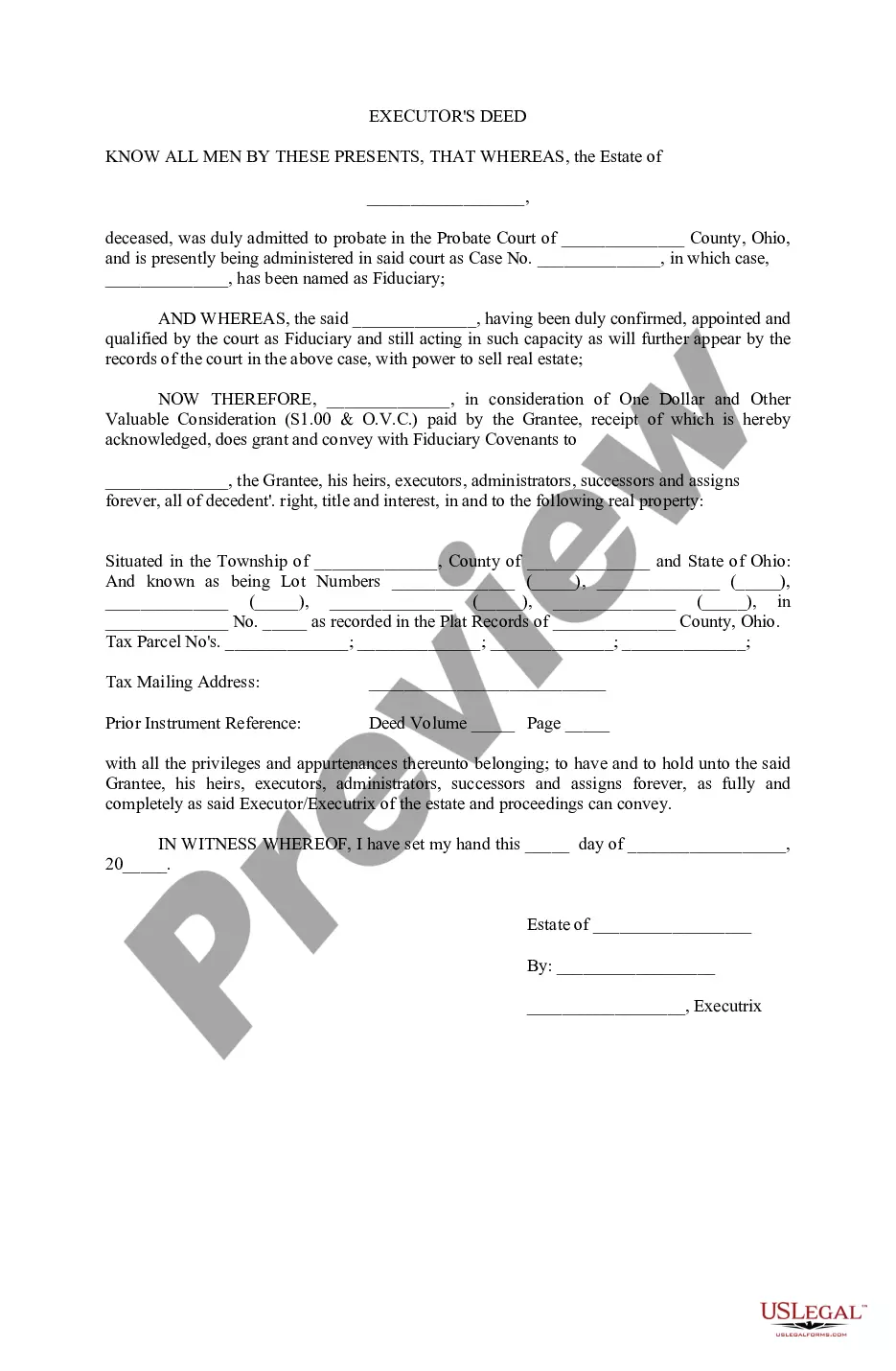

Ohio Executor's Deed

Description Ohio Fiduciary Deed

How to fill out Ohio Executor's Deed?

