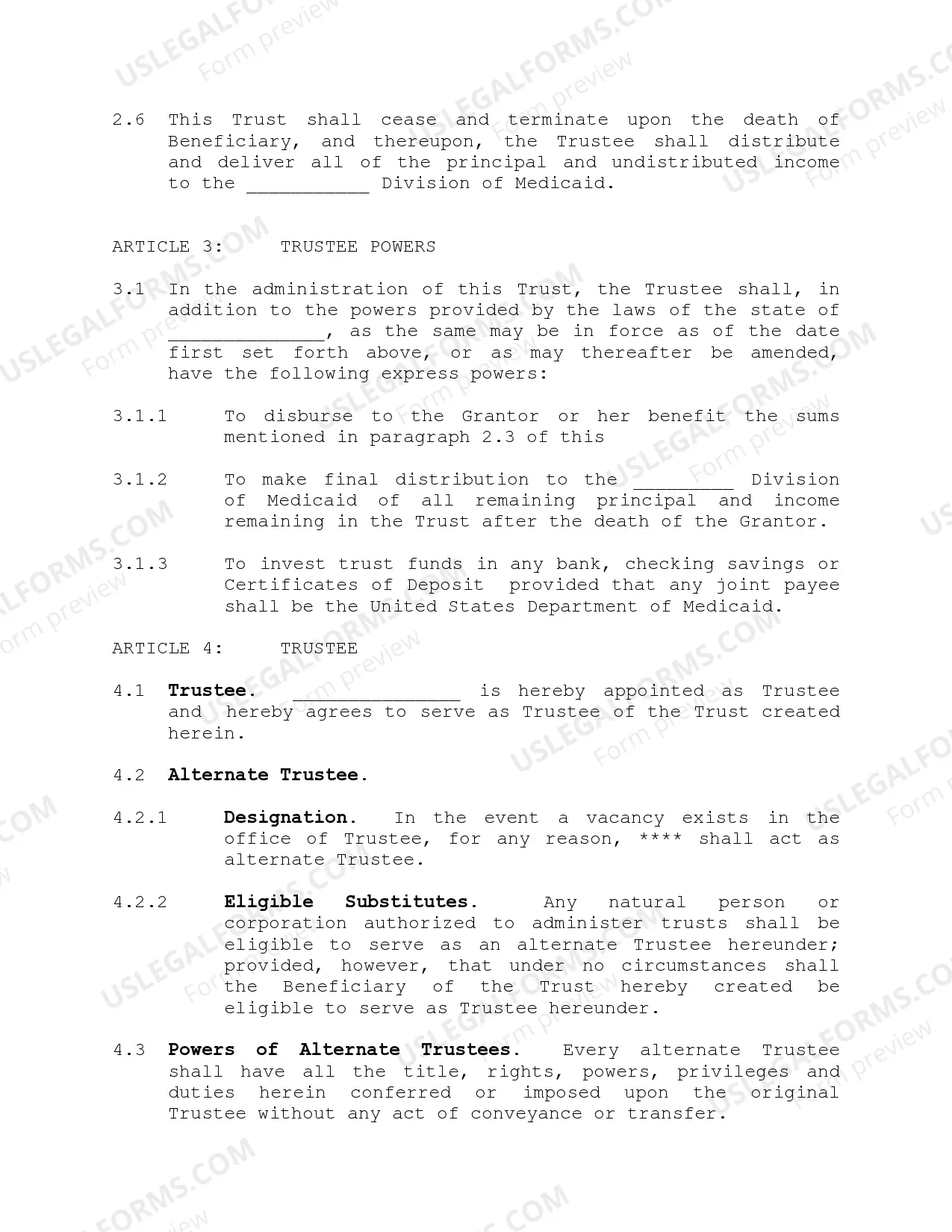

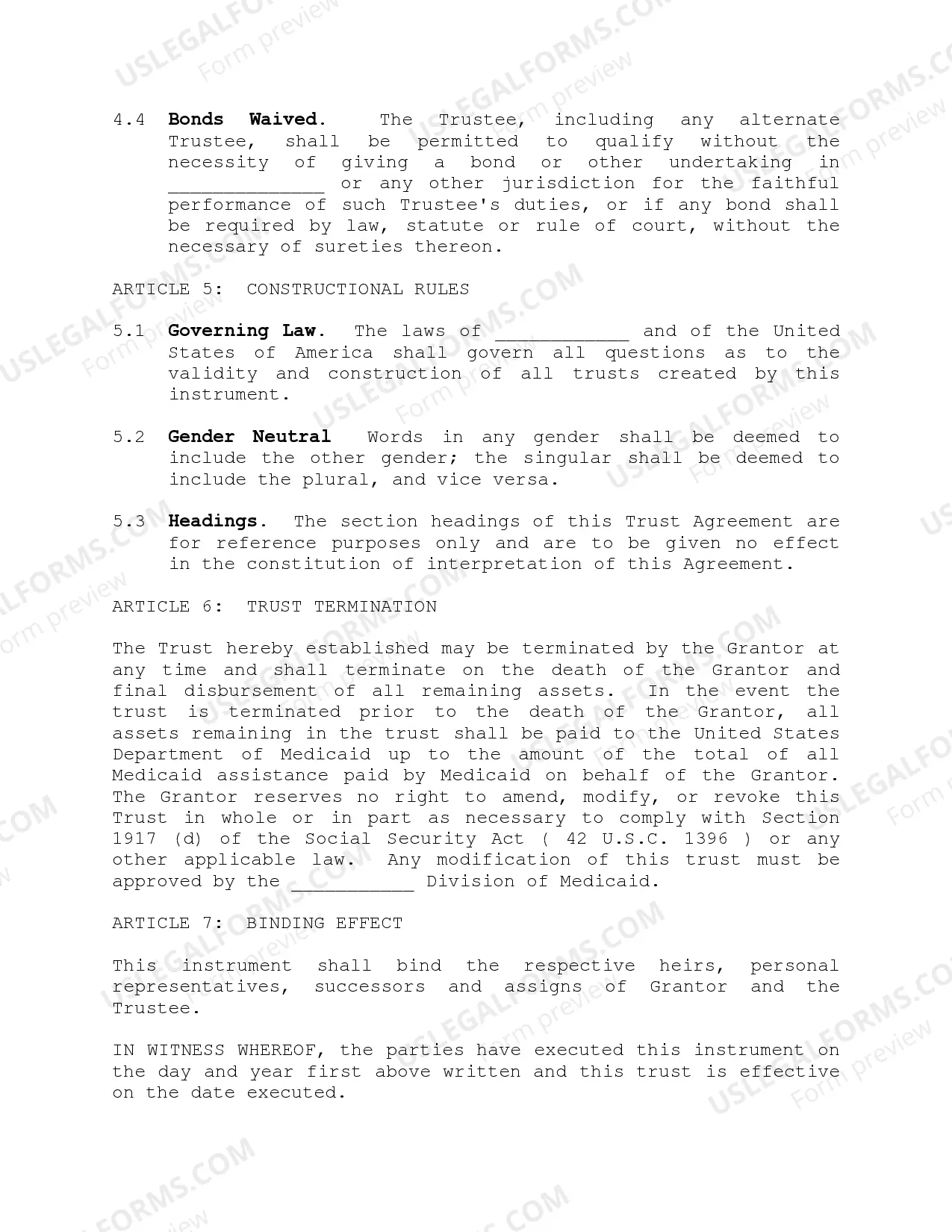

In this agreement, the grantor establishes an income trust and directs that the trustee shall receive unto to the trust all income due to grantor and the trustee will accept such property as the initial trust estate. Other provisions of the agreement include: additions to the trust, the management and disposition of the trust estate, trustee powers, and trust termination.

Ohio Medicaid Income Trust Form

Description

How to fill out Medicaid Income Trust Form?

Are you located in a space where you often require documentation for either organizational or personal reasons nearly every day.

There are numerous legal document templates accessible online, but discovering reliable ones can be challenging.

US Legal Forms offers a vast assortment of form templates, such as the Ohio Medicaid Income Trust Form, which are designed to comply with both federal and state regulations.

Select the pricing option you prefer, complete the necessary information to process your payment, and pay for your order using your PayPal or credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Ohio Medicaid Income Trust Form at any time if needed. Just follow the necessary form to download or print the document template. Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes. The service provides expertly crafted legal document templates that can be employed for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Ohio Medicaid Income Trust Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the appropriate region/state.

