This sample form is an Entry Appointing Fiduciary - Letters of Authority document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Ohio Entry Appointing Fiduciary - Letters of Authority

Description Letters Of Authority

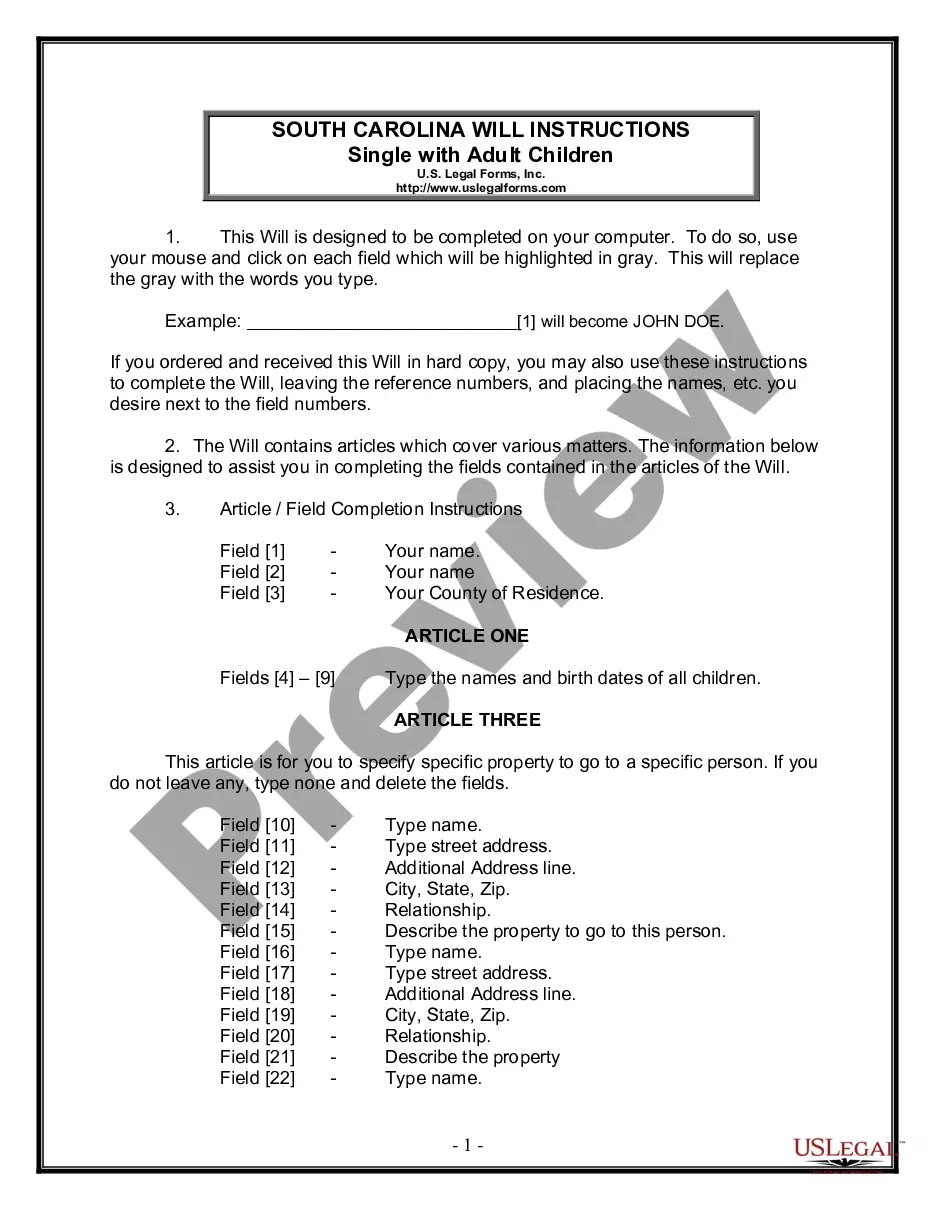

How to fill out Letter Of Authority For Estate?

In terms of submitting Ohio Entry Appointing Fiduciary - Letters of Authority, you probably think about an extensive process that requires getting a perfect form among hundreds of similar ones and then needing to pay an attorney to fill it out to suit your needs. Generally, that’s a sluggish and expensive option. Use US Legal Forms and pick out the state-specific form in a matter of clicks.

For those who have a subscription, just log in and click Download to have the Ohio Entry Appointing Fiduciary - Letters of Authority template.

In the event you don’t have an account yet but want one, follow the step-by-step guideline listed below:

- Be sure the document you’re saving applies in your state (or the state it’s needed in).

- Do it by looking at the form’s description and through visiting the Preview option (if readily available) to view the form’s information.

- Simply click Buy Now.

- Find the suitable plan for your budget.

- Sign up to an account and select how you would like to pay out: by PayPal or by card.

- Download the file in .pdf or .docx file format.

- Find the file on the device or in your My Forms folder.

Professional attorneys draw up our samples to ensure after saving, you don't need to worry about modifying content material outside of your individual info or your business’s information. Join US Legal Forms and receive your Ohio Entry Appointing Fiduciary - Letters of Authority sample now.

What Does Letters Of Authority Allow Me To Do In Ohio Form popularity

Fiduciary Letter Other Form Names

How Long Does It Take To Get A Letter Of Authority FAQ

To acquire a Letter of Executorship and a Letter of Authority, one must report the death of the deceased Master of the High Court within 14 days. The court permits executorship only in the presence of a Death Certificate.

The turnaround time for processing an LOA could take up to 120 calendar days, depending on the accuracy of the information submitted and payment of the applicable fee. 5. An application must be completed and signed by an applicant, or in case of organizations or companies, by an appointed proxy.

Letters of Authority refer to a document issued by the master of the high court regarding the appointment of a competent person to handle certain matters. Trust assets are controlled by trustees who need to take their fiduciary responsibilities seriously in terms of the law.

A person accepts the appointment by signing the trust deed (where a new trust is being formed) and then applying to the master for appointment and the issuing of Letters of Authority. The master may issue Letters of Authority if a person dies and the value of their deceased estate is less than R125 000.

Letters of Authority will be issued by the probate court or register once the Personal Representative qualifies by filing an Acceptance of Appointment and a bond if bond is required.

Letters of Authority are issued by the probate court upon proper filing on an estate by an interested party.

A Letter of Authority (LOA) is a legal document that allows customers to authorise someone to act on their behalf within agreed limits. They are often used to create an agreement between three or more parties.

The Letter of Authority dictates the liquidation and distribution of the properties of the deceased. The report provides a procedure for the collection and distribution of assets as well as disbursing debts. The properties are then distributed to the heirs according to the notations of the provided will.