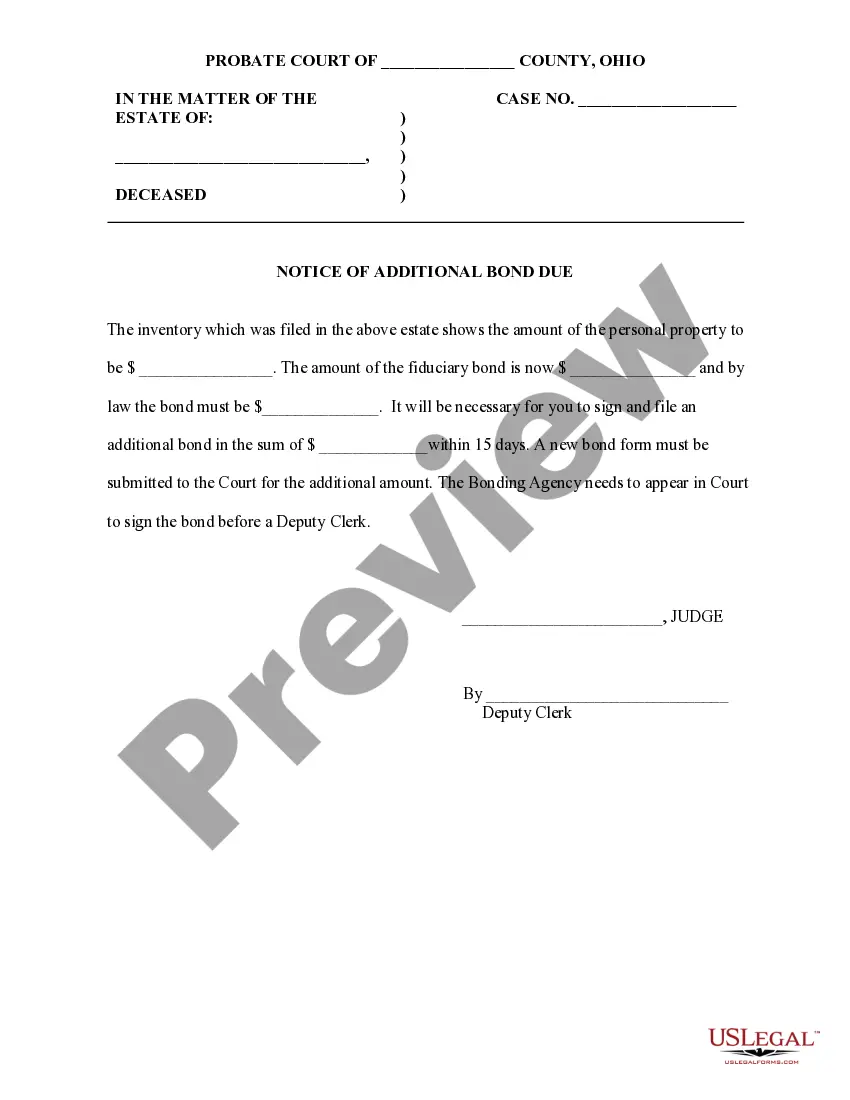

This sample form is a Notice of Additional Bond Due document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Ohio Notice of Additional Bond Due

