Ohio Option to Purchase a Business: A Comprehensive Guide Keywords: Ohio, option to purchase a business, types Introduction: An Ohio Option to Purchase a Business refers to a legal agreement that grants an individual or entity the right, but not the obligation, to acquire a business at a predetermined price and within a specified timeframe. This contractual arrangement allows potential buyers to assess the business's performance and market conditions before committing to a purchase. Ohio offers various types of options to purchase a business, each with their distinct features and implications. This article aims to provide a detailed description of the Ohio Option to Purchase a Business, shedding light on its types, advantages, key considerations, and legal requirements. Types of Ohio Options to Purchase a Business: 1. Fixed Price Option: In this type of option, the buyer and the seller agree on a specific purchase price for the business. The option holder pays a premium to secure the right to purchase the business at the predetermined price within a predetermined timeframe. This type offers price certainty but limits negotiation opportunities. 2. Percentage-Based Option: Unlike the fixed price option, this type determines the purchase price as a percentage of the business's value at the time of exercise. The parties agree on a percentage, and the option holder pays a premium based on this percentage. This type allows for flexibility in determining the purchase price while accounting for market fluctuations. 3. Lease with Option to Purchase: This option combines a lease agreement and an option to purchase. The buyer initially leases the business premises and gains the right to buy the business within a specified period. This type allows the potential buyer to generate income and evaluate the business's profitability before making a final decision. Advantages of Ohio Option to Purchase a Business: 1. Flexibility: Options provide the potential buyers with the freedom to choose whether to proceed with the purchase or not. It allows time for due diligence, analyzing market trends, and assessing the viability of the business. 2. Risk Mitigation: Options facilitate risk reduction as buyers avoid committing substantial funds initially. They can assess the business's success, potential challenges, and profitability, reducing the risk of making hasty or ill-informed decisions. 3. Price Determination: Options provide an opportunity to negotiate the purchase price or evaluate the market value of the business. Different types of Ohio Options to Purchase a Business offer distinct mechanisms for price determination, enabling buyers to find terms that align with their budget and goal. Key Considerations when Utilizing an Ohio Option to Purchase a Business: 1. Legal Compliance: Parties involved must adhere to all legal requirements surrounding the option agreement and its execution in accordance with Ohio's business laws. 2. Time Constraints: There is typically a predetermined timeframe within which the option must be exercised. Buyers must carefully consider this period and any associated penalties for non-compliance. 3. Due Diligence: Buyers should conduct thorough due diligence, analyzing financials, tax records, legal contracts, market conditions, and potential risks before making a final decision. Conclusion: Ohio Option to Purchase a Business offers flexibility and risk management to potential buyers, allowing them to evaluate the performance and feasibility of a business before committing significant resources. By understanding the different types of options available and carefully considering legal obligations, timeframe, and due diligence, potential buyers can make informed decisions that align with their goals and interests.

