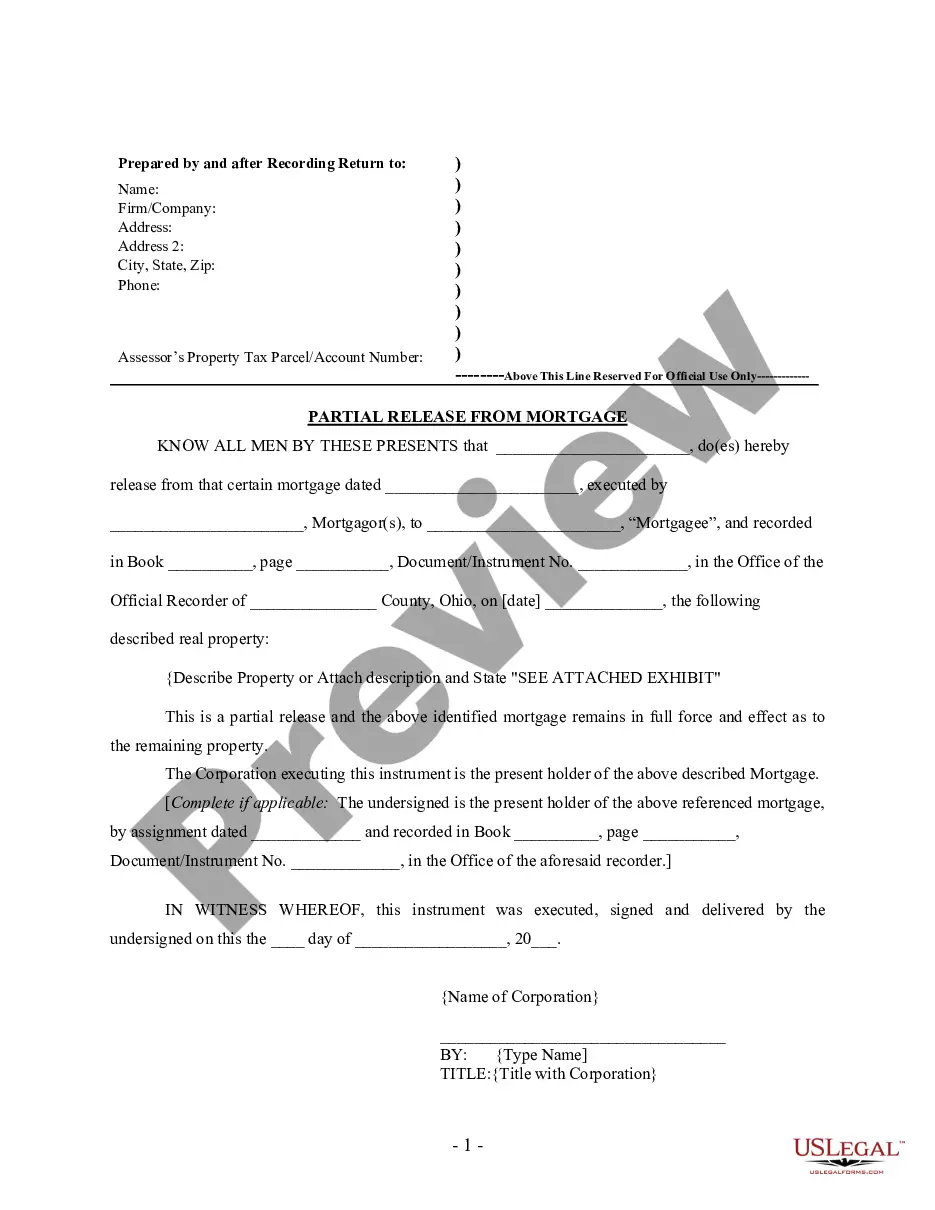

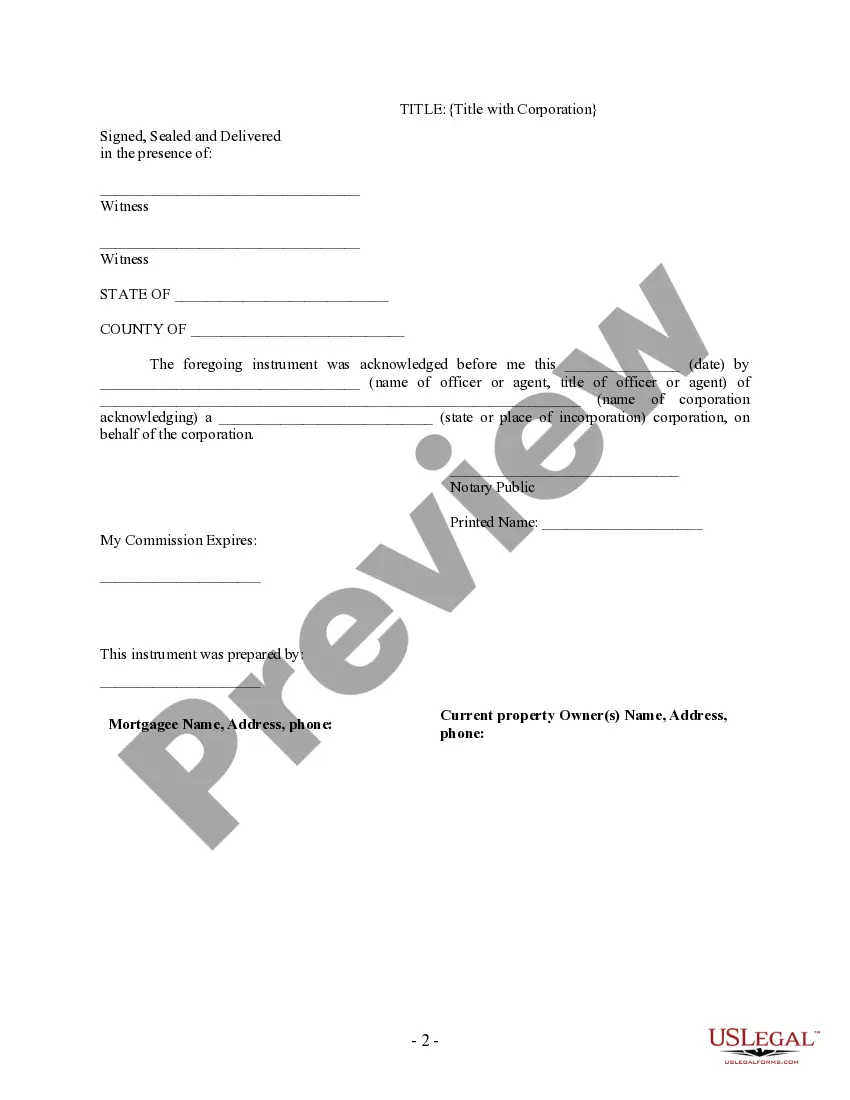

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

- US Legal Forms

-

Ohio Partial Release of Property From Mortgage for Corporation

Partial Release Of Mortgage Form

Description

Related forms

View TF-201 (Anchorage)

View TF-304 (All Other Locations)

View TF-304 (Anchorage)

View Instructions and Request for Records

View TF-311 (Fairbanks)

How to fill out Ohio Partial Release Of Property From Mortgage For Corporation?

When it comes to submitting Ohio Partial Release of Property From Mortgage for Corporation, you almost certainly imagine a long process that involves choosing a perfect sample among a huge selection of similar ones and after that having to pay legal counsel to fill it out to suit your needs. Generally, that’s a slow and expensive option. Use US Legal Forms and pick out the state-specific template within clicks.

In case you have a subscription, just log in and then click Download to find the Ohio Partial Release of Property From Mortgage for Corporation template.

In the event you don’t have an account yet but want one, stick to the step-by-step guideline below:

- Make sure the file you’re getting applies in your state (or the state it’s required in).

- Do so by looking at the form’s description and by clicking the Preview function (if readily available) to see the form’s content.

- Click Buy Now.

- Choose the proper plan for your financial budget.

- Subscribe to an account and choose how you want to pay: by PayPal or by credit card.

- Download the file in .pdf or .docx file format.

- Find the file on your device or in your My Forms folder.

Skilled lawyers draw up our samples to ensure after downloading, you don't have to bother about editing and enhancing content material outside of your individual info or your business’s information. Join US Legal Forms and get your Ohio Partial Release of Property From Mortgage for Corporation sample now.

