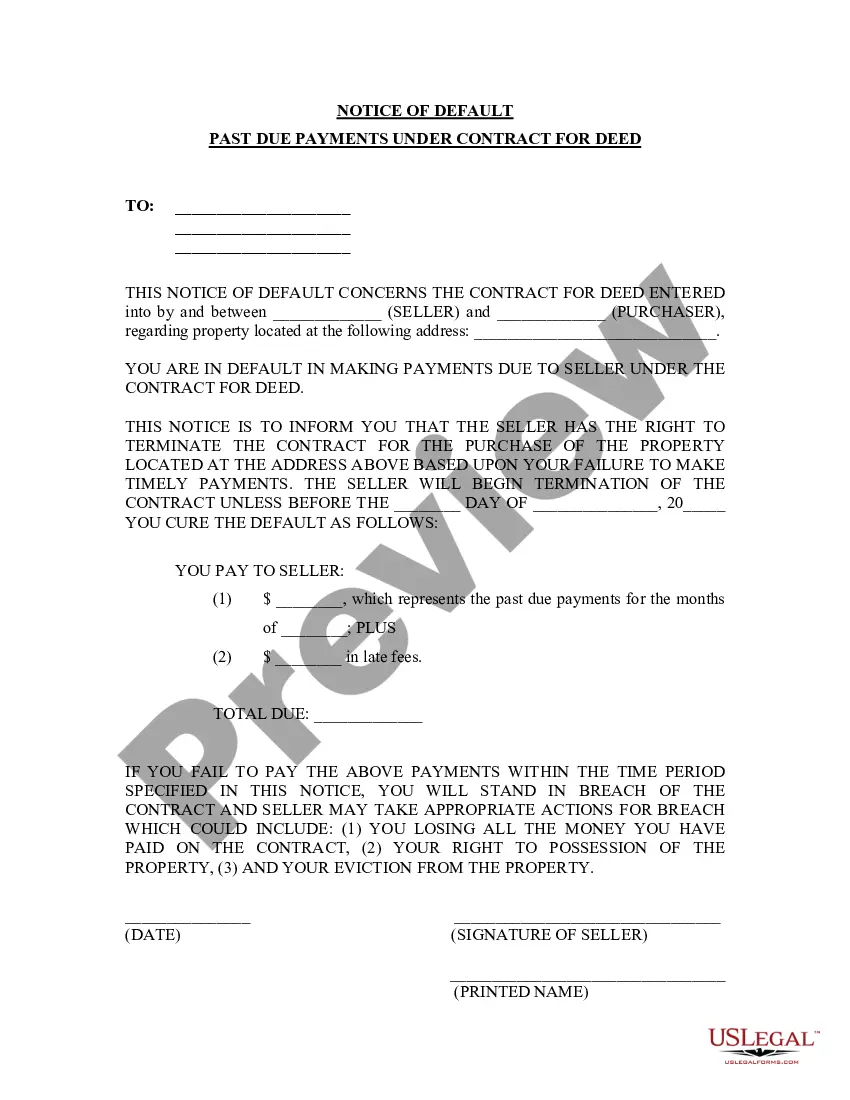

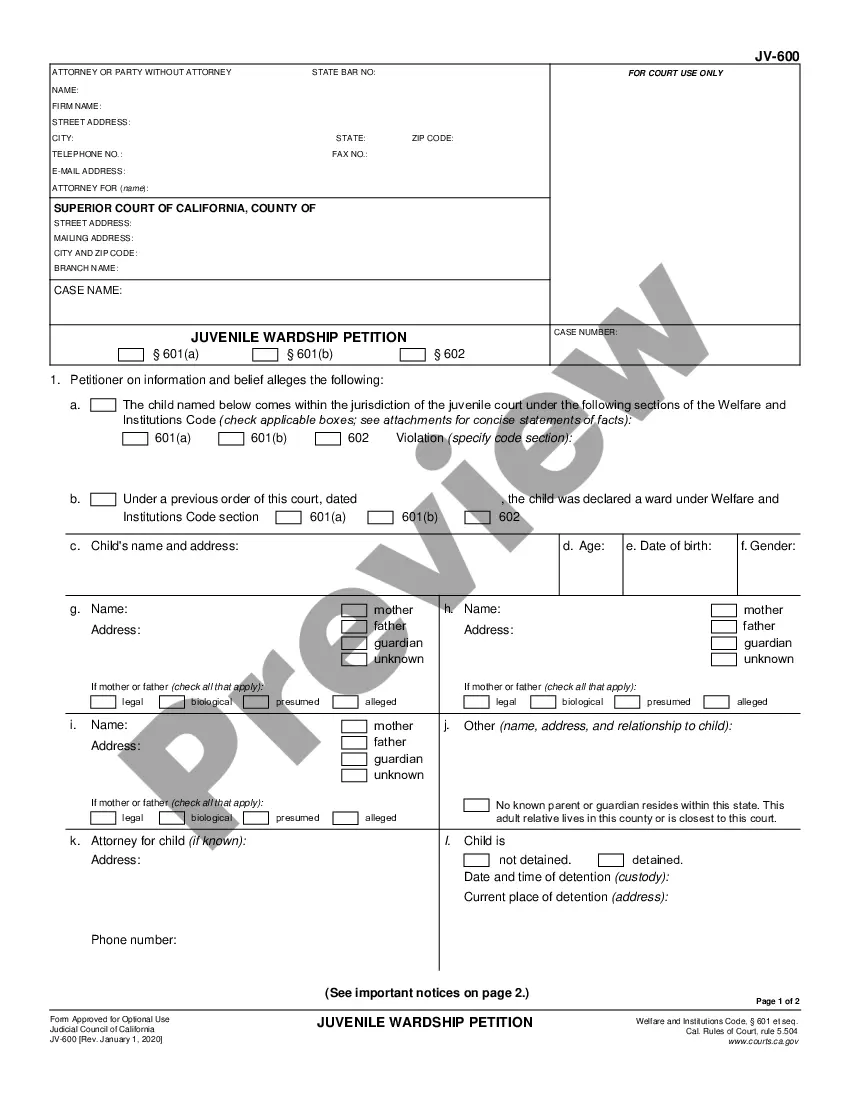

This form is an assumption agreement for a Small Business Administration (SBA) loan. Party assuming the loan agrees to continue payments thereon. SBA agrees to the assumption of the loan and release of original debtor. Adapt to fit your circumstances.

Ohio Assumption Agreement of SBA Loan

Description

How to fill out Assumption Agreement Of SBA Loan?

Are you presently in a situation where you require documents for personal or business purposes almost all the time.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, such as the Ohio Assumption Agreement of SBA Loan, which can be tailored to comply with state and federal regulations.

Choose a convenient file format and download your copy.

You can find all the document templates you have purchased in the My documents section. You may obtain an additional copy of the Ohio Assumption Agreement of SBA Loan at any time if needed. Click on the desired document to download or print the template.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you will be able to download the Ohio Assumption Agreement of SBA Loan template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the template you need and ensure it is for the correct area/county.

- Utilize the Preview option to review the document.

- Check the details to ensure you have selected the right document.

- If the document is not what you are looking for, use the Search field to find the template that matches your needs.

- Once you have found the correct document, simply click Purchase now.

- Select the pricing plan you want, complete the required information to create your account, and pay for your order using your PayPal or credit card.

Form popularity

FAQ

The assignment agreement definition is a portion of the common law that is in charge of transferring the rights of an individual or party to another person or party. The assignment agreement is often seen in real estate but can occur in other contexts as well.

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract.

