Ohio Promissory Note - Payable on Demand

Description

How to fill out Promissory Note - Payable On Demand?

You can invest hours online searching for the sanctioned document template that fulfills the federal and state criteria you require.

US Legal Forms offers a vast selection of legal templates that can be reviewed by professionals.

You can conveniently download or print the Ohio Promissory Note - Payable on Demand through the service.

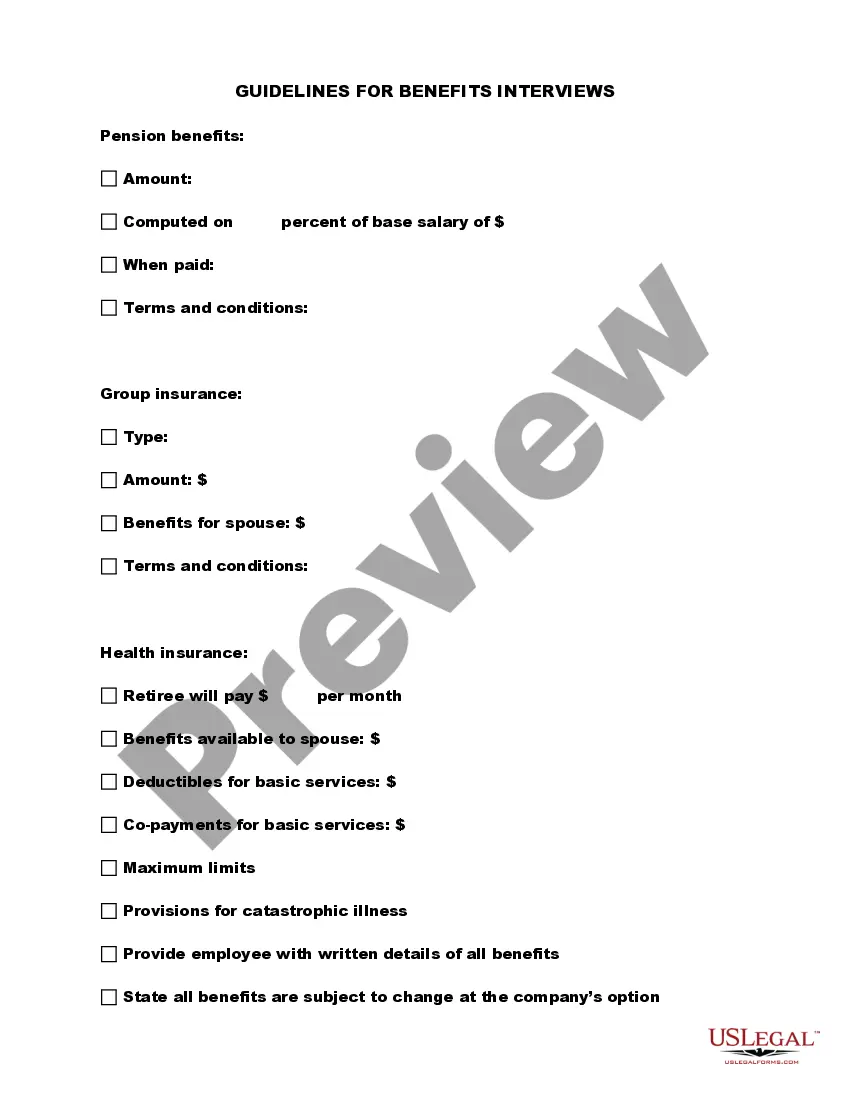

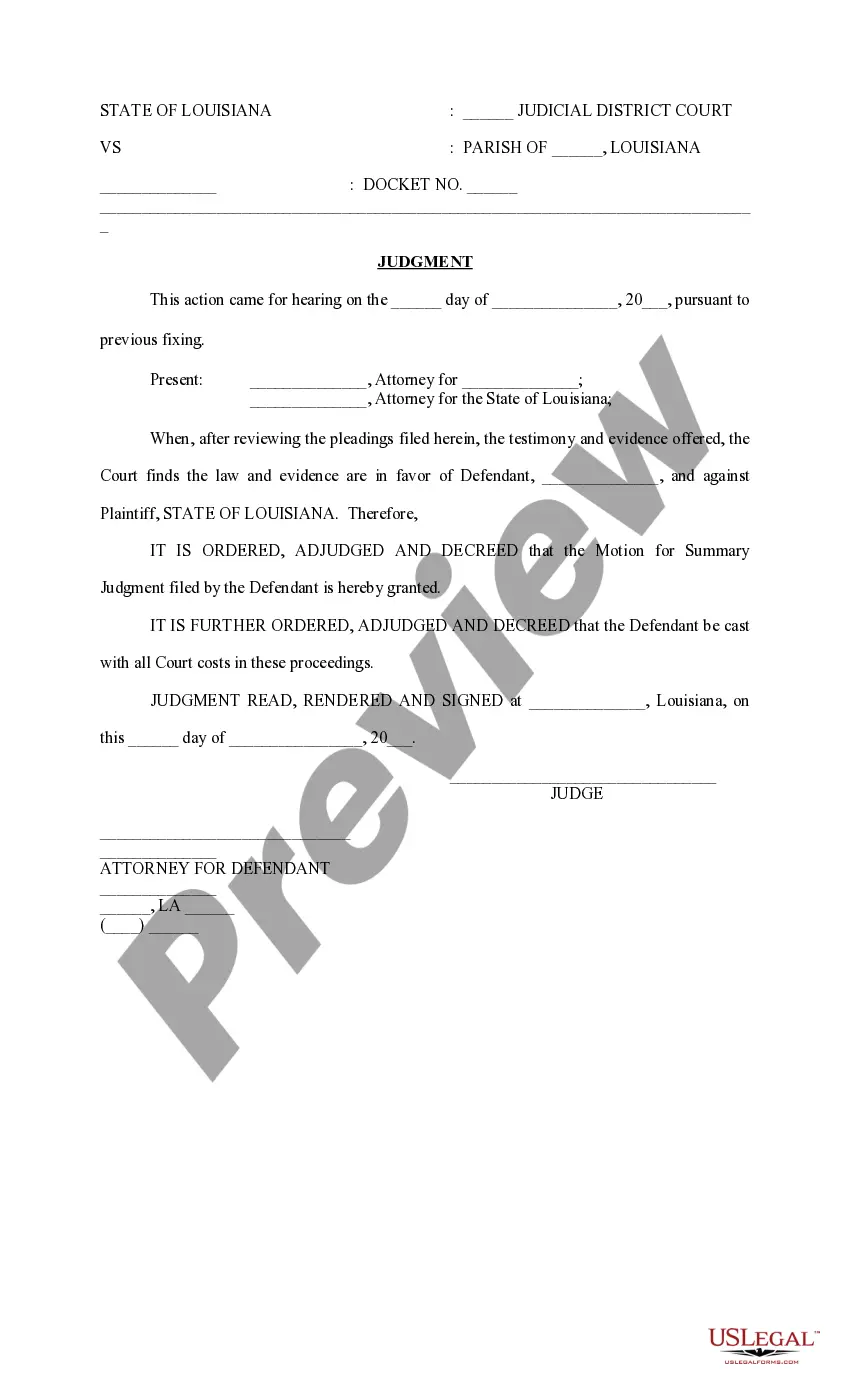

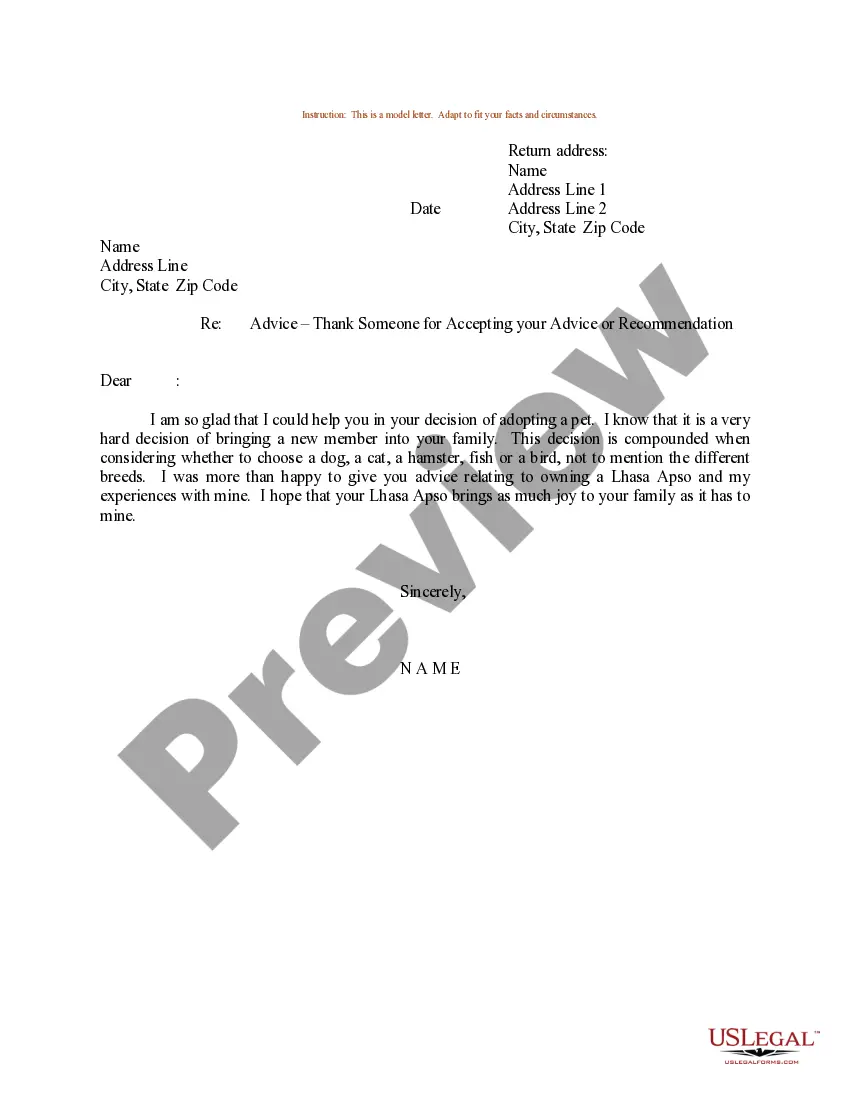

If available, use the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can sign in and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Ohio Promissory Note - Payable on Demand.

- Each legal document format you purchase belongs to you indefinitely.

- To obtain an additional copy of a purchased document, go to the My documents section and click the appropriate button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your state/region of choice.

- Review the document description to confirm that you have chosen the correct form.

Form popularity

FAQ

In Ohio, most contracts do not need to be notarized to be legally enforceable. However, certain types of contracts, particularly those involving real estate, may require notarization for added protection. For other agreements, like an Ohio Promissory Note - Payable on Demand, notarization is optional but can enhance the document's legitimacy and ensure both parties are held accountable.

