Ohio Revocable Trust Agreement - Grantor as Beneficiary

Description

How to fill out Revocable Trust Agreement - Grantor As Beneficiary?

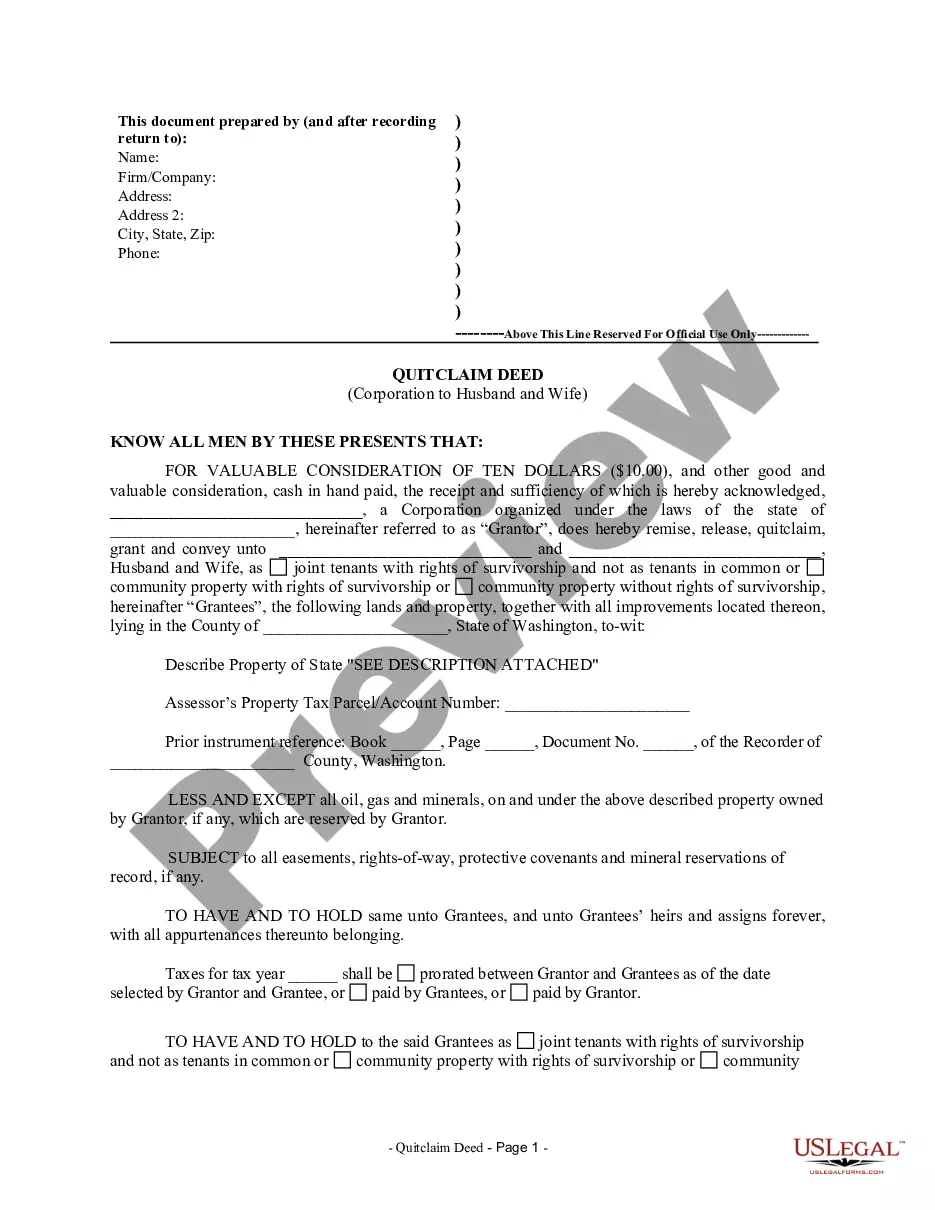

Selecting the correct legal document template can be challenging. Naturally, there are numerous templates accessible online, but how can you secure the legal document you need? Utilize the US Legal Forms website. This service provides thousands of templates, including the Ohio Revocable Trust Agreement - Grantor as Beneficiary, suitable for both business and personal needs. All forms are verified by experts and meet federal and state requirements.

