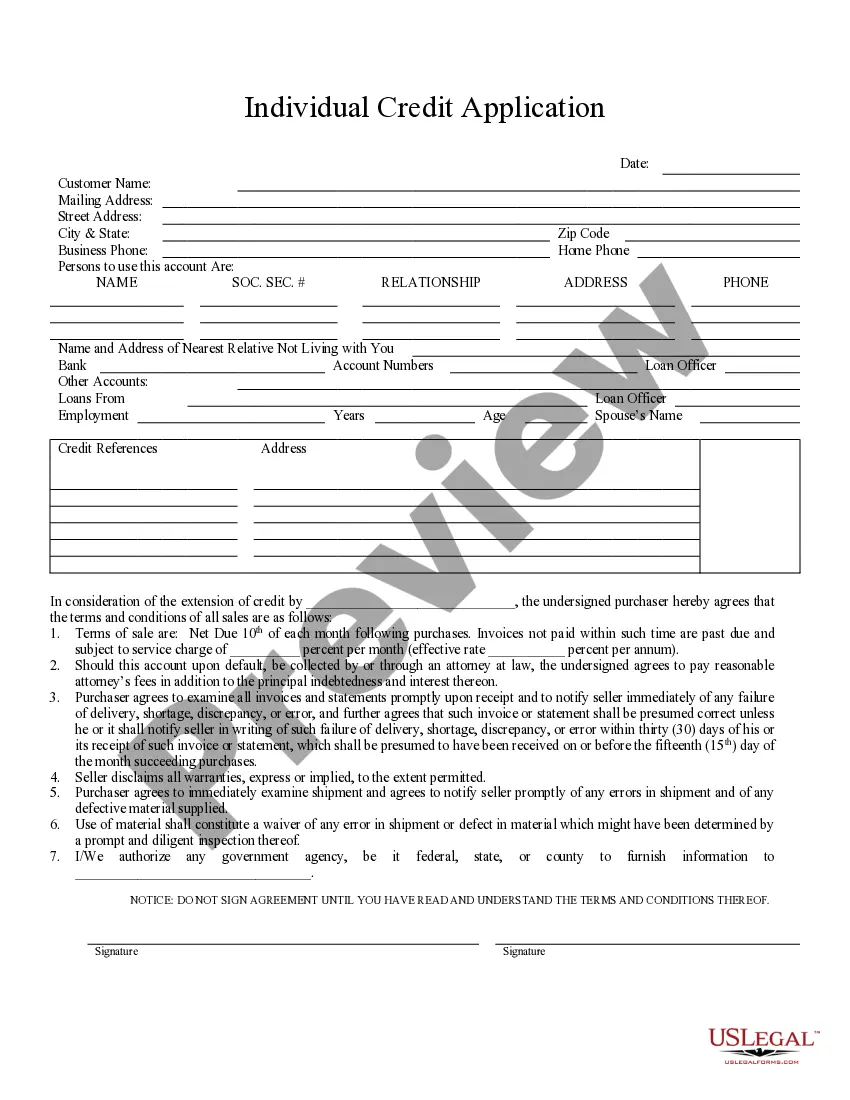

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Ohio Individual Credit Application

Description

How to fill out Ohio Individual Credit Application?

When it comes to filling out Ohio Individual Credit Application, you almost certainly imagine a long procedure that consists of getting a suitable sample among countless very similar ones after which being forced to pay a lawyer to fill it out to suit your needs. In general, that’s a slow and expensive option. Use US Legal Forms and select the state-specific document within clicks.

If you have a subscription, just log in and then click Download to have the Ohio Individual Credit Application form.

If you don’t have an account yet but need one, follow the point-by-point manual below:

- Be sure the document you’re downloading applies in your state (or the state it’s required in).

- Do so by reading the form’s description and also by visiting the Preview option (if available) to find out the form’s information.

- Click Buy Now.

- Choose the appropriate plan for your financial budget.

- Subscribe to an account and choose how you want to pay: by PayPal or by card.

- Save the document in .pdf or .docx file format.

- Find the document on your device or in your My Forms folder.

Professional lawyers work on drawing up our samples to ensure that after downloading, you don't have to worry about editing and enhancing content material outside of your personal details or your business’s info. Sign up for US Legal Forms and get your Ohio Individual Credit Application sample now.

Form popularity

FAQ

Single: $12,200 Up from $12,000 for 2018. Married filing jointly or qualifying widow: $24,400 Up from $24,000 for 2018. Married filing separately: $12,200 Up from $12,000 for 2018. Head of household: $18,350 Up from $18,000 for 2018.

No. According to the information that the IRS provides, you only need to file your 2020 tax return, which is the return for last year. The reason this return is important is that it provides a way for you to claim your Recovery Rebate Credit.

There are two types of exemptions: personal exemptions and dependent exemptions. Personal Exemptions: You may generally claim one tax exemption for yourself if you are a single taxpayer. If you are married and file a joint return, you may claim one tax exemption for yourself and one for your spouse.

Ohio does not have a state standard deduction, nor do they use the federal standard deduction amounts.

Ohio residents are eligible for the resident credit on any non-Ohio income if they were subject to, and paid tax on, that income in another state.Nonresidents who earn or receive income within Ohio will be able to claim the nonresident credit with respect to all items of income not earned and not received in Ohio.

The Ohio Form IT-4, Employee's Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.If for some reason an employee does not file one, you must withhold tax as if the employee had claimed no exemptions.

There will be no personal exemption amount for 2019. The personal exemption amount was set to zero (0) under the Tax Cuts and Jobs Act. Kiddie Tax. The kiddie tax applies to unearned income for children under the age of 19 and college students under the age of 24.

It appears the an IT-1040 is the Ohio income tax form.It appears that most people with any almost any OH income (residents or business or property in OH) will need to file an IT-1040, unless they look closely at the exceptions.

You are entitled to a $1,850 - $2,350 deduction for each dependent exemption depending on your modified adjusted gross income. NOTE: You must claim the same number of personal and dependent exemptions on your Ohio return that you claimed on your federal return.