Ohio Request For Hearing (Personal Earnings)

Description

How to fill out Ohio Request For Hearing (Personal Earnings)?

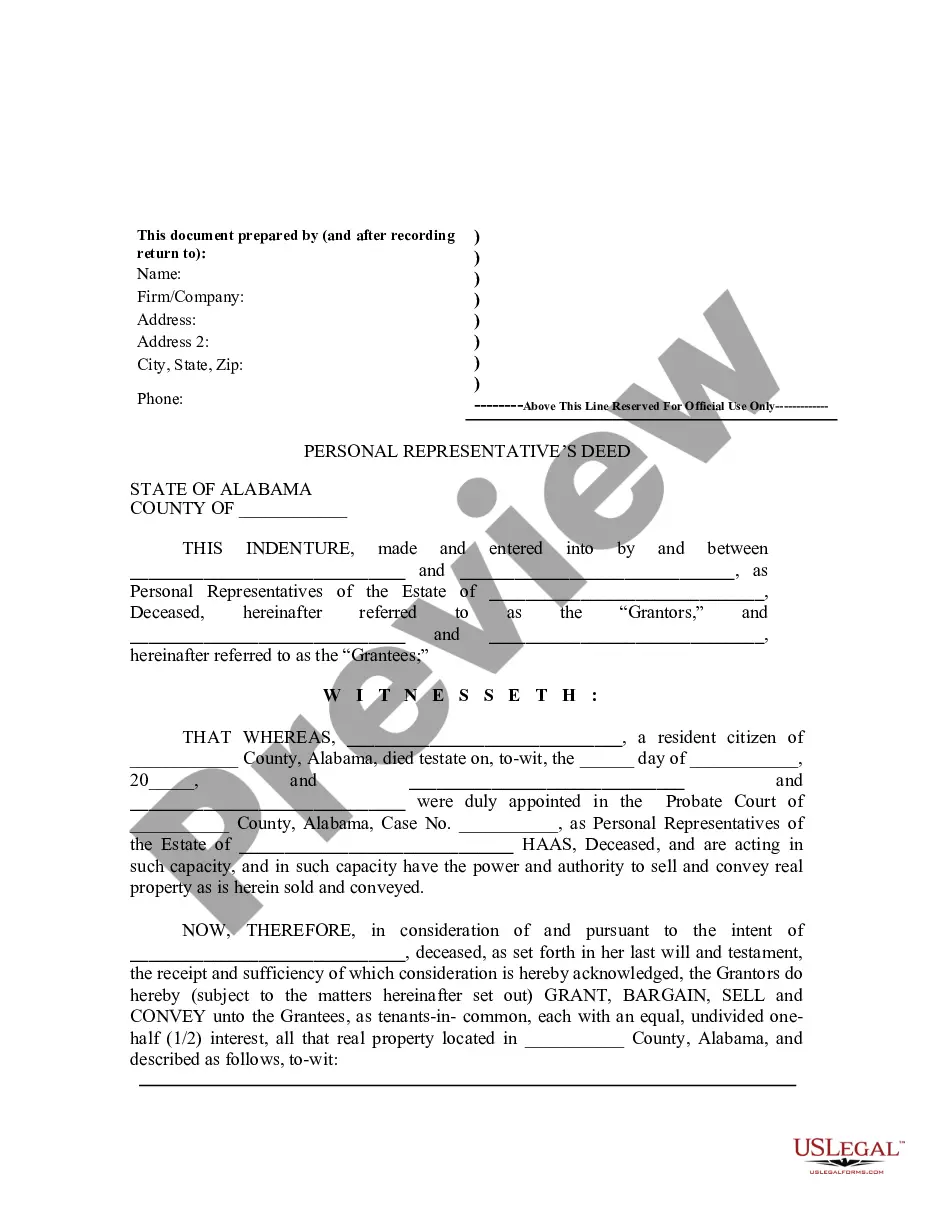

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state regulations and are verified by our specialists. So if you need to prepare Ohio Request For Hearing (Personal Earnings), our service is the best place to download it.

Getting your Ohio Request For Hearing (Personal Earnings) from our catalog is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they locate the proper template. Later, if they need to, users can take the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a brief guide for you:

- Document compliance verification. You should carefully examine the content of the form you want and ensure whether it suits your needs and complies with your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab on the top of the page until you find an appropriate blank, and click Buy Now once you see the one you want.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Ohio Request For Hearing (Personal Earnings) and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any official document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

If you owe money and your creditor gets a judgment against you, that creditor can garnish your wages to receive either 25% of your disposable earnings or your disposable earnings less 30 times the current federal minimum wage.

And some states also allow judgment liens on the debtor's personal property -- things like jewelry, art, antiques, and other valuables. In Ohio, a judgment lien can be attached to real estate only (such as a house, land, or similar property interest).

Wages and other property, including bank accounts, may be garnished. However, the 25% limit on garnishment of personal earnings continues even when the money is deposited into a personal checking account. The amount that can be garnished must be determined at the garnishment hearing.

In Ohio, a debt collector may only garnish up to 25% of your non-exempt wages and must leave at least $425 in your bank account. They also may not seize a vehicle worth less than $3,225. Better yet, the law protects $125,000 in home equity from creditors and $10,775 in aggregate value of household goods.

With your demand letter or notice, you will get a form titled ?Payment to Avoid Garnishment.? Complete the form and return it to the creditor within 15 days and you can make periodic payments without having to go through the formal garnishment process.

The total amount garnished cannot be more than 25% of the employee's monthly disposable earnings. Exemptions from garnishment, including, but not limited to, worker's compensation, unemployment compensation, disability payments, OWF payments, or child support or spousal support, and most pensions.

Wage Garnishment Results from a Court Judgment or a Governmental Action. Most creditors can't begin garnishing your wages just because you fell behind on a bill. The creditor must first file a collection lawsuit and receive a judgment permitting them to take a portion of your paychecks.

Section 2716.041 Order of garnishment of personal earnings to be continuous.