Ohio Letter to Credit Reporting Bureaus or Agencies Requesting Copy of Deceased Person's Credit Report and Placement of Deceased Alert In Ohio, when a loved one passes away, it is crucial to take steps to protect their finances and prevent identity theft. One important action to take is to write a letter to credit reporting bureaus or agencies requesting a copy of the deceased person's credit report, as well as the placement of a deceased alert on their record. These steps ensure that no one can misuse the deceased person's identity or open new accounts in their name. A well-written Ohio Letter to Credit Reporting Bureaus or Agencies Requesting Copy of Deceased Person's Credit Report and Placement of Deceased Alert should include the following information: 1. Introduction: Begin the letter by addressing it to the credit reporting bureau or agency, clearly stating that it is a request regarding the credit report of a deceased individual. 2. Deceased person's information: Provide the full legal name, date of birth, and Social Security number of the deceased person. Including their last known address is also helpful. 3. Request for credit report: Clearly state that you are requesting a copy of the deceased person's credit report. Mention that this request is being made in accordance with the Fair Credit Reporting Act (FCRA) to ensure compliance. 4. Explanation of purpose: Explain that the purpose of obtaining the credit report is to confirm and protect the deceased person's financial accounts and personal information. Emphasize the importance of preventing identity theft in these circumstances. 5. Deceased alert placement: Request the credit reporting bureau or agency to place a deceased alert on the deceased person's credit file. This alert helps prevent fraudulent activity on their credit report and notifies any lenders or creditors about the individual's passing. 6. Supporting documents: Include copies of the deceased person's death certificate and proof of your relationship to the deceased, such as a marriage certificate or birth certificate, to substantiate your request. 7. Contact information: Provide your full name, mailing address, email address, and telephone number. This information will enable the credit reporting bureau or agency to reach out to you for any clarifications or updates. Different types of Ohio Letters to Credit Reporting Bureaus or Agencies Requesting Copy of Deceased Person's Credit Report and Placement of Deceased Alert can vary based on the specific circumstances. Some variations may include letters for: 1. Spouse requesting the credit report and deceased alert 2. Child requesting the credit report and deceased alert 3. Executor or administrator of the deceased person's estate requesting the credit report and deceased alert Remember to keep copies of all correspondence and communications with credit reporting bureaus or agencies for your records. It is also advisable to send the letter via certified mail with a return receipt to ensure proof of delivery. By taking swift action and sending an Ohio Letter to Credit Reporting Bureaus or Agencies Requesting Copy of Deceased Person's Credit Report and Placement of Deceased Alert, you are safeguarding the deceased person's financial legacy and protecting their identity from potential fraud.

Ohio Letter to Credit Reporting Bureaus or Agencies Requesting Copy of Deceased Person's Credit Report and Placement of Deceased Alert

Description

How to fill out Ohio Letter To Credit Reporting Bureaus Or Agencies Requesting Copy Of Deceased Person's Credit Report And Placement Of Deceased Alert?

Discovering the right legal file design might be a struggle. Needless to say, there are plenty of layouts available on the net, but how can you find the legal kind you will need? Use the US Legal Forms web site. The services offers a large number of layouts, like the Ohio Letter to Credit Reporting Bureaus or Agencies Requesting Copy of Deceased Person's Credit Report and Placement of Deceased Alert, which can be used for company and private needs. All the kinds are examined by specialists and meet up with federal and state needs.

In case you are already listed, log in to your accounts and click on the Down load button to obtain the Ohio Letter to Credit Reporting Bureaus or Agencies Requesting Copy of Deceased Person's Credit Report and Placement of Deceased Alert. Make use of accounts to search through the legal kinds you might have purchased previously. Go to the My Forms tab of your own accounts and have one more version in the file you will need.

In case you are a fresh end user of US Legal Forms, here are straightforward instructions that you can stick to:

