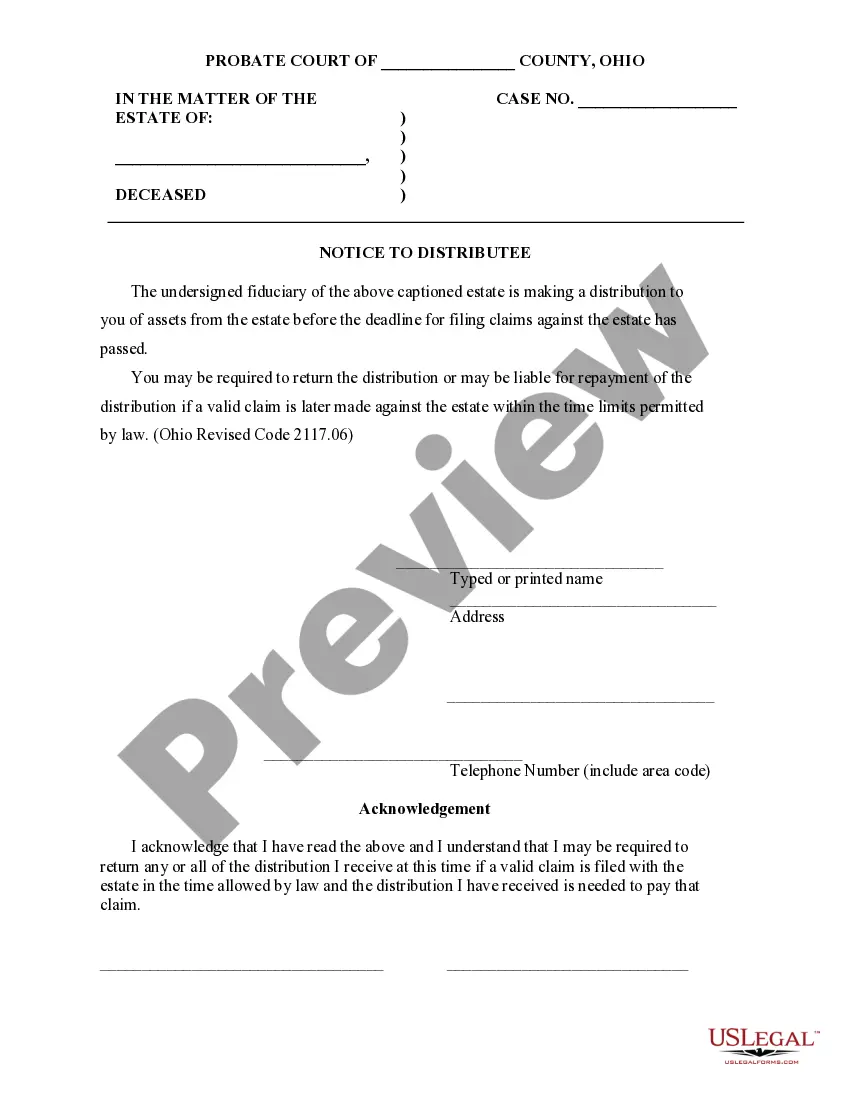

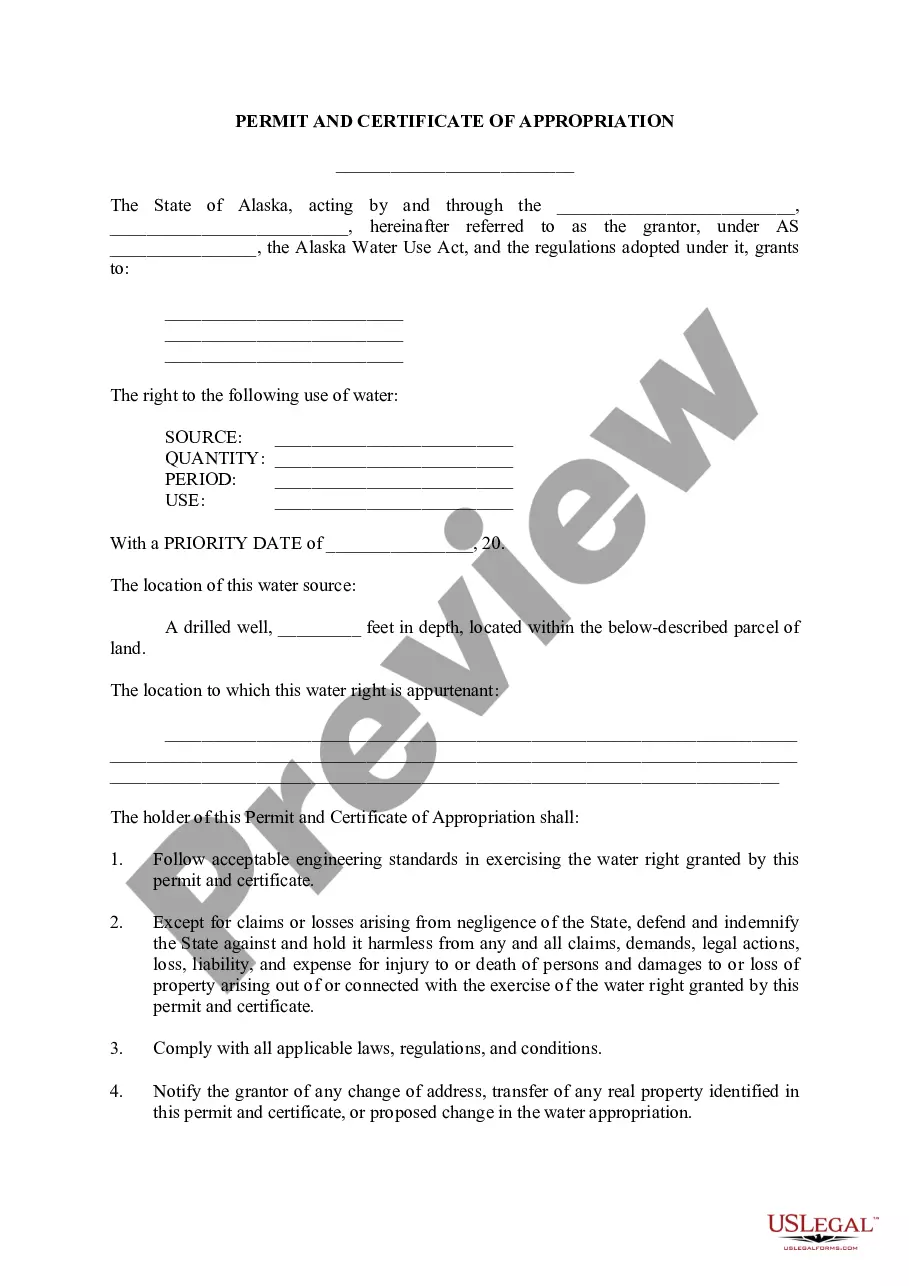

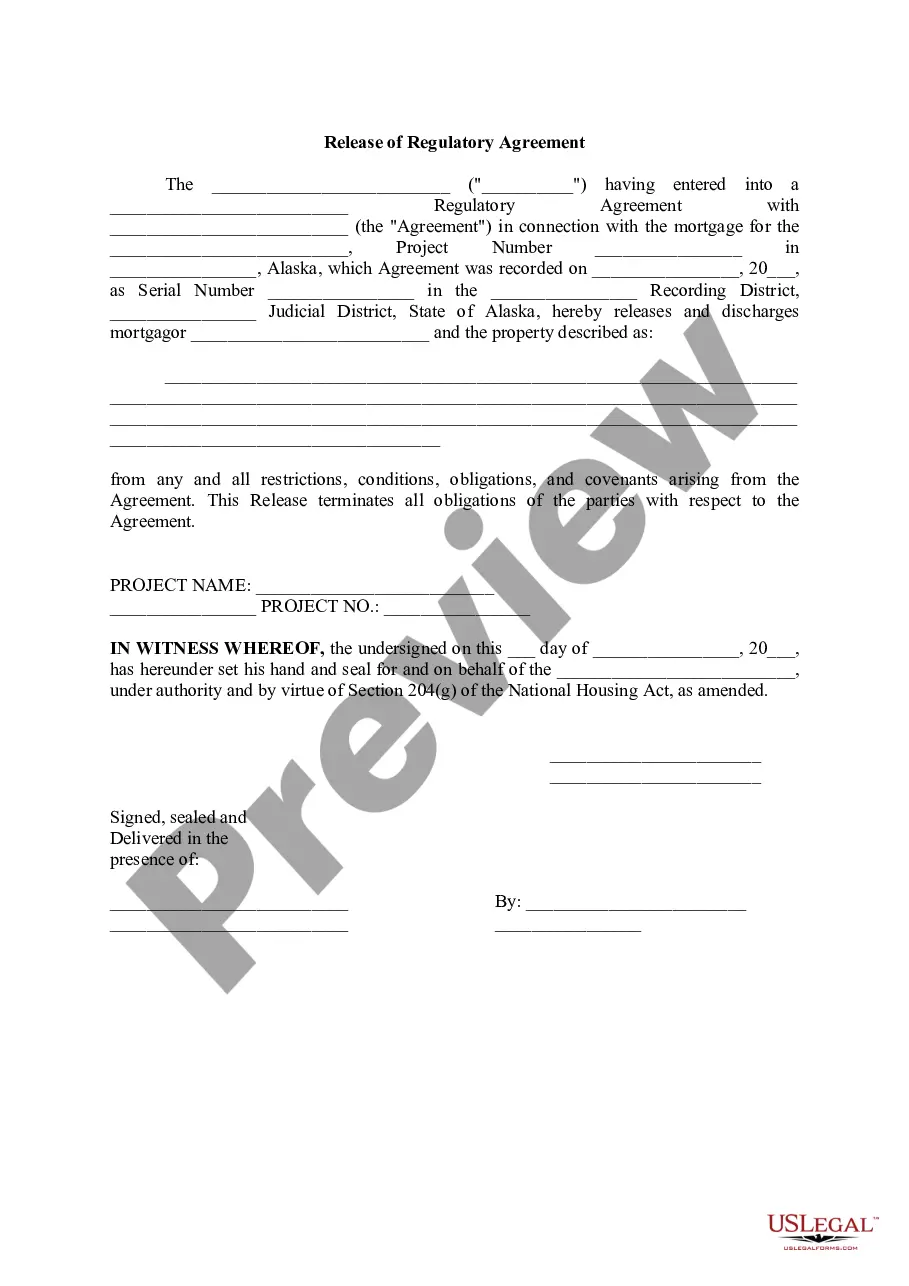

This sample form is a Notice to Distrubutee document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Ohio Notice to Distributee

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Ohio Notice To Distributee?

In terms of filling out Ohio Notice to Distributee, you almost certainly imagine an extensive procedure that requires finding a perfect form among numerous similar ones then needing to pay legal counsel to fill it out to suit your needs. On the whole, that’s a slow and expensive option. Use US Legal Forms and choose the state-specific form in just clicks.

In case you have a subscription, just log in and click on Download button to get the Ohio Notice to Distributee sample.

If you don’t have an account yet but want one, keep to the point-by-point manual below:

- Be sure the document you’re getting applies in your state (or the state it’s needed in).

- Do so by reading the form’s description and also by visiting the Preview option (if accessible) to find out the form’s content.

