Ohio Corporate Resolution for PPP Loan

Description

How to fill out Corporate Resolution For PPP Loan?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a range of legal form templates that you can download or print.

With the website, you'll find thousands of forms for business and personal purposes, organized by category, state, or keywords. You can discover the latest editions of forms such as the Ohio Corporate Resolution for PPP Loan in just a few moments.

If you have a subscription, Log In to download the Ohio Corporate Resolution for PPP Loan from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Choose the file format and download the form to your device. Make modifications. Complete, edit, print, and sign the saved Ohio Corporate Resolution for PPP Loan. Each template you added to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Ohio Corporate Resolution for PPP Loan with US Legal Forms, the most extensive collection of legal document templates. Utilize numerous professional and state-specific templates that fulfill your business or personal requirements and specifications.

- Ensure you have selected the correct form for your jurisdiction.

- Click the Preview button to review the form's details.

- Check the form description to make sure you have chosen the right one.

- If the form does not meet your needs, use the Search feature at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your choice by clicking on the Purchase now button.

- Then, select the pricing plan you prefer and provide your details to create an account.

Form popularity

FAQ

The SBA and the US Treasury have released a new forgiveness application for borrowers with Paycheck Protection Program (PPP) loans less than $50,000. In addition to simplifying the application, a borrower can receive forgiveness for their loan even if they have laid off employees since receiving their PPP loan.

First Draw PPP Loan If You Have No Employees (If you are using 2020 to calculate payroll costs and have not yet filed a 2020 return, fill it out and compute the value.) If this amount is over $100,000, reduce it to $100,000. If both your net profit and gross income are zero or less, you are not eligible for a PPP loan.

What is the resolution of the board of directors SBA?Organization name.Minimum and maximum loan amounts.These officers' names, titles, and signatures.When and where the Resolution took place.That meeting's exact date.Signature of the secretary attesting to the genuineness of signatures and names provided by officers.18-Aug-2021

PPP Specific Industries, Activities, and Other Factors: The following activities and industries make a business ineligible:illegal activity under federal, state, or local law;household employer (individuals who employ household employees such as nannies or housekeepers);More items...?

The resolution of board of directors is the convenient form that satisfies this requirement. The completed form signifies that the board of directors is aware of the fact that the finances are requested, of the exact sum, and has authorized the organization indicated in the document to receive funds.

The employee cash compensation of a C corporation owner-employee, defined as an owner who is also an employee (including when the owner is the only employee), is eligible for loan forgiveness up to the amount of 2.5/12 of his or her 2019 or 2020 employee cash compensation, with cash compensation defined as it is for

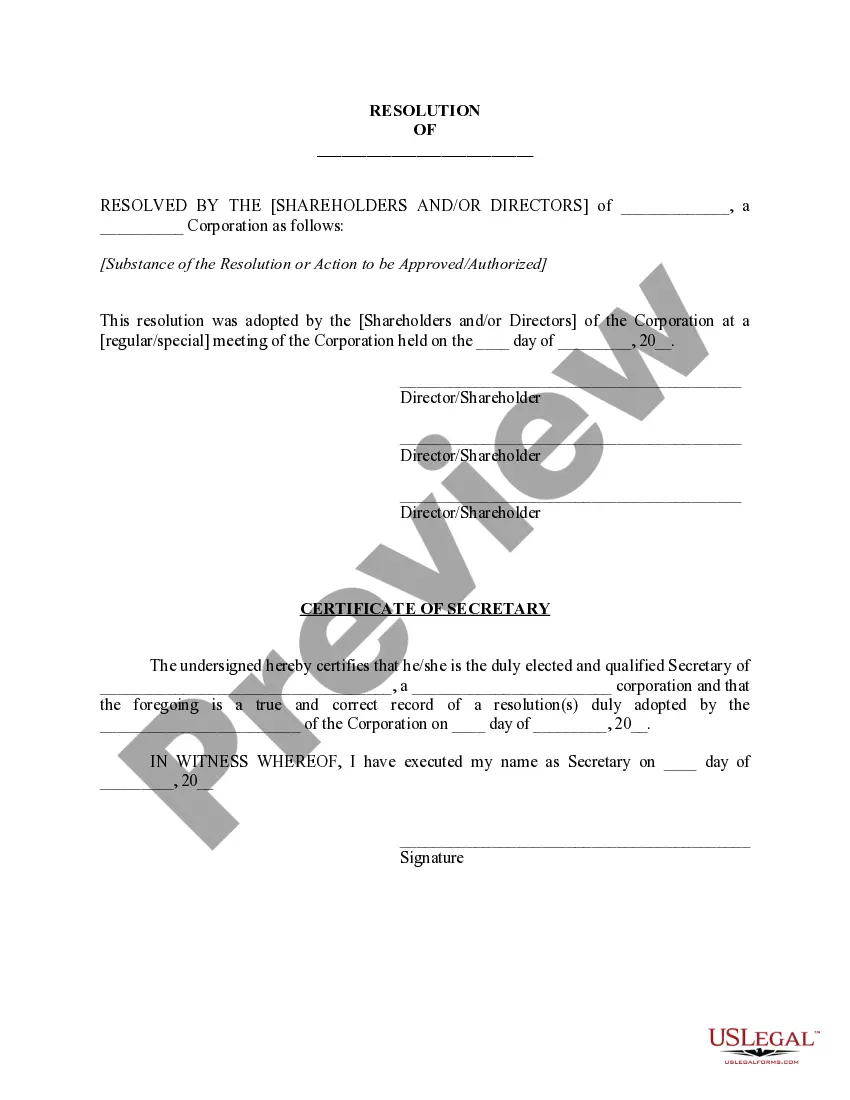

A certified board resolution is a written document that provides an explanation of the actions of a company's board of directors that has been verified by the secretary of the organization and approved by the board's president. It gives authority to an individual or group to act on behalf of the corporation.

All publicly traded companies are prohibited from receiving PPP loans. Businesses can apply for a PPP loan as long as they were operational on February 15, 2020, and had paid employees at that time (even if the owner is the only employee).

The maximum amount of money you can borrow as a first-time PPP borrower is 2.5 times your average monthly payroll costs, up to a maximum of $10 million.

A board resolution, also sometimes called a corporate resolution, is a formal document that makes a statement about an issue that is so important that the board wants to have a record of it. A resolution is a document stands as a record if compliance comes in to question.