Ohio Authority to Borrow Money from Bank — Certificate of Corporate Vote and Resolution Form — Corporate Resolutions is a legal document that grants a corporation the power to borrow money from a bank in the state of Ohio. This form is crucial for obtaining financial resources to support the corporation's operations, expansion, or other financial needs. It demonstrates the corporation's commitment to repay the borrowed amount according to the agreed terms and conditions. The certificate of corporate vote and resolution form serves as evidence that the corporation's board of directors, shareholders, or other relevant parties have officially approved the decision to borrow money. It ensures that the borrowing process is carried out in accordance with the corporation's bylaws, operating agreements, or other governance documents. When filling out the Ohio Authority to Borrow Money from Bank — Certificate of Corporate Vote and Resolution Form, the following information should be included: 1. Corporation details: The legal name, registered address, and other identifying information of the corporation should be provided. 2. Borrowing details: This section should outline the scope and purpose of the borrowing, including the amount sought, the intended use of funds, and any specific conditions or limitations attached to the borrowing. 3. Resolution details: The form should state the date on which the corporate vote or resolution took place, typically accompanied by the names and titles of the individuals who voted in favor of the borrowing. 4. Authorization and signatures: The form should include space for the authorized individuals, such as the corporation's president or CEO, to sign and date the certificate, affirming their agreement and commitment to abide by the borrowing terms. It is important to note that while the Ohio Authority to Borrow Money from Bank — Certificate of Corporate Vote and Resolution Form is a common template, each corporation's specific requirements may vary. Therefore, it is advisable to consult with legal counsel or knowledgeable professionals to ensure compliance with the relevant laws and regulations. Different types of Ohio Authority to Borrow Money from Bank — Certificate of Corporate Vote and Resolution Forms may exist based on the specific nature of the borrowing. For instance, corporations may seek authority to borrow money for general operational purposes, such as to cover payroll expenses, purchase inventory, or invest in marketing campaigns. Alternatively, there could be forms designed for specific borrowing needs, such as acquiring real estate, financing equipment purchases, or funding research and development projects. In conclusion, the Ohio Authority to Borrow Money from Bank — Certificate of Corporate Vote and Resolution Form is a vital document that enables corporations in Ohio to secure financial resources from banks. By following the correct procedures and using the appropriate form, corporations can ensure legal compliance and establish a clear record of their borrowing activities.

Ohio Authority to Borrow Money from Bank - Certificate of Corporate Vote and Resolution Form - Corporate Resolutions

Description

How to fill out Ohio Authority To Borrow Money From Bank - Certificate Of Corporate Vote And Resolution Form - Corporate Resolutions?

Are you presently within a place that you require files for both enterprise or personal functions virtually every day time? There are plenty of legal document web templates available on the Internet, but locating types you can depend on isn`t simple. US Legal Forms provides 1000s of form web templates, much like the Ohio Authority to Borrow Money from Bank - Certificate of Corporate Vote and Resolution Form - Corporate Resolutions, which are published to fulfill state and federal requirements.

In case you are previously familiar with US Legal Forms internet site and possess a free account, simply log in. After that, it is possible to obtain the Ohio Authority to Borrow Money from Bank - Certificate of Corporate Vote and Resolution Form - Corporate Resolutions design.

Unless you offer an accounts and would like to begin using US Legal Forms, follow these steps:

- Discover the form you want and ensure it is for that right area/region.

