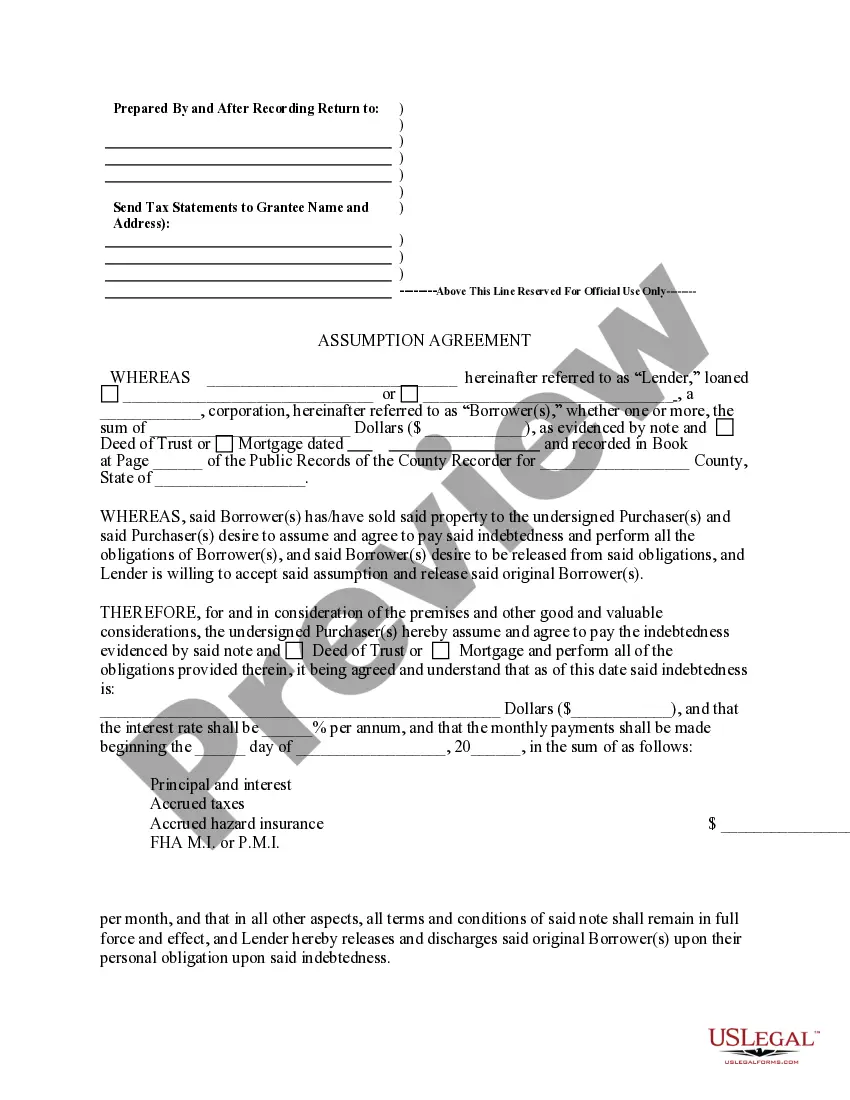

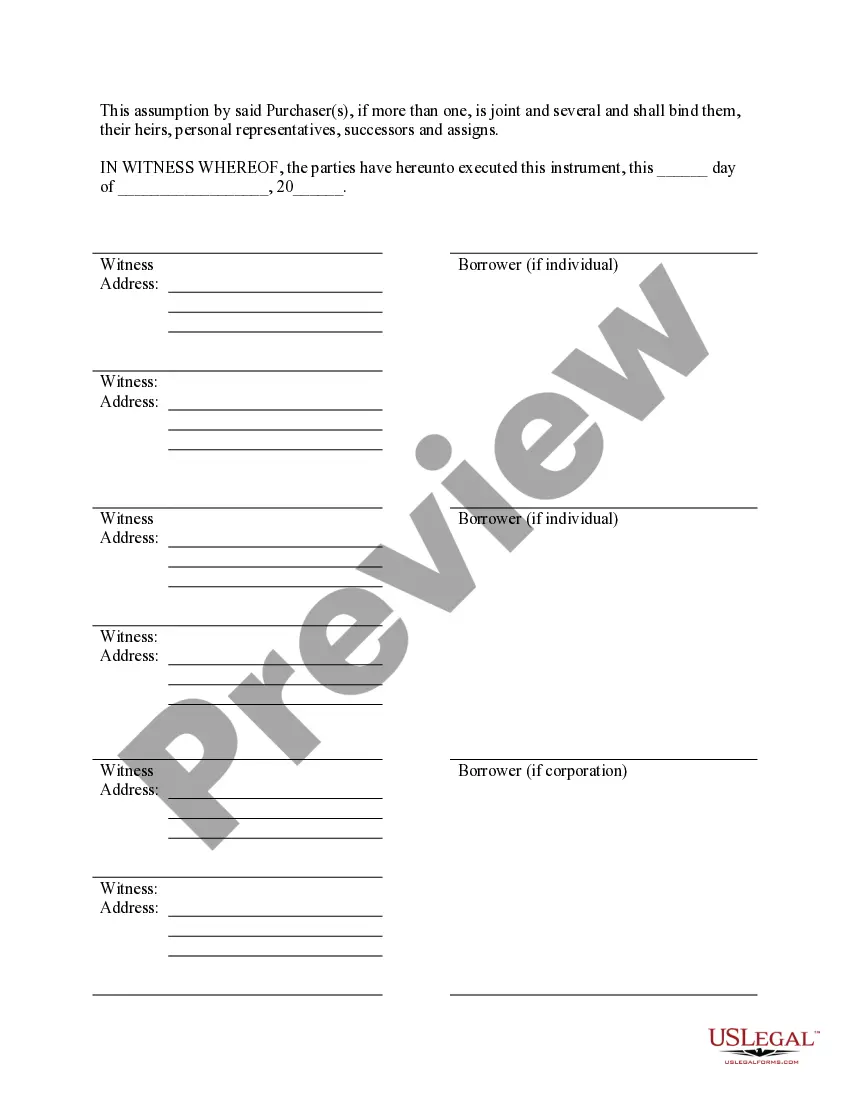

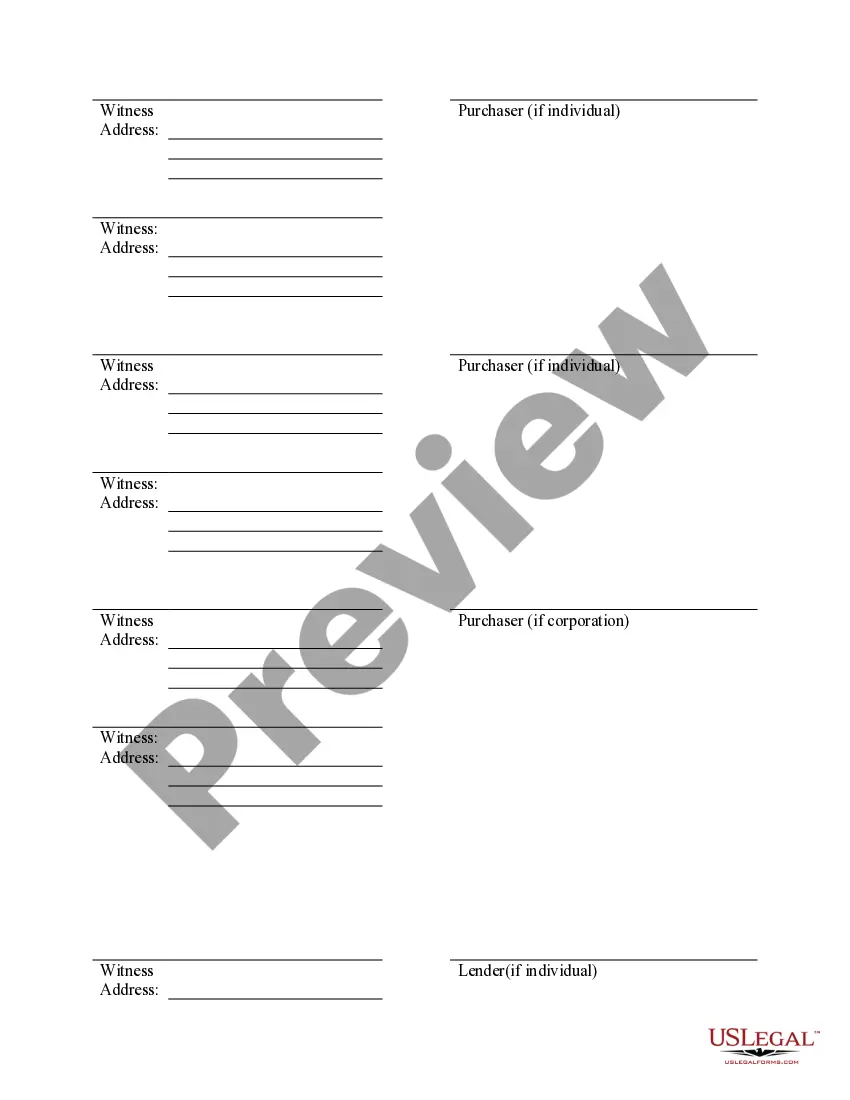

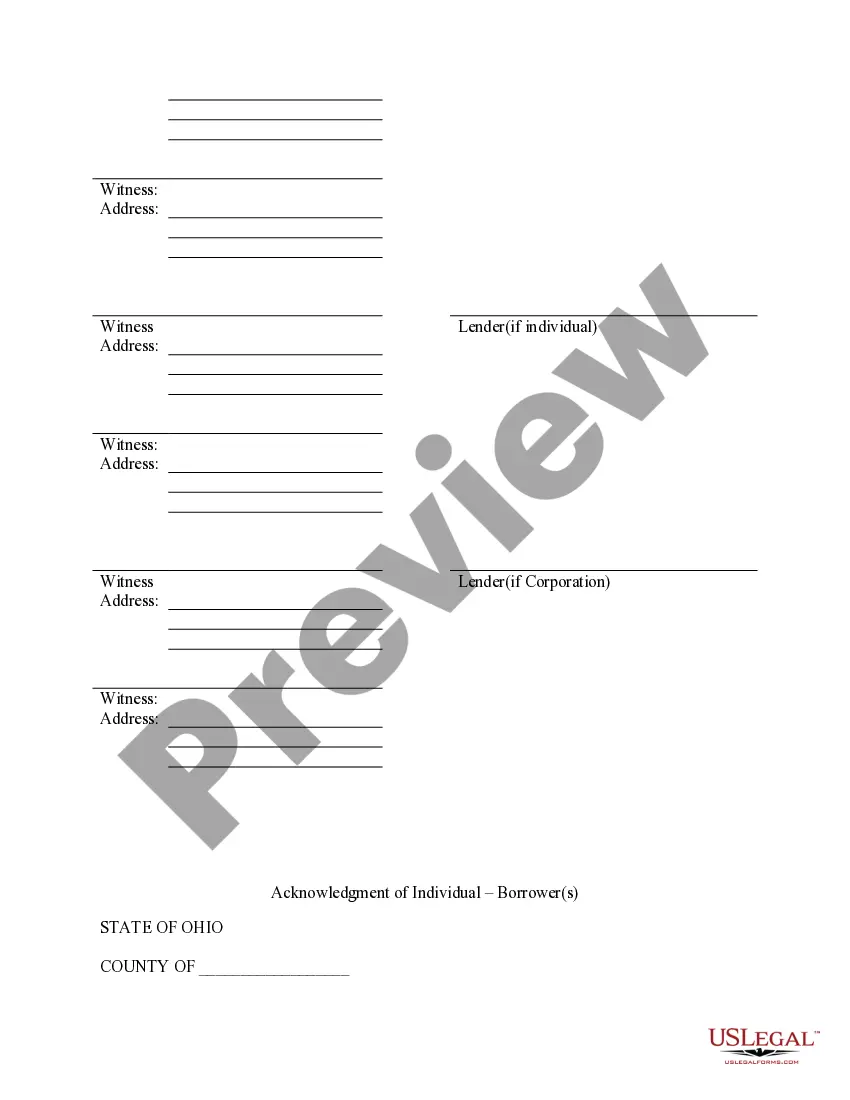

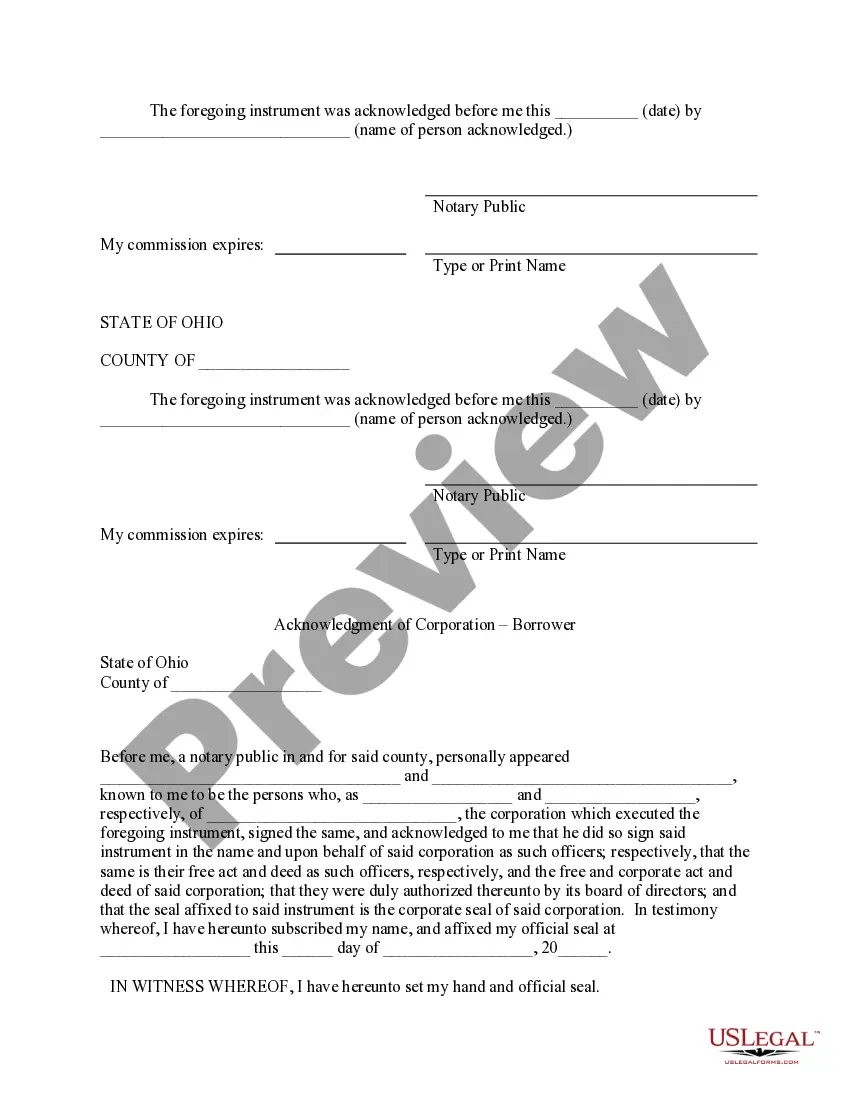

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors

Description Assumption Letter For Mortgage

How to fill out Ohio Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

When it comes to filling out Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors, you almost certainly visualize an extensive procedure that requires choosing a appropriate form among countless similar ones then having to pay out an attorney to fill it out to suit your needs. Generally, that’s a slow and expensive option. Use US Legal Forms and pick out the state-specific document in a matter of clicks.

If you have a subscription, just log in and click Download to get the Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors form.

