This form is for a holder of a deed of trust or mortgage (see title) to release a portion of the real property described as security. It asserts that the identified and referenced deed of trust or mortgage remains in full force or effect as to the remaining property.

Ohio Partial Release of Property From Mortgage by Individual Holder

Description

Definition and meaning

The Ohio Partial Release of Property From Mortgage by Individual Holder is a legal document that enables a mortgage holder to release a portion of the property from the constraints of a mortgage agreement. This occurs when a borrower has fulfilled part of their mortgage obligations for specific property while still maintaining other obligations for the remaining property covered by the mortgage.

How to complete a form

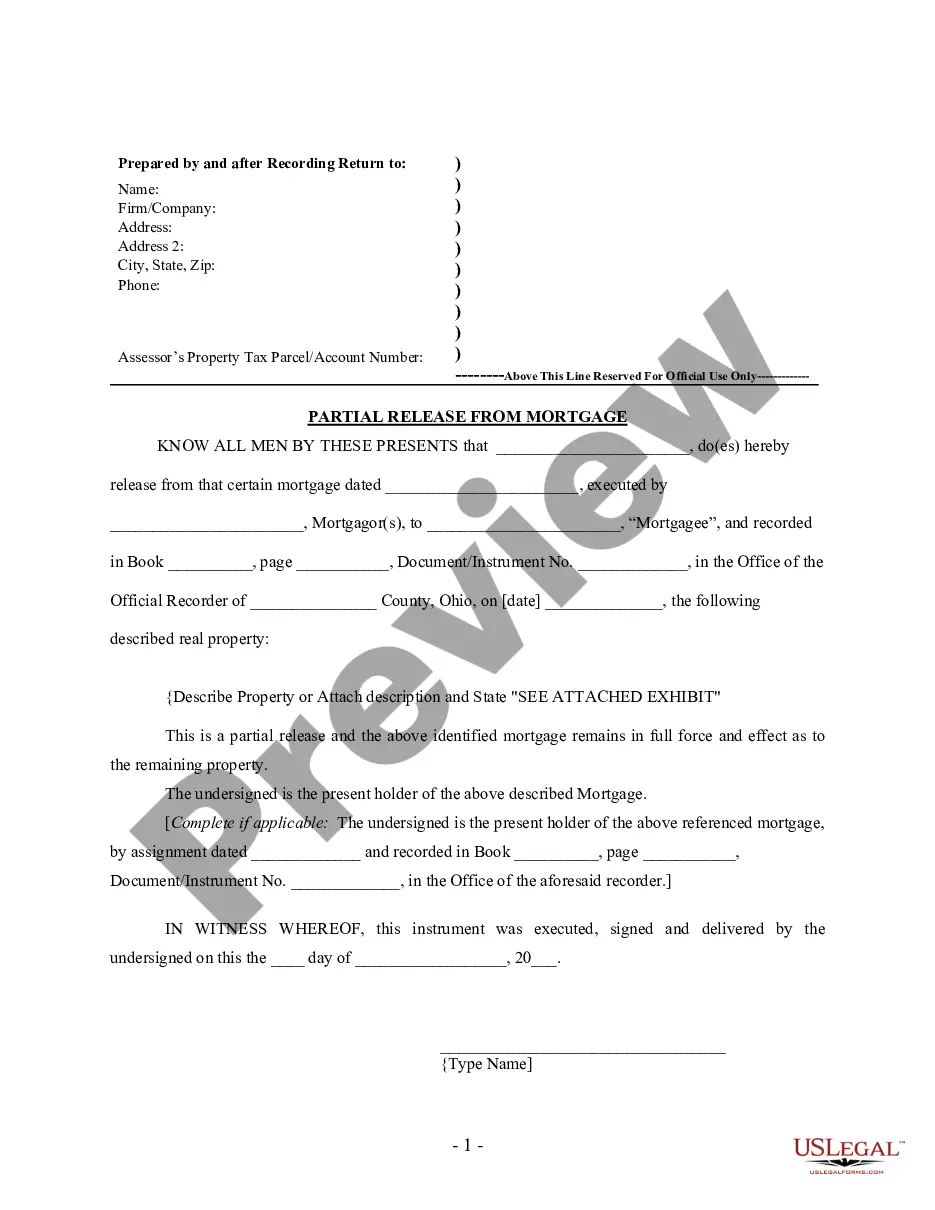

To successfully complete the Ohio Partial Release of Property From Mortgage form, follow these steps:

- Fill out the date the mortgage was executed.

- Input the names of the mortgagor(s) and mortgagee.

- Provide the recording details, including Book number, page number, and document number.

- Describe the real property being released or attach a description.

- Indicate that this is a partial release and affirm that the mortgage remains in effect for the remaining property.

