Ohio Warranty Deed for Husband and Wife to Three Individuals as Joint Tenants

Description

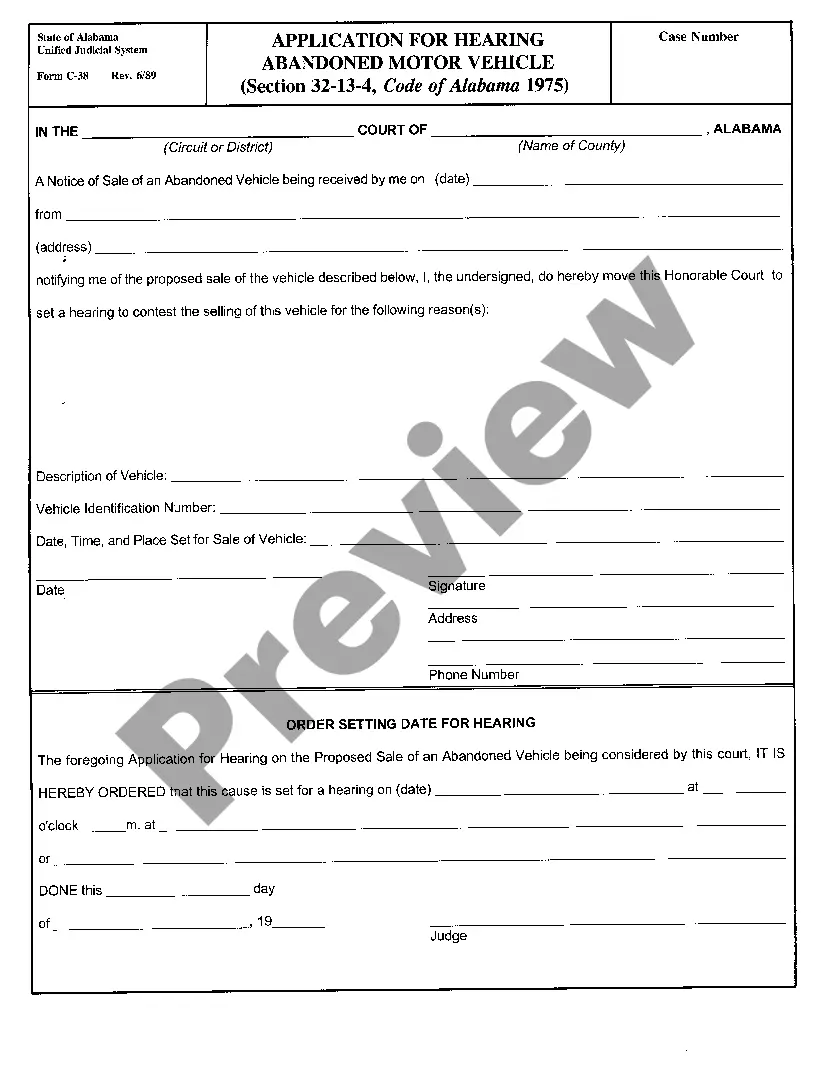

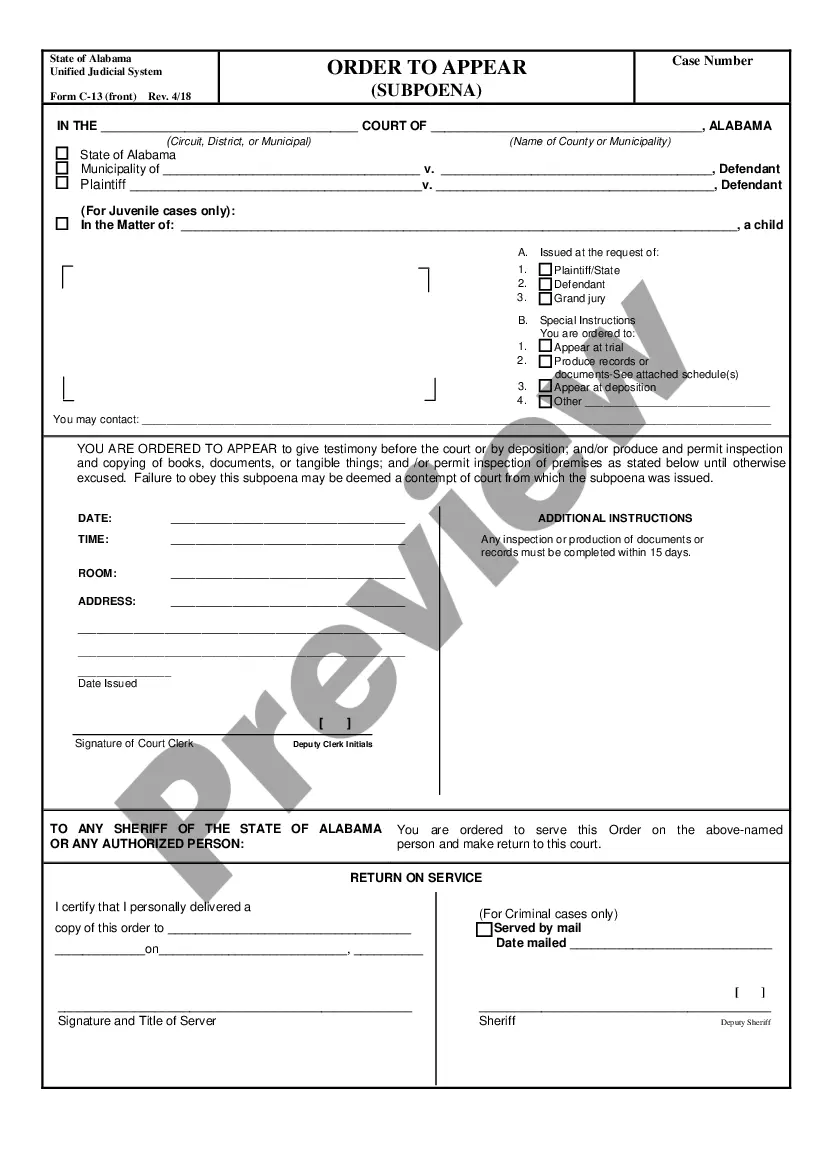

How to fill out Ohio Warranty Deed For Husband And Wife To Three Individuals As Joint Tenants?

Among numerous paid and free examples that you can find on the web, you can't be sure about their accuracy. For example, who created them or if they’re qualified enough to take care of the thing you need these people to. Keep relaxed and make use of US Legal Forms! Locate Ohio Warranty Deed for Husband and Wife to Three Individuals as Joint Tenants samples made by skilled lawyers and prevent the expensive and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to write a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you’re trying to find. You'll also be able to access all your earlier acquired files in the My Forms menu.

If you are using our website the very first time, follow the tips below to get your Ohio Warranty Deed for Husband and Wife to Three Individuals as Joint Tenants fast:

- Make certain that the document you find applies where you live.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another example using the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

When you have signed up and paid for your subscription, you can utilize your Ohio Warranty Deed for Husband and Wife to Three Individuals as Joint Tenants as many times as you need or for as long as it stays active in your state. Edit it in your favorite online or offline editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

It's perfectly legal to have a sole proprietorship with a spouse employee. If you and your spouse co-own the business but don't incorporate or create an LLC, your business will usually be a general partnership.

A business jointly owned and operated by a married couple is a partnership (and should file Form 1065, U.S. Return of Partnership Income) unless the spouses qualify and elect to have the business be treated as a qualified joint venture, or they operate their business in one of the nine community property states.