- Utilize the Preview button to review the form.

- Verify the details to confirm you have selected the correct form.

- If the form is not what you require, use the Lookup field to find a form that matches your needs and specifications.

- Once you have the right form, click on Buy now.

Form popularity

FAQ

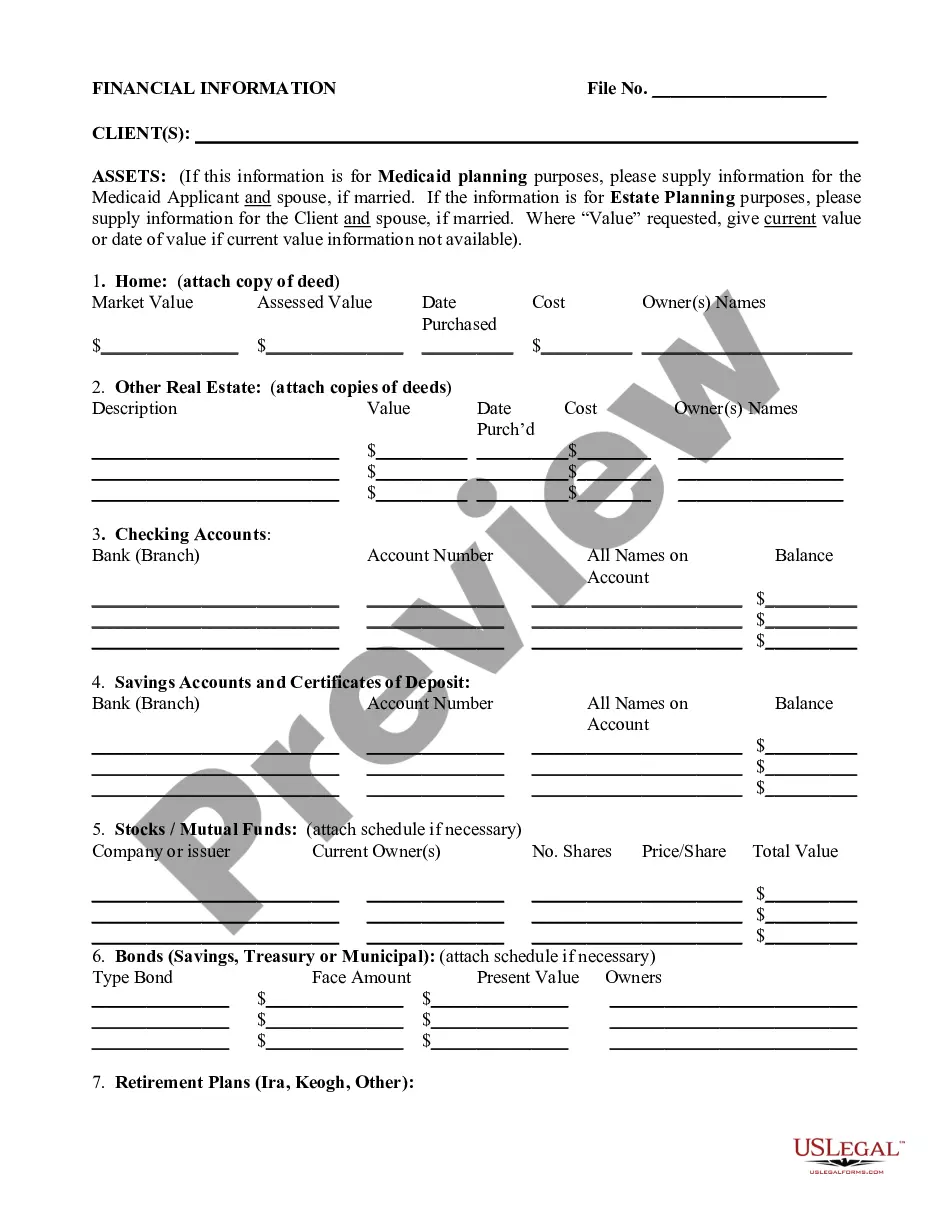

Yes, you can set up a trust to qualify for Medicaid, and the Ohio Medicaid Income Trust Form is designed for this purpose. Establishing this trust allows you to protect your assets while meeting eligibility requirements for Medicaid benefits. With proper setup, you can ensure that your income is properly managed and does not impede your access to necessary healthcare services. Utilizing resources like uslegalforms can simplify the process and guide you in creating an effective trust.