Description

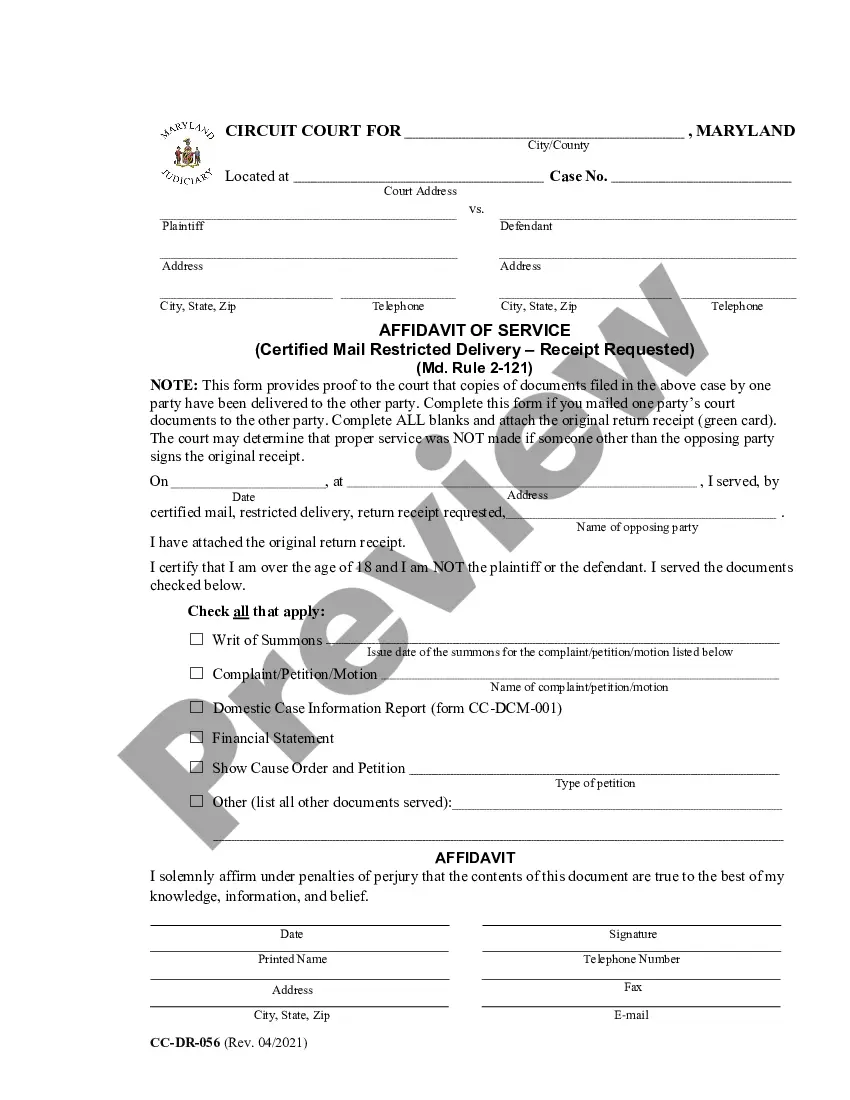

How to fill out Ohio Notice Of Additional Bond Due?

In terms of submitting Ohio Notice of Additional Bond Due, you almost certainly visualize a long process that consists of choosing a perfect sample among a huge selection of similar ones and after that having to pay legal counsel to fill it out for you. In general, that’s a slow-moving and expensive choice. Use US Legal Forms and choose the state-specific document in a matter of clicks.

For those who have a subscription, just log in and click Download to find the Ohio Notice of Additional Bond Due sample.

If you don’t have an account yet but need one, follow the point-by-point guideline listed below:

- Be sure the document you’re getting applies in your state (or the state it’s needed in).

- Do this by looking at the form’s description and by clicking the Preview function (if offered) to see the form’s content.

- Simply click Buy Now.

- Find the proper plan for your financial budget.

- Sign up for an account and choose how you would like to pay: by PayPal or by credit card.

- Save the document in .pdf or .docx file format.

- Find the file on your device or in your My Forms folder.

Skilled legal professionals work on drawing up our templates so that after downloading, you don't have to bother about editing and enhancing content material outside of your personal info or your business’s info. Sign up for US Legal Forms and receive your Ohio Notice of Additional Bond Due document now.

Form popularity

FAQ

Federal government bonds. Treasury bills. Treasury notes. Treasury bonds. Zero-coupon bond. Municipal bonds.

A bond is a debt security, similar to an IOU. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time. When you buy a bond, you are lending to the issuer, which may be a government, municipality, or corporation.

Bond: An Overview.A bond is a debt instrument that allows an investor to lend money to a corporation or government institution in return for an amount of interest earned over the life of the bond. A bond is essentially a loan issued by an entity and invested in by outside investors.

As a revenue bond is not backed by the full faith and credit of the issuing government, it does not require voter approval.

In finance, a bond is an instrument of indebtedness of the bond issuer to the holders. The most common types of bonds include municipal bonds and corporate bonds.Bonds provide the borrower with external funds to finance long-term investments, or, in the case of government bonds, to finance current expenditure.

A revenue bond repays creditors from income generated by the project that the bond itself is funding, such as a toll road or bridge. While a revenue bond is backed by a specific revenue stream, holders of GO bonds are relying on the full faith and credit of the issuing municipality.

A bond, especially a municipal bond, where the coupons and principal are paid with funding from the project the debt seeks to finance. It may be used, for example, to build a hospital or a toll bridge, and bondholders are repaid with the revenue the hospital or toll bridge derives.

The term bond resolution is typically applicable to bonds issued by municipalities. A bond resolution describes how much interest and principal will be paid to bondholders, when and how payments will be made, how bonds may be redeemed, and what happens in the event of default.

A bond is a fixed income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental).Bonds are used by companies, municipalities, states, and sovereign governments to finance projects and operations. Owners of bonds are debtholders, or creditors, of the issuer.