Ohio General Warranty Deed for Corporation to Corporation

Description Ohio Deed Sample

How to fill out General Deed?

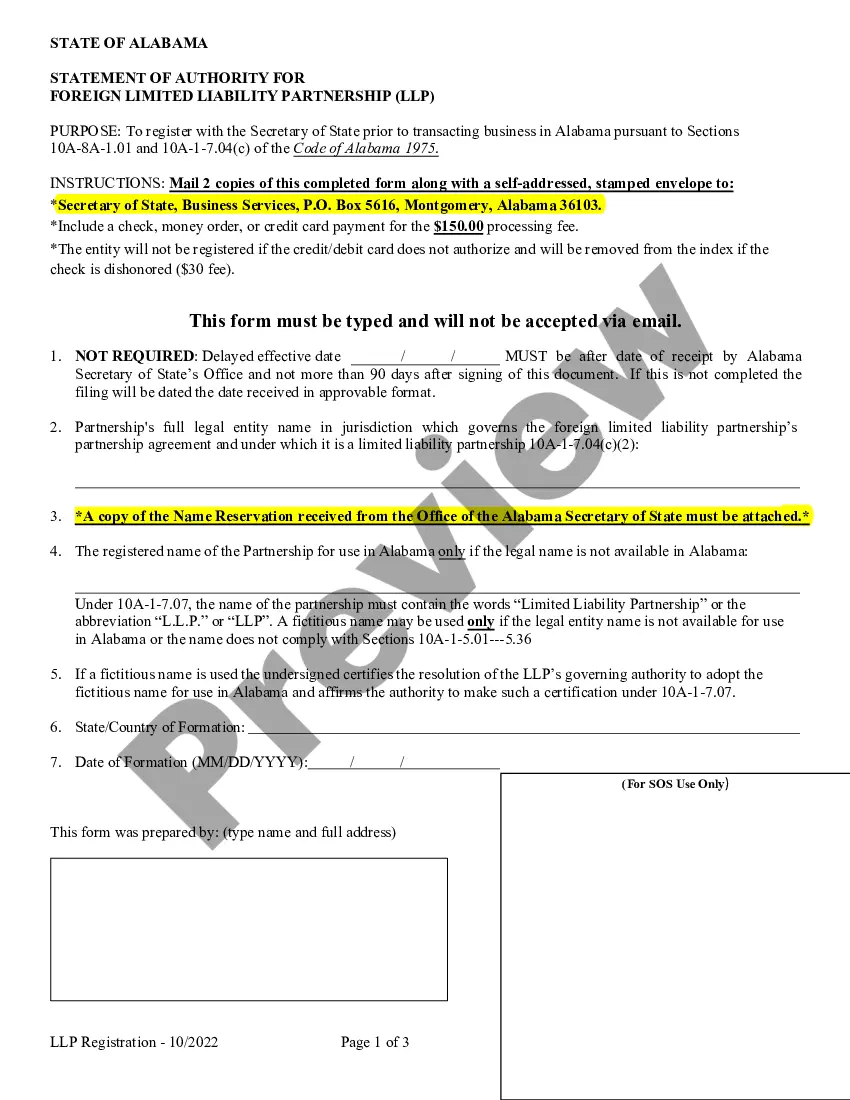

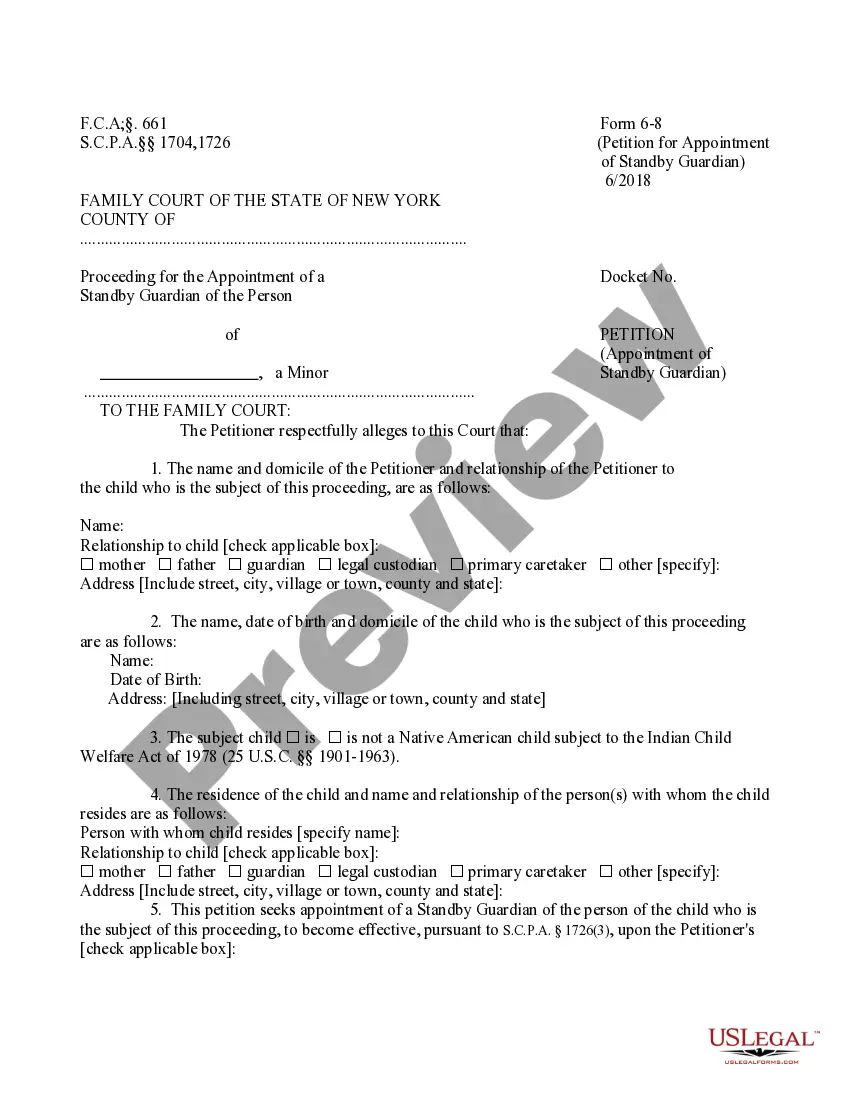

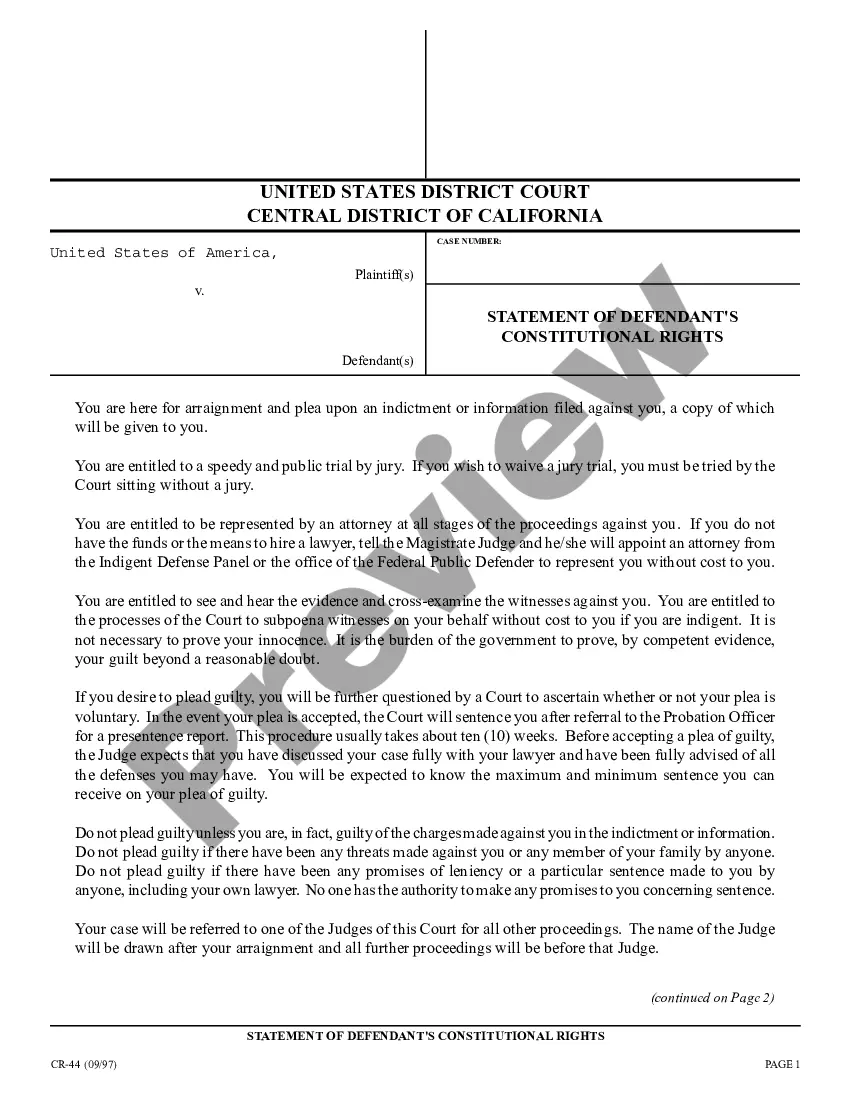

Among lots of paid and free examples that you find on the internet, you can't be certain about their accuracy and reliability. For example, who created them or if they are qualified enough to deal with what you require them to. Keep calm and use US Legal Forms! Get Ohio General Warranty Deed for Corporation to Corporation samples developed by skilled lawyers and prevent the costly and time-consuming procedure of looking for an attorney and after that having to pay them to draft a document for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button next to the form you’re trying to find. You'll also be able to access your earlier saved files in the My Forms menu.

If you’re using our service the very first time, follow the tips below to get your Ohio General Warranty Deed for Corporation to Corporation with ease:

- Ensure that the document you discover applies in the state where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or look for another sample utilizing the Search field located in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

Once you’ve signed up and bought your subscription, you can use your Ohio General Warranty Deed for Corporation to Corporation as many times as you need or for as long as it continues to be valid in your state. Edit it in your preferred offline or online editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Deed Real Estate Form popularity

