Ohio Claim to Preserve Mineral Interest

Description

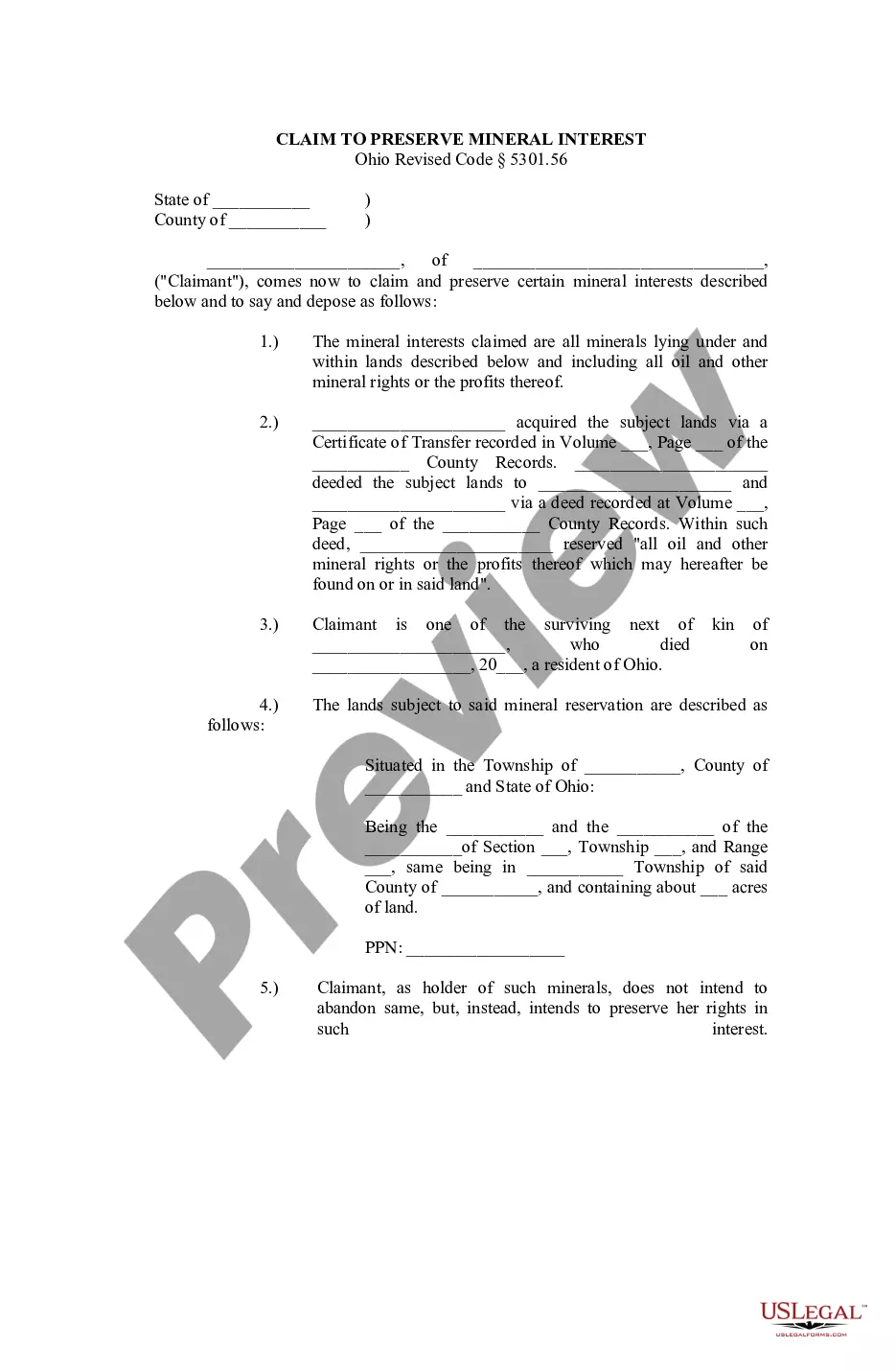

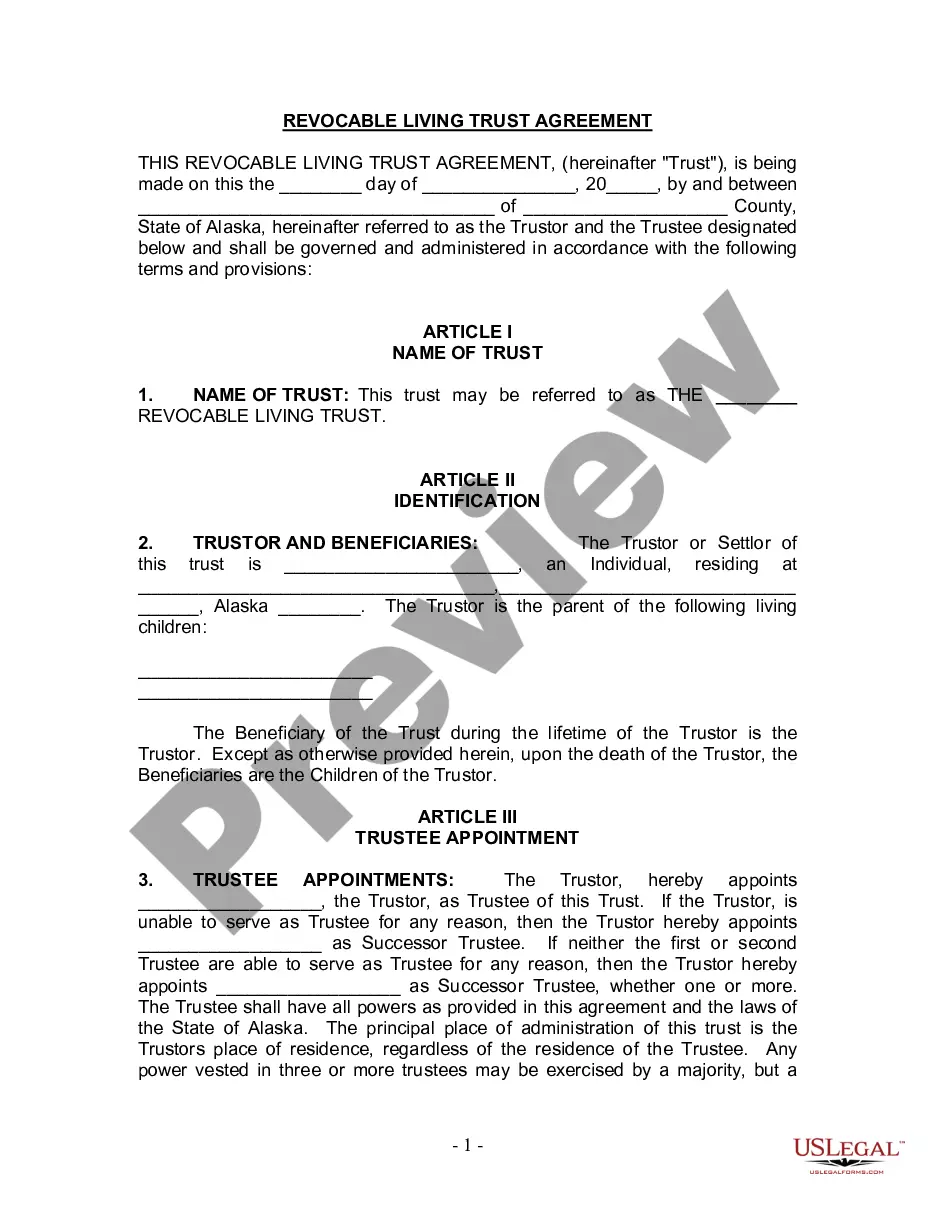

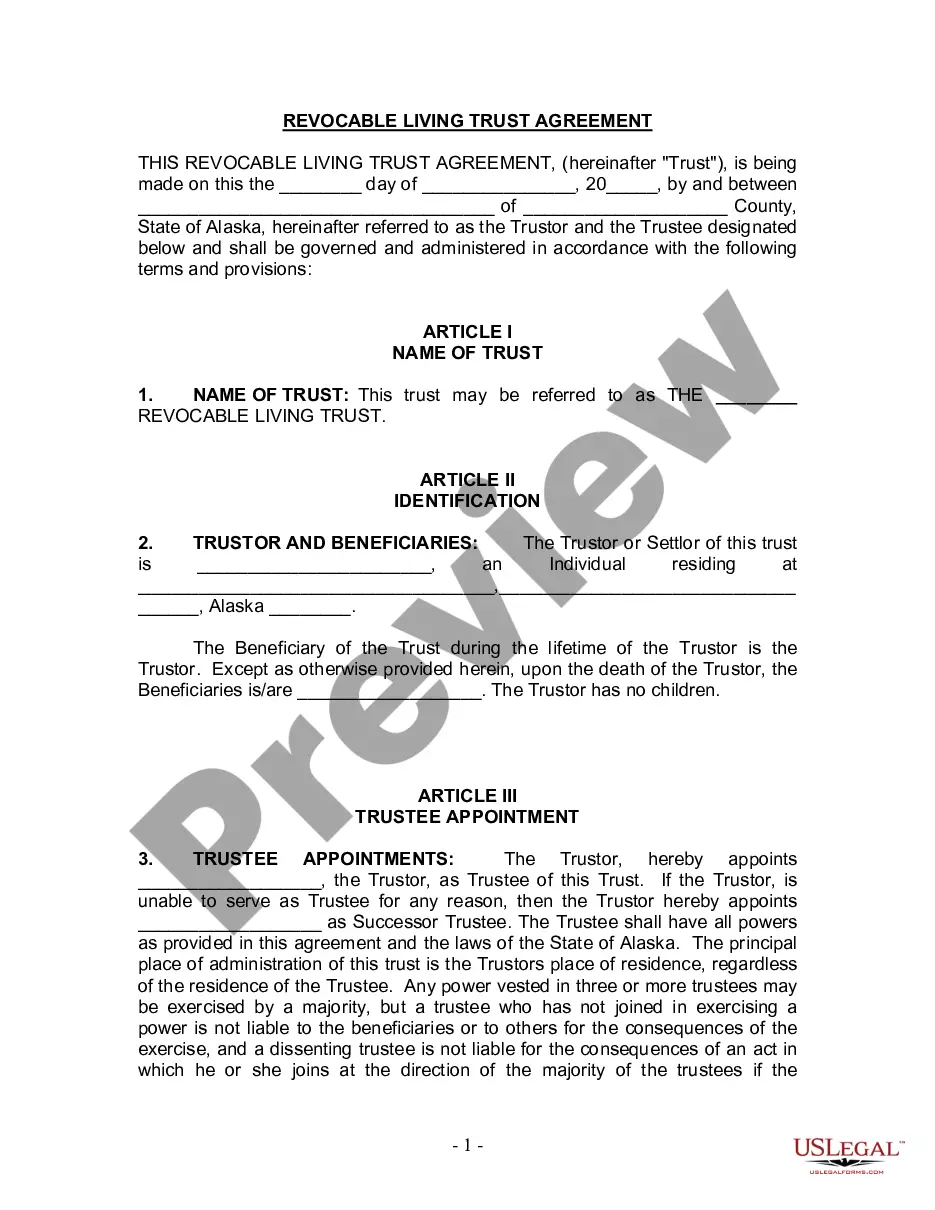

How to fill out Ohio Claim To Preserve Mineral Interest?

When it comes to filling out Ohio Claim to Preserve Mineral Interest, you probably visualize an extensive process that consists of getting a suitable form among numerous very similar ones then being forced to pay legal counsel to fill it out for you. In general, that’s a slow-moving and expensive option. Use US Legal Forms and choose the state-specific document in just clicks.

For those who have a subscription, just log in and click on Download button to have the Ohio Claim to Preserve Mineral Interest sample.

In the event you don’t have an account yet but need one, stick to the step-by-step manual listed below:

- Make sure the document you’re saving is valid in your state (or the state it’s required in).

- Do so by reading through the form’s description and also by clicking the Preview function (if offered) to view the form’s content.

- Click Buy Now.

- Select the appropriate plan for your budget.

- Subscribe to an account and select how you would like to pay out: by PayPal or by card.

- Download the file in .pdf or .docx file format.

- Find the document on your device or in your My Forms folder.

Skilled attorneys work on creating our templates so that after saving, you don't have to bother about editing content material outside of your individual information or your business’s info. Join US Legal Forms and receive your Ohio Claim to Preserve Mineral Interest example now.

Form popularity

FAQ

Not owning the mineral rights to a parcel of land doesn't mean your property is worthless. If someone else owns the mineral rights and they sell those rights to an individual or corporation, you can still make a profit as the surface rights owner. You have the rights of ingress and egress.

Selling means that you can receive a large cash payment upfront, regardless of minerals found on your land. A company who leases your land may deplete the mineral supply substantially before returning the land back to you. Selling reduces overall risk of handling mineral rights.

Mineral Rights Reservations Most commonly, large companies selling their mineral rights will transfer the ownership of some of the land to a new party, while setting aside some for federal reservation. In this case, the mineral rights will not expire so long as the contract outlines the details of the reserve.

In fact, for the most part, the ownership records of Ohio mineral rights are usually found in the offices of one of the 88 county recorders in Ohio.

You can retain your mineral rights simply by putting an exception in your sales contract, provided that the buyer agrees to it, of course. If you sell your house with no such legal clarification, then those mineral rights automatically transfer to the buyer.

Hence, mineral rights. Also known as a mineral estate, mineral rights are just what their name implies: The right of the owner to utilize minerals found below the surface of property. Besides minerals, these rights can apply to oil and gas.

Mineral rights are the ownership rights to underground resources such as fossil fuels (oil, natural gas, coal, etc.), metals and ores, and mineable rocks such as limestone and salt. In the United States, mineral rights are legally distinct from surface rights.

You can retain your mineral rights simply by putting an exception in your sales contract, provided that the buyer agrees to it, of course. If you sell your house with no such legal clarification, then those mineral rights automatically transfer to the buyer.