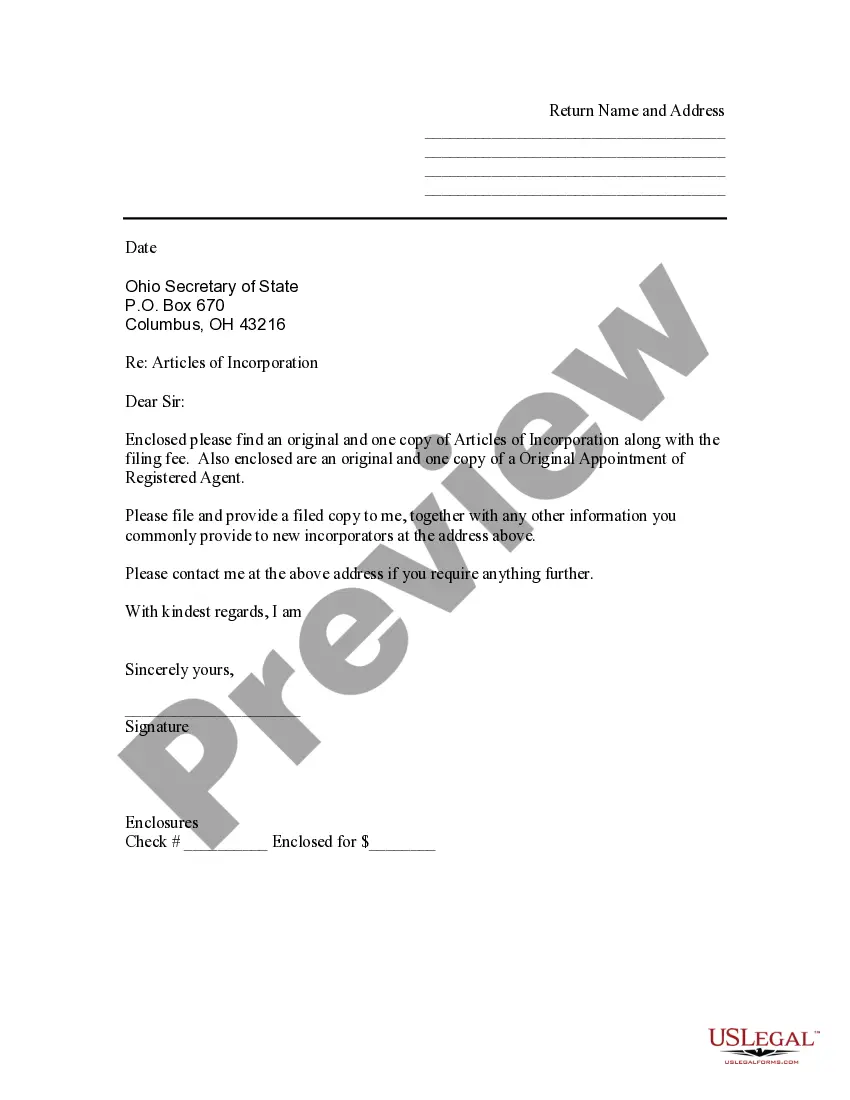

Use this sample letter as a cover sheet to accompany the Articles of Incorporation for filing with the Secretary of State's Office.

Ohio Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation

Description

How to fill out Ohio Sample Transmittal Letter To Secretary Of State's Office To File Articles Of Incorporation?

In terms of filling out Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - Ohio, you almost certainly visualize an extensive procedure that involves getting a suitable form among countless very similar ones after which being forced to pay out an attorney to fill it out for you. On the whole, that’s a sluggish and expensive choice. Use US Legal Forms and pick out the state-specific document within just clicks.

In case you have a subscription, just log in and click Download to get the Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - Ohio form.

If you don’t have an account yet but want one, follow the step-by-step manual listed below:

- Be sure the document you’re saving applies in your state (or the state it’s required in).

- Do it by looking at the form’s description and also by clicking on the Preview option (if readily available) to see the form’s information.

- Click Buy Now.

- Select the proper plan for your financial budget.

- Sign up to an account and select how you would like to pay: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Get the file on your device or in your My Forms folder.

Skilled attorneys work on drawing up our samples to ensure after downloading, you don't need to bother about editing and enhancing content material outside of your personal info or your business’s details. Sign up for US Legal Forms and get your Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - Ohio sample now.

Form popularity

FAQ

Incorporation costs are the costs a company incurs before it begins active business. All companies require money to form even LLC and LLP business forms have fees but the types of fees can vary per company.

Articles of incorporation are important because they establish a company within its home state, informing the state of the key aspects of the business.By making your business a legal corporation, you protect yourself from the company's debts.

Broadly, articles of incorporation should include the company's name, type of corporate structure, and number and type of authorized shares. Bylaws work in conjunction with the articles of incorporation to form the legal backbone of the business.

You must file the Articles of Incorporation with the California Secretary of State, along with a filing fee of $100.

Articles of Organization are generally used for LLC formation, while Articles of Incorporation are the type of documents that you need to form a C Corporation or S Corporation. But the general concept remains the same you need to file these articles upfront as part of starting your business as a legal entity.

Proof of Corporation Ownership S Corporation owners can prove business ownership with the following documents: A copy of their personal tax returns. The articles of incorporation with the stock information included.

More expensive than some other services: The cost of forming a LLC ranges from $79 to $359 plus filing fees. Other websites provide similar services for filing fees only (as part of a trial) or from $49 plus filing fees.

LLCs are not corporations and do not use articles of incorporation. Instead, LLCs form by filing articles of organization.

Articles of Incorporation are public records, Bylaws are not.In the case of a corporation, the name and address of each incorporator must be listed in the Articles of Incorporation.