Ohio Deed Contract Other Form Names

Deed Estate Form FAQ

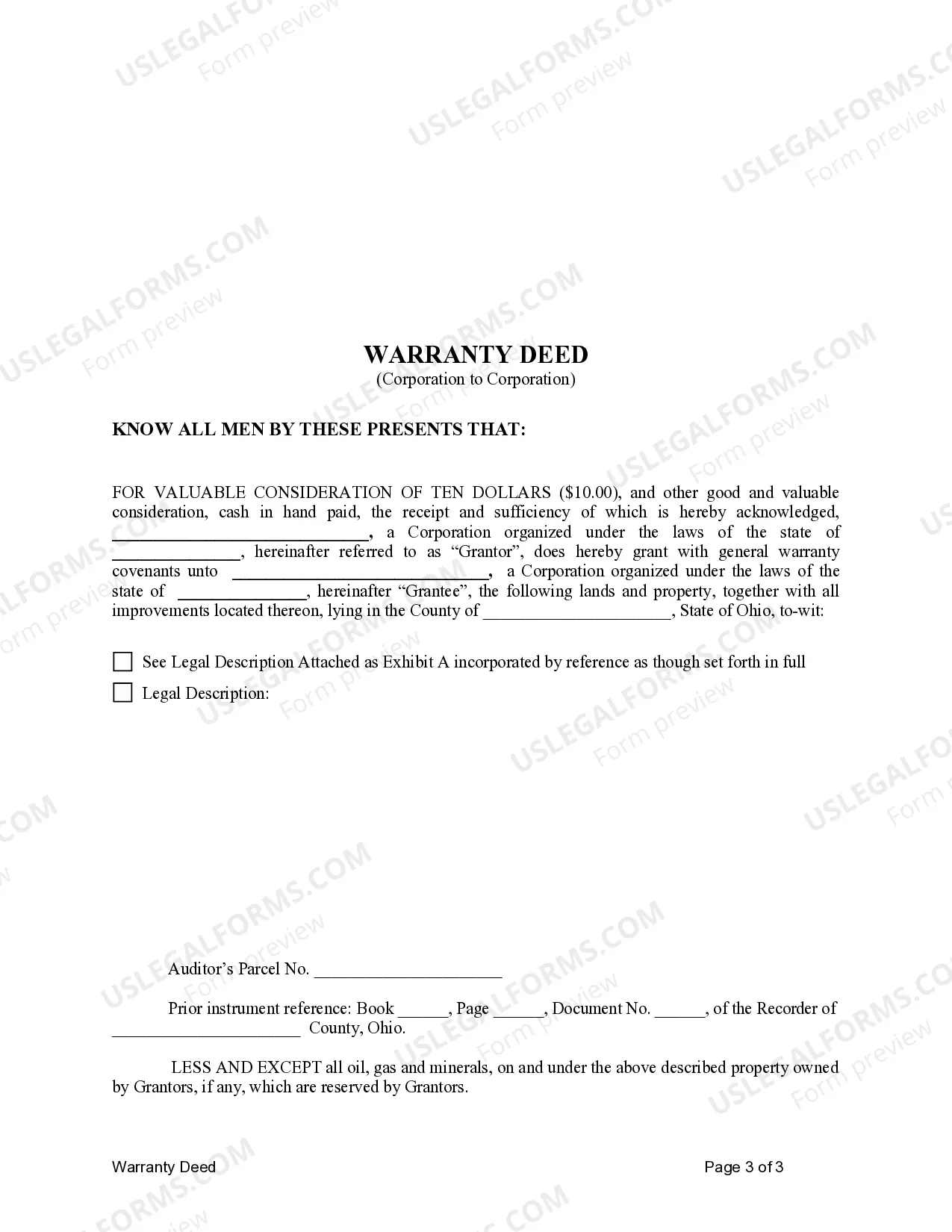

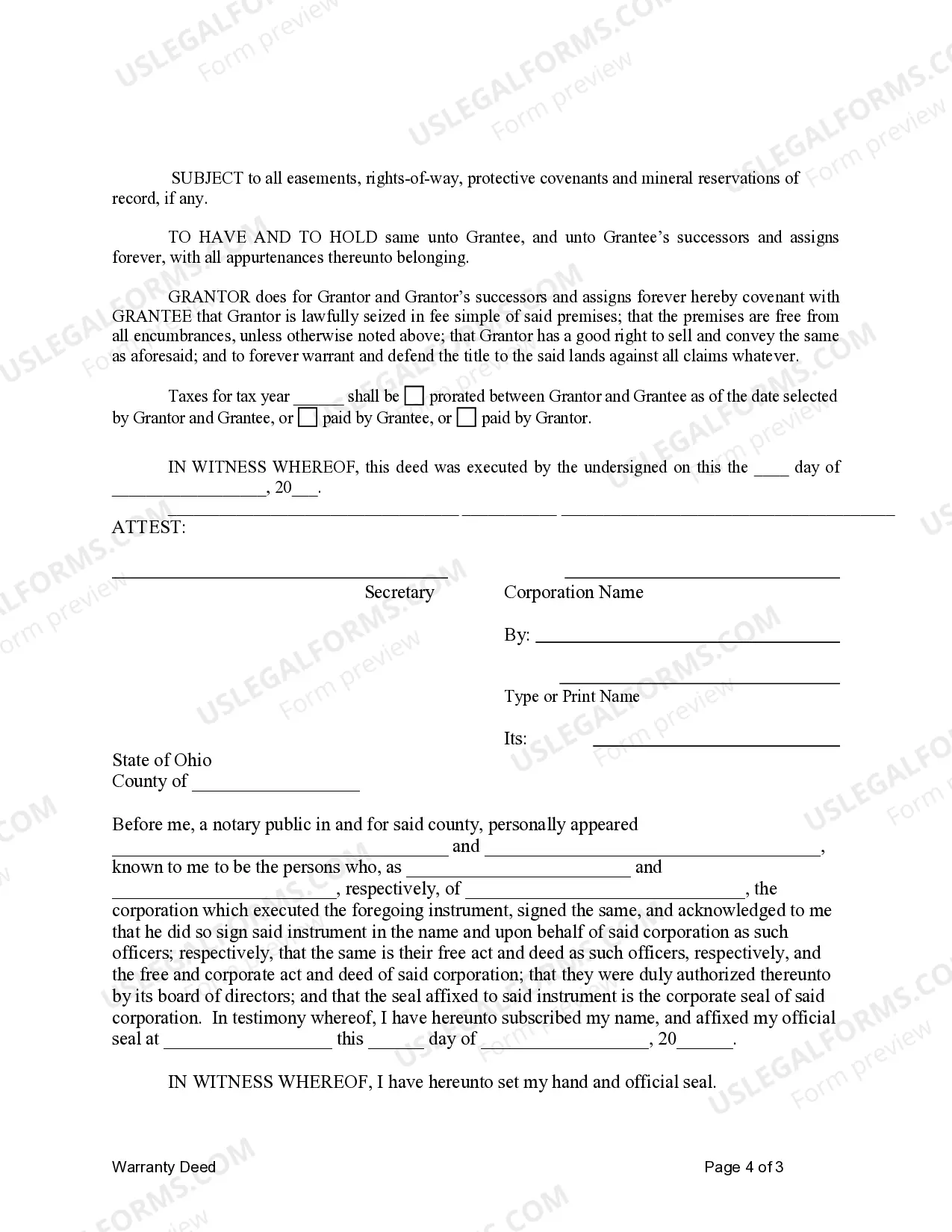

A general warranty deed is the most common type of deed used for transferring real estate. It basically promises that: not only does the seller have good and proper title to sell the property, but all the prior owners also had good title, thus making a complete chain of ownership; and.

A general warranty deed covers the property's entire history. It guarantees the property is free-and-clear from defects or encumbrances, no matter when they happened or under whose ownership.With a special warranty deed, the guarantee covers only the period when the seller held title to the property.

A warranty deed is a type of deed where the grantor (seller) guarantees that he or she holds clear title to a piece of real estate and has a right to sell it to the grantee (buyer).A general warranty deed protects the grantee against title defects arising at any point in time, extending back to the property's origins.

Quitclaim Deed. Deed of Trust. Warranty Deed. Grant Deed. Bargain and Sale Deed. Mortgage Deed.

Limited Warranty Deeds In a Limited Warranty Deed, the seller usually gives two warranties. The seller only warrants to the buyer that: The seller personally has not done anything to the title that the seller received.

Corporate warranty deeds offer the seller's guarantee to the buyer in regards to the validity of the chain of title. Generally, special warranty deeds only protect against problems occurring since the seller purchased the property.