When it comes to submitting Ohio Executor's Deed, you probably think about a long process that requires finding a suitable form among countless very similar ones then being forced to pay out legal counsel to fill it out to suit your needs. In general, that’s a sluggish and expensive option. Use US Legal Forms and select the state-specific template within clicks.

If you have a subscription, just log in and click on Download button to get the Ohio Executor's Deed form.

In the event you don’t have an account yet but need one, follow the step-by-step manual listed below:

- Be sure the file you’re downloading applies in your state (or the state it’s required in).

- Do so by looking at the form’s description and through visiting the Preview option (if accessible) to find out the form’s information.

- Simply click Buy Now.

- Choose the appropriate plan for your financial budget.

- Sign up for an account and choose how you want to pay out: by PayPal or by credit card.

- Download the document in .pdf or .docx file format.

- Find the document on your device or in your My Forms folder.

Professional attorneys work on drawing up our samples so that after downloading, you don't have to bother about modifying content outside of your individual info or your business’s information. Be a part of US Legal Forms and get your Ohio Executor's Deed example now.

Executor Deed Form Form popularity

Executive Deed Other Form Names

FAQ

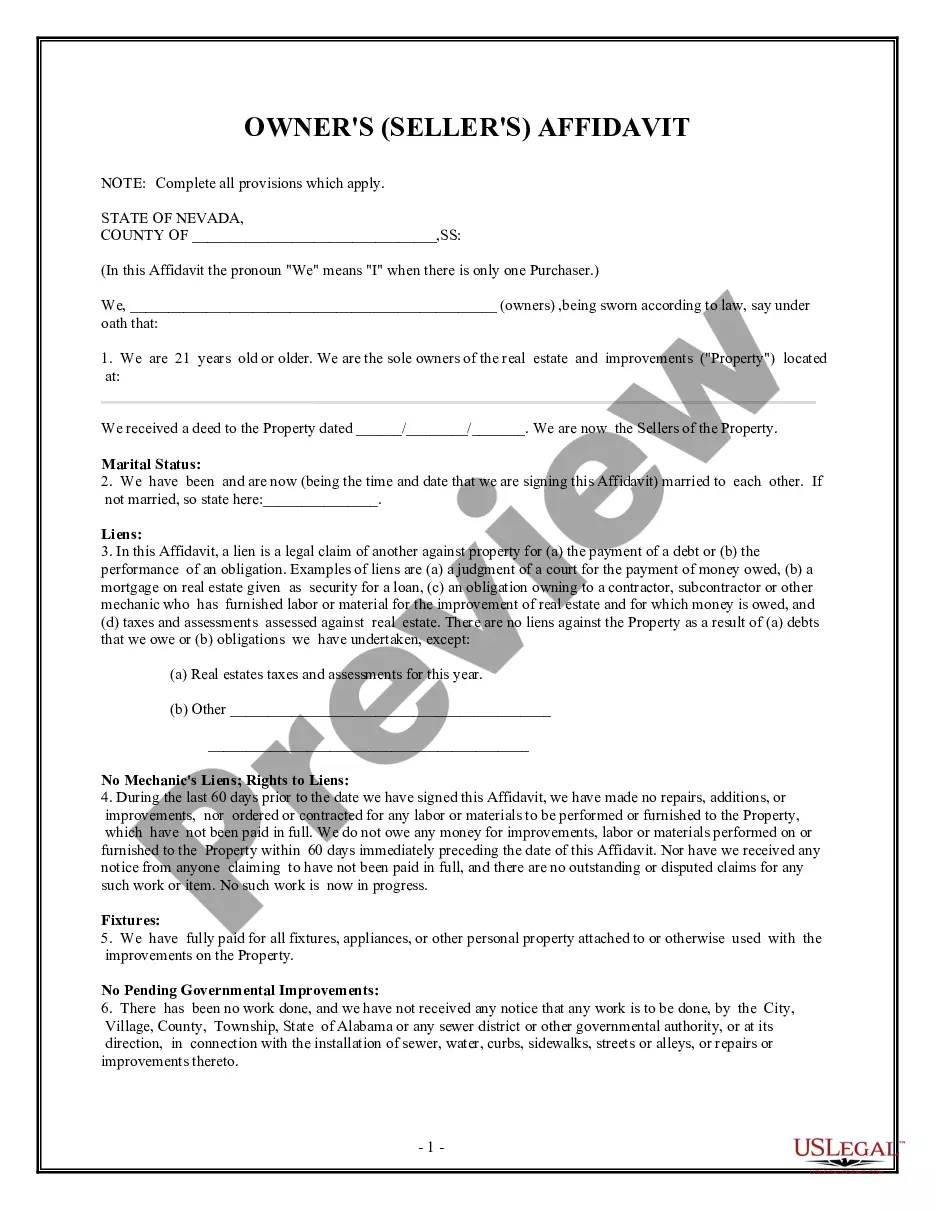

A fiduciary deed does not contain the same warranties as a warranty or grant deed. Often it only warranties that the fiduciary acts in an appointed capacity and that signing the deed falls within the authority given him.