An income trust for Medicaid is a legal tool that allows individuals to set aside excess income while qualifying for Medicaid benefits. By using the Ohio Medicaid Income Trust Form, you can ensure that your income does not exceed the Medicaid eligibility limits. Essentially, this trust holds your income and provides a way to manage funds for your care. It’s a practical solution for those seeking long-term medical assistance.

A qualified income trust for Medicaid serves to hold income that exceeds the state’s Medicaid income limit. This trust effectively allows individuals to qualify for Medicaid benefits while still managing their finances. By completing the Ohio Medicaid Income Trust Form, you can maintain necessary coverage without depleting your resources. Utilizing this trust can simplify the application process and protect your financial stability.

A qualified income trust for Medicaid in Ohio is a specific type of trust designed to manage excess income for Medicaid eligibility. By using the Ohio Medicaid Income Trust Form, individuals can direct their income into the trust, allowing them to qualify for Medicaid services. This trust ensures that your income does not exceed the Medicaid limit, thus enabling access to essential healthcare. Understanding the requirements of this trust is crucial, so consider seeking professional guidance.

Yes, a trust can help protect assets from Medicaid in Ohio. By establishing an Ohio Medicaid Income Trust Form, you can legally set aside income to qualify for Medicaid benefits while safeguarding your assets. This strategy allows you to meet Medicaid eligibility requirements without losing your property. It's essential to consult with a legal expert to ensure your trust meets all necessary regulations.

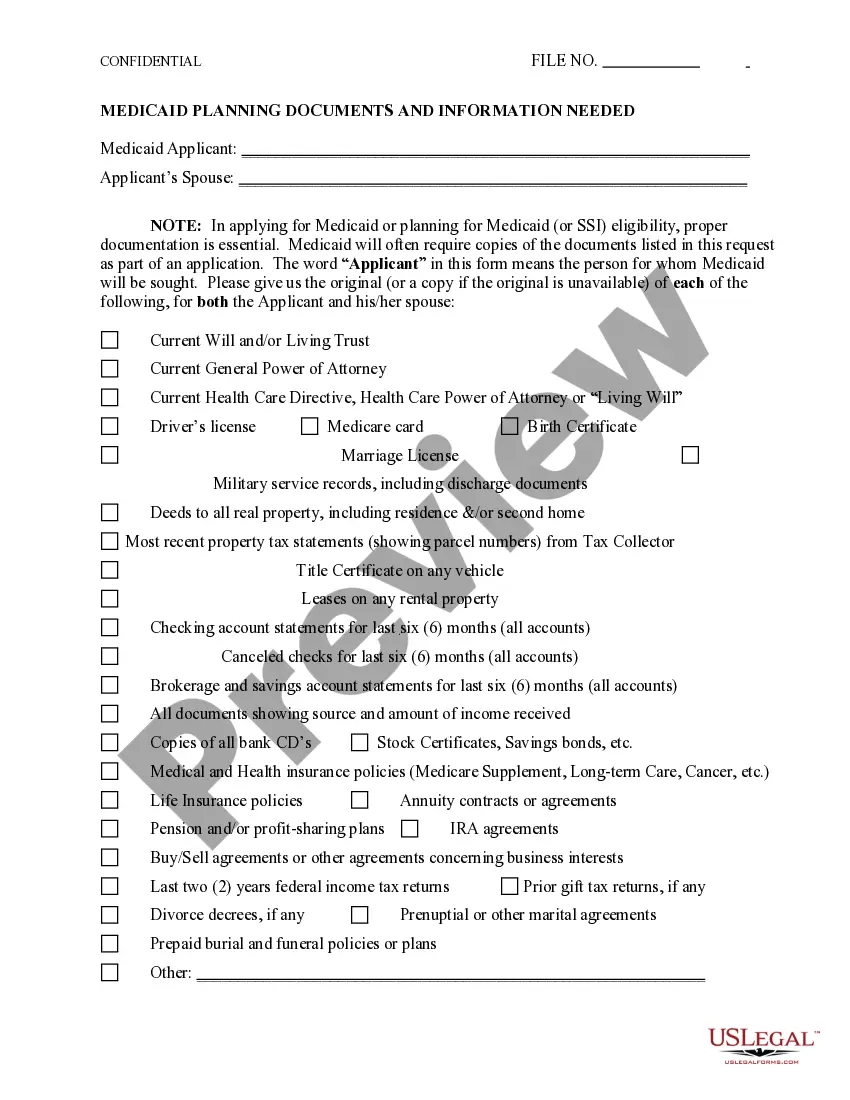

No property other than the Primary Beneficiary's income may be placed in the Trust. Income must be deposited into the trust account during the same month in which the income is received by the Primary Beneficiary.

