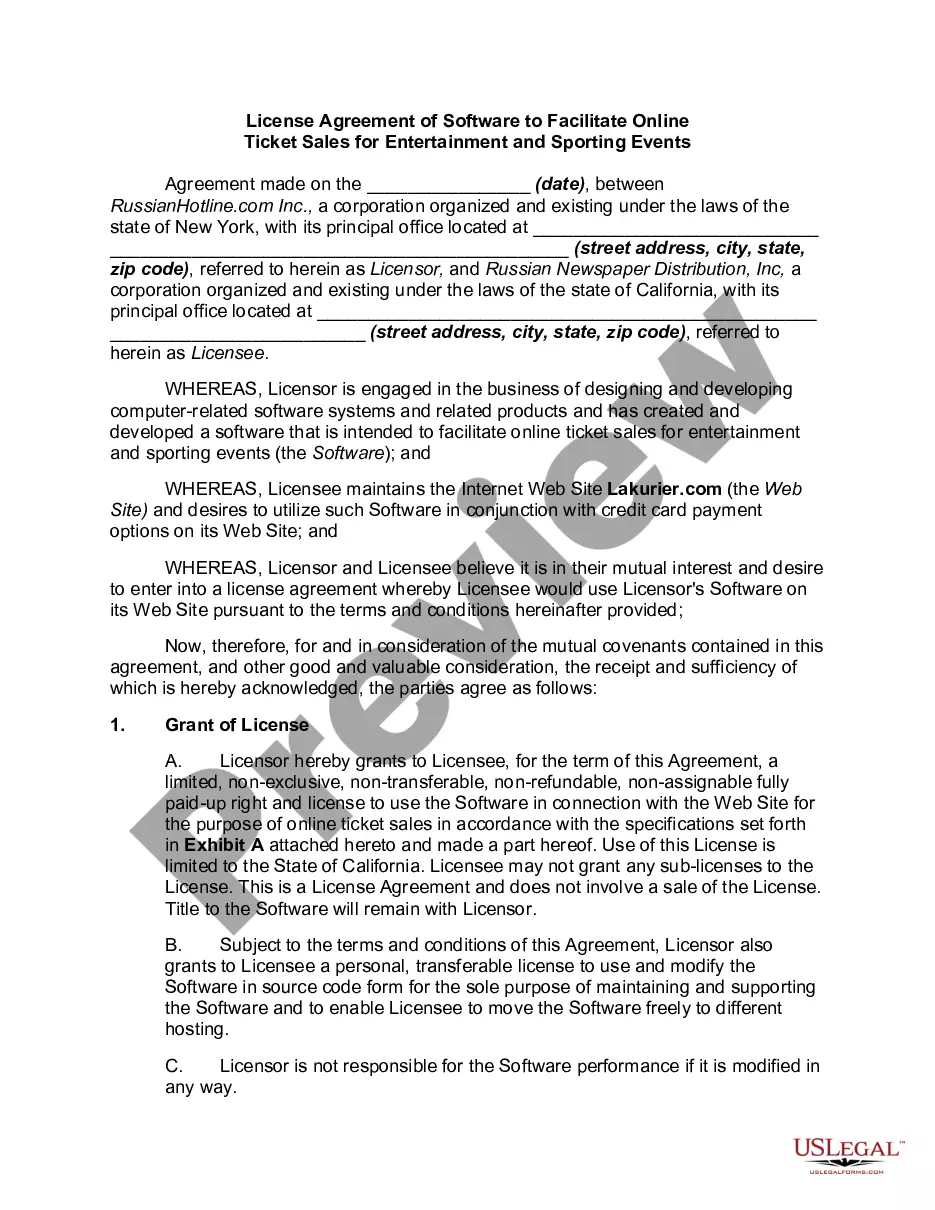

Ohio Corporation — Transfer of Stock refers to the process of transferring ownership of shares in a corporation from one individual or entity to another within the state of Ohio, United States. It involves the legal transfer of stock certificates or electronic shares, which represent ownership in a corporation, from the seller (transferor) to the buyer (transferee). The transfer of stock in an Ohio corporation typically follows a set of procedures and requirements as outlined in the Ohio Revised Code and the corporation's bylaws. These regulations ensure transparency, validity, and compliance during the stock transfer process, safeguarding the interests of both parties involved. Ohio's corporations may have different types of stock transfers, depending on various factors such as the class of shares, restrictions applied by the corporation, the purpose of the transfer, and the nature of the transferee. Some common types of Ohio Corporation — Transfer of Stock include: 1. Private Stock Transfers: These transfers occur between private individuals or entities, often involving closely-held corporations. The parties negotiate the stock transfer directly, and the transaction may be subject to specific rules and agreements outlined in buy-sell agreements or shareholders' agreements. 2. Public Stock Transfers: In this type of transfer, shares of a publicly-traded Ohio corporation are bought or sold on a stock exchange, such as the New York Stock Exchange or NASDAQ. These transactions typically involve brokerage firms or intermediaries who facilitate the transfer on behalf of investors. 3. Intra-Corporate Transfers: When shares are transferred between different ownership entities within the same corporation, it is referred to as an intra-corporate transfer. For example, if an Ohio corporation acquires another corporation or merges with another entity, the transfer of stock may occur between the two involved entities to reflect the new ownership structure. Regardless of the type of stock transfer, it is crucial to follow specific steps and requirements. These may include obtaining consent from the corporation's board of directors or shareholders, executing a stock transfer agreement or assignment form, delivering the stock certificates (if applicable), updating the corporation's stock ledger and records, and notifying relevant parties about the ownership change. It is important to note that Ohio Corporation — Transfer of Stock can have legal and tax implications for both parties involved and may require professional advice from attorneys, accountants, or financial advisors familiar with Ohio corporate law and taxation regulations. Consulting experts will ensure compliance with all applicable laws and regulations throughout the transfer process and help protect the interests of the transferor and transferee.

Ohio Corporation - Transfer of Stock

Description

How to fill out Ohio Corporation - Transfer Of Stock?

US Legal Forms - one of many largest libraries of legal kinds in America - provides a wide range of legal document layouts you are able to down load or produce. Utilizing the web site, you may get a large number of kinds for business and personal functions, sorted by types, claims, or key phrases.You will discover the most recent models of kinds much like the Ohio Corporation - Transfer of Stock within minutes.

If you currently have a monthly subscription, log in and down load Ohio Corporation - Transfer of Stock in the US Legal Forms library. The Acquire switch can look on each and every form you see. You get access to all formerly saved kinds from the My Forms tab of your respective bank account.

If you would like use US Legal Forms initially, listed below are basic recommendations to get you started out:

- Be sure to have picked out the correct form for your personal city/state. Select the Preview switch to check the form`s content material. Browse the form description to actually have chosen the right form.

- In case the form does not satisfy your specifications, make use of the Research field towards the top of the monitor to discover the the one that does.

- Should you be content with the shape, validate your option by clicking the Get now switch. Then, pick the prices plan you want and offer your credentials to register to have an bank account.

- Method the transaction. Make use of Visa or Mastercard or PayPal bank account to finish the transaction.

- Choose the structure and down load the shape in your product.

- Make changes. Complete, edit and produce and signal the saved Ohio Corporation - Transfer of Stock.

Every template you included in your bank account does not have an expiration particular date which is the one you have forever. So, if you wish to down load or produce yet another backup, just check out the My Forms section and click on the form you need.

Gain access to the Ohio Corporation - Transfer of Stock with US Legal Forms, probably the most substantial library of legal document layouts. Use a large number of expert and express-specific layouts that satisfy your small business or personal needs and specifications.