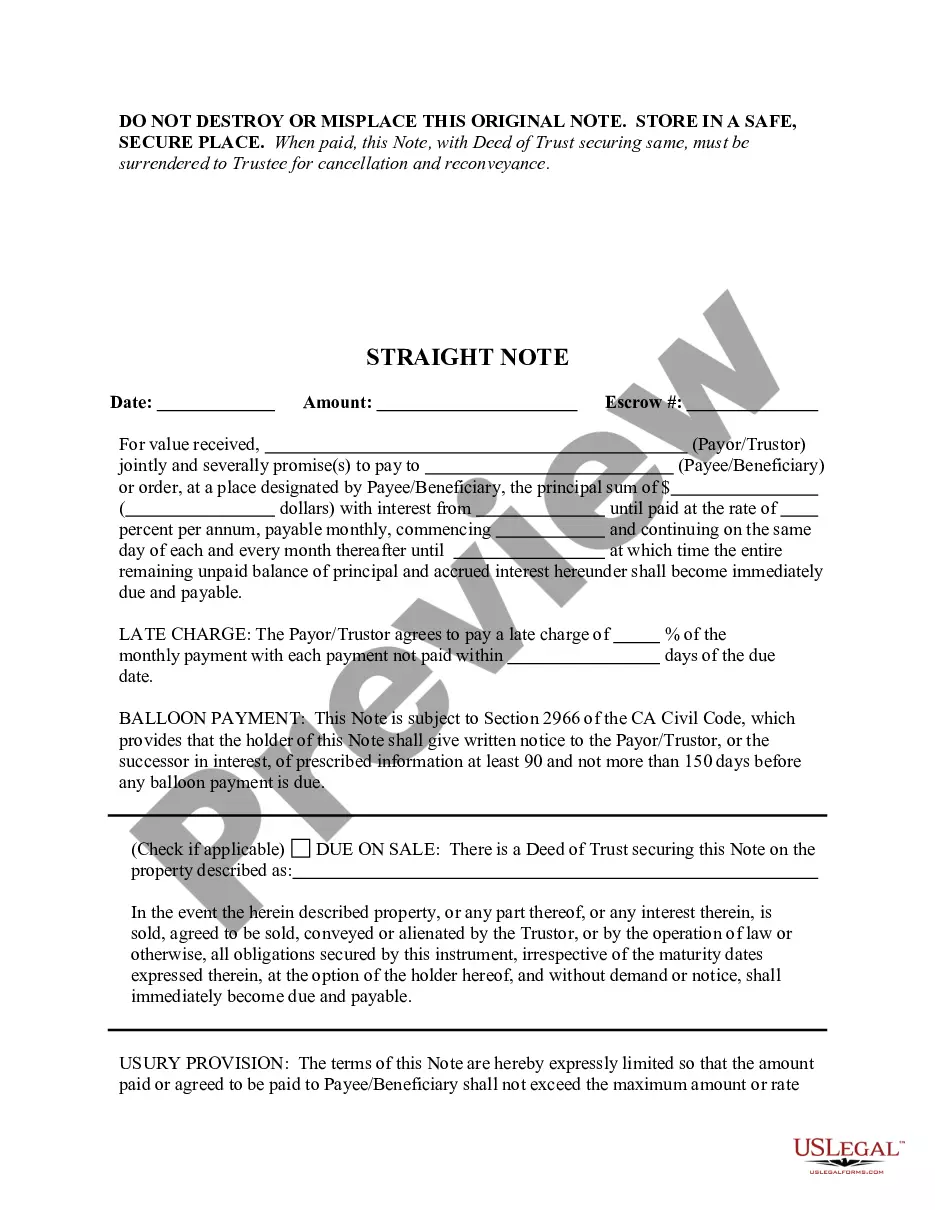

Three basic types of deeds commonly used are the grant deed, the quitclaim deed, and the warranty deed. A sample grant deed. the property he or she is transferring is implied from such language.

Fiduciary deeds are just one of several types of deeds used in property transfers. This type is used to transfer property such as real estate when the owner can't sign a deed for legal or other reasons. Fiduciary deeds are commonly employed when settling estates and the original owner of the property is deceased.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

Quitclaim Deed. Deed of Trust. Warranty Deed. Grant Deed. Bargain and Sale Deed. Mortgage Deed.

