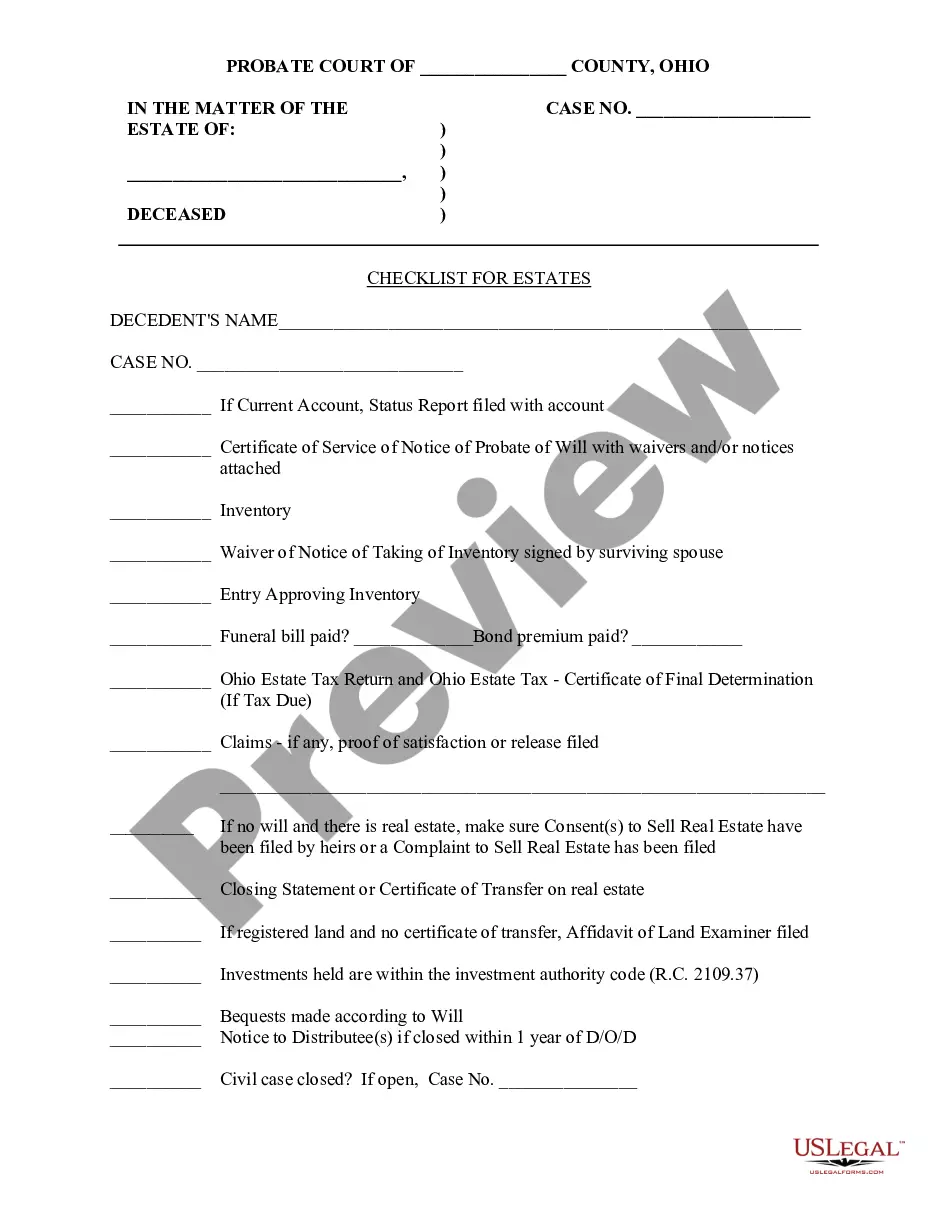

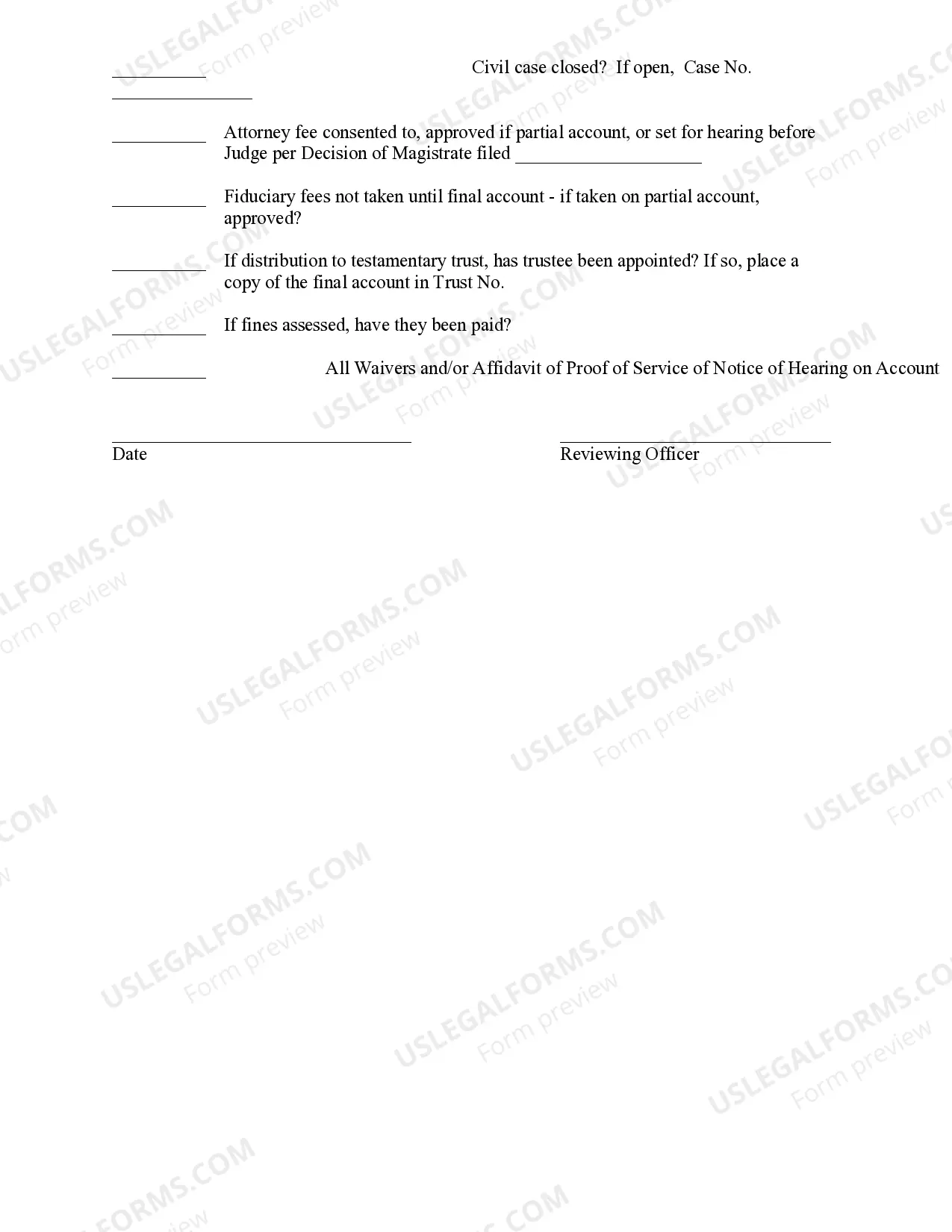

This sample form is a Checklist for Estates document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Ohio Checklist for Estates

Description

How to fill out Ohio Checklist For Estates?

In terms of submitting Ohio Checklist for Estates, you almost certainly imagine an extensive process that involves getting a perfect form among hundreds of similar ones then needing to pay an attorney to fill it out to suit your needs. Generally speaking, that’s a slow and expensive choice. Use US Legal Forms and pick out the state-specific template in a matter of clicks.

If you have a subscription, just log in and click on Download button to find the Ohio Checklist for Estates sample.

In the event you don’t have an account yet but want one, follow the step-by-step guide below:

- Make sure the file you’re saving applies in your state (or the state it’s required in).

- Do it by looking at the form’s description and also by clicking the Preview function (if accessible) to find out the form’s content.

- Simply click Buy Now.

- Choose the suitable plan for your budget.

- Subscribe to an account and choose how you want to pay out: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Find the file on the device or in your My Forms folder.

Skilled attorneys work on drawing up our samples to ensure that after saving, you don't have to bother about editing and enhancing content outside of your personal info or your business’s info. Join US Legal Forms and receive your Ohio Checklist for Estates example now.

Form popularity

FAQ