If you are already registered, Log In to your account and click the Obtain button to access the Ohio Revocable Trust Agreement - Grantor as Beneficiary. Use your account to review the legal templates you have previously purchased. Navigate to the My documents section of your account to get another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct template for your city/location. You can examine the template using the Review button and read the description to confirm it is the right one for your needs.

US Legal Forms is the largest repository of legal documents where you can find various document templates. Take advantage of the service to acquire professionally prepared documents that adhere to state regulations.

- If the template does not meet your requirements, use the Search field to find the suitable template.

- Once you are confident that the template is appropriate, click the Acquire now button to obtain the template.

- Select the pricing plan you prefer and provide the necessary information.

- Create your account and complete the transaction using your PayPal account or credit card.

- Choose the file format and download the legal document template to your system.

- Complete, modify, and print, then sign the downloaded Ohio Revocable Trust Agreement - Grantor as Beneficiary.

Form popularity

FAQ

For a trust to be valid in Ohio, it must have a clear purpose, identifiable beneficiaries, and be funded properly. Additionally, the grantor must have the capacity to create the trust and must intend to create it. A well-structured Ohio Revocable Trust Agreement - Grantor as Beneficiary will meet these criteria, ensuring that your wishes are carried out effectively. Ensuring compliance with these requirements can save you and your heirs from potential legal troubles.

Yes, you can write your own trust in Ohio. Many individuals find templates helpful, which can lead to a well-structured document that meets legal standards. Consider utilizing resources like the Ohio Revocable Trust Agreement - Grantor as Beneficiary to guide you in this process. This approach makes it easier to ensure that your trust works in your favor and for your beneficiaries after your passing.