Assignment of contract allows one person to assign, or transfer, their rights, obligations, or property to another. An assignment of contract clause is often included in contracts to give either party the opportunity to transfer their part of the contract to someone else in the future.

Fortunately for borrowers, SBA loans, including the SBA 7(a) loan, are fully assumable with SBA approval. However, if you're selling your business, getting approval from the SBA for another borrower to assume your loan can be somewhat complex.

Also referred to as an assignment and assumption, an assignment and assumption agreement is an agreement that is established when one party of a contract wishes to transfer his or her contractual obligations and rights to another party.

It is a legal contract that effectuates an agreement between two parties, whereby one party agrees to assume the responsibilities, interests, rights, and obligations of another party in respect to a separate agreement made between the latter and a third party.

The current borrower (seller) must provide: A letter explaining the assumption, including an explanation of any cash paid to the seller by the individual assuming the loan. The letter must be signed and dated by all original borrows/guarantors (except in the case of death).

Assumption of SBA Loan. A borrower may request for another person to assume the borrower's legal obligations and benefits under the SBA loan documents. Essentially, the assignor-borrower is requesting that another person step into their shoes as it relates to the loan.

If the assignor dies or is unable to repay the loan, the remaining amount owed is deducted from the value of the life insurance policy. Once the loan has been repaid fully, the remaining amount of death benefit is transferred to the beneficiaries, such as spouses, relatives or children.

SBA loans are fully assumable with SBA approval. Getting this approval, however, can be very complex. Any borrower attempting to assume an SBA loan will be carefully examined by the SBA and must meet a lengthy list of requirements.