The dissolution of a corporation package contains all forms to dissolve a corporation in Ohio, step by step instructions, addresses, transmittal letters, and other information.

Ohio Dissolution Package to Dissolve Corporation

Description Ohio Dissolve

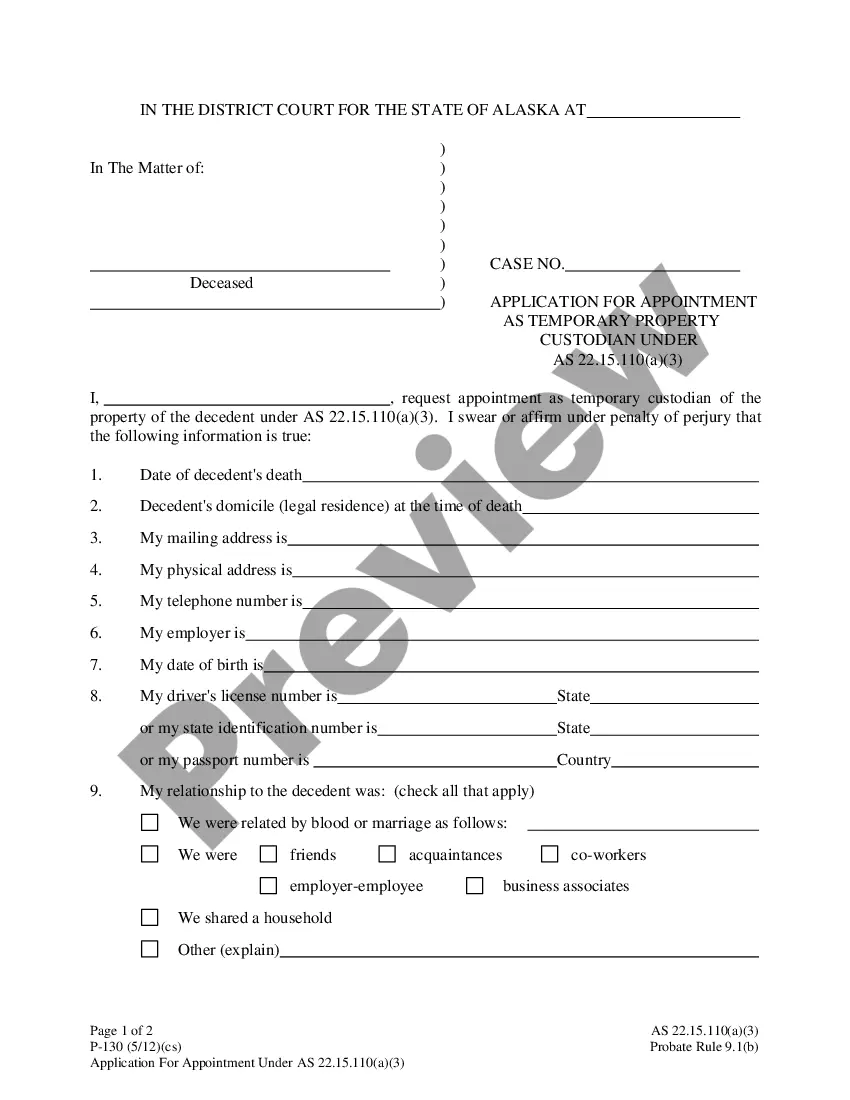

How to fill out Oh Dissolve Corporation?

When it comes to submitting Ohio Dissolution Package to Dissolve Corporation, you almost certainly imagine an extensive procedure that involves finding a ideal form among hundreds of similar ones and after that having to pay out legal counsel to fill it out for you. Generally speaking, that’s a slow-moving and expensive choice. Use US Legal Forms and pick out the state-specific form in just clicks.

If you have a subscription, just log in and click on Download button to have the Ohio Dissolution Package to Dissolve Corporation sample.

If you don’t have an account yet but need one, stick to the point-by-point guideline below:

- Make sure the document you’re saving applies in your state (or the state it’s needed in).

- Do so by reading through the form’s description and through visiting the Preview function (if readily available) to find out the form’s content.

- Click on Buy Now button.

- Select the appropriate plan for your financial budget.

- Sign up to an account and choose how you would like to pay out: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Get the document on the device or in your My Forms folder.

Professional legal professionals work on creating our templates so that after saving, you don't have to worry about modifying content outside of your personal details or your business’s information. Be a part of US Legal Forms and get your Ohio Dissolution Package to Dissolve Corporation example now.

Oh Dissolution Form popularity

Oh Dissolution Dissolve Other Form Names

Ohio Dissolve File FAQ

In legal terms, when a company is dissolved, it ceases to exist. It cannot still be trading - although a person may trade (misleadingly) using its name.

If the company has ceased trading and is closed owing money and your debt is with that company then your liability ends with that company.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

After dissolution, you cannot use the funds remaining in your business bank account for new business. LLC members no longer have the authority to conduct business or do anything that would indicate that the LLC is still active. Your bank account can cover only essential winding up affairs.

Definition. The ending of a corporation, either voluntarily by filing a notice of dissolution with the Secretary of State or as ordered by a court after a vote of the shareholders, or involuntarily through government action as a result of failure to pay taxes.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets.Assets used as security for loans must be given to the bank or creditor that extended the loan, or you must pay off the loan before selling such assets.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.