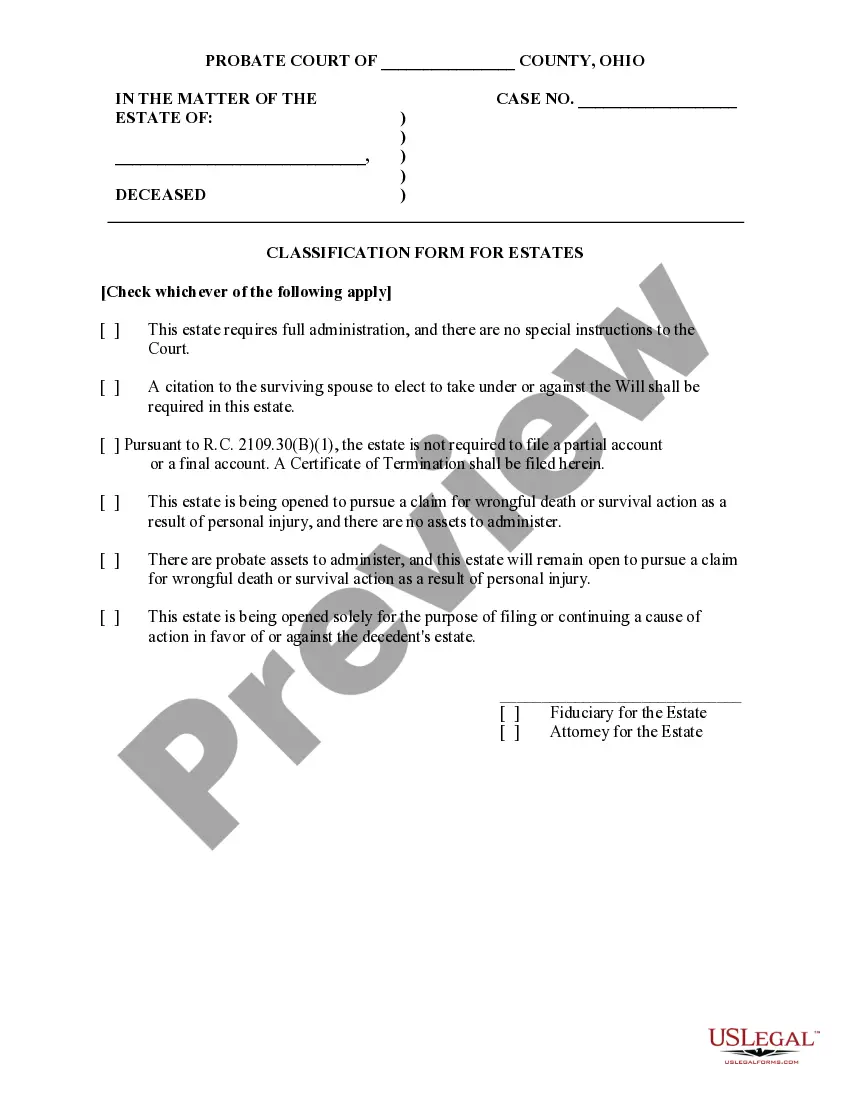

This sample form is a Classification Form for Estates document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Ohio Classification Form for Estates

Description

How to fill out Ohio Classification Form For Estates?

When it comes to completing Ohio Classification Form for Estates, you most likely imagine a long process that requires choosing a appropriate sample among a huge selection of very similar ones and after that being forced to pay an attorney to fill it out to suit your needs. Generally, that’s a sluggish and expensive option. Use US Legal Forms and choose the state-specific form within just clicks.

For those who have a subscription, just log in and click Download to have the Ohio Classification Form for Estates sample.

If you don’t have an account yet but want one, keep to the point-by-point guide listed below:

- Be sure the document you’re downloading applies in your state (or the state it’s required in).

- Do this by looking at the form’s description and also by clicking the Preview option (if accessible) to find out the form’s information.

- Simply click Buy Now.

- Pick the suitable plan for your budget.

- Sign up to an account and select how you want to pay: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Get the file on the device or in your My Forms folder.

Professional attorneys work on creating our samples so that after downloading, you don't have to worry about editing and enhancing content material outside of your personal information or your business’s details. Sign up for US Legal Forms and get your Ohio Classification Form for Estates example now.

Form popularity

FAQ

An inventory and appraisal is a required filing in California probate. The inventory and appraisal is a single document that (1) inventories the property in the decedent's estate and (2) contains an appraisal of the property in the inventory. California Probate Code § 8800(a).

5.7 Information about the estate Assets include the full market value of houses, flats or other property, the value of household goods, jewellery and belongings at the sum for which they could be sold, including assets held jointly with another person.

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

First, the person who makes the will, also known as the testator, can name an individual to be the executor. The testator would stipulate this appointment in the will. Once the testator passes away, the named executor may have to submit a petition to the appropriate probate court to be confirmed as the executor.

Last Will and Testament and Codicil(s): The original will and codicils will be required because if an original cannot be found, then it is presumed the decedent destroyed them, Revocable Living Trust and Amendment(s): Usually a copy of the trust or amendment is all that is required.

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.

The first step in probating an estate is to locate all of the decedent's estate planning documents and other important papers, even before being appointed to serve as the personal representative or executor.