Form Rating

Form popularity

FAQ

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

A partial reconveyance is to reconvey a portion of the land subject to a deed of trust, not the loan amount.He will have to wait to pay off the full loan before the property is granted back to him.

A mortgage release usually takes around 90 days to complete, but this could be shorter or longer depending upon your specific situation.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

Attorney Involvement An attorney licensed to practice law in Ohio must prepare deeds, powers of attorney, and other instruments that are to be recorded. One exception is that a party to the transaction may prepare an instrument in which they are a party.

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Ohio

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Assignment and Satisfaction of Mortgages

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rule is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Ohio Law

Execution of Assignment or Satisfaction:

An assignment or satisfaction must be signed by the mortgagee or authorized representative.

Assignment:

An assignment must be in writing and recorded. Except in counties in which a separate instrument is required to assign or partially release a mortgage as described in section 5301.32 of the Revised Code, a mortgage may be assigned or partially released by the holder of the mortgage, by writing the assignment or partial release on the original mortgage or upon the margin of the record of the original mortgage and signing it. This is also allowed by separate instrument, see code sections 5301.31 and 5301.32, below.

Demand to Satisfy:

Not required.

Recording Satisfaction:

Except in a county in which the county recorder has elected to require that all satisfactions of mortgages be recorded by separate instrument as allowed under section 5301.28 of the Revised Code, when recording a mortgage, county recorders shall leave space on the margin of the record for the entry of satisfaction, and record therein the satisfaction made on the mortgage.

Marginal Satisfaction:

Marginal satisfaction is allowed, unless the specific county requires it to be recorded by separate instrument.

Penalty:

If satisfaction is not recorded within 90 days following the full satisfaction of the mortgage, then the Mortgagor may recover, in an action at law, the sum of $250, and other recoverable damages.

Acknowledgment:

An assignment or satisfaction must contain a proper Ohio acknowledgment, or other acknowledgment approved by Statute.

Ohio Statutes

§ 5301.28 Release of mortgage; assignment.

When the mortgagee of property within this state, or the party to whom the mortgage has been assigned, either by a separate instrument, or in writing on such mortgage, or on the margin of the record thereof, which assignment, if in writing on such mortgage or on the margin of the record thereof, need not be witnessed or acknowledged, receives payment of any part of the money due the holder of such mortgage, and secured by the mortgage, and enters satisfaction or a receipt therefor, either on the mortgage or its record, such satisfaction or receipt, when entered on such record, or copied thereon from the original mortgage by the county recorder, will release the mortgage to the extent of such receipt. In all cases when a mortgage has been assigned in writing on such mortgage, the recorder must copy the assignment from the original mortgage upon the margin of the record of the mortgage before such satisfaction or receipt is entered upon the record thereof.

In a county in which the county recorder has determined to use the microfilm process as provided by section 9.01 of the Revised Code, the recorder may require that all satisfactions of mortgages be made by separate instrument. The original instrument bearing the proper endorsement may be used as such separate instrument. Such separate instrument shall be recorded in the book provided by section 5301.34 of the Revised Code for the satisfactions of mortgages. The recorder shall charge the fee for such recording as provided by section 317.32 of the Revised Code for recording mortgages.

§ 5301.29 Releases of mortgages made valid.

When any release, cancellation, or satisfaction of a mortgage of real estate has been of record for more than twenty-one years in the office of the county recorder of the county in which such real estate is situated, and the record thereof shows that there is a defect in such release, cancellation, or satisfaction, such release, cancellation, or satisfaction, and the record thereof shall be cured of such defect, if such defect is due to any of the following:

(A) It purports to be signed by an agent or attorney of the mortgagee

or a trustee, and no power of attorney or other evidence of authority so

to release, cancel, or satisfy such mortgage is of record.

(B) It was signed by less than all of two or more executors, administrators,

guardians, assignees in insolvency, or trustees.

(C) The record of such release, cancellation, or satisfaction is

not attested by the recorder.

(D) The release, cancellation, or satisfaction by a corporation

is executed by officers thereof without signing the name of the corporation

thereto.

[§ 5301.29.1] § 5301.291 Mortgage release, cancellation, or satisfaction.

No real estate mortgage release, cancellation, or satisfaction of record in the office of the county recorder of the county within this state in which such real estate is situated shall be deemed defective because:

(A) The executor, administrator, guardian, assignee, or trustee

signed it individually instead of in his representative or official capacity.

