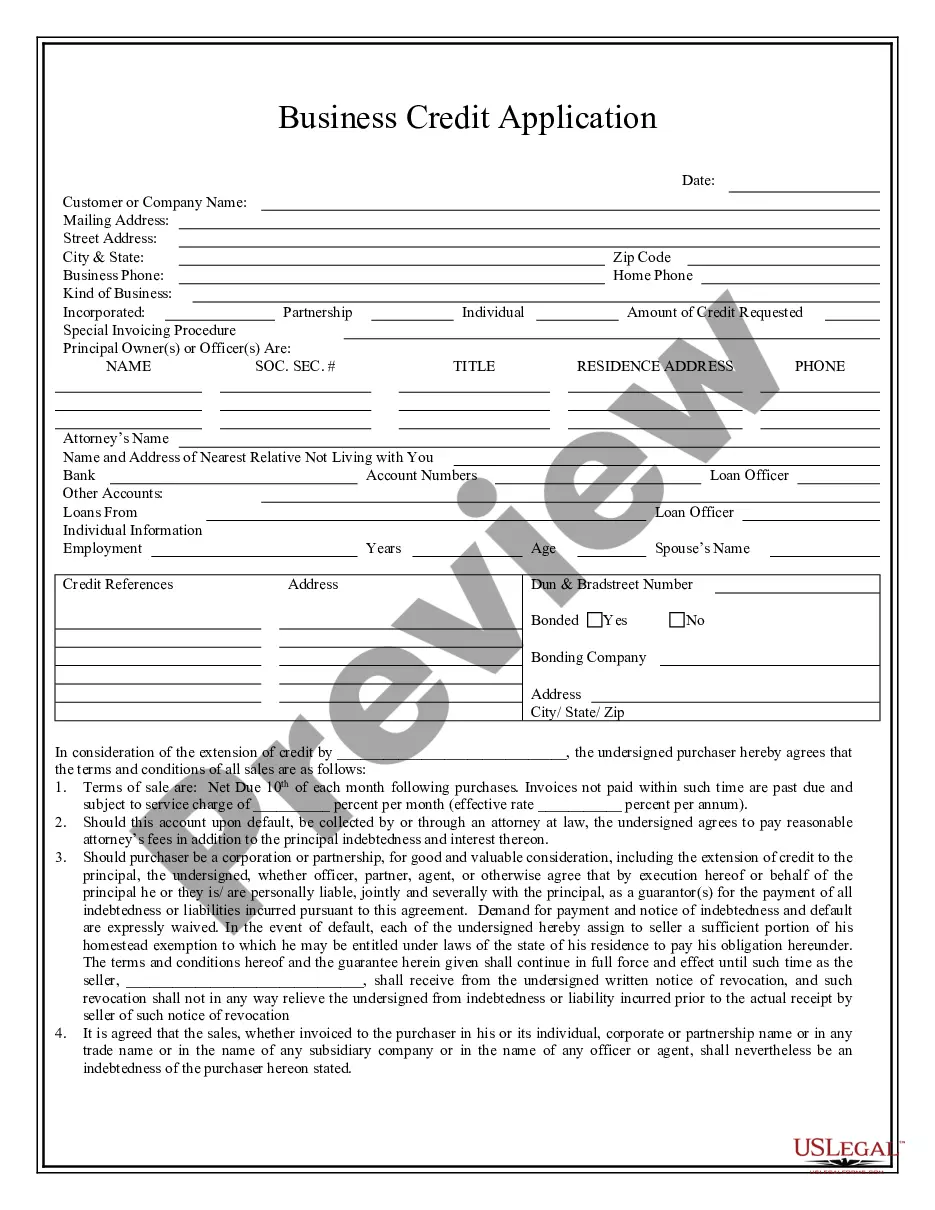

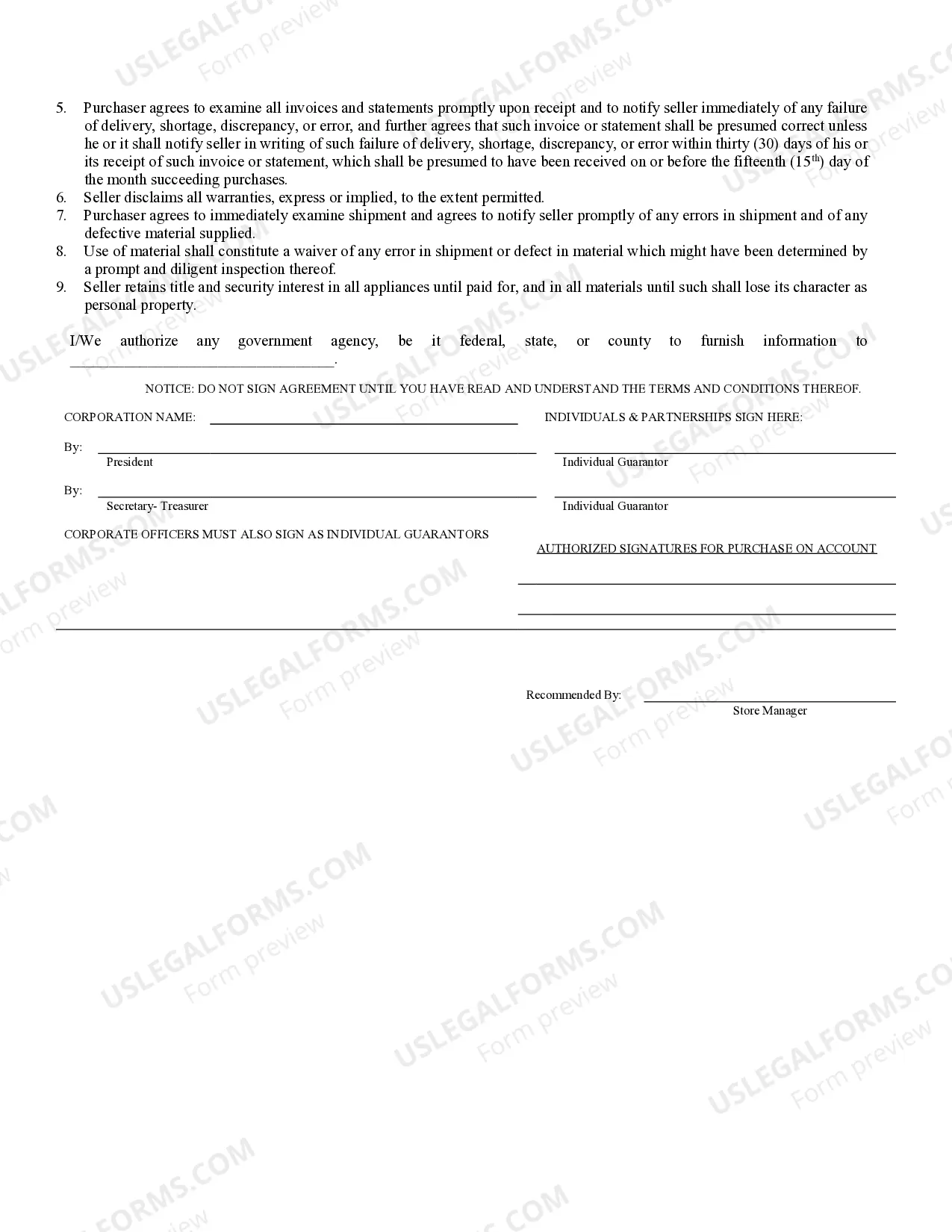

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Ohio Business Credit Application

Description

How to fill out Ohio Business Credit Application?

In terms of filling out Ohio Business Credit Application, you most likely visualize an extensive procedure that requires finding a perfect sample among countless very similar ones and then needing to pay out an attorney to fill it out for you. On the whole, that’s a slow and expensive option. Use US Legal Forms and pick out the state-specific template in just clicks.

For those who have a subscription, just log in and click Download to get the Ohio Business Credit Application template.

If you don’t have an account yet but need one, keep to the point-by-point guideline listed below:

- Make sure the file you’re saving applies in your state (or the state it’s required in).

- Do it by reading through the form’s description and by clicking the Preview option (if available) to see the form’s content.

- Simply click Buy Now.

- Select the suitable plan for your budget.

- Sign up for an account and choose how you would like to pay out: by PayPal or by card.

- Save the file in .pdf or .docx file format.

- Get the record on the device or in your My Forms folder.

Skilled legal professionals work on drawing up our samples so that after saving, you don't have to bother about editing and enhancing content outside of your individual info or your business’s info. Join US Legal Forms and receive your Ohio Business Credit Application document now.

Form popularity

FAQ

Currently, six states Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming do not have a corporate income tax.Ohio has a commercial activity tax (CAT) that applies to nearly every Ohio business and is based on gross receipts.