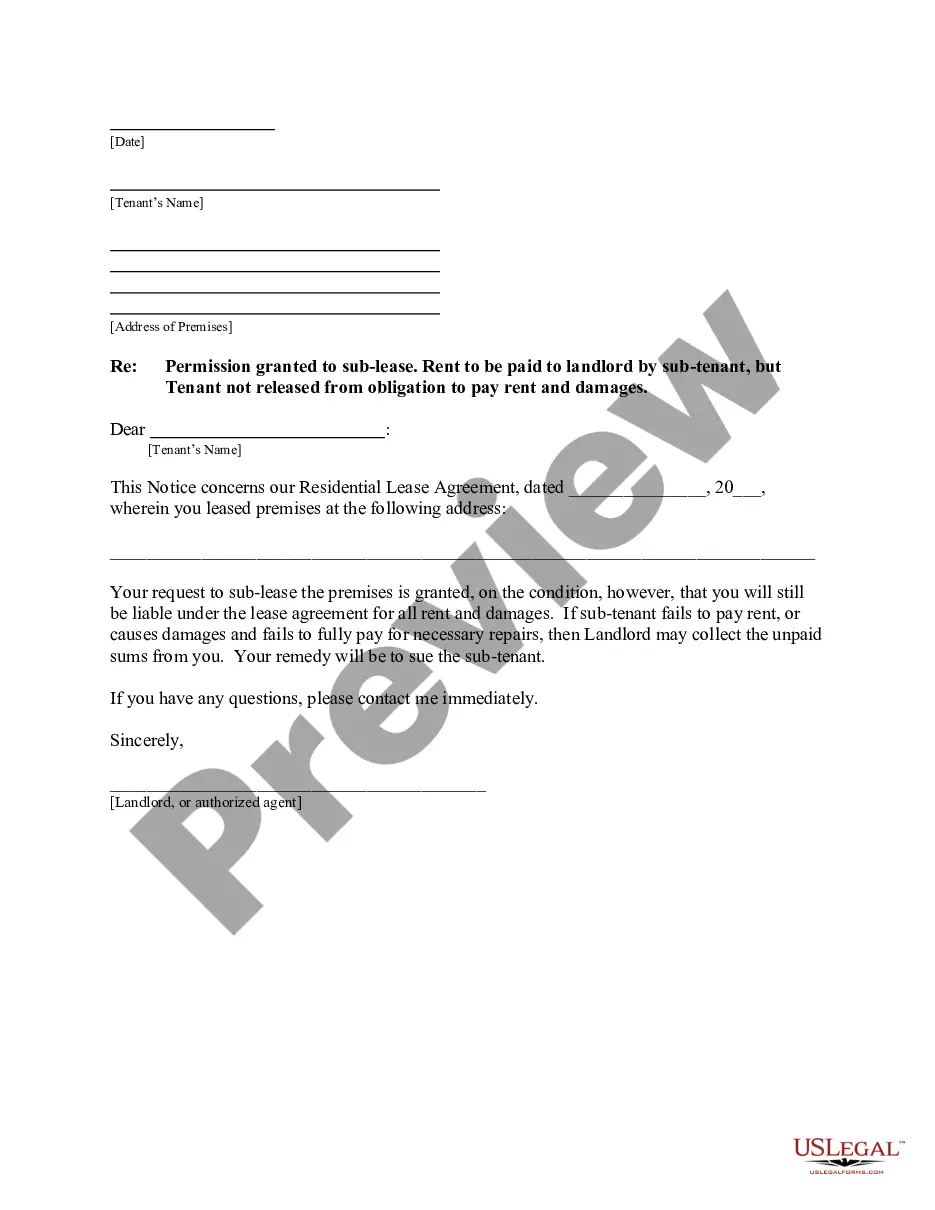

- Make use of the Review switch to analyze the form.

- Look at the outline to actually have selected the appropriate form.

- In case the form isn`t what you`re seeking, make use of the Lookup industry to obtain the form that meets your requirements and requirements.

- If you get the right form, click Buy now.

- Pick the rates plan you would like, complete the required information to generate your money, and buy an order with your PayPal or charge card.

- Decide on a hassle-free data file format and obtain your version.

Locate every one of the document web templates you might have bought in the My Forms food selection. You may get a further version of Ohio Authority to Borrow Money from Bank - Certificate of Corporate Vote and Resolution Form - Corporate Resolutions whenever, if possible. Just select the required form to obtain or print the document design.

Use US Legal Forms, probably the most comprehensive variety of legal kinds, in order to save time and prevent errors. The support provides expertly created legal document web templates which can be used for a range of functions. Generate a free account on US Legal Forms and start producing your life easier.

Form popularity

FAQ

A corporate resolution that authorizes borrowing on a line of credit is often referred to a borrowing resolution. This resolution indicates that the members (LLC) or Board of Directors (Corporation) have held a meeting and conducted a vote allowing the company to borrow a specific loan amount.

A Corporate Resolution is a way of documenting a decision made by a Corporation's Board of Directors or Shareholders on behalf of the Corporation, or by Members on behalf of an LLC. The Corporation or LLC might decide to extend a loan to another business, or to vote another officer onto the Board.

What should corporate resolutions include? Your corporation's name. Date, time and location of meeting. Statement of unanimous approval of resolution. Confirmation that the resolution was adopted at a regularly called meeting. Resolution. Statement authorizing officers to carry out the resolution.

A borrowing resolution is a legally binding document that approves a corporation's management or executives to borrow funds on behalf of the corporation. The company's board generally approves it.

Unlike LLCs, corporations are required to make resolutions. Therefore, they are used to preparing them when shareholders or the board of directors make decisions. Although an LLC is not required to make resolutions, there are many reasons for getting in the habit of maintaining resolutions.

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A corporate resolution is a legal document that provides the rules and framework for how the board can act under various circumstances.