If you don’t have an account yet but need one, stick to the step-by-step manual below:

- Make sure the document you’re downloading is valid in your state (or the state it’s needed in).

- Do it by reading the form’s description and through clicking the Preview option (if offered) to view the form’s information.

- Click on Buy Now button.

- Pick the suitable plan for your financial budget.

- Join an account and choose how you want to pay out: by PayPal or by card.

- Download the file in .pdf or .docx file format.

- Get the document on your device or in your My Forms folder.

Skilled attorneys work on drawing up our templates to ensure that after saving, you don't need to bother about enhancing content material outside of your individual info or your business’s information. Be a part of US Legal Forms and get your Ohio Assumption Agreement of Mortgage and Release of Original Mortgagors example now.

Letter Of Assumption Of Property Form popularity

Letter Of Assumption Sample Other Form Names

Mortgage Release Of Liability Assumption FAQ

The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility. The lender usually requires a credit history from the buyer before approving the assumption and the payment of assumption fee(s).

It is a legal contract that effectuates an agreement between two parties, whereby one party agrees to assume the responsibilities, interests, rights, and obligations of another party in respect to a separate agreement made between the latter and a third party.

You will need a minimum credit score of 580 to 620, depending on individual lender guidelines. Your household income cannot exceed 115% of the average median income for the area. Your debt ratios should not exceed 29% for your housing expenses and 41% for your total monthly expenses.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

An assumable mortgage is an arrangement in where an outstanding mortgage and its terms can be transferred from the current owner to a buyer.

The loan transaction consists of two main documents: the mortgage (or deed of trust) and a promissory note.

What is a mortgage assumption agreement? It's actually pretty self-explanatory. A person who assumes a mortgage takes over a payment from the previous homeowner. Basically, the agreement shifts the financial responsibility of the loan to a different borrower.

Having an assumable loan might give a seller a marketing edge, particularly if mortgage rates have risen since the seller got the loan. For a buyer, assuming a mortgage can save thousands of dollars in interest payments and closing costs but it could require making a big down payment.