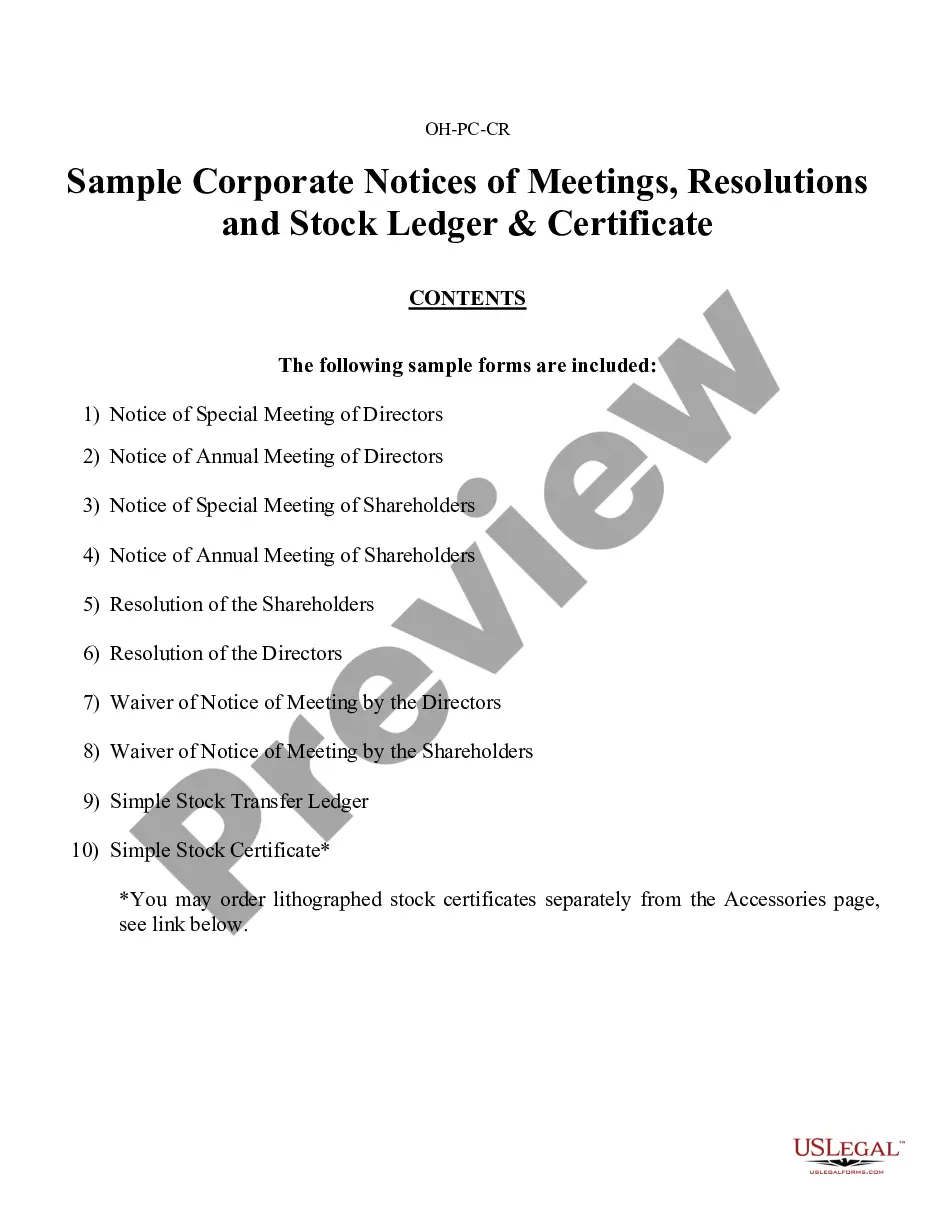

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Sample Corporate Records for an Ohio Professional Corporation aka Professional Association

Description

How to fill out Sample Corporate Records For An Ohio Professional Corporation Aka Professional Association?

When it comes to submitting Sample Corporate Records for an Ohio Professional Corporation aka Professional Association, you most likely visualize an extensive process that involves choosing a perfect form among countless very similar ones and after that having to pay an attorney to fill it out to suit your needs. Generally, that’s a sluggish and expensive choice. Use US Legal Forms and select the state-specific form within clicks.

In case you have a subscription, just log in and then click Download to find the Sample Corporate Records for an Ohio Professional Corporation aka Professional Association form.

In the event you don’t have an account yet but want one, keep to the step-by-step manual listed below:

- Make sure the file you’re getting is valid in your state (or the state it’s required in).

- Do it by reading through the form’s description and through clicking on the Preview option (if readily available) to see the form’s information.

- Simply click Buy Now.

- Pick the appropriate plan for your budget.

- Sign up to an account and choose how you would like to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx format.

- Find the document on the device or in your My Forms folder.

Skilled attorneys work on drawing up our templates to ensure that after downloading, you don't need to worry about modifying content material outside of your individual details or your business’s info. Be a part of US Legal Forms and receive your Sample Corporate Records for an Ohio Professional Corporation aka Professional Association sample now.

Form popularity

FAQ

A professional corporation is one that only performs services in one, single profession. It is a specific type of corporation for professionals like doctors, lawyers, accountants, etc. The professional is able to form a corporation, but the professional remains liable for his or her own actions.

A PA, or professional association, is a business entity that is limited to specific professions. In contrast, an LLC, or limited liability company, is a hybrid between a corporation and a partnership. Each state has specific regulations for each type of business entity.

If you're starting a business that provides a professional service, you could consider both a professional association (PA) or a limited liability company (LLC).

Most professional corporations are classified as "personal service corporations" by the IRS and must file a professional corporation tax return. As of 2018, all professional corporations pay a flat tax rate of 21%.

A professional corporation can be either a regular C corporation that is a separate taxpaying entity that files its own tax returns and pays taxes at corporate tax rates, or it can elect to be taxed as an S corporation in which profits or losses are passed through the corporation to be taxed on the shareholders'

Depending on the individual state, shareholders in this type of corporation must be licensed in law, medicine, architecture, or another professional service.The IRS categorizes professional corporations as C corporations. They are considered taxpayers and must pay income taxes at the corporate rate.

Professional Associations and Professional Corporations Thus, most professional associations are, in-fact, merely professional corporations.