(B) The release, cancellation, or satisfaction is by separate instrument,

and the certificate of acknowledgment is not on the same sheet of paper

as the release, cancellation, or satisfaction.

(C) A satisfaction was not recorded within ninety days as required

by division (B) of section 5301.36 of the Revised Code.

§ 5301.31 Recording of assignment or partial release in margin of original record.

Except in counties in which a separate instrument is required to assign or partially release a mortgage as described in section 5301.32 of the Revised Code, a mortgage may be assigned or partially released by the holder of the mortgage, by writing the assignment or partial release on the original mortgage or upon the margin of the record of the original mortgage and signing it. The assignment or partial release need not be acknowledged or witnessed, but, if it is written upon the margin of the record of the original mortgage, the signing shall be attested by the county recorder. The assignment, whether it is upon the original mortgage, upon the margin of the record of the original mortgage, or by separate instrument, shall transfer not only the lien of the mortgage but also all interest in the land described in the mortgage. An assignment of a mortgage shall contain the then current mailing address of the assignee. The signature of a person on the assignment or partial release may be a facsimile of that person's signature. A facsimile of a signature on an assignment or partial release is equivalent to and constitutes the written signature of the person for all requirements regarding mortgage assignments or partial releases. For entering an assignment or partial release of a mortgage upon the margin of the record of the original mortgage or for attesting it, the recorder shall be entitled to the fee provided by section 317.32 of the Revised Code for recording the assignment and satisfaction of mortgages.

§ 5301.32 Assignment or partial release by separate instrument.

A mortgage may be assigned or partially released by a separate instrument of assignment or partial release, acknowledged and witnessed as provided by section 5301.01 of the Revised Code. The separate instrument of assignment or partial release shall be recorded in the book provided by section 5301.34 of the Revised Code for the recording of satisfactions of mortgages, and the county recorder shall be entitled to charge the fee for that recording as provided by section 317.32 of the Revised Code for recording deeds. The signature of a person on the assignment or partial release may be a facsimile of that person's signature. A facsimile of a signature on an assignment or partial release is equivalent to and constitutes the written signature of the person for all requirements regarding mortgage assignments or partial releases.

In a county in which the recorder has determined to use the microfilm process as provided by section 9.01 of the Revised Code, the recorder may require that all assignments and partial releases of mortgages be by separate instruments. The original instrument bearing the proper endorsement may be used as the separate instrument. An assignment of a mortgage shall contain the then current mailing address of the assignee.

§ 5301.34 Release of mortgage on certificate of mortgagee or assignee.

A mortgage must be discharged upon the record thereof by the county recorder when there is presented to him a certificate executed by the mortgagee or his assigns, acknowledged and witnessed as provided in section 5301.01 of the Revised Code, or when there is presented to him a deed of release executed by the governor as provided in section 5301.19 of the Revised Code, certifying that the mortgage has been fully paid and satisfied. In addition to the discharge on the records by the recorder, such certificate shall be recorded in a book kept for that purpose by the recorder. Such recorder is entitled to the fees for such recording as provided by section 317.32 of the Revised Code for recording deeds.

§ 5301.36 Entry of satisfaction.

(A) Except in a county in which the county recorder has elected

to require that all satisfactions of mortgages be recorded by separate

instrument as allowed under section 5301.28 of the Revised Code, when recording

a mortgage, county recorders shall leave space on the margin of the record

for the entry of satisfaction, and record therein the satisfaction made

on the mortgage, or permit the owner of the claim secured by the mortgage

to enter such satisfaction. Such record shall have the same effect as the

record of a release of the mortgage.

(B) Within ninety days from the date of the satisfaction

of a residential mortgage, the mortgagee shall record the fact of the satisfaction

in the appropriate county recorder's office and pay any fees required for

the recording. The mortgagee may, by contract with the mortgagor, recover

the cost of the fees required for the recording of the satisfaction by

the county recorder.

(C) If the mortgagee fails to comply with division (B) of this section,

the mortgagor may recover, in a civil action, damages of two hundred

fifty dollars. This division does not preclude or affect any other legal

remedies that may be available to the mortgagor.