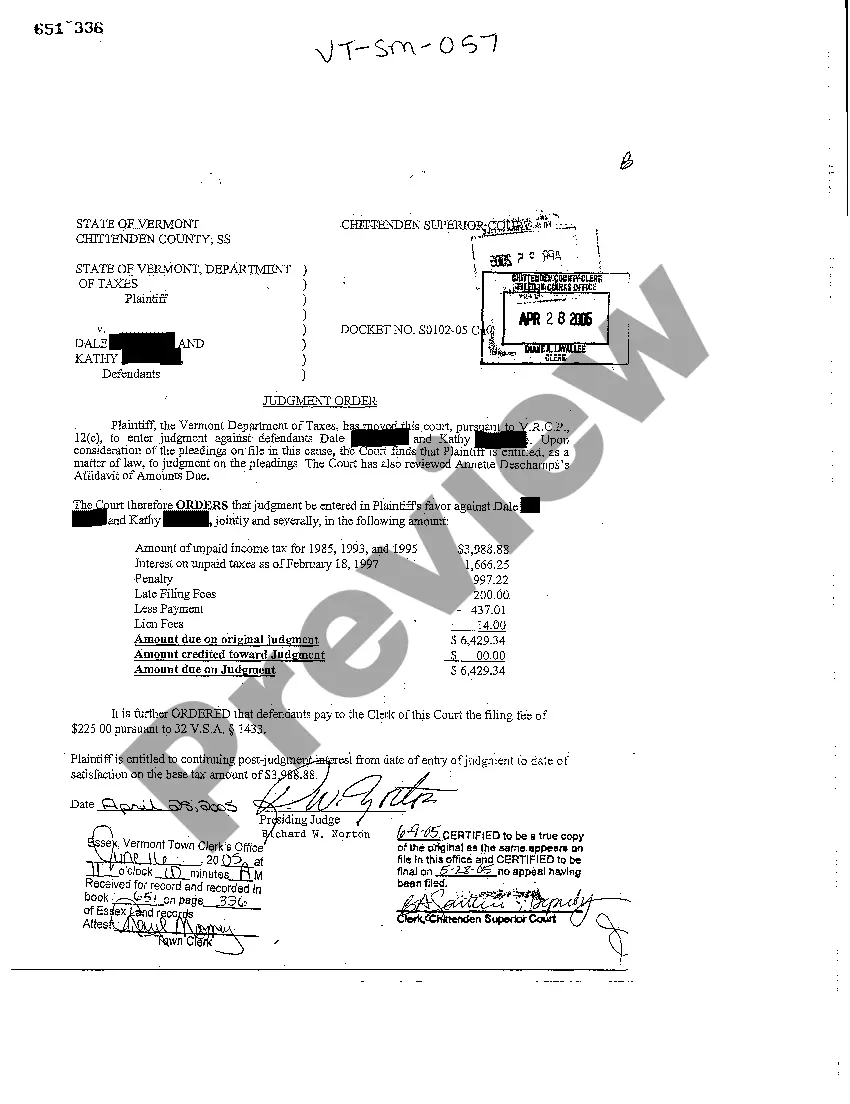

Executor's Deed: This may be used when a person dies testate (with a will). The estate's executor will dispose of the decedent's assets and an executor's deed may be used to convey the title or real property to the grantee.

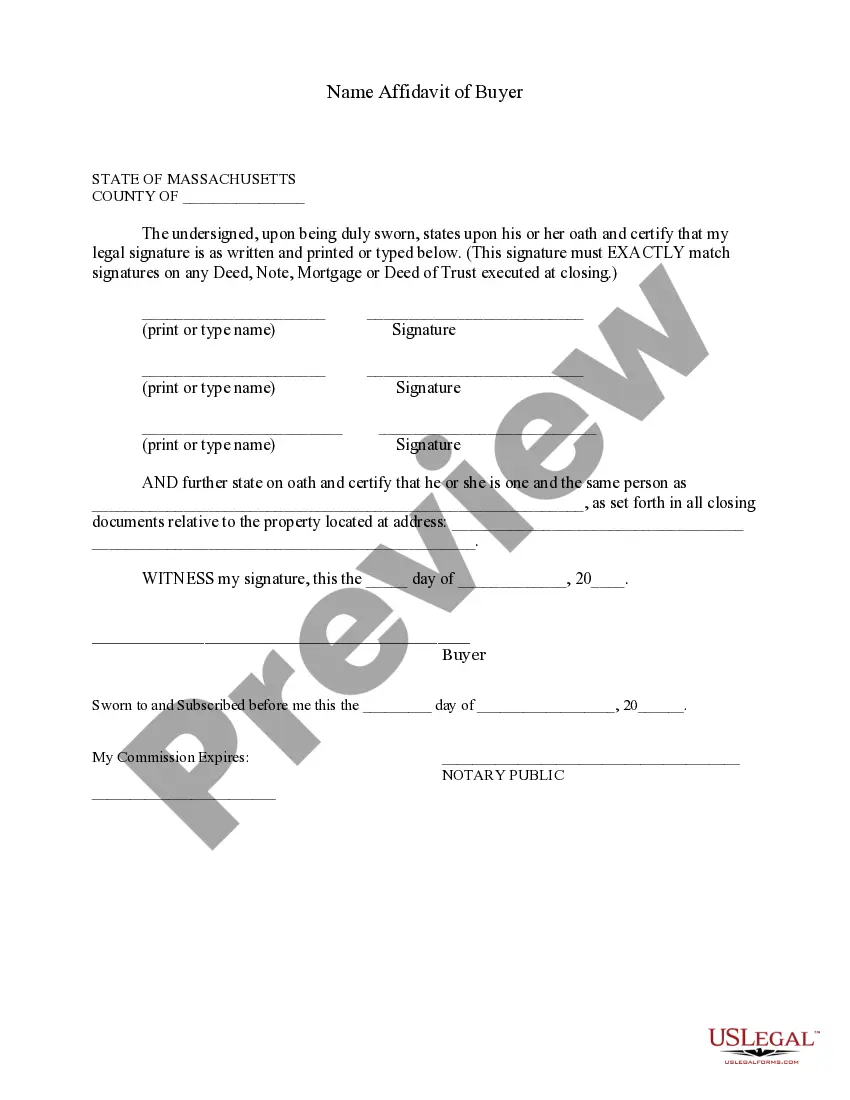

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

A fiduciary deed is used to transfer property when the executor is acting in his official capacity. A fiduciary deed warrants that the fiduciary is acting in the scope of his appointed authority but it does not guarantee title of the property.

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.