Ohio Option to Purchase a Business

Description

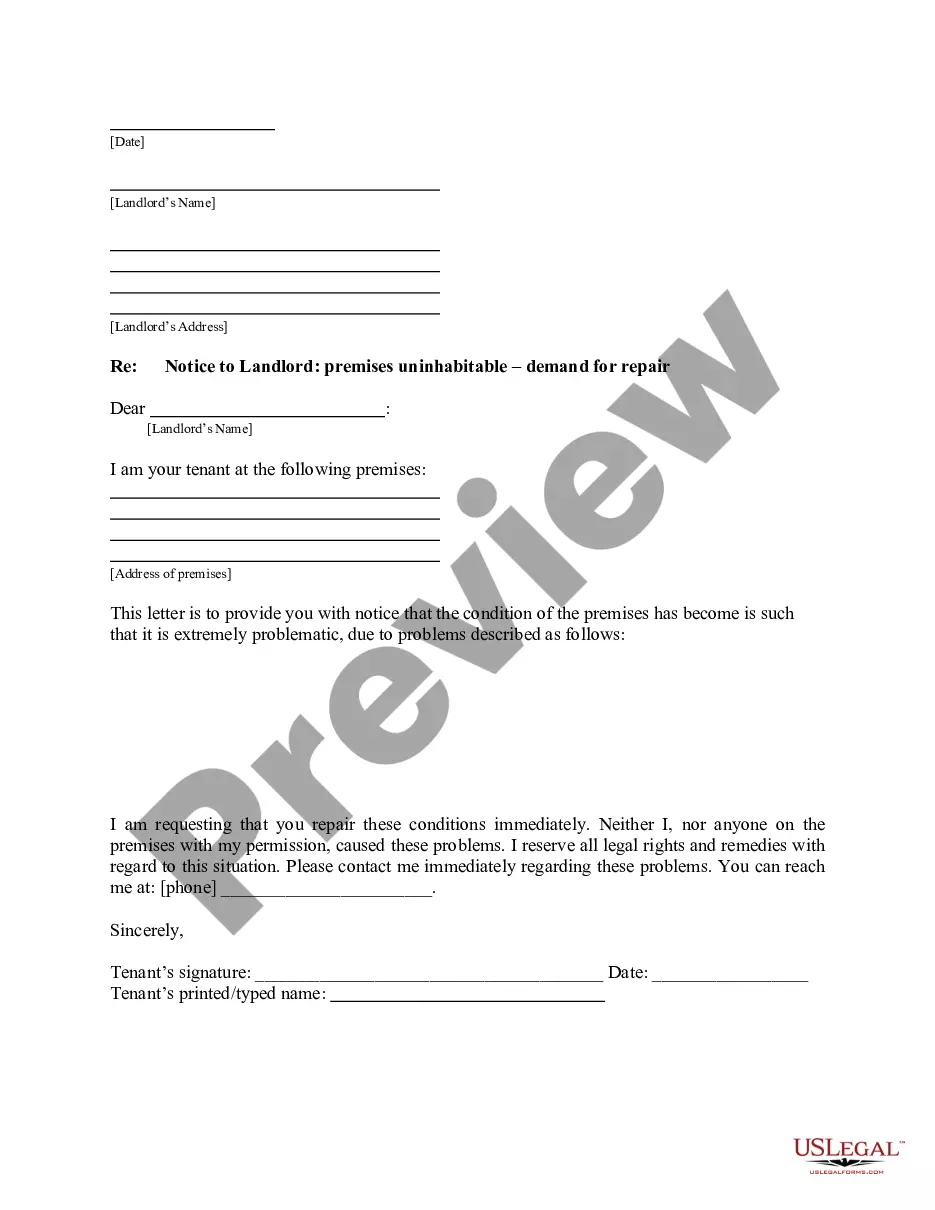

How to fill out Ohio Option To Purchase A Business?

US Legal Forms - among the most prominent libraries of legal documents in the United States - offers a wide range of legal document templates that you can download or print.

Through the website, you can locate thousands of forms for commercial and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Ohio Option to Purchase a Business in mere minutes.

If the form doesn't meet your requirements, use the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Download now button. Then, select the payment plan you prefer and provide your credentials to register for the account.

- If you already possess a subscription, Log In and download the Ohio Option to Purchase a Business from the US Legal Forms collection.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms within the My documents section of your account.

- If you intend to use US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have chosen the appropriate form for your location/region. Click the Preview button to inspect the form's details.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

What is an "option to purchase" agreement? An option to purchase is an agreement that gives a potential buyer (optionee) the right, but not the obligation, to buy property in the future. The optionee must decide by a certain time whether to exercise the option and thereafter by bound under the contract to purchase.

A purchase agreement is a type of contract that outlines terms and conditions related to the sale of goods. As a legally binding contract between buyer and seller, the agreements typically relate to buying and selling goods rather than services. They cover transactions for nearly any type of product.

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

The simple answer is YES. You can write your own contracts. There is no requirement that they must be written by a lawyer. There is no requirement that they have to be a certain form or font.

A business purchase agreement should detail the names of the buyer and seller at the start of the agreement. It will also need to include the information of the business being sold, such as name, location, a description of the business and the type of business entity it is.

A purchase option is a right to purchase or lease land or other property interests without any obligation to do so.

Know How to Fill Out the Business Bill of SaleDate of Sale.Buyer's name and address.Seller's name and address.Business name and details, which include: State of incorporation. Address of the business's main headquarters. Assets, shares, personal property and other interests included with the company.

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.