Ohio LLCs are not taxable entities as such, but Ohio does impose filing, withholding, and tax remission obligations on them. General rule is LLCs must withhold, and pay to the Ohio Treasurer, an amount equal to 5% of the distributive share of income, gain, expense or loss allocable to individuals.

By utilizing the Ohio BID, Ohio taxpayers filing jointly can deduct up to $250,0002 of business income from their Federal Adjusted Gross Income (AGI) when calculating their Ohio taxable income. The excess amount of business income left after the BID is taxed at the 3% flat rate.

Like a sole proprietorship, a single-member LLC is taxed as a disregarded entity by default. Because the government ignores disregarded entities, they undergo "pass-through taxation." This means all profits or losses from the business pass through the business directly to you, the business owner.

LLCs give business owners significantly greater federal income tax flexibility than a sole proprietorship, partnership and other popular forms of business organization. Make sure you have a financial plan in place for your small business.

Small businesses pay an average of 19.8 percent in taxes depending on the type of small business. Small businesses with one owner pay a 13.3 percent tax rate on average and ones with more than one owner pay an average of 23.6 percent.

Please note that as of 2016, taxable business income is taxed at a flat rate of 3%. The tax brackets have been indexed for inflation per Ohio Revised Code section 5747.02. Taxpayers with $22,150 or less of income are not subject to income tax for 2020.

The IRS treats one-member LLCs as sole proprietorships for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the IRS. As the sole owner of your LLC, you must report all profits (or losses) of the LLC on Schedule C and submit it with your 1040 tax return.