Ohio Appointment Of Testamentary Trustee is a legal document that is used to appoint a person to act as the Trustee of a deceased individual's estate. The document must be filed with the probate court in the county where the deceased individual resided at the time of death. The appointed Trustee will be responsible for administering the estate according to the terms of the Trust Agreement. The Trust Agreement, which is usually included in the will of the deceased, will outline the duties and responsibilities of the Trustee. The appointment of a Trustee can be made either by the deceased in their will or by the court if the deceased did not make such an appointment. In both cases, the appointed Trustee must meet certain criteria, such as being of sound mind and having the capacity to act in a fiduciary capacity. There are three types of Ohio Appointment Of Testamentary Trustee: 1. Direct Appointment of a Trustee — This type of appointment is made by the deceased in their will. 2. Appointment of a Trustee by the Court — This type of appointment is made by the court if the deceased did not make an appointment. 3. Appointment of a Successor Trustee — This type of appointment is made when the original appointed Trustee is unable or unwilling to serve.

Ohio Appointment Of Testamentary Trustee

Description

How to fill out Ohio Appointment Of Testamentary Trustee?

If you’re searching for a way to properly prepare the Ohio Appointment Of Testamentary Trustee without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every individual and business situation. Every piece of documentation you find on our online service is designed in accordance with federal and state regulations, so you can be sure that your documents are in order.

Follow these straightforward instructions on how to obtain the ready-to-use Ohio Appointment Of Testamentary Trustee:

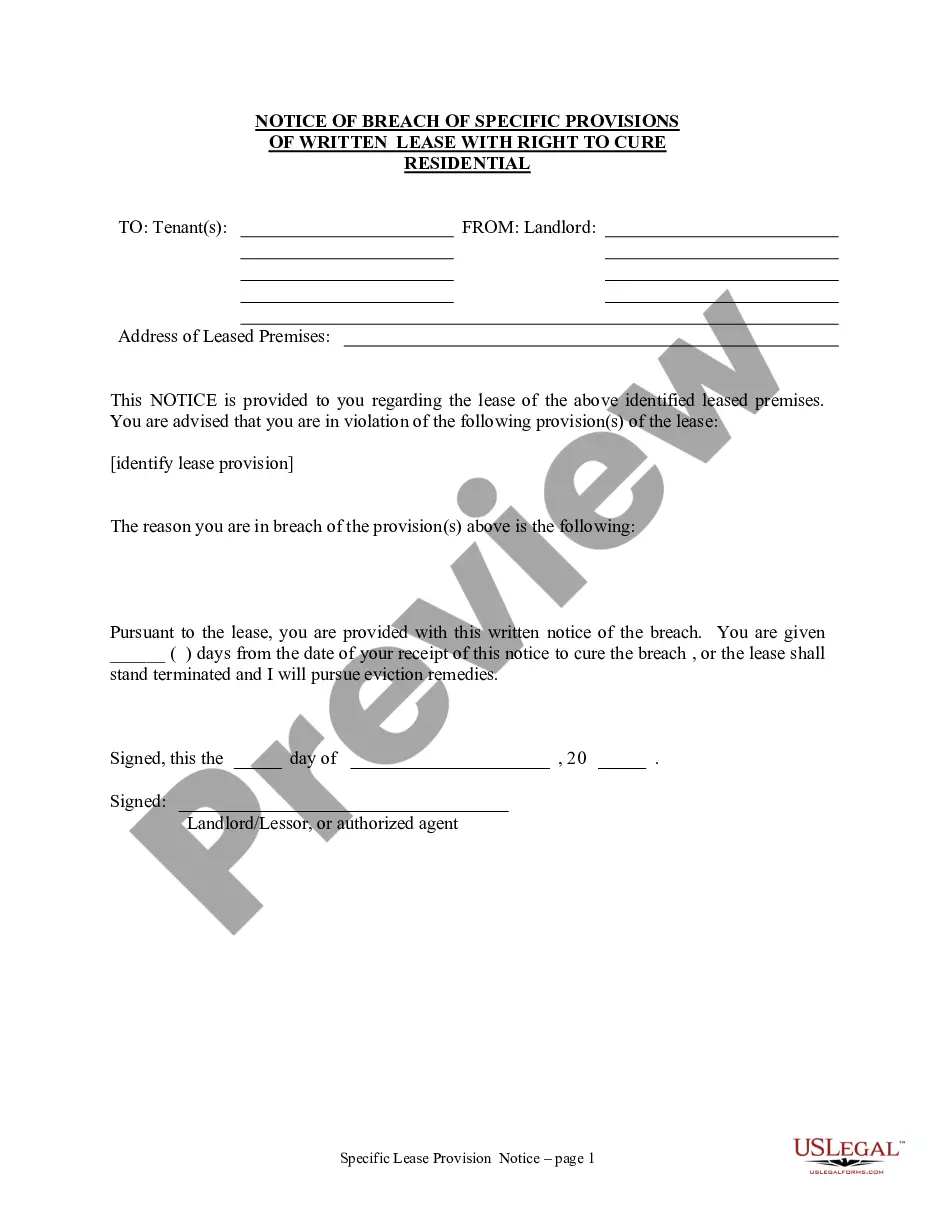

- Make sure the document you see on the page meets your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and choose your state from the dropdown to find another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your Ohio Appointment Of Testamentary Trustee and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Trustees have a duty to inform a beneficiary of the existence and terms of the trust and of the general nature of their interest. Beyond these duties, establishing what information and documents a beneficiary is entitled to see is not always clear cut and it is a common issue that arises when dealing with trusts.

Living trusts and testamentary trusts A living trust (sometimes called an inter vivos trust) is one created by the grantor during his or her lifetime, while a testamentary trust is a trust created by the grantor's will. Only a funded living trust avoids probate court.

The trustee acts as the legal owner of the asset. They're responsible for managing the assets, filing taxes and distributing assets as necessary. In Ohio, they must also keep ?adequate records of administration? and keep the beneficiaries informed as to the administration, distribution and status of the trust.

Unless the beneficiary expressly requests a copy of the entire trust instrument, the trustee may furnish to the beneficiary a copy of a redacted trust instrument that includes only those provisions of the trust instrument that the trustee determines are relevant to the beneficiary's interest in the trust.

Generally speaking, a trustee cannot withhold money from a beneficiary unless they are acting in ance with the trust. If the trust does not indicate any conditions for dispersing funds, the trustee cannot make them up or follow their own desires.

Section 5808.15 General powers of trustee. (2) Any other powers appropriate to achieve the proper investment, management, and distribution of the trust property; (3) Any other powers conferred by Chapters 5801. to 5811.

A trustee has a fiduciary duty to act in the best interests of both current and future beneficiaries of the trust and can be held personally liable for any breach of that duty.

Under current Ohio law, a trustee shall, within sixty (60) days after accepting its duties as trustee, notify the current beneficiaries of a trust of the trustee's acceptance of the trust, together with the trustee's name, address, and telephone number.