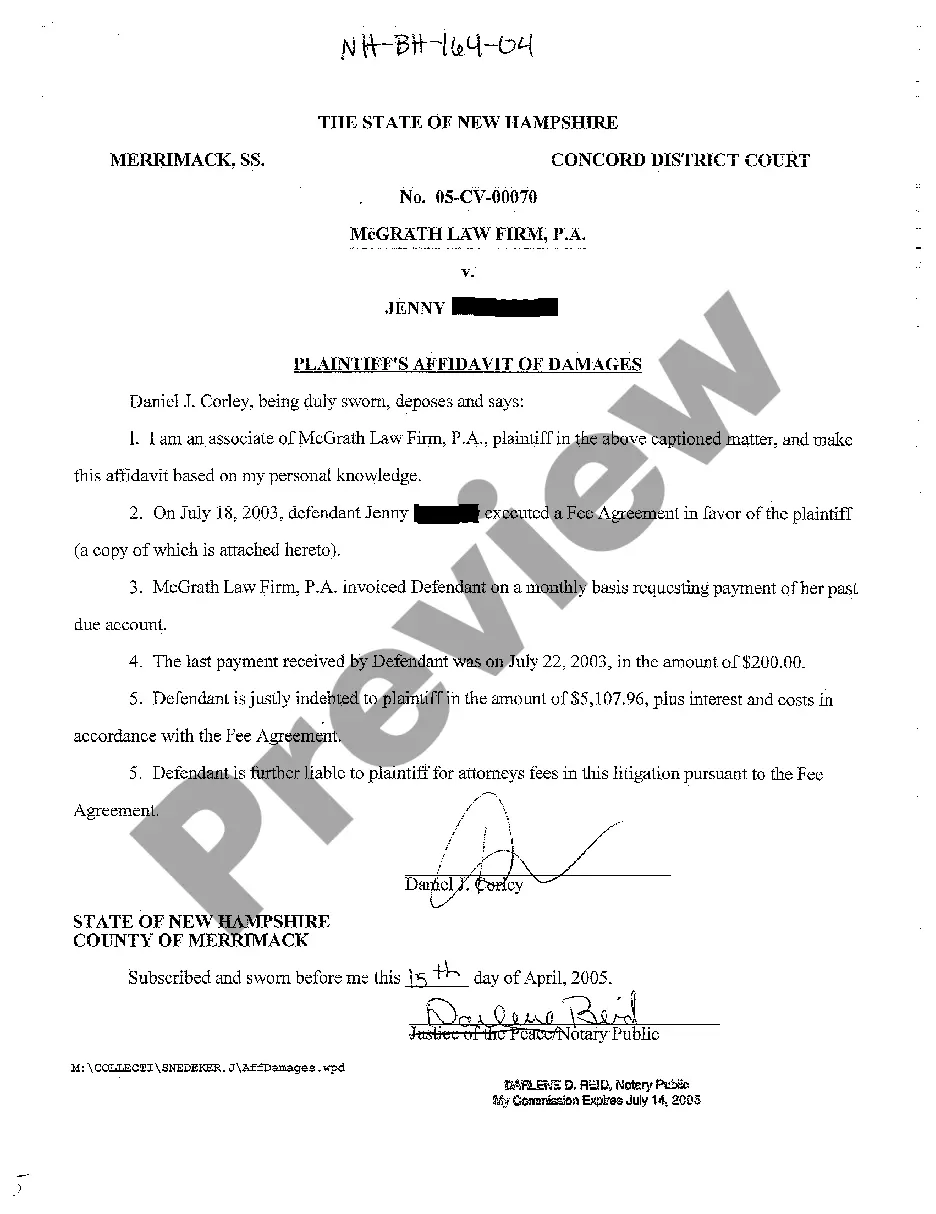

A trust agreement does not need to be notarized in Ohio, but signing it in front of a notary can prevent future disputes. Notarization adds to the authenticity of the document, making it harder for anyone to contest it later. By establishing an Ohio Revocable Trust Agreement - Grantor as Beneficiary, you can create a trust that is clear and reliable for your beneficiaries.

Generally, contracts do not need to be notarized in Ohio to be enforceable. However, specific types of contracts, such as real estate transactions, may require notarization. To ensure your documents are properly executed, you might want to consider the Ohio Revocable Trust Agreement - Grantor as Beneficiary as part of your estate planning. This can help safeguard your wishes effectively.

Yes, beneficiaries are entitled to receive a copy of the trust document in Ohio. This transparency helps them understand their rights and the distributions they are to receive. With the Ohio Revocable Trust Agreement - Grantor as Beneficiary, beneficiaries can easily familiarize themselves with the terms of the trust. This can promote clarity and reduce disputes among heirs.

Yes, a grantor can absolutely be a beneficiary of a trust they create. In fact, many people choose the Ohio Revocable Trust Agreement - Grantor as Beneficiary for this reason. This arrangement allows the grantor to retain some control over the assets and potentially enjoy their benefits during their lifetime. It also simplifies the transition of assets upon the grantor's passing.

In Ohio, a will does not have to be notarized to be valid. However, having it notarized can provide an extra layer of protection against challenges. A notarized will typically helps demonstrate the intent of the testator, adding to its credibility. The Ohio Revocable Trust Agreement - Grantor as Beneficiary can also be beneficial in outlining your wishes clearly.

While naming a trust as a beneficiary of an IRA allows for controlled distributions, it can introduce complications relating to tax implications and required minimum distributions. These details need to align clearly with your Ohio Revocable Trust Agreement - Grantor as Beneficiary to avoid unexpected financial burdens on beneficiaries. Furthermore, trusts can sometimes trigger higher tax rates on distributions, which may diminish the overall value of the inheritance.

Being a beneficiary can come with certain disadvantages, primarily related to taxation and the potential for disputes among family members. Beneficiaries may face taxes on inherited assets, which can reduce the overall inheritance. Additionally, if numerous beneficiaries are involved, it could lead to disagreements about asset distribution, impacting family harmony.

To add a beneficiary to a revocable trust, you typically need to amend your existing Ohio Revocable Trust Agreement - Grantor as Beneficiary. This amendment should clearly outline the additional beneficiary and their corresponding rights. It’s important to follow legal guidelines and consider consulting with a legal expert to ensure the amendment is executed correctly and meets your goals.