This form for use in litigation against an insurance company for bad faith breach of contract. Adapt this model form to fit your needs and specific law. Not recommended for use by non-attorney.

Ohio Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand

Description

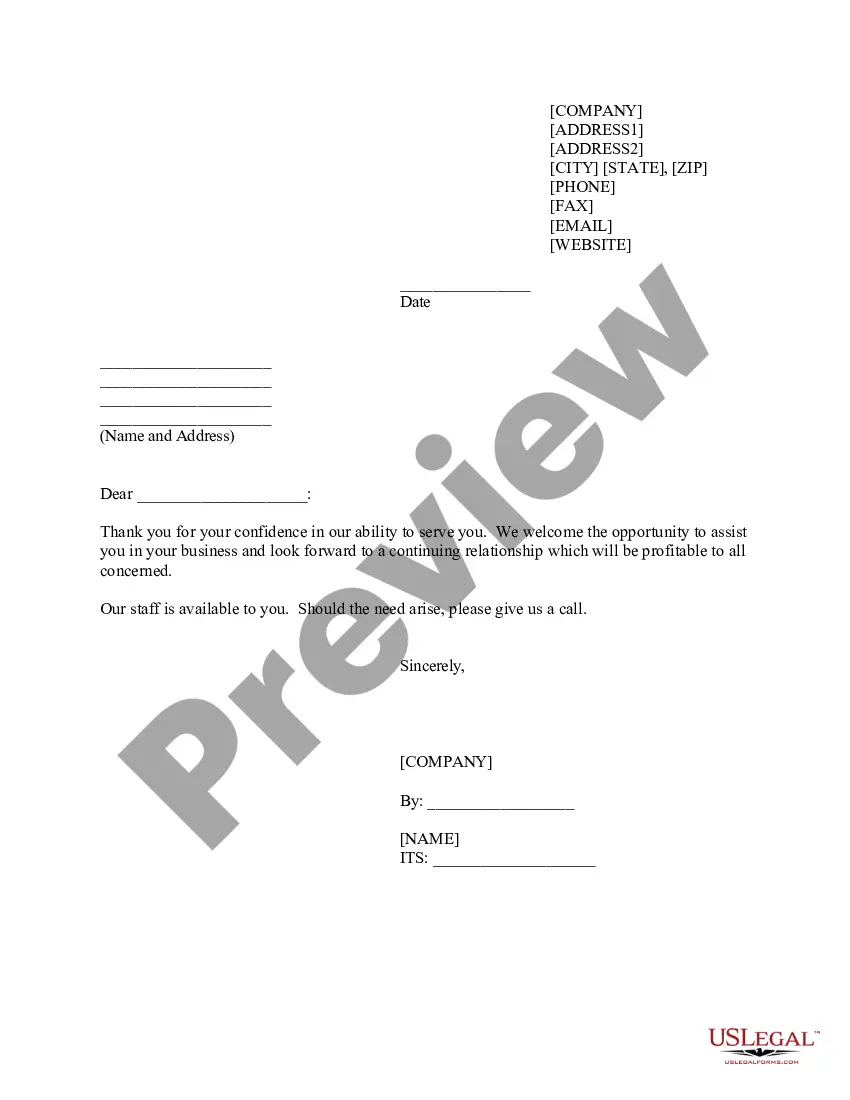

How to fill out Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand?

If you want to comprehensive, download, or print out lawful document themes, use US Legal Forms, the greatest assortment of lawful kinds, which can be found on-line. Take advantage of the site`s basic and handy research to find the papers you need. Different themes for organization and personal uses are sorted by classes and says, or search phrases. Use US Legal Forms to find the Ohio Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand within a couple of click throughs.

If you are currently a US Legal Forms client, log in to the account and click the Down load switch to find the Ohio Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand. You can also entry kinds you previously saved inside the My Forms tab of your respective account.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form to the correct metropolis/region.

- Step 2. Make use of the Preview option to examine the form`s content material. Don`t forget to see the explanation.

- Step 3. If you are not happy using the type, make use of the Research discipline at the top of the monitor to find other versions from the lawful type format.

- Step 4. Upon having discovered the form you need, go through the Acquire now switch. Choose the prices strategy you like and include your qualifications to sign up on an account.

- Step 5. Approach the deal. You can use your charge card or PayPal account to accomplish the deal.

- Step 6. Find the format from the lawful type and download it in your product.

- Step 7. Full, change and print out or indicator the Ohio Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.

Every lawful document format you buy is yours permanently. You may have acces to each and every type you saved within your acccount. Select the My Forms portion and choose a type to print out or download yet again.

Contend and download, and print out the Ohio Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand with US Legal Forms. There are many specialist and status-certain kinds you can use for the organization or personal requirements.

Form popularity

FAQ

Call toll-free: 1-800-686-1526. The analyst will answer questions over the phone and explain any additional steps you should take to resolve the problem. The department will decide if the company handled your issue appropriately and within the terms of the policy or certificate of coverage.

Mary Jo Hudson (MJ) is a partner with Squire Patton Boggs (US) LLP in Columbus, Ohio. MJ is a former Insurance Commissioner for the State of Ohio with over 30 years of experience in the practice of law and in insurance regulation, financial services and consumer finance regulation.

The Definition of a Total Loss Vehicle ing to Ohio Law The cost to replace the vehicle is based solely on the actual cash value, and is not tied to a set dollar amount to replace or repair the vehicle. It is not the same thing as the cost to buy a new (current model year) vehicle, either.

The Ohio Department of Insurance regulates the state's insurance industry. It provides consumer protection through education and regulation while promoting a stable and competitive marketplace. Staff help consumers understand different types of insurance, review products and rates, and fight fraud.

Ohio Department of Insurance Department overviewFormedMarch 12, 1872JurisdictionOhioDepartment executiveJudith L. French, directorWebsiteinsurance.ohio.gov

Governor Mike DeWine appointed Judith L. French director of the Ohio Department of Insurance on February 8, 2021. Director French serves as a member of Governor DeWine's cabinet and is responsible for the overall leadership and direction of the department.

You have the right to request OEM parts to repair your vehicle after a car accident. However, the insurance company might refuse to use OEM parts because the cost is unreasonable when comparable aftermarket parts are available.

The Ohio Department of Insurance regulates the state's insurance industry. It provides consumer protection through education and regulation while promoting a stable and competitive marketplace. Staff help consumers understand different types of insurance, review products and rates, and fight fraud.