(D) As used in this section, "residential mortgage" means an obligation

to pay a sum of money evidenced by a note and secured by a lien upon real

property located within this state containing two or fewer residential

units or on which two or fewer residential units are to be constructed

and shall include such an obligation on a residential condominium or cooperative

unit.

Assignment and Satisfaction of Mortgages

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rule is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Ohio Law

Execution of Assignment or Satisfaction:

An assignment or satisfaction must be signed by the mortgagee or authorized representative.

Assignment:

An assignment must be in writing and recorded. Except in counties in which a separate instrument is required to assign or partially release a mortgage as described in section 5301.32 of the Revised Code, a mortgage may be assigned or partially released by the holder of the mortgage, by writing the assignment or partial release on the original mortgage or upon the margin of the record of the original mortgage and signing it. This is also allowed by separate instrument, see code sections 5301.31 and 5301.32, below.

Demand to Satisfy:

Not required.

Recording Satisfaction:

Except in a county in which the county recorder has elected to require that all satisfactions of mortgages be recorded by separate instrument as allowed under section 5301.28 of the Revised Code, when recording a mortgage, county recorders shall leave space on the margin of the record for the entry of satisfaction, and record therein the satisfaction made on the mortgage.

Marginal Satisfaction:

Marginal satisfaction is allowed, unless the specific county requires it to be recorded by separate instrument.

Penalty:

If satisfaction is not recorded within 90 days following the full satisfaction of the mortgage, then the Mortgagor may recover, in an action at law, the sum of $250, and other recoverable damages.

Acknowledgment:

An assignment or satisfaction must contain a proper Ohio acknowledgment, or other acknowledgment approved by Statute.

Ohio Statutes

§ 5301.28 Release of mortgage; assignment.

When the mortgagee of property within this state, or the party to whom the mortgage has been assigned, either by a separate instrument, or in writing on such mortgage, or on the margin of the record thereof, which assignment, if in writing on such mortgage or on the margin of the record thereof, need not be witnessed or acknowledged, receives payment of any part of the money due the holder of such mortgage, and secured by the mortgage, and enters satisfaction or a receipt therefor, either on the mortgage or its record, such satisfaction or receipt, when entered on such record, or copied thereon from the original mortgage by the county recorder, will release the mortgage to the extent of such receipt. In all cases when a mortgage has been assigned in writing on such mortgage, the recorder must copy the assignment from the original mortgage upon the margin of the record of the mortgage before such satisfaction or receipt is entered upon the record thereof.

In a county in which the county recorder has determined to use the microfilm process as provided by section 9.01 of the Revised Code, the recorder may require that all satisfactions of mortgages be made by separate instrument. The original instrument bearing the proper endorsement may be used as such separate instrument. Such separate instrument shall be recorded in the book provided by section 5301.34 of the Revised Code for the satisfactions of mortgages. The recorder shall charge the fee for such recording as provided by section 317.32 of the Revised Code for recording mortgages.

§ 5301.29 Releases of mortgages made valid.

When any release, cancellation, or satisfaction of a mortgage of real estate has been of record for more than twenty-one years in the office of the county recorder of the county in which such real estate is situated, and the record thereof shows that there is a defect in such release, cancellation, or satisfaction, such release, cancellation, or satisfaction, and the record thereof shall be cured of such defect, if such defect is due to any of the following:

(A) It purports to be signed by an agent or attorney of the mortgagee

or a trustee, and no power of attorney or other evidence of authority so

to release, cancel, or satisfy such mortgage is of record.

(B) It was signed by less than all of two or more executors, administrators,

guardians, assignees in insolvency, or trustees.

(C) The record of such release, cancellation, or satisfaction is

not attested by the recorder.

(D) The release, cancellation, or satisfaction by a corporation

is executed by officers thereof without signing the name of the corporation

thereto.

[§ 5301.29.1] § 5301.291 Mortgage release, cancellation, or satisfaction.

No real estate mortgage release, cancellation, or satisfaction of record in the office of the county recorder of the county within this state in which such real estate is situated shall be deemed defective because:

(A) The executor, administrator, guardian, assignee, or trustee

signed it individually instead of in his representative or official capacity.

(B) The release, cancellation, or satisfaction is by separate instrument,

and the certificate of acknowledgment is not on the same sheet of paper

as the release, cancellation, or satisfaction.

