCs are favored by small, owner-managed businesses that want flexibility without a lot of corporate formality. Corporations are a good choice for a business that plans to seek outside investment.

The main advantage of having an LLC taxed as a corporation is the benefit to the owner of not having to take all of the business income on your personal tax return. You also don't have to pay self-employment tax on your income as an owner from the corporation. The main disadvantage is double taxation.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

A limited liability company (LLC) is not a separate tax entity like a corporation; instead, it is what the IRS calls a "pass-through entity," like a partnership or sole proprietorship.The LLC itself does not pay federal income taxes, although some states impose an annual tax on LLCs.

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.