An employee lease agreement is an agreement between a company and another party whereby the company agrees to contract out the services of some or all of its employees to the other party on specific terms and conditions.

The employees are actually employed by a third-party leasing company, but do their work for the company that contracts with the leasing company. In addition to relieving companies of the administrative responsibilities of managing a workforce, leasing employees can also save a company money by reducing the cost of benefits and insurance, to name just two areas.

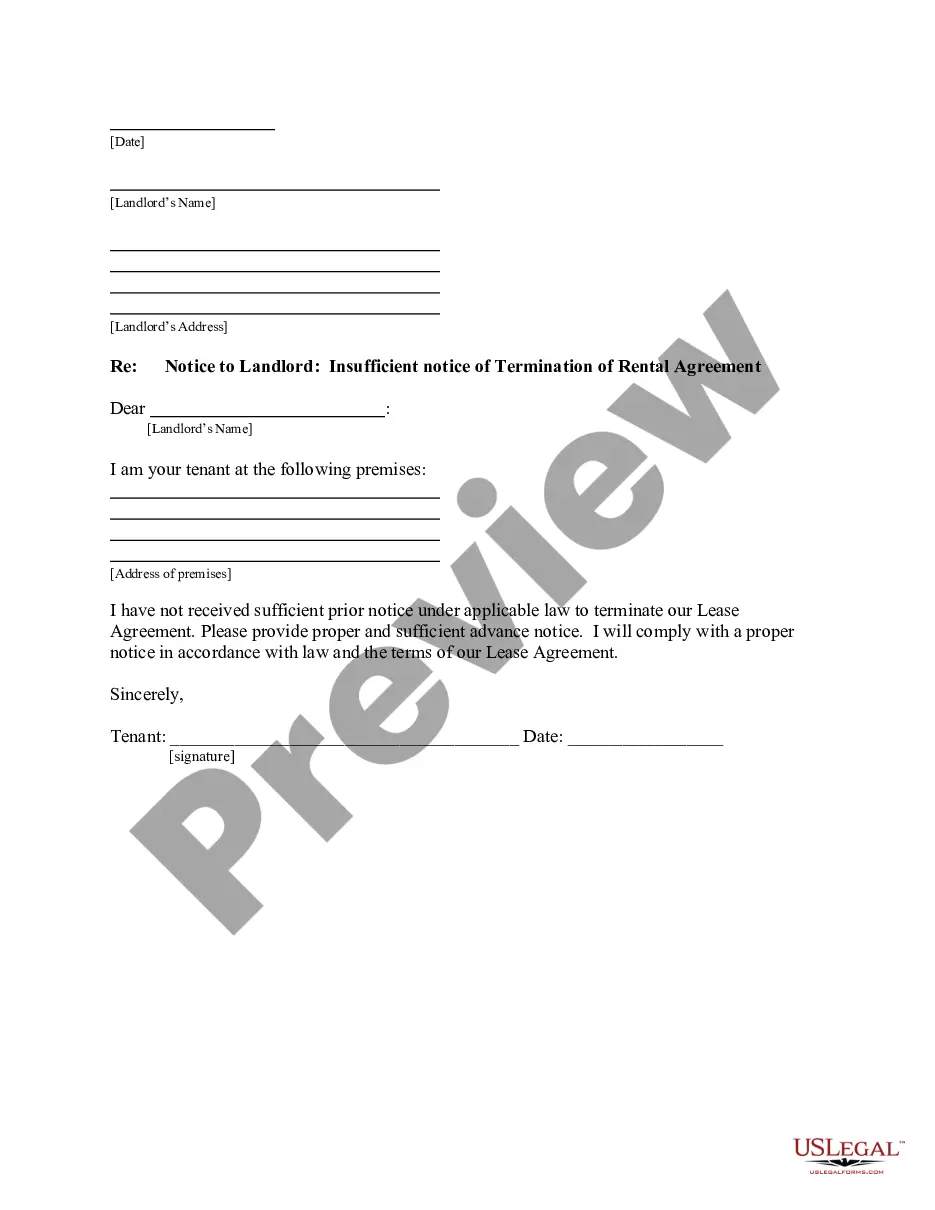

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Ohio Employee Lease Agreement is a legally binding contract designed to ensure that both employers and employees have a comprehensive understanding of their rights and obligations during the course of their employment relationship. This document outlines the terms and conditions under which an employee will be leased or assigned by one employer (known as the lessor) to another employer (known as the lessee). The Ohio Employee Lease Agreement typically contains several key components. Firstly, it includes the identification details of both the lessor and the lessee, such as their names, addresses, and contact information. It also specifies the duration of the lease, outlining the exact start and end dates, as well as any provisions for renewal or termination of the lease. Additionally, the agreement details the specific job responsibilities and duties of the leased employee, ensuring clarity regarding the tasks they will be expected to perform while working for the lessee. It may also specify any necessary qualifications or certifications required for the job. Furthermore, the Ohio Employee Lease Agreement addresses the compensation and benefits to be provided to the leased employee. This includes information on the salary or wage rate, frequency of payment, any applicable overtime rates, and details of any additional benefits, such as health insurance, retirement plans, or paid time off. The agreement also outlines the obligations and responsibilities of both the lessor and lessee. It may include provisions regarding the protection of confidential information, non-disclosure agreements, and non-compete clauses. This ensures that both parties understand their obligations to maintain the confidentiality of sensitive information and prohibit the employee from working for a competitor during and after the lease period. Different types of Ohio Employee Lease Agreements may exist depending on the industry or nature of employment. Some examples include: 1. Temporary Staffing Lease Agreement: This type of agreement is commonly used when a business needs to temporarily fill a position or handle a specific project. The lessor, typically a staffing agency, leases the employee to the lessee for a predetermined period. 2. Professional Services Lease Agreement: This type of agreement is often utilized when a company requires the expertise of a specific professional for a limited duration. The lessor may be a consulting firm or an individual contractor, and the lessee benefits from the leased employee's specialized knowledge. 3. Outsourcing Lease Agreement: This type of agreement can be employed when a company outsources specific functions or services to a third-party provider. The lessor, in this case, could be a company specializing in that particular service, and the lessee utilizes their employees to carry out the outsourced tasks. In conclusion, the Ohio Employee Lease Agreement is a vital document that establishes the terms and conditions of the employment relationship between a lessor, lessee, and leased employee. It ensures transparency, protects the rights of both parties, and clarifies their respective obligations throughout the lease period.