(C) A satisfaction was not recorded within ninety days as required

by division (B) of section 5301.36 of the Revised Code.

§ 5301.31 Recording of assignment or partial release in margin of original record.

Except in counties in which a separate instrument is required to assign or partially release a mortgage as described in section 5301.32 of the Revised Code, a mortgage may be assigned or partially released by the holder of the mortgage, by writing the assignment or partial release on the original mortgage or upon the margin of the record of the original mortgage and signing it. The assignment or partial release need not be acknowledged or witnessed, but, if it is written upon the margin of the record of the original mortgage, the signing shall be attested by the county recorder. The assignment, whether it is upon the original mortgage, upon the margin of the record of the original mortgage, or by separate instrument, shall transfer not only the lien of the mortgage but also all interest in the land described in the mortgage. An assignment of a mortgage shall contain the then current mailing address of the assignee. The signature of a person on the assignment or partial release may be a facsimile of that person's signature. A facsimile of a signature on an assignment or partial release is equivalent to and constitutes the written signature of the person for all requirements regarding mortgage assignments or partial releases. For entering an assignment or partial release of a mortgage upon the margin of the record of the original mortgage or for attesting it, the recorder shall be entitled to the fee provided by section 317.32 of the Revised Code for recording the assignment and satisfaction of mortgages.

§ 5301.32 Assignment or partial release by separate instrument.

A mortgage may be assigned or partially released by a separate instrument of assignment or partial release, acknowledged and witnessed as provided by section 5301.01 of the Revised Code. The separate instrument of assignment or partial release shall be recorded in the book provided by section 5301.34 of the Revised Code for the recording of satisfactions of mortgages, and the county recorder shall be entitled to charge the fee for that recording as provided by section 317.32 of the Revised Code for recording deeds. The signature of a person on the assignment or partial release may be a facsimile of that person's signature. A facsimile of a signature on an assignment or partial release is equivalent to and constitutes the written signature of the person for all requirements regarding mortgage assignments or partial releases.

In a county in which the recorder has determined to use the microfilm process as provided by section 9.01 of the Revised Code, the recorder may require that all assignments and partial releases of mortgages be by separate instruments. The original instrument bearing the proper endorsement may be used as the separate instrument. An assignment of a mortgage shall contain the then current mailing address of the assignee.

§ 5301.34 Release of mortgage on certificate of mortgagee or assignee.

A mortgage must be discharged upon the record thereof by the county recorder when there is presented to him a certificate executed by the mortgagee or his assigns, acknowledged and witnessed as provided in section 5301.01 of the Revised Code, or when there is presented to him a deed of release executed by the governor as provided in section 5301.19 of the Revised Code, certifying that the mortgage has been fully paid and satisfied. In addition to the discharge on the records by the recorder, such certificate shall be recorded in a book kept for that purpose by the recorder. Such recorder is entitled to the fees for such recording as provided by section 317.32 of the Revised Code for recording deeds.

§ 5301.36 Entry of satisfaction.

(A) Except in a county in which the county recorder has elected

to require that all satisfactions of mortgages be recorded by separate

instrument as allowed under section 5301.28 of the Revised Code, when recording

a mortgage, county recorders shall leave space on the margin of the record

for the entry of satisfaction, and record therein the satisfaction made

on the mortgage, or permit the owner of the claim secured by the mortgage

to enter such satisfaction. Such record shall have the same effect as the

record of a release of the mortgage.

(B) Within ninety days from the date of the satisfaction

of a residential mortgage, the mortgagee shall record the fact of the satisfaction

in the appropriate county recorder's office and pay any fees required for

the recording. The mortgagee may, by contract with the mortgagor, recover

the cost of the fees required for the recording of the satisfaction by

the county recorder.

(C) If the mortgagee fails to comply with division (B) of this section,

the mortgagor may recover, in a civil action, damages of two hundred

fifty dollars. This division does not preclude or affect any other legal

remedies that may be available to the mortgagor.

(D) As used in this section, "residential mortgage" means an obligation

to pay a sum of money evidenced by a note and secured by a lien upon real

property located within this state containing two or fewer residential

units or on which two or fewer residential units are to be constructed

and shall include such an obligation on a residential condominium or cooperative

unit.