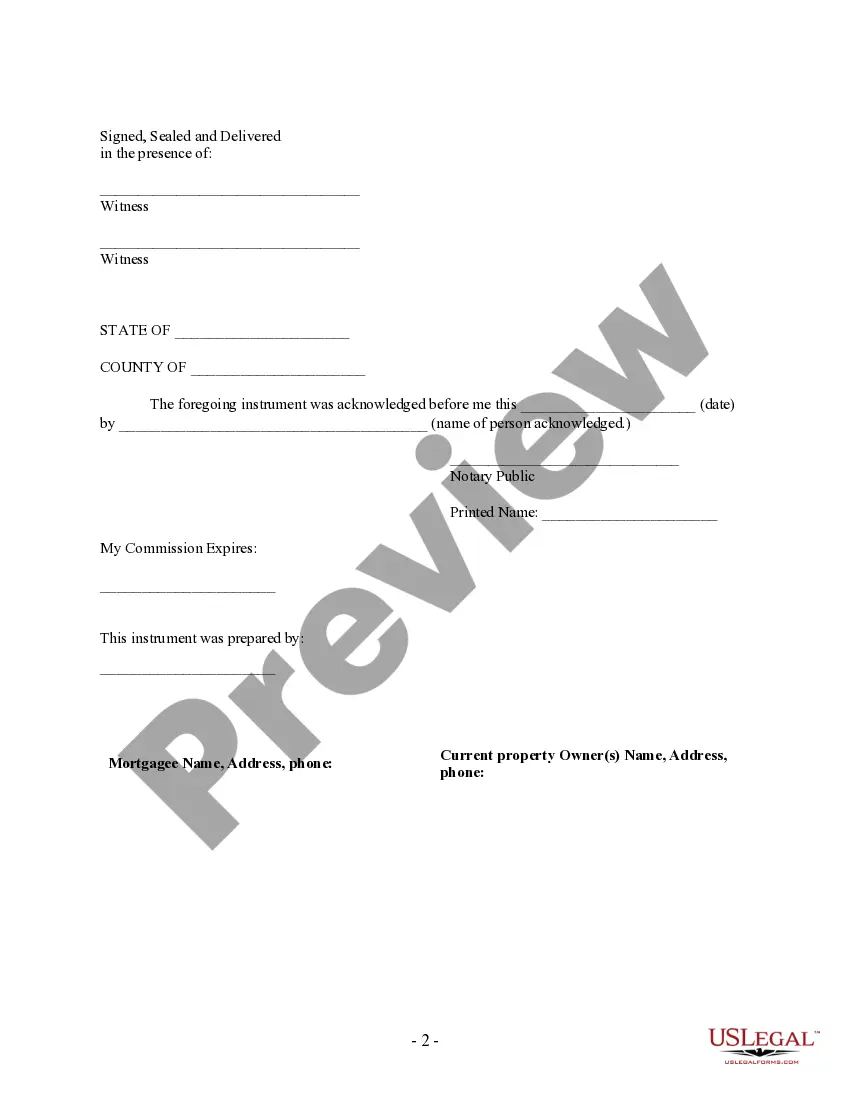

- Sign the document in front of witnesses and a notary public.

Who should use this form

This form is essential for mortgage holders in Ohio who wish to partially release a property secured by a mortgage. It is typically used by:

- Individual property owners looking to sell a portion of their property.

- Borrowers who have paid off part of their mortgage obligations and want to release the corresponding portion of their real estate.

- Mortgage lenders who are responding to a borrower’s request for a partial release of mortgage obligations.

Legal use and context

The Ohio Partial Release of Property From Mortgage by Individual Holder is utilized in the context of real estate transactions. It serves to clearly delineate which parts of the property remain under mortgage and which are unfettered. This document is important for ensuring clarity in property rights, especially in cases of property division, sales, or development. Understanding this form's use is critical for maintaining compliance with Ohio real estate laws.

Common mistakes to avoid when using this form

When completing the Ohio Partial Release of Property From Mortgage, be cautious of the following common mistakes:

- Failing to provide an accurate description of the property being released.

- Not including the complete recording information, which may hinder the enforceability of the release.

- Neglecting to have the document witnessed or notarized, which is crucial for legal validation.

How to fill out Ohio Partial Release Of Property From Mortgage By Individual Holder?

When it comes to submitting Ohio Partial Release of Property From Mortgage by Individual Holder, you most likely visualize a long procedure that requires finding a appropriate form among hundreds of very similar ones and then having to pay an attorney to fill it out for you. In general, that’s a slow-moving and expensive option. Use US Legal Forms and pick out the state-specific document within clicks.

For those who have a subscription, just log in and then click Download to find the Ohio Partial Release of Property From Mortgage by Individual Holder form.

If you don’t have an account yet but need one, keep to the point-by-point guide below:

- Make sure the document you’re saving is valid in your state (or the state it’s needed in).

- Do so by looking at the form’s description and also by visiting the Preview function (if readily available) to see the form’s information.

- Simply click Buy Now.

- Pick the appropriate plan for your budget.

- Subscribe to an account and choose how you would like to pay out: by PayPal or by card.

- Download the file in .pdf or .docx format.

- Find the record on your device or in your My Forms folder.

Professional attorneys draw up our templates to ensure after saving, you don't have to bother about modifying content outside of your personal information or your business’s info. Sign up for US Legal Forms and get your Ohio Partial Release of Property From Mortgage by Individual Holder example now.

Form popularity

FAQ

If the mortgage has been registered, then you should take an NOC from registrar's office to get the lien removed. For this both the parties, borrower and representative of the bank need to be present there. In case, the mortgage is not registered, the bank will simply return your documents.

Take possession of all the papers. Get an NOC. Get your CIBIL report updated. Get the lien withdrawn. Get an encumbrance certificate.

Which situation would require a partial release? A borrower who wishes to sell a property that is part of a blanket mortgage(multiple properties and one mortgage loan) would need the lender to issue a partial release on the property being sold to release the lien and give the property a clean title.

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

A mortgage release usually takes around 90 days to complete, but this could be shorter or longer depending upon your specific situation.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

You can remove a name from your mortgage without refinancing by informing your lender that you are taking over the mortgage, and you want a loan assumption. Under a loan assumption, you take full responsibility for the mortgage and remove the other person from the note.