To make the election, income, deductions, asset gain or loss must be divided between each spouse based on the percentage of their ownership in the LLC. Then each spouse must file a separate Schedule C or C-EZ and will also file a Schedule SE to pay any self-employment tax.

Spouses electing qualified joint venture status are treated as sole proprietors for Federal tax purposes.Each spouse must file a separate Schedule C (or Schedule F) to report profits and losses and, if otherwise required, a separate Schedule SE to report self-employment tax for each spouse.

Married couples have the option to file jointly or separately on their federal income tax returns.In the vast majority of cases, it's best for married couples to file jointly, but there may be a few instances when it's better to submit separate returns.

You do not need to name a spouse as a member of an LLC. While there are some beneficial reasons for naming your spouse, there is no law or regulation that states you must. An LLC is a limited liability company recognized by the IRS. It's nothing more than a partnership that has preferential liability protection.

You do not need to name a spouse as a member of an LLC. While there are some beneficial reasons for naming your spouse, there is no law or regulation that states you must. An LLC is a limited liability company recognized by the IRS. It's nothing more than a partnership that has preferential liability protection.

Note: If an LLC is owned by husband and wife in a non-community property state, the LLC should file as a partnership. LLCs owned by a husband and wife are not eligible to be "qualified joint ventures" (which can elect not be treated as partnerships) because they are state law entities.

Generally, a spouse can actually work for a limited liability company (LLC) without receiving pay. While federal and state wage and hour laws usually require that anyone who works for a private company such as an LLC must receive payment for their work, spouses are often exempt from these requirements.

As a sole proprietor, you can hire your spouse to be an employee. But, your spouse must be a legitimate employee.If your spouse is your employee, their wages are not subject to federal unemployment tax (FUTA tax). However, their wages are still subject to federal income and FICA taxes.