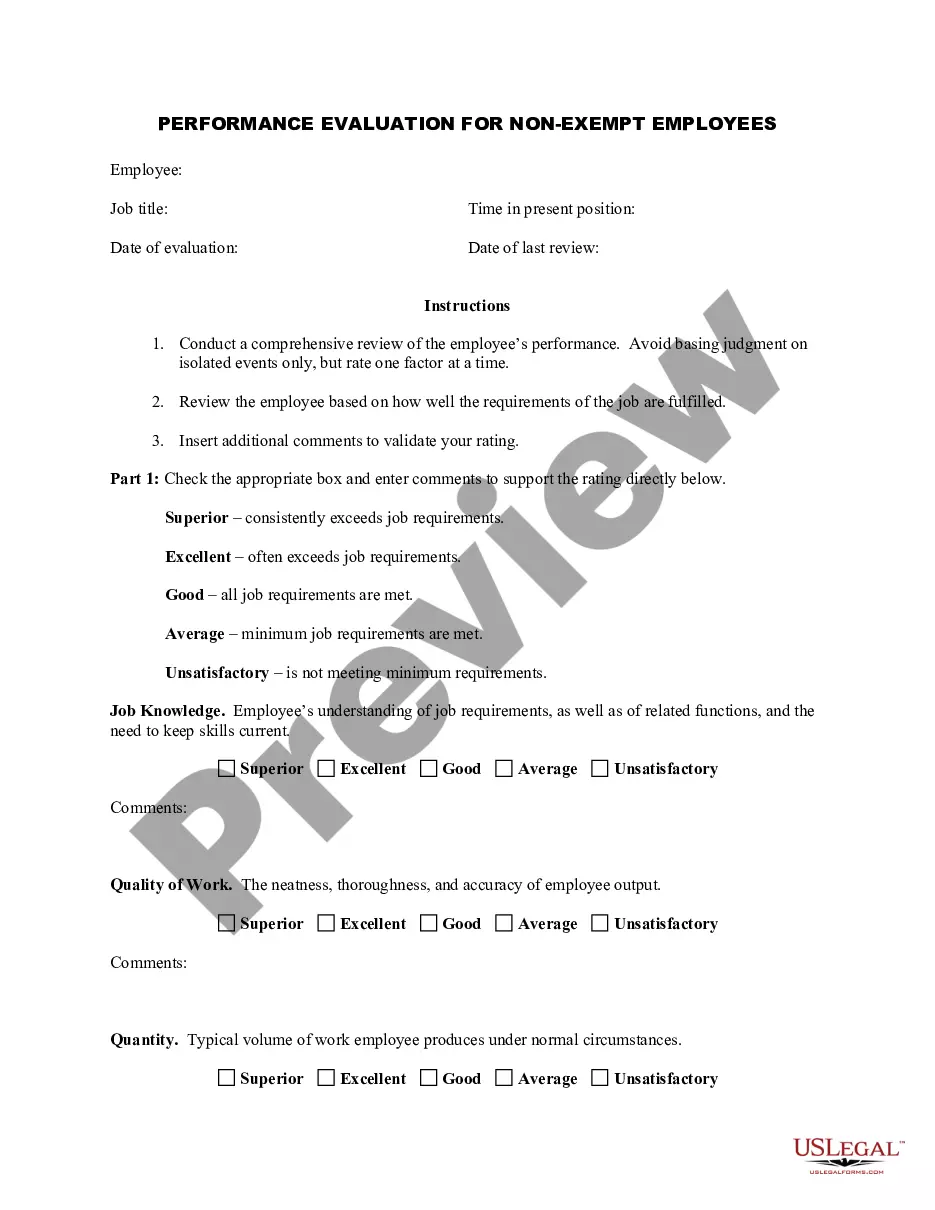

1. Summary of Rights and Obligations under COBRA

2. Termination Letter (General)

3. Checklist for Termination Action

4. Employment Termination Agreement

5. Consent to Release of Employment Information and Release

6. Exit Interview

Ohio Employment or Job Termination Package

Description

How to fill out Ohio Employment Or Job Termination Package?

In terms of completing Ohio Employment or Job Termination Package, you almost certainly visualize an extensive process that involves getting a appropriate sample among numerous very similar ones and then having to pay out legal counsel to fill it out for you. In general, that’s a slow and expensive choice. Use US Legal Forms and choose the state-specific document in just clicks.

For those who have a subscription, just log in and then click Download to find the Ohio Employment or Job Termination Package template.

If you don’t have an account yet but want one, follow the point-by-point guide listed below:

- Be sure the file you’re downloading applies in your state (or the state it’s required in).

- Do it by looking at the form’s description and through clicking on the Preview option (if readily available) to see the form’s information.

- Click Buy Now.

- Find the proper plan for your financial budget.

- Sign up for an account and choose how you would like to pay: by PayPal or by credit card.

- Download the document in .pdf or .docx format.

- Find the file on your device or in your My Forms folder.

Skilled attorneys work on creating our templates so that after downloading, you don't need to worry about editing content material outside of your individual info or your business’s details. Be a part of US Legal Forms and receive your Ohio Employment or Job Termination Package sample now.

Form popularity

FAQ

To apply for PUA, visit pua.unemployment.ohio.gov and click the button that says "Click Here to Apply for Pandemic Unemployment Assistance."

If your employer pays you severance all at once in a lump sum, you may or may not be entitled to unemployment benefits. If the lump sum is just an upfront payment of a number of weeks of your pay, the agency may treat the payment like salary continuation.

Under California law, severance pay is not considered wages for unemployment purposes. Instead, it is considered a payment in recognition of your past service. Even if it is paid out in installments, as yours will be, it doesn't count against your unemployment.

An employee is entitled to separation pay equivalent to one-month pay or at least one-month pay for every year of service, whichever is higher. A fraction of at least six months shall be considered as one whole year. The period of service is deemed to have lasted up to the time of closure of the establishment.

Lump sum amounts are great if they best meet your financial needs after job loss. There are tax breaks galore the more an employer transfers directly into your personal RRSP portfolio. Severance agreements are legal documents. They have been prepared on behalf of the employer.

Workers in Ohio who have been laid off, fired, or forced to leave their jobs might be eligible for unemployment benefits through the Ohio Department of Job and Family Services (ODJFS). Unemployment benefits are available to employees when they are no longer working through no fault of their own.

Collecting Unemployment After Being Fired If, however, you were fired for good cause, you may be disqualified from receiving benefits. For example, if you were fired for failing to perform your job duties or willfully violating company policies of which you were aware, you might not be eligible for benefits.

Under California law, severance pay is not considered wages for unemployment purposes. Instead, it is considered a payment in recognition of your past service. Even if it is paid out in installments, as yours will be, it doesn't count against your unemployment.

If severance pay does extend the employment relationship, however, unemployment benefits may not be available until the severance ends. For example, if you receive a lump sum amount of severance on your last day of work, you may apply for unemployment.