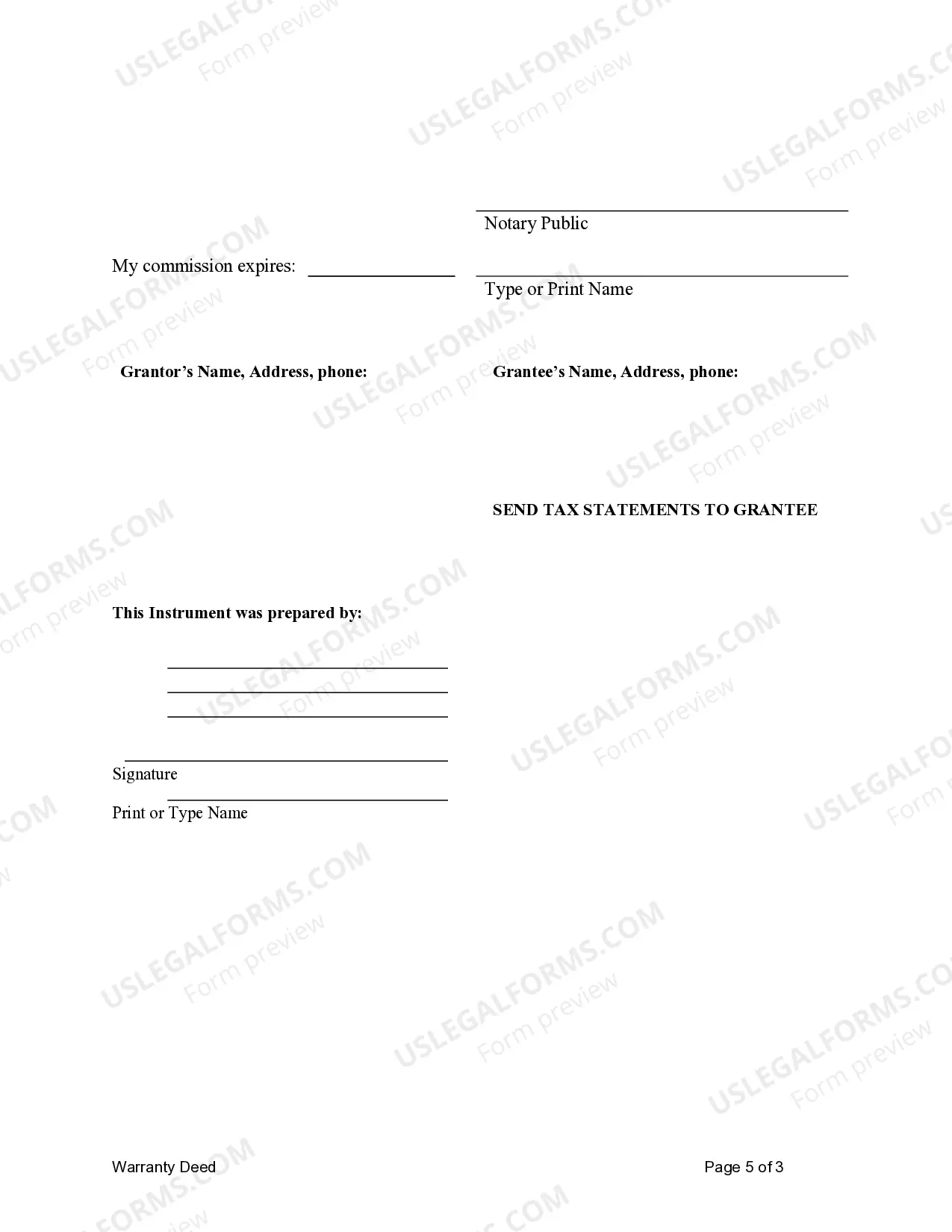

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

A warranty deed is a document often used in real estate that provides the greatest amount of protection to the purchaser of a property. It pledges or warrants that the owner owns the property free and clear of any outstanding liens, mortgages, or other encumbrances against it.

While a general warranty deed guarantees against all encumbrances and claims to title, a limited warranty deed protects only against claims made after the seller obtained title to the property. A limited warranty deed therefore makes no guarantees about anything that occurred before the seller owned the property.