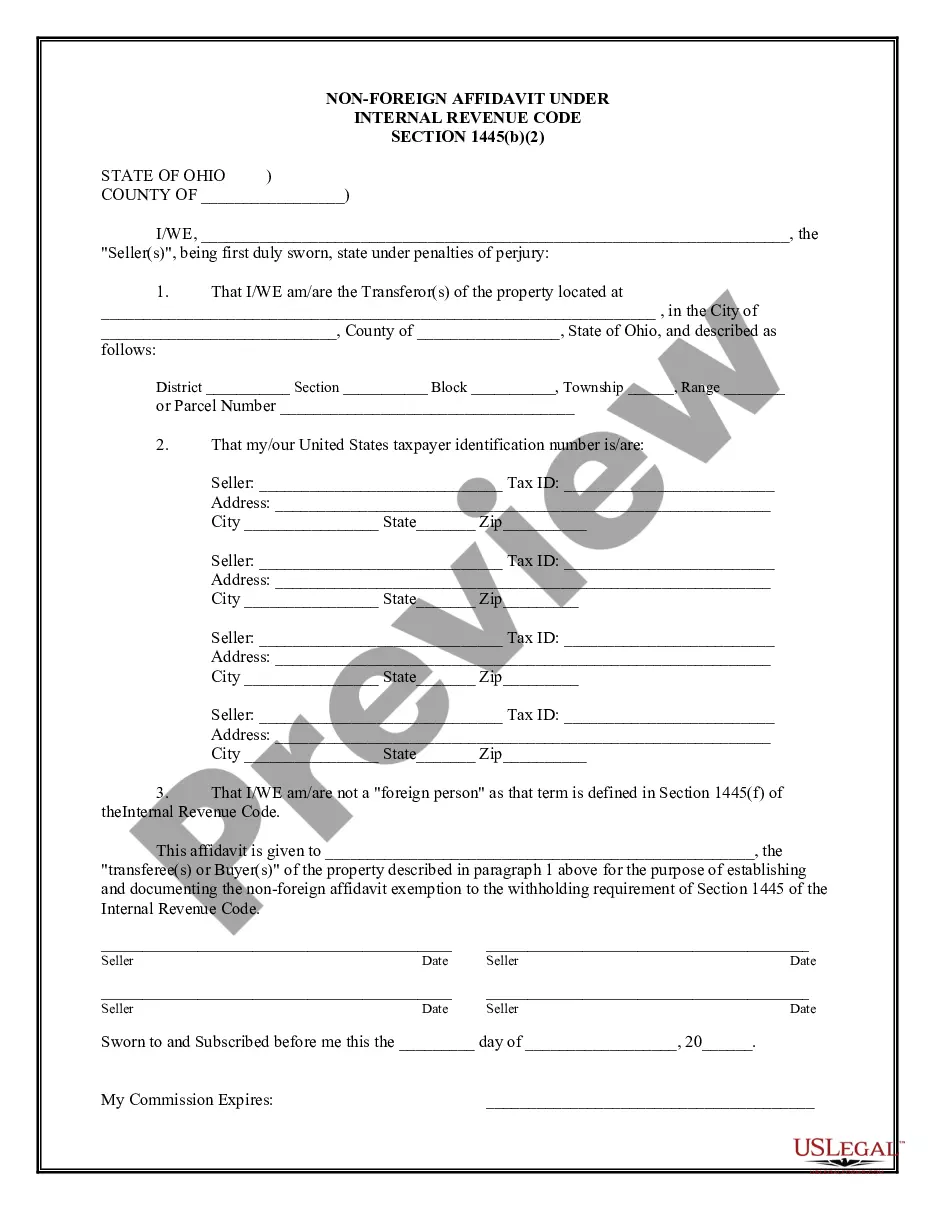

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Ohio Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Ohio Non-Foreign Affidavit Under IRC 1445?

In terms of filling out Ohio Non-Foreign Affidavit Under IRC 1445, you most likely visualize an extensive process that requires getting a ideal form among countless very similar ones and after that having to pay out a lawyer to fill it out for you. In general, that’s a slow-moving and expensive choice. Use US Legal Forms and pick out the state-specific template in a matter of clicks.

In case you have a subscription, just log in and click Download to have the Ohio Non-Foreign Affidavit Under IRC 1445 template.

In the event you don’t have an account yet but need one, keep to the point-by-point manual listed below:

- Be sure the document you’re getting is valid in your state (or the state it’s required in).

- Do so by looking at the form’s description and through visiting the Preview function (if readily available) to see the form’s information.

- Simply click Buy Now.

- Pick the appropriate plan for your budget.

- Sign up for an account and select how you would like to pay: by PayPal or by credit card.

- Save the file in .pdf or .docx format.

- Find the file on your device or in your My Forms folder.

Professional attorneys work on drawing up our samples so that after downloading, you don't have to bother about enhancing content material outside of your personal details or your business’s details. Join US Legal Forms and get your Ohio Non-Foreign Affidavit Under IRC 1445 sample now.

Form popularity

FAQ

FIRPTA is a tax law that imposes U.S. income tax on foreign persons selling U.S. real estate. Under FIRPTA, if you buy U.S. real estate from a foreign person, you may be required to withhold 10% of the amount realized from the sale.Along with the form, you submit 10% withholding.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445).Withholding is required on certain distributions and other transactions by domestic or foreign corporations, partnerships, trusts, and estates.

The only other way to avoid FIRPTA is via a withholding certificate. If FIRPTA withholding exceeds the maximum tax liability realized on the sale of the real property, sellers can appeal to the IRS for a lower withholding amount.