Ohio State Retirement System Investment Officers are professionals that are responsible for managing the investments of the Ohio State Retirement System. They are responsible for developing, implementing, and monitoring investment strategies, managing portfolios, and managing risk. They are also responsible for selecting and monitoring investments, ensuring compliance with regulations, and providing investment advice. Ohio State Retirement System Investment Officers typically have a degree in finance, economics, or accounting, and experience with portfolio management, investment analysis, and financial modeling. There are two types of Ohio State Retirement System Investment Officer: the Defined Benefit Investment Officer and the Defined Contribution Investment Officer. The Defined Benefit Investment Officer is responsible for managing the Defined Benefit Pension Plan investments, which are long-term investments meant to provide retirement income for eligible participants. The Defined Contribution Investment Officer is responsible for managing the Defined Contribution Investment Plan, which is a 401(k) plan that allows participants to save for retirement with pre-tax contributions.

Ohio State Retirement System Investment Officer

Description

How to fill out Ohio State Retirement System Investment Officer?

How much time and resources do you usually spend on drafting formal documentation? There’s a better way to get such forms than hiring legal experts or wasting hours browsing the web for an appropriate blank. US Legal Forms is the top online library that offers professionally designed and verified state-specific legal documents for any purpose, like the Ohio State Retirement System Investment Officer.

To get and prepare an appropriate Ohio State Retirement System Investment Officer blank, follow these simple steps:

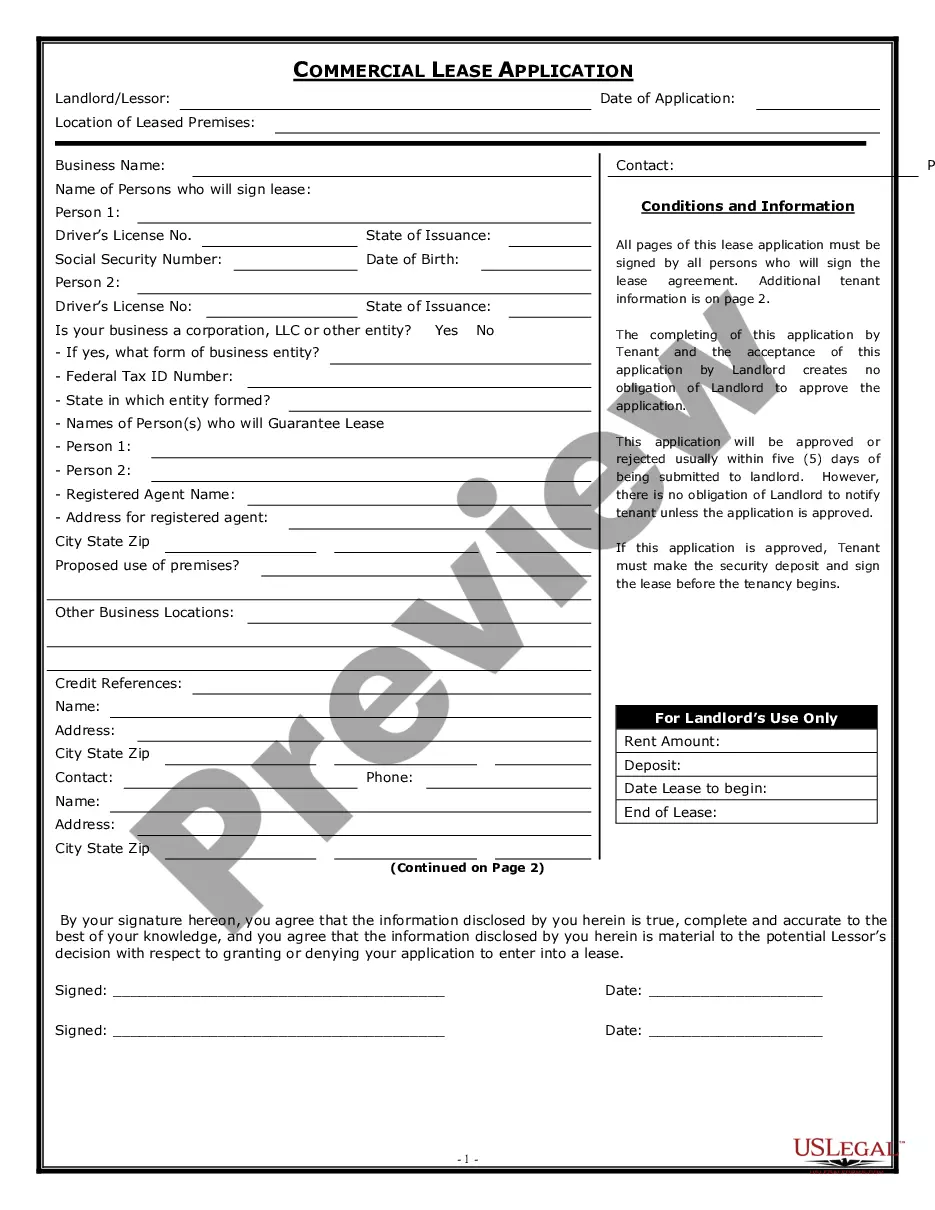

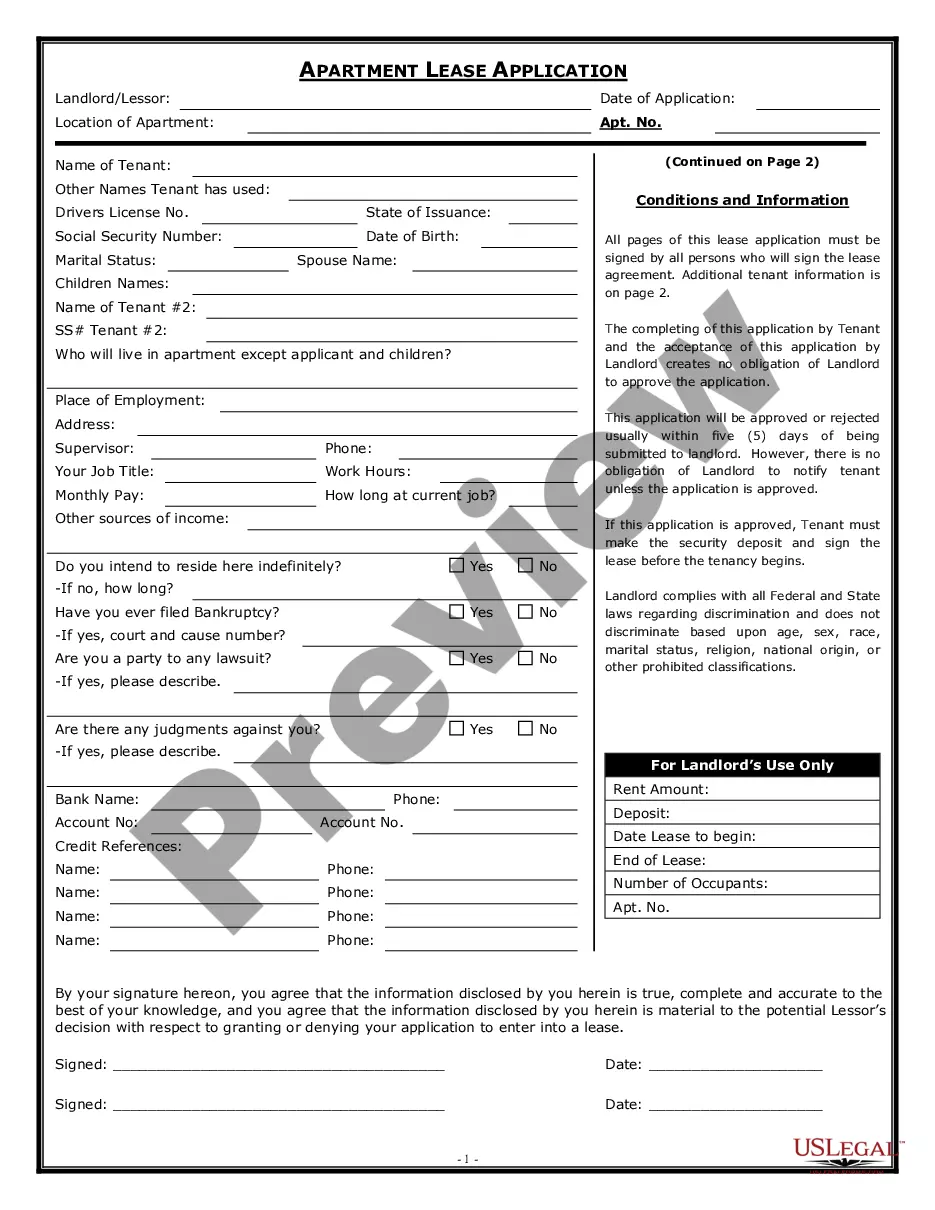

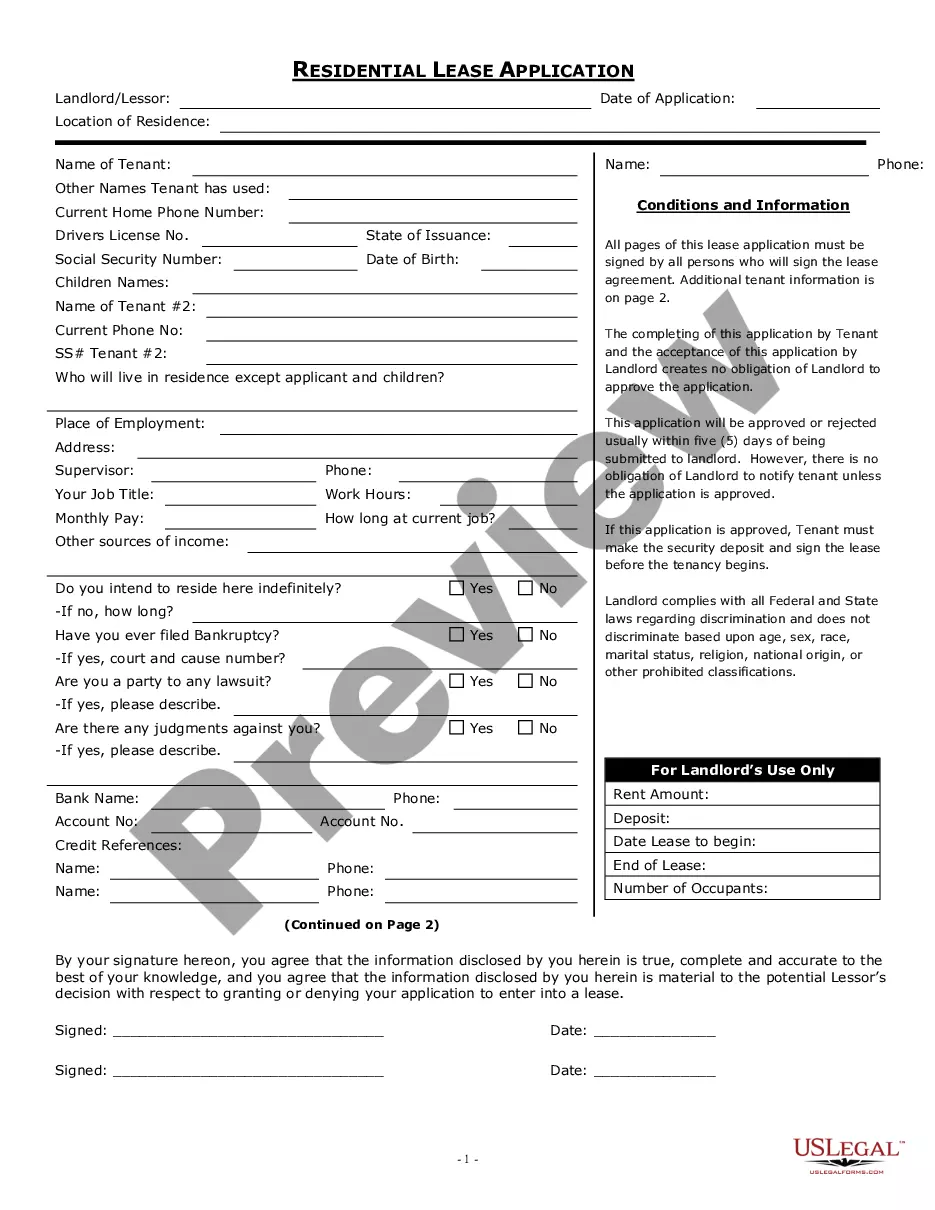

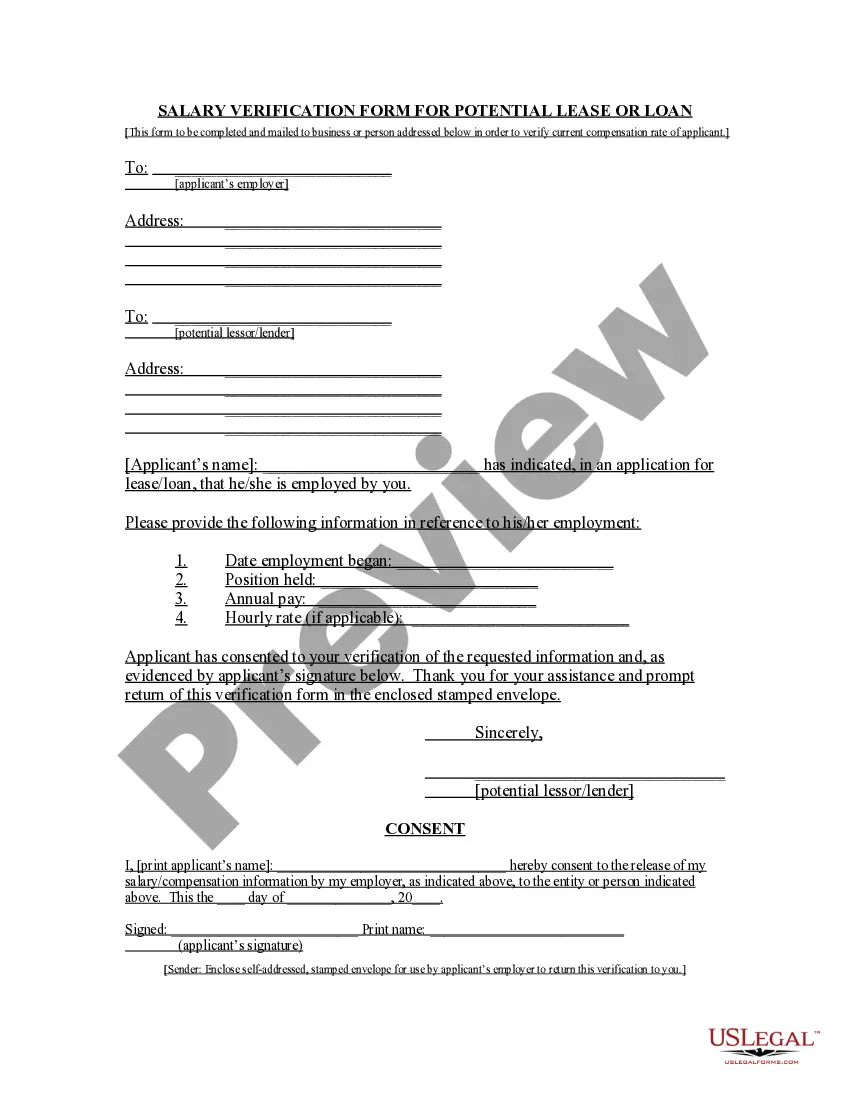

- Examine the form content to ensure it meets your state regulations. To do so, read the form description or use the Preview option.

- If your legal template doesn’t meet your requirements, find another one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Ohio State Retirement System Investment Officer. If not, proceed to the next steps.

- Click Buy now once you find the correct document. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely safe for that.

- Download your Ohio State Retirement System Investment Officer on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously purchased documents that you safely keep in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as often as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most trustworthy web solutions. Join us now!