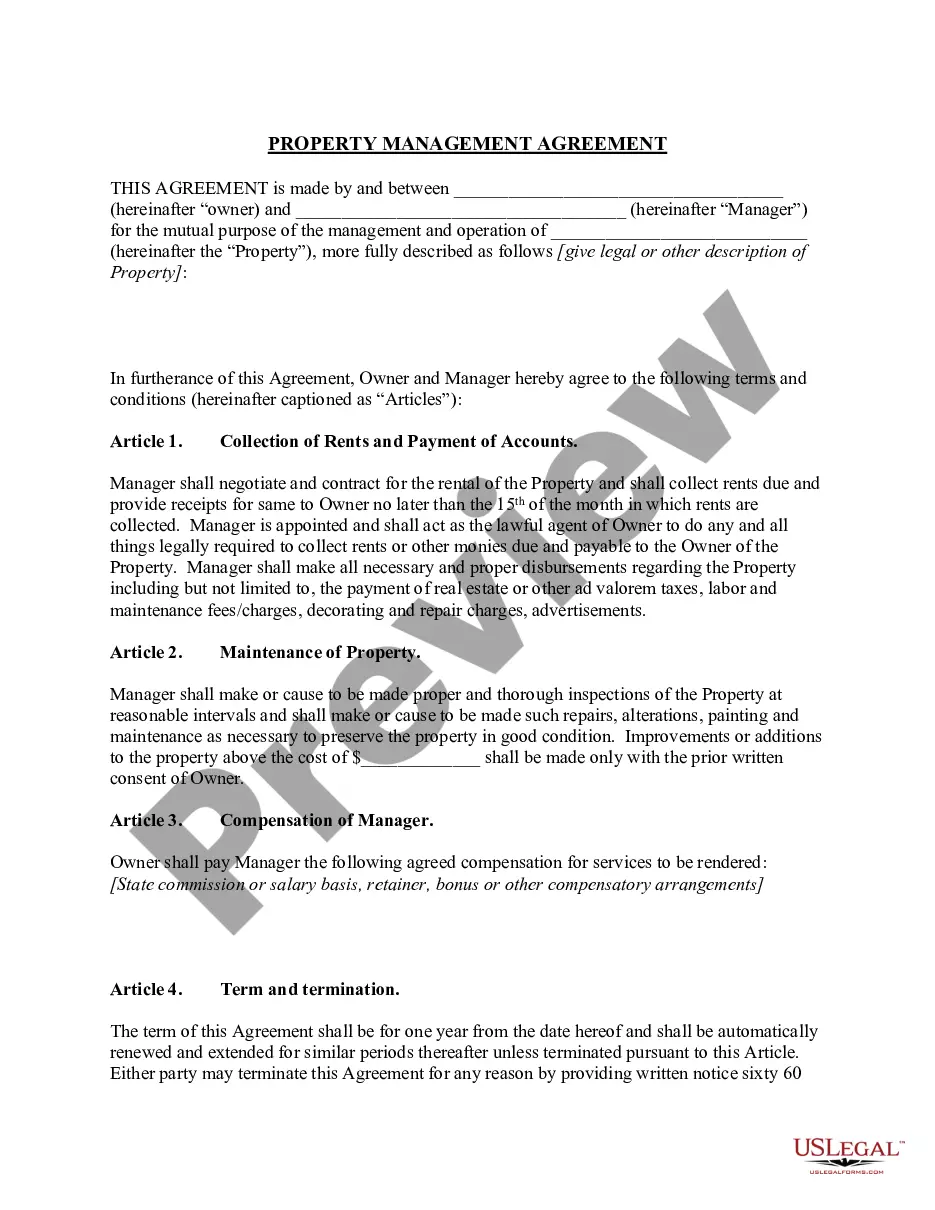

This Property Manager Agreement is an employment contract. A Property Manager Agreement is a contract containing terms and conditions of employment of property manager by owner of rental property. This form is compliant with state statutory law.

Ohio Property Manager Agreement

Description

How to fill out Ohio Property Manager Agreement?

In terms of completing Ohio Property Manager Agreement, you most likely visualize an extensive procedure that involves choosing a suitable sample among hundreds of very similar ones and after that having to pay an attorney to fill it out to suit your needs. Generally, that’s a sluggish and expensive choice. Use US Legal Forms and choose the state-specific form in just clicks.

For those who have a subscription, just log in and then click Download to get the Ohio Property Manager Agreement sample.

In the event you don’t have an account yet but need one, stick to the point-by-point guideline below:

- Make sure the file you’re downloading is valid in your state (or the state it’s required in).

- Do so by looking at the form’s description and also by clicking on the Preview function (if offered) to view the form’s information.

- Simply click Buy Now.

- Select the appropriate plan for your budget.

- Join an account and select how you want to pay out: by PayPal or by card.

- Download the document in .pdf or .docx format.

- Get the record on the device or in your My Forms folder.

Skilled lawyers work on creating our samples so that after saving, you don't need to bother about modifying content outside of your personal info or your business’s information. Join US Legal Forms and receive your Ohio Property Manager Agreement document now.

Form popularity

FAQ

Check For a Cancellation Policy. There is a likely a specific cancellation policy in your management agreement. Send the Cancellation Notice in Writing. Prepare For Possible Costs. Make Sure the Management Company Notifies the Tenant. Collect Necessary Documents and Materials. Tell Them Why You're Cancelling.

Government Issued Real Estate License & REALTOR® License: Many states, including Ohio, require that a property manager have a real estate broker's license, as well; the only exception to this law is a property owner.

Most property managers are required to hold a property management license or a real estate broker's license in order to conduct real estate transactions, which includes those related to managing and leasing rental properties. Only a couple of states do not have this requirement.

The percentage collected will vary, but is traditionally between 8% and 12% of the gross monthly rent. Managers will often charge a lower percentage, between 4% and 7%, for properties with 10 units or more or for commercial properties, and a higher percentage, 10% or more, for smaller or residential properties.

Property management isn't worth the money to some investors.One important note, even if you choose to manage your own properties it pays to have a backup plan in case you're no longer able to handle them. For others investing in real estate, there's no way they'd choose to manage their own rental properties.

Undertake a certificate-level course in real estate. To become licensed as a property manager in your state, you can complete a Certificate IV (QLD and NSW) or a Certificate of Registration or Licensing Program (all states).

What is a property manager's first responsibility to the owner? To realize the maximum profit on the property that is consistent with the owner's instructions.

A property manager costs approximately 7-10% of your total rental income, however the services and expertise offered by a good property manager is worth much much more than this fee, plus in many cases the agents service fee is tax deductable.

In Ohio, subject to limited exceptions, property management companies must have a real estate broker's license. While there is no specific Ohio statute governing property managers, Chapter 4735 of the Ohio Revised Code governing Real Estate Brokers is dispositive.