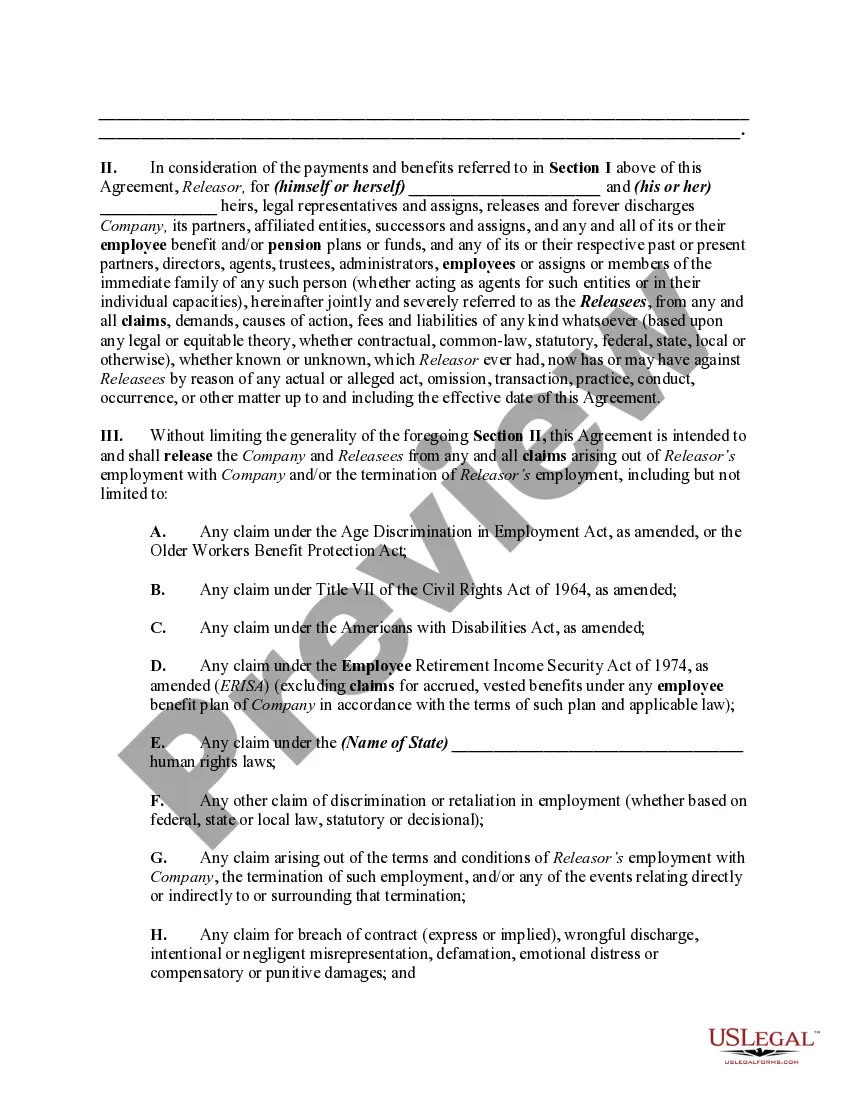

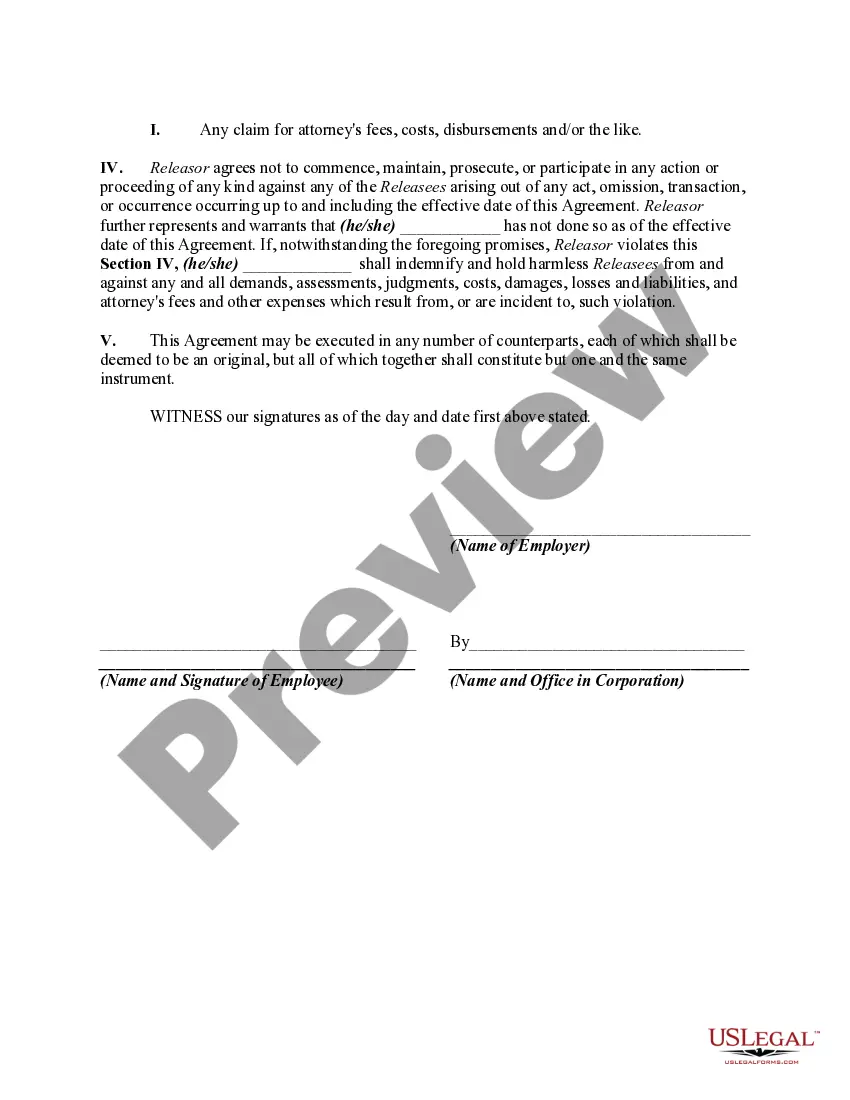

In this form, as a result of a lump sum settlement, a former employee is releasing a former employer from any and all claims for breach of contract or wrongful termination as well as any claim under the Employee Retirement Income Security Act of 1974, as amended (ERISA);

any claim under the Age Discrimination in Employment Act, as amended, or the Older Workers Benefit Protection Act; any claim under Title VII of the Civil Rights Act of 1964, as amended;

any claim under the Americans with Disabilities Act, as amended; and any other claim of discrimination or retaliation in employment (whether based on federal, state or local law, statutory or decisional);

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Ohio Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a legal agreement between an employee and their employer in the state of Ohio. This agreement aims to settle any claims or disputes that may arise from the termination of the employee's employment, including matters pertaining to employee benefits and pension plans. The Ohio Release serves as a legal document that ensures both parties are in agreement regarding the resolution of any possible claim. In the context of terminated employment, there are several types of Ohio Release that may be applicable. These include: 1. General Ohio Release: This type of release encompasses all claims, including those related to employee benefits and pension plans, that the employee may have against the employer arising from their termination. 2. Ohio Release of Employee Benefit Claims: This release specifically focuses on claims related to employee benefits, such as health insurance, retirement plans, or stock options. It ensures that the employee will not pursue any legal action against the employer in relation to such benefits. 3. Ohio Release of Pension Plan Claims: This release is specific to claims related to pension plans. It ensures that the employee will not pursue any legal action against the employer in regard to their pension plan, including contribution disputes or eligibility issues. 4. Ohio Release of Funds Claims: This release addresses claims related to funds that may be owed to the employee upon their termination, such as unpaid wages, commissions, or bonuses. It ensures that the employee will not seek legal action against the employer to recover such funds. The Ohio Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds typically includes the following key elements: 1. Parties: Identification of the employer and the employee involved in the agreement. 2. Effective Date: The date from which the agreement is enforceable. 3. Termination Details: Comprehensive description of the terms and conditions under which the employee's employment was terminated, including the reasons behind the termination. 4. Release of Claims: An explicit statement by the employee that they are releasing the employer from any and all claims arising from their terminated employment, including claims related to employee benefits and pension plans. 5. Consideration: Any consideration or compensation provided to the employee in exchange for the release of claims. This could include monetary compensation, continuation of certain benefits, or other forms of consideration as agreed upon by both parties. 6. Confidentiality: A provision that bars the employee from disclosing any confidential information or trade secrets of the employer. 7. Severability: A clause ensuring that if any provision of the agreement is found to be invalid, the remaining provisions will still be enforceable. It is important for both employers and employees in Ohio to understand the details and implications of the Ohio Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds. Seeking legal advice before entering into such agreements is highly recommended ensuring both parties are protected and their interests are properly addressed.