Ohio Durable Limited Power of Attorney

Description Ohio Durable

How to fill out Ohio Durable Limited Power Of Attorney?

When it comes to filling out Ohio Durable Limited Power of Attorney, you probably visualize a long procedure that involves choosing a perfect sample among countless similar ones and after that being forced to pay an attorney to fill it out for you. On the whole, that’s a sluggish and expensive option. Use US Legal Forms and select the state-specific template within just clicks.

For those who have a subscription, just log in and then click Download to find the Ohio Durable Limited Power of Attorney template.

If you don’t have an account yet but want one, keep to the step-by-step manual below:

- Be sure the file you’re saving applies in your state (or the state it’s needed in).

- Do it by looking at the form’s description and through clicking on the Preview option (if readily available) to see the form’s information.

- Click Buy Now.

- Find the proper plan for your financial budget.

- Sign up for an account and choose how you want to pay out: by PayPal or by credit card.

- Download the file in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Skilled lawyers work on drawing up our templates to ensure that after downloading, you don't have to worry about modifying content outside of your individual info or your business’s details. Be a part of US Legal Forms and receive your Ohio Durable Limited Power of Attorney example now.

Form popularity

FAQ

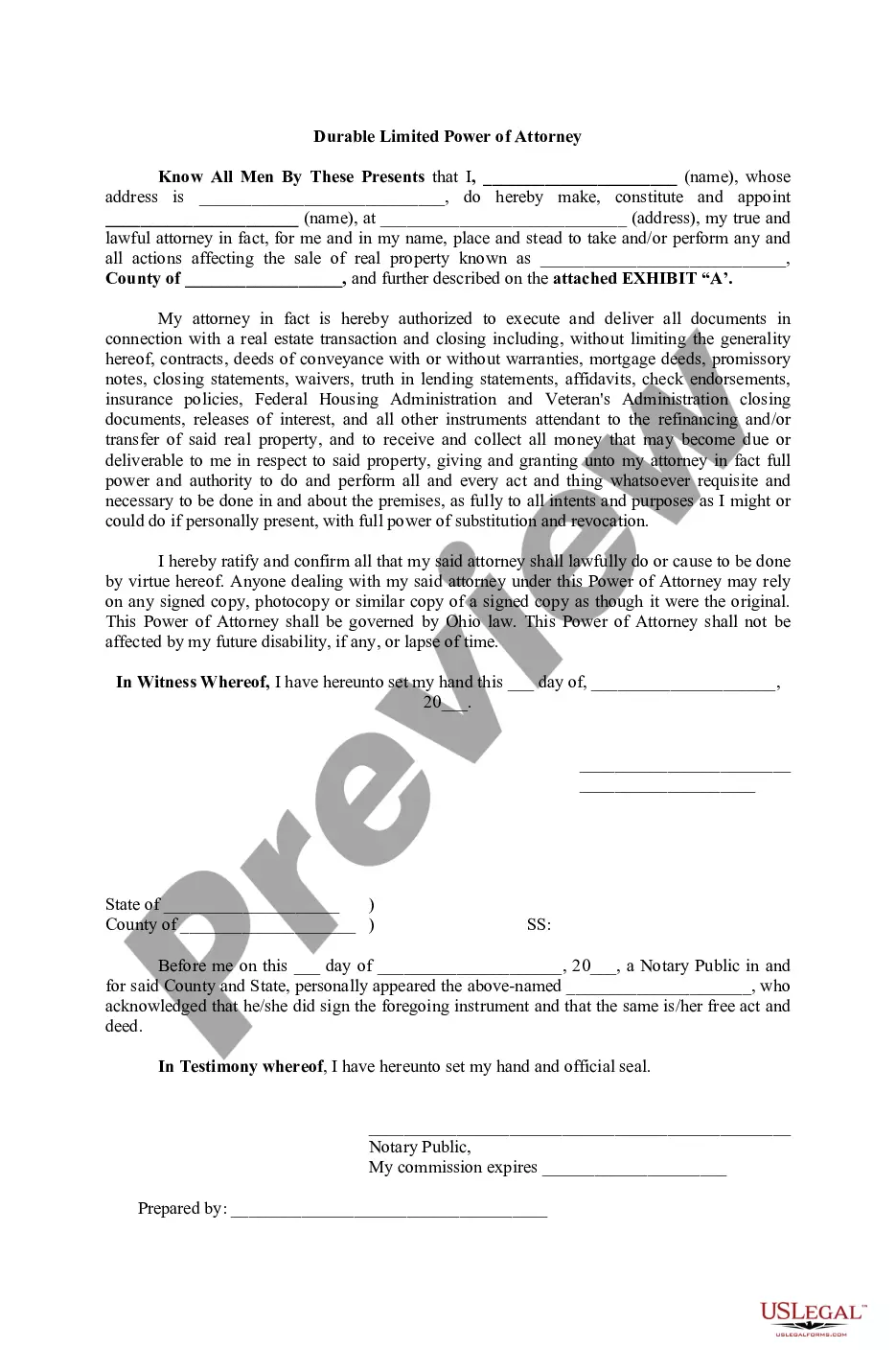

In many states, notarization is required by law to make the durable power of attorney valid. But even where law doesn't require it, custom usually does. A durable power of attorney that isn't notarized may not be accepted by people with whom your attorney-in-fact tries to deal.

Ohio Healthcare Power of Attorney It must be dated, signed by the principal at the end of the document, either signed by two witnesses or notarized, and include a specified statement regarding who can be an attorney in fact.

A power of attorney for the conveyance, mortgage, or lease of an interest in real property must be recorded in the office of the county recorder of the county in which such property is situated, previous to the recording of a deed, mortgage, or lease by virtue of such power of attorney.

An Ohio Power of Attorney is now presumed to be durable meaning it survives the incapacity of the principal.Although this is not required by law, if the document is notarized the principal's signature is presumed to be valid, and if the document is witnessed, it may then be used in a state that requires witnesses.

By signing the durable power of attorney, you are authorizing another person to act for you, the principal. Before you sign this durable power of attorney, you should know these important facts:This durable power of attorney must be dated and must be acknowledged before a notary public or signed by two witnesses.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

A Power of Attorney is a legal document which appoints a person (the Attorney-in-Fact, AIF) to act on your behalf. A durable Power of Attorney authorizes your AIF to act on your behalf even if you become incapacitated and unable to handle matters on your own.

An Ohio durable (statutory) durable power of attorney form enables a person (principal) to appoint another person (agent) whom they trust to handle financial matters on their behalf. The term durable refers to the form remaining legal even if the principal should become mentally handicapped.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.