Appoint a qualified estate planning attorney. Make a list of what you own and owe. Decide if you need a will or a living trust. Make an advance health care directive. Consider a financial power of attorney. Appoint your beneficiaries. Organize your documents and files.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

Gather Important Documents and Contact Information. Execute a Last Will and Testament. Complete a Living Will or Advance Directive. Put in Place a Power of Attorney. Establish a Living Trust. Update Your Beneficiaries. Secure Your Digital Assets. Plan Final Arrangements.

More Than a Last Will. Itemize Your Inventory. Follow with Non-Physical Assets. Assemble a List of Debts. Make a Memberships List. Make Copies of Your Lists. Review Your Retirement Account. Update Your Insurance.

Creating an estate plan is a lot like getting into better shape. Step 1: Sign a will. Step 2: Name beneficiaries. Step 3: Dodge estate taxes. Step 4: Leave a letter. Step 5: Draw up a durable power of attorney. Step 6: Create an advance health care directive.

A Last Will and Testament. When it comes to estate planning, having a last will and testament is likely the first thing that will come to mind. A Document Granting Power of Attorney. An Advance Medical Directive. Revocable Living Trust.

In general, an estate inventory checklist will include financial assets that belonged to the deceased.The financial information must also include the deceased's debts, such as credit card bills, student loans, alimony, child support and medical bills.

Last Will & Testament. The fundamental purpose of a will is to outline who will receive your assets upon your death. Trust. A trust is a legal instrument that provides ongoing management for your assets. Power of Attorney. Healthcare Power of Attorney. Living Will. HIPAA Release. Letter of Intent.