A MAPT is an irrevocable trust created during your lifetime. The primary goal of a MAPT is to transfer assets to it so that Medicaid will not count these assets toward your resource limit when determining whether you qualify for Medicaid benefits.

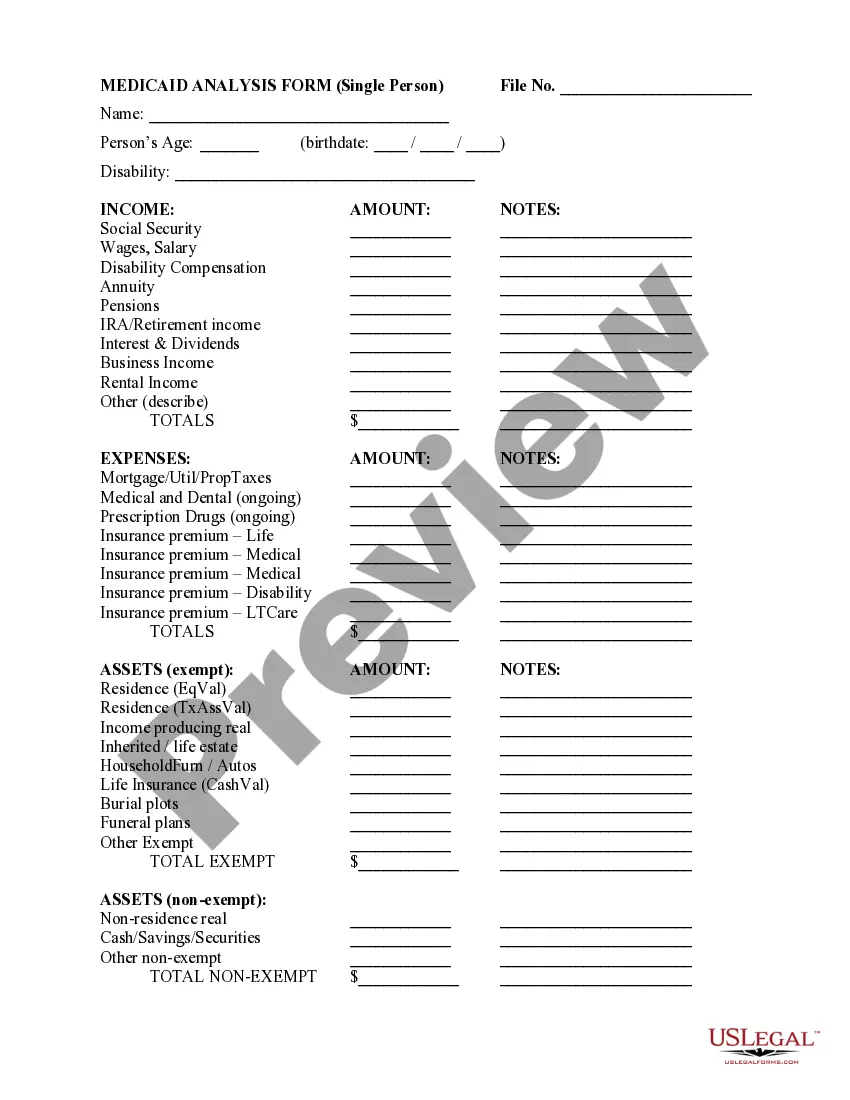

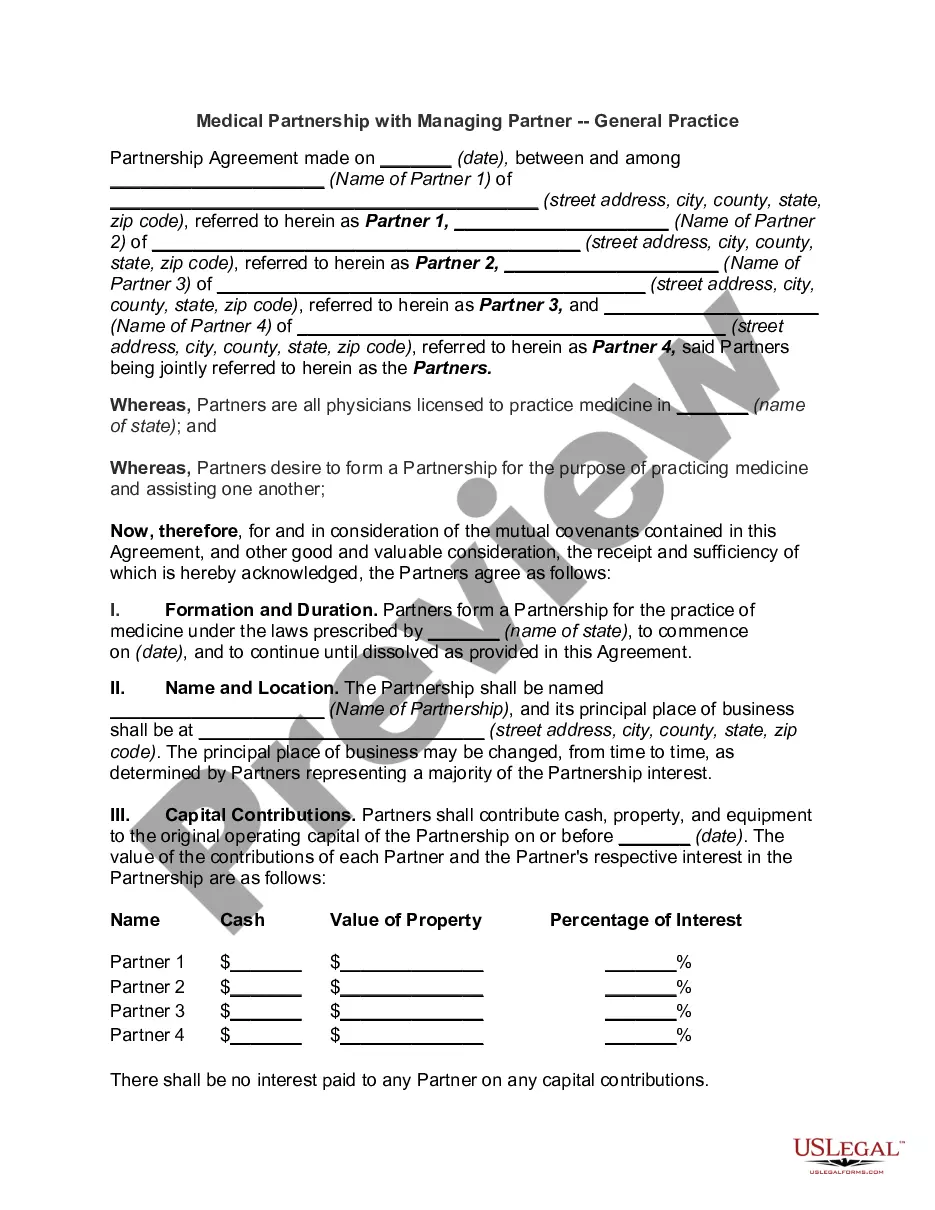

Income & Asset Limits for Eligibility 2023 Ohio Medicaid Long-Term Care Eligibility for SeniorsType of MedicaidSingleMarried (both spouses applying)Income LimitIncome LimitInstitutional / Nursing Home Medicaid$2,742 / month*$5,484 / month*Medicaid Waivers / Home and Community Based Services$2,742 / month?$5,484 / month?1 more row ?

An income trust will hold income-producing assets. Income cannot be assigned. A trust fund is typically managed by a trustee on behalf of a trustor who seeks to pass on the assets to a beneficiary. The terms of the trust fund are designated by the trustor and managed by the trustee.

Exempt Assets Primary residence (with an equity value of up to $688,000) One automobile. Household goods and personal effects. Prepaid funeral arrangements (with certain restrictions) Life insurance policies with a combined face value of $1,500 or less. Term life insurance with no cash value.