- Click Buy Now.

- Pick the proper plan for your financial budget.

- Join an account and select how you would like to pay: by PayPal or by credit card.

- Download the file in .pdf or .docx format.

- Get the file on your device or in your My Forms folder.

Professional legal professionals draw up our templates so that after saving, you don't need to worry about editing content outside of your personal details or your business’s details. Sign up for US Legal Forms and receive your Ohio Notice to Distributee document now.

Form popularity

FAQ

Executor Fees: Executors can be compensated for the responsibility taken and the time and effort they put in to complete the estate process. Executor fees in Ohio are set by statute.: 4% of the first $100,000 of probate assets; 3% of the next $300,000; and 2% of the assets above $400,000.

The Ohio small estate affidavit, or the 'Application to Relieve Estate from Administration,' is used to ask the probate court to be relieved of the formal probate process in Ohio. There are certain requirements that must be met before this form of estate administration can be used.

Generally, only assets that the deceased person owned in his or her name alone go through probate. Everything else can probably be transferred to its new owner without probate court approval.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

How Long Does Formal Probate Take? Most straightforward probate cases can be wrapped up within about nine months after the executor or administrator is appointed. Creditors have six months to file a claim, so probate must last at least that long.

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

An Ohio estate qualifies as a small estate if the value of the probate estate is: $35,000 or less; OR. $100,000 or less and the entire estate goes to the decedent's surviving spouse whether under a valid will or under intestacy.

Summary Release from Administration Avoids probate entirely if either: The estate's worth less than $45,000 and the surviving spouse is the sole heir. The estate's worth less than $5,000 and/or the decedent's final expenses total no more than $5,000.