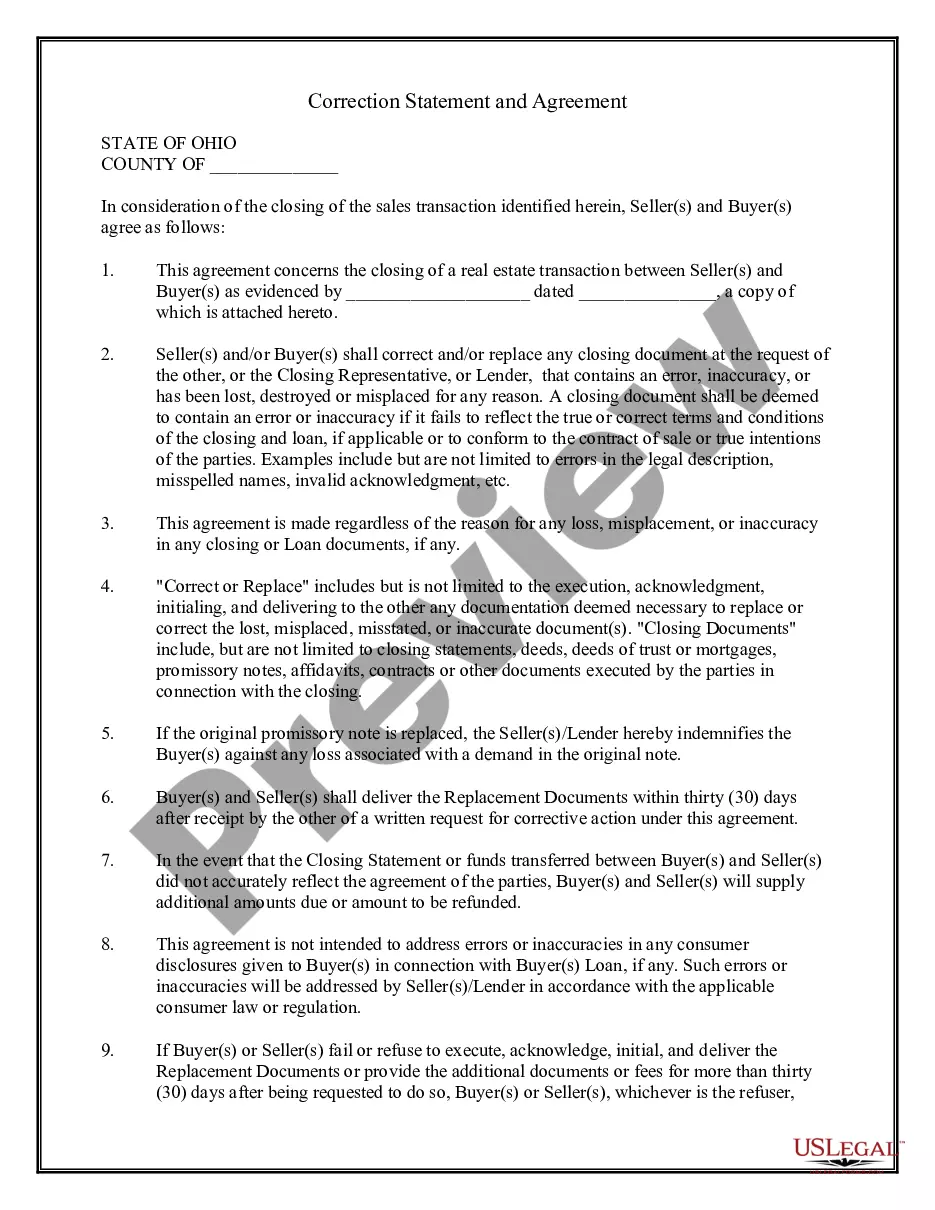

This Correction Statement and Agreement form is for a buyer and seller to sign at the closing for a loan or purchase of real property agreeing to execute corrected documents in the event of certain errors. It also is used to provide replacement documents in the event any documents are lost or misplaced.

Ohio Correction Statement and Agreement

Description

How to fill out Ohio Correction Statement And Agreement?

When it comes to filling out Ohio Correction Statement and Agreement, you almost certainly visualize a long procedure that consists of getting a ideal sample among hundreds of very similar ones and after that needing to pay an attorney to fill it out to suit your needs. Generally, that’s a slow and expensive choice. Use US Legal Forms and select the state-specific form within just clicks.

For those who have a subscription, just log in and click on Download button to have the Ohio Correction Statement and Agreement sample.

In the event you don’t have an account yet but need one, follow the step-by-step guide listed below:

- Be sure the document you’re downloading applies in your state (or the state it’s needed in).

- Do it by reading through the form’s description and by clicking the Preview option (if offered) to see the form’s information.

- Click on Buy Now button.

- Pick the appropriate plan for your budget.

- Sign up for an account and select how you want to pay: by PayPal or by card.

- Download the file in .pdf or .docx format.

- Find the document on the device or in your My Forms folder.

Professional lawyers work on creating our samples to ensure that after saving, you don't need to worry about enhancing content material outside of your individual information or your business’s information. Join US Legal Forms and get your Ohio Correction Statement and Agreement sample now.

Form popularity

FAQ

An initial statement of personal and financial information required to approve a loan provided by the borrower and necessary to initiate the approval process for a loan. This document is required by lenders prior to loan approval, borrowers must sign original copy at time of closing.

3-Deed of Trust or Mortgage This document is also called a security instrument. It gives the lender an interest in your property; it will be recorded in the public (or real estate) records.

Correction Agreement Limited Power of Attorney This document authorizes the lender to make corrections to clerical errors.The type of clerical errors which are typically corrected would include mispelled names, typos, and other clerical mistakes which don't effect the conditions of the loan in any way.

Promissory Note This document is legal evidence of your mortgage and pledge to repay the loan, and a copy is kept as a public record, often with your county clerk office. The promissory note details the loan amount, interest rate, payment schedule, and length of term.

Correction Agreement Limited Power of Attorney This document authorizes the lender to make corrections to clerical errors.The type of clerical errors which are typically corrected would include mispelled names, typos, and other clerical mistakes which don't effect the conditions of the loan in any way.

What is a Compliance Agreement? A Compliance Agreement is a document in a closing loan document package in which a borrower agrees to comply with requests from the lender or closing agent to correct typographical or clerical errors and inadvertent mistakes in the loan documentation.

The most common documents are related to mortgages, deeds, easements, foreclosures, estoppels, leases, licenses, and fees, among other kinds of documents. The most important real estate documents list ownership, encumbrances, and lien priority. These are used to maintain proper real estate transactions.

A security agreement refers to a document that provides a lender a security interest in a specified asset or property that is pledged as collateral.In the event that the borrower defaults, the pledged collateral can be seized by the lender and sold.

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.