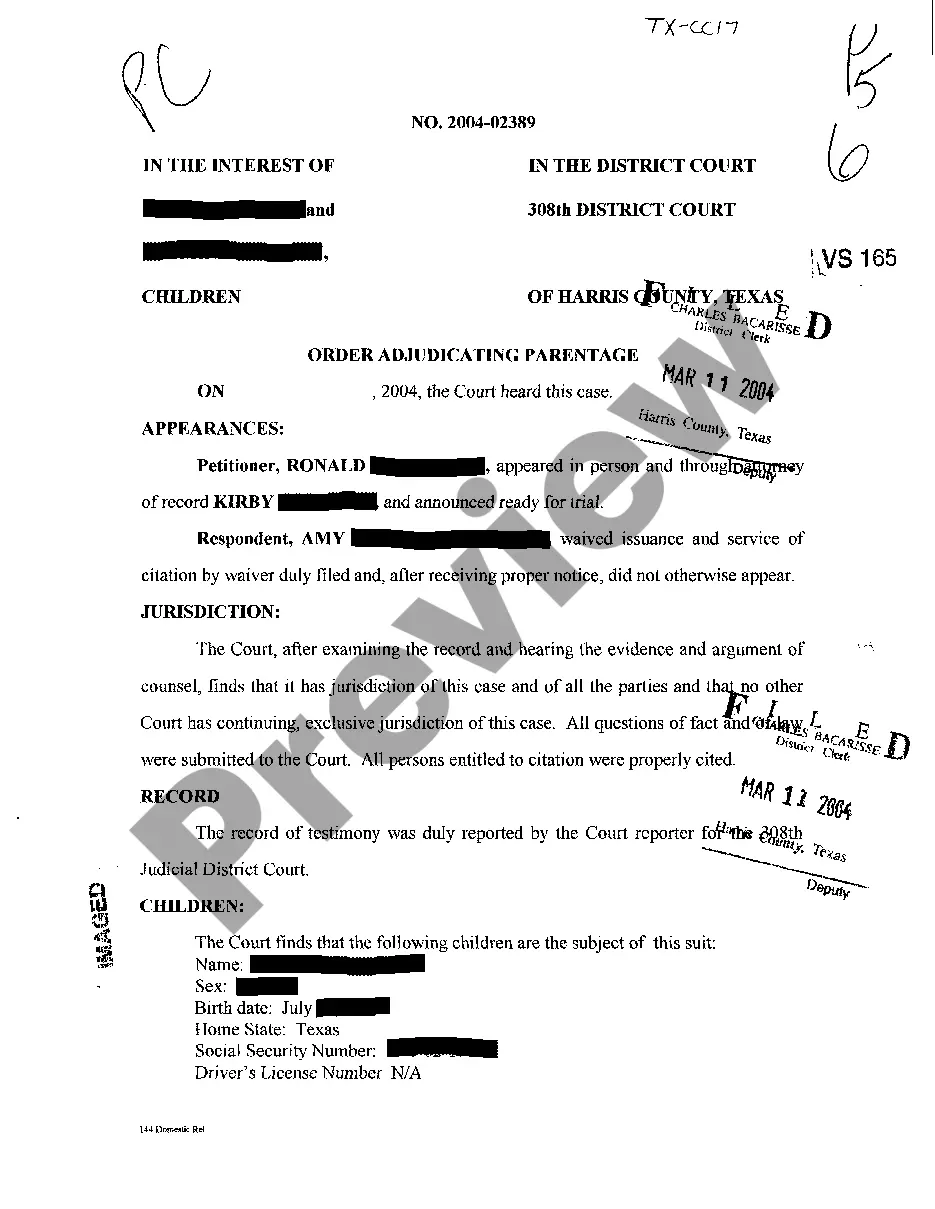

- Initially, be sure you have chosen the correct kind for your personal town/state. You are able to check out the form while using Review button and study the form information to make certain this is the best for you.

- When the kind fails to meet up with your needs, take advantage of the Seach industry to find the appropriate kind.

- Once you are certain the form is proper, click on the Get now button to obtain the kind.

- Pick the costs program you want and enter in the required information. Create your accounts and purchase your order with your PayPal accounts or Visa or Mastercard.

- Choose the data file format and obtain the legal file design to your system.

- Total, revise and print and signal the received Ohio Letter to Credit Reporting Bureaus or Agencies Requesting Copy of Deceased Person's Credit Report and Placement of Deceased Alert.

US Legal Forms will be the biggest collection of legal kinds in which you can discover different file layouts. Use the company to obtain expertly-made paperwork that stick to condition needs.

Form popularity

FAQ

They can flag the account and provide the address where you'll need to send the necessary documentation. Once each card issuer receives your letter, they'll ask for an official copy of the death certificate if you didn't send one in your initial letter.

That notification can happen one of two ways ? from the executor of the person's estate or from the Social Security Administration.

Estate executors or court-appointed designees, however, are encouraged to contact at least one of the three nationwide credit bureaus so that the deceased's credit report can be flagged, appropriately.

Draft a notification letter. Specify your relationship to the deceased and provide supporting documents, as required. d. Ask that the credit bureau post on the decedent's credit report: ?Deceased, Do Not Issue Credit.? e. Request a current copy of the decedent's credit report.

The spouse or executor of the estate may request the deceased person's credit report by mailing a request to each of the credit reporting companies. Send a letter along with the following information about the deceased: Legal name. Social Security Number.

Credit reporting companies regularly receive notifications from the Social Security Administration about individuals who have passed away, but it's better to also notify them on your own to ensure no one applies for credit in the deceased's name in the meantime.

Dear [name of credit bureau]: I am writing to request that a formal death notice be placed on the credit file of: Deceased's full name (with middle initial if used): Most recent address: Social Security number: Birthdate: Enclosed please find one copy of decedant's death certificate.

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.