This is one of the official workers' compensation forms for the state of Ohio.

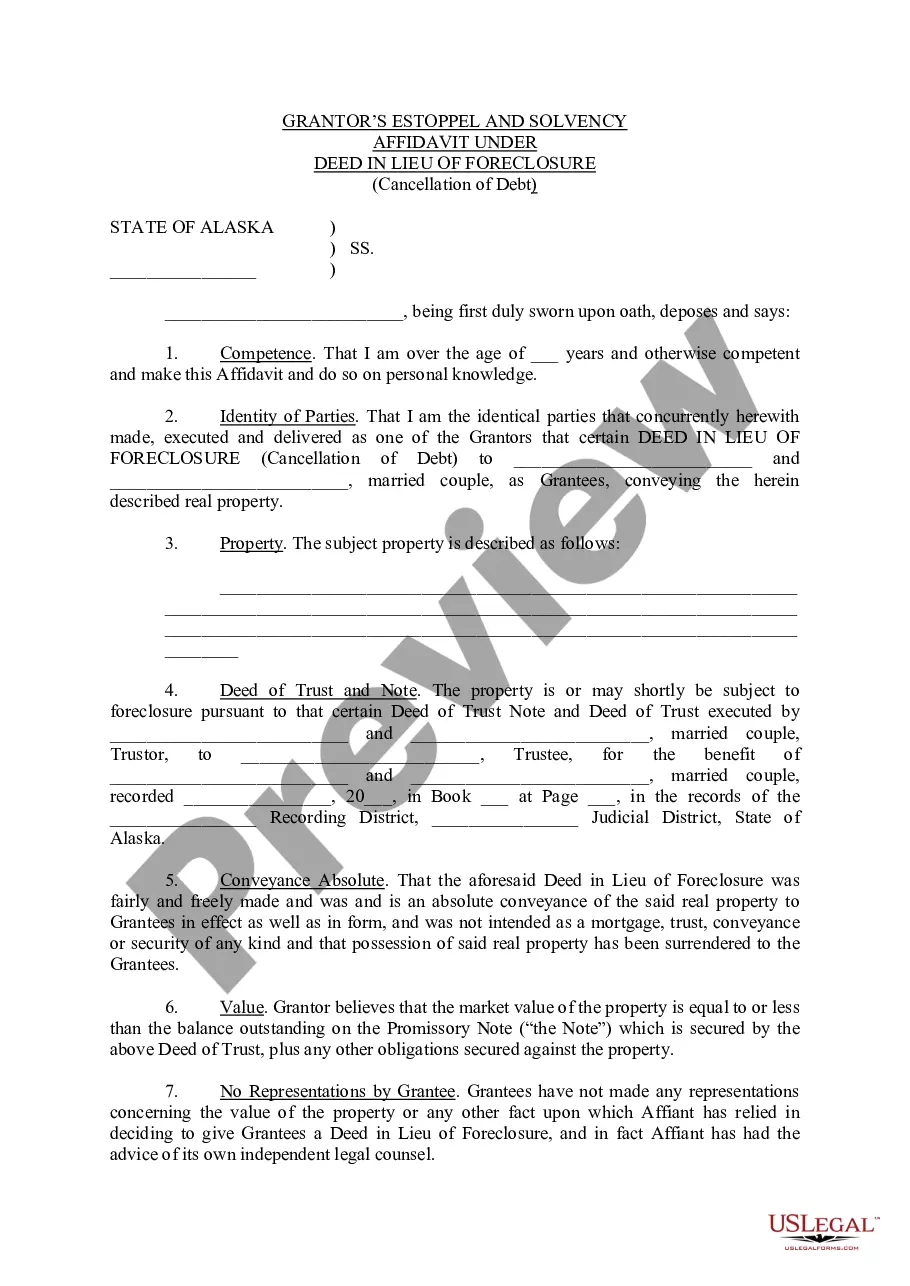

Ohio Self-Insurer's Agreement as to Compensation on Account of Death for Workers' Compensation

Description

How to fill out Ohio Self-Insurer's Agreement As To Compensation On Account Of Death For Workers' Compensation?

In terms of completing Ohio Self-Insurer's Agreement as to Compensation on Account of Death for Workers' Compensation, you probably think about a long process that involves choosing a appropriate sample among numerous similar ones then being forced to pay out an attorney to fill it out for you. In general, that’s a slow-moving and expensive option. Use US Legal Forms and pick out the state-specific template in just clicks.

If you have a subscription, just log in and then click Download to have the Ohio Self-Insurer's Agreement as to Compensation on Account of Death for Workers' Compensation template.

In the event you don’t have an account yet but want one, keep to the step-by-step guide listed below:

- Make sure the file you’re downloading applies in your state (or the state it’s required in).

- Do so by reading through the form’s description and through clicking the Preview function (if offered) to view the form’s information.

- Click on Buy Now button.

- Find the proper plan for your budget.

- Sign up to an account and select how you would like to pay out: by PayPal or by credit card.

- Download the document in .pdf or .docx format.

- Get the record on the device or in your My Forms folder.

Professional legal professionals work on creating our samples to ensure that after downloading, you don't have to bother about enhancing content material outside of your individual details or your business’s details. Join US Legal Forms and receive your Ohio Self-Insurer's Agreement as to Compensation on Account of Death for Workers' Compensation sample now.

Form popularity

FAQ

Self-Insurer Licence - New South Wales This licence will allow you to manage your own workers' compensation claims instead of paying workers compensation premiums to a licensed insurer.Self-Insurance can provide: better work health and safety conditions. fair and equitable treatment.

Medical Expenses. Missed Wages. Ongoing Care. Funeral Costs. Illness. Repetitive Injury. Disability.

Self-Insurer Licence - New South Wales This licence will allow you to manage your own workers' compensation claims instead of paying workers compensation premiums to a licensed insurer.Self-Insurance can provide: better work health and safety conditions. fair and equitable treatment.

As a self-employed business owner, you need to have a policy in place before hiring that first non-owner employee. Workers' comp insurance pays the medical and rehabilitation bills for workers who are injured on the job. The insurance may also pay some missed wages if an employee cannot work due to the injury.

Most states require employers to provide workers' compensation insurance for their employees. Executive officers and owners, however, are generally not required to be included in the coverage but have the option if they so choose.

A self-insured Workers' Compensation plan (or a self-funded plan as it is also called) is one in which the employer assumes the financial risk for providing Workers' Compensation benefits to its employees.

Typically, small business owners in California are not required to have workers' compensation coverage if they are sole proprietors with no employees. However, it may become necessary to purchase workers' comp insurance if the business hires one or more employees, even on a temporary basis.

Medical. Surgical. Chiropractic. Acupuncture.

In California, workers' compensation is mandatory for all employers, even if the company only has one employee.California law requires a business owner to carry workers' comp insurance for employees who regularly work in California, even if the business is headquartered in another state.