In Ohio, the validity of a promissory note largely depends on the terms specified in the note itself. Typically, promissory notes have a statute of limitations that lasts for six years from the date of default. If the repayment terms are fulfilled, the note remains valid as long as the borrowing agreement is honored. With an Ohio Promissory Note - Payable on Demand, it is crucial to adhere to the terms to maintain its validity.

In Ohio, a promissory note does not legally require notarization to be valid. However, having it notarized can provide additional legal protection and make it easier to enforce in court. Notarization adds a layer of authenticity and helps confirm the identities of the parties involved. For an Ohio Promissory Note - Payable on Demand, it's advisable to consider notarization especially for larger amounts.

A promissory note example could include a situation where John borrows $5,000 from Mary, agreeing to repay the amount on demand. The note would clearly state this agreement, including the interest rate and any other relevant terms. Templates available on uslegalforms can provide a clear format, making it easier for you to draft an effective note.

To write up a promissory note, start with the date and identify the parties involved. Clearly state the amount being borrowed, the payment terms, and any applicable interest rates. Also, include what happens in case of a default. Using tools available on uslegalforms can simplify this process and ensure you cover all necessary details.

A promissory note payable on demand is a financial instrument that allows the lender to request payment from the borrower at any time. Unlike fixed-term notes, there's no set repayment schedule, providing flexibility for both parties. This type of note is particularly useful for informal loans between family and friends. Always ensure the terms are clear to avoid misunderstandings.

To accelerate a promissory note, you must notify the borrower of your intent to require full repayment. This usually occurs when the borrower defaults on terms outlined in the note. Provide written notification outlining the default and state the total amount due. You can use platforms like uslegalforms to find templates tailored for your situation.

Writing an on demand promissory note involves including essential elements such as the amount borrowed, the borrower's name, and the lender's name. Specify that the note is payable on demand, meaning the lender can request repayment at any time. Be sure to include applicable interest rates and any other terms you find relevant. Using a straightforward template can help streamline the process.

To demand a payment on a promissory note, you typically need to send a formal notice to the borrower. This notice should clearly state that the payment is due, include the amount owed, and mention the due date. You can deliver this notice via certified mail or another reliable method. Always keep a copy of the communication for your records.

Banks are not legally obligated to accept promissory notes. Each financial institution has its own policies regarding forms of payment. However, a well-drafted Ohio Promissory Note - Payable on Demand may be considered by